Company Registration no: RC000886

CIM and its subsidiary companies

Report and Financial

Statements

Year ended 30 June 2023

CIM | Report and Financial Statements 2

Contents

Directors’ report 3

Legal and administration information 10

Independent auditor’s report 12

Consolidated profit and loss account 15

Consolidated balance sheet 16

Consolidated cash flow statement 17

CIM balance sheet

18

Notes forming part of the financial statements 19

CIM | Report and Financial Statements 3

Directors’ report

For the year ended 30 June 2023

The Directors present their report together with the financial statements of the Chartered Institute of Marketing (CIM) for

the year ended 30 June 2023. This report is prepared in accordance with CIM’s Constitution and its Royal Charter.

As the organisation emerged into post-covid normality, it became clear that a fresh approach and strategy was required if

the growth aspirations desired by both the Board and the Executive would be achieved. In December 2022, it was

determined that this fresh strategy would break the mould of the traditional three-year planning cycle and, instead, adopt a

seven-year strategy that would take CIM up to June 2030. Every Board member was individually interviewed and, combined

with insights from the Executive, the concepts of this fresh strategy were approved in March and the full strategy, together

with the budget for the first year of this strategy, were approved in April 2023.

This year CIM was operating towards a breakeven budget and, while the budgeted revenue was not achieved, with

initiatives coming to bear, new products being launched and the careful control of costs, June 2023 saw a strong finish to

the financial year and overall, a satisfactory year end group net surplus of £208k was delivered.

The lifeblood of a professional body is to remain relevant, and the launch of CIM’s seven new intermediate-level open

training courses in AI is just such an example. These courses are designed to empower delegates with cutting-edge

knowledge and practical skills in the potential and application of AI. Another example is the launch of the suite of Specialist

Awards providing participants with in-depth expertise in focused areas of digital marketing.

The membership census that was carried out in October 2022 was the first opportunity since the pandemic for CIM to

engage with our total membership base, and the response indicated that there was a need for CIM to take stock of how

effectively our proposition was landing. This in turn led to a broader reality check and it was clear that if CIM was to achieve

its true potential, then this would require a whole new approach, and the seeds of the fresh strategy were born. During the

second half of this financial year, considerable time and effort was invested in determining what this fresh strategy would

look like. Strategic shifts were identified, enablers were established, and in total twelve separate project teams were created

to transition the organisation and align it behind a clear purpose with aspirations linked not only to CIM itself, but also to the

profession of marketing as a whole, as per the Objects of our Charter.

The need to continue to adapt has never been stronger, and this fresh strategy comes at a time when our professional

marketing competencies need to be updated, and our suite of qualifications are also due for review, so the momentum for

change has never been stronger. This year our undergraduate competition (The Pitch) was joined by our inaugural

postgraduate competition (The Challenge) and, going forwards, both undergraduates and postgraduates will be competing

in the same competition.

Investment in reducing our technical debt and improving the Moor Hall site continues to ensure that we are able to deliver

an exemplary customer experience both virtually and physically when people come to the site. Our work overseas has also

continued, with a joint event taking place in Sydney promoting our partnership with the Australian Marketing Institute and,

after such a difficult period, it was a real delight to see 400 CIM graduates being honoured by the British High Commissioner

at their Graduation in Sri Lanka. CIM retains its position as Vice Chair of the European Marketing Confederation that

currently consists of 12 countries, with separate forums being held in Lisbon and Vilnius. Wherever we go we are

recognising a growing appreciation that professional marketing makes the difference to business performance, and it is vital

that CIM is seen to support and deliver the difference in marketing.

The Directors would like to thank all staff and volunteer members for their unfaltering support and efforts in delivering the

Objects of CIM during this continuingly difficult operating environment. CIM now has a clear aspiration for both the

organisation and the marketing profession over the coming years, and this will be cascaded down amongst our stakeholders

and communities across the globe over the coming months so that we are all fully aligned in how we can help to continue to

deliver on the Objects of our Charter.

Constitution

CIM is incorporated by Royal Charter, which was awarded on 7 February 1989. It is governed by its Constitution comprising

its Charter, Bye-laws, General Regulations and Board Regulations.

Governance, structure, and management

The Board of Directors is the governing body for CIM and determines the overall direction and development of the

organisation through good governance and effective strategic planning.

CIM | Report and Financial Statements 4

Statement of directors’ responsibilities

The Board of Directors is responsible for preparing the annual report and financial statements in accordance with UK

Generally Accepted Accounting Practice. CIM’s Royal Charter and Bye-laws require the Directors to prepare financial

statements for each financial year which give a true and fair view of the state of affairs of CIM and of the income and

expenditure for that year. In preparing those financial statements the Directors are required to:

• Select suitable accounting policies and then apply them consistently;

• Make judgements and estimates that are reasonable and prudent;

• State whether applicable UK Accounting Standards have been followed, subject to any material departures

disclosed and explained in the Financial Statements;

• Prepare the financial statements on a going concern basis unless it is inappropriate to presume CIM will continue.

The Directors are responsible for keeping proper accounting records which disclose with reasonable accuracy at any time

the financial position of CIM and to enable them to ensure that the financial statements comply with the Charter. They are

also responsible for safeguarding CIM’s assets and hence for taking reasonable steps for the prevention and detection of

fraud and other irregularities.

Financial statements are published on the Group’s website. The Directors’ responsibility extends to the on-going integrity of

the financial statements contained therein.

Five principal Committees operate to support the Board of Directors:

• The Strategy and Finance Committee reviews CIM’s management accounts on a monthly basis and oversees

strategy implementation;

• The Appointments and Remuneration Committee manages the process for appointments to CIM’s Board and

Committees and oversees the appointment process and terms of the CEO;

• The Audit and Risk Committee advises the Directors on risk, internal controls and financial reporting and oversees

the annual statutory audit. The Committee reviews the risk register to enable risks to be managed and minimised;

• The Constitution and Ethics Committee provides the Board with advice on CIM’s governance structure;

• The Disciplinary Committee considers complaints raised against CIM members under the Code of

Professional Conduct.

CIM has a number of connected organisations worldwide. CIM Hong Kong Limited and CIM Enterprises Limited are

consolidated in these financial statements.

The Communication, Advertising and Marketing Education Foundation (CAM) is a subsidiary of CIM. CAM is a charity, has a

separate Board and operates independently of CIM.

Objects

The Objects of CIM are:

• To promote and develop the art and science of marketing and to encourage, advance and disseminate knowledge,

education, and practical training in and research into that art and science;

• To promote and maintain high standards of professional skill, ability and integrity among persons engaged in

marketing products and services;

• To promote entry to and advancement in the profession of marketing by means of examination and other methods

of assessment;

• To provide and develop a professional organisation for marketing;

• To increase public awareness and understanding of marketing as a vital factor in business success and prosperity.

Risk management

The Audit and Risk Committee bi-annually undertakes a detailed review of the risk register which provides an in-depth

analysis of the exposure to high level risks. The risks are covered under six categories:

• Strategic

• Financial

• Operational

CIM | Report and Financial Statements 5

• Compliance and Legal

• People

• Other

The scoring system rates each identified risk on the likelihood and severity of occurrence. Each risk is assigned to a member

of the Executive for management and monitoring; this is either by inclusion in the appropriate procedures, monthly reports,

management accounts or contained in individuals’ objectives.

The Board of Directors review new and high-rated risks at each quarterly meeting and receives a report from the Audit and

Risk Committee to aid their annual review and discussion of the full risk register. The Board is ultimately responsible for

ensuring that risks are determined, reviewed, and managed.

Looking forward, the increasing inflation rates in the UK and geopolitical instability in our largest overseas market (Sri

Lanka) has increased the financial risk profile across a number of areas of the business. This has been factored into the

budget planning process and will be monitored throughout the year to enable mitigating actions to be taken to ensure the

businesses ongoing financial stability.

Climate Change and Sustainability, Cyber security and AI remain as key risk areas for CIM to embed a robust proactive plan

that pre-empts both our clients expectations as well as supporting our own strategic goals.

Achievements and performance:

Qualifications

The anticipated decline in qualification bookings for the year ended 30

th

June 2023 following an increased individual focus

on learning during lockdown did occur with a year-on-year revenue reduction of £275k. The economic and political unrest

in markets such as Sri Lanka and Sudan also contributed to this. Other challenges include the lack of employer funding for

qualifications which is around 30% lower than it was in 2019/2020.

Despite the decline, the projections for 2023/2024 are positive with anticipated growth through greater engagement with

university students through the Accredited Degree Programme and revenue from CIM’s role as an End Point Assessor

Organisation (EPAO). In addition, CIM has launched a series of five Specialist Awards with a digital focus to meet the

challenges presented by changes in Learner Buying behaviour favouring shorter bite size online study. Many of these

initiatives, which focus on developing and growing new revenue streams in the learners space, have been made possible by

recruiting additional resource in the partnership and qualifications development area.

Work is now being undertaken to develop a revised set of marketing competencies which will underpin the development of

a revised qualification suite for launch in late 2023. These will also be the focus of discussions with other national marking

institutes across the globe to both support existing international reach and build relationships in new markets such as China

& Vietnam.

Partnership relationships are continuing to be developed to create awareness across certain market segments, most notably

in the pre-career stage marketer where CIM’s relationship with Pearson will gain awareness in the 16-18 year old market

with the launch of a ‘T’ Level for marketing in Sept 2025.

Membership

We ended June 2023 with a membership of 24,814, which is a 3% decline on the previous year. This reduction represents a

slowing from our 2022 decline, which is testament to the business’s efforts in improving our membership experience during

a challenging year. Our membership remains a 70/30 split between the UK and abroad, and our professional members

constitute 54% of our total. Whilst acquisition and retention are 6% below budget for professional membership, our

studying member acquisition was 13% below where we expected to end the year. Just over 50% of membership are

registered on to the CPD programme, and 22% of our professional member community are Chartered Marketers, which is a

growth of 3% since 2022.

In October 2022 we launched our first Census, surveying our membership on their requirements of CIM, as well as a cohort

of marketers who were non-members. We received a 10% response rate from our members (2,612) and 444 responses

from non-members. This ground-breaking Census gave us great insight into the respondents’ roles, careers, and their

thoughts on the marketing profession, providing us with valuable information from which we have built a continuous

improvement plan for 2023/24 which will see our membership offering evolve to better suit the large cross-section of the

marketing community we serve. Through greater understanding of our members, we aim to reverse our decline and end the

next year with growth in our member community.

CIM | Report and Financial Statements 6

Looking forward, the difficult global economic situation will continue to place additional pressure on our membership growth,

and we will continue to closely monitor the situation, with the aim that our improved offering will negate this. With a broader

set of qualifications that we will be offering, we also hope to return to growth in our studying area of membership. The

evolution of our professional membership offering supports an ambitious retention improvement goal of 89% in 2023/24 (80%

in 2022/23). With plans for increasing our marketing activity and investigating pro-active opportunities for members

acquisition, we aim to end 2023/24 with an overall membership of circa 27,000 representing an increase of 9%.

Training

The training business continues to be a significant revenue and contribution driver for the organisation, with revenue growth

up on the previous year by £183k. There has been continued investment in e-learning courses which has provided greater

customer choice of delivery mode across an increased range of marketing topics. Revenue from e-learning now accounts for

10% of all Open Training bookings. The shift to virtual and online made during the pandemic has also made the training

offer more accessible, with an increasing number of delegates now coming from outside of the UK. International bookings

accounted for 8% of total Open training revenue (predominantly coming from Europe and the Middle East).

The Open Training portfolio consists of c.100 different programmes. These are constantly reviewed and refined based on

customer feedback and market changes. While there have been many new courses developed and launched during the

year, the Google Analytics Four programme has generated significant demand and has led the revenue rankings.

Traditionally, new subject courses are introduced in isolation and tested before adding more similar programmes. However,

this has not been the case with AI. The level of business and public debate and uncertainty around the area meant that a

decision was made to launch a whole new category of courses and five AI-specific courses were launched simultaneously.

Even though these were launched in the latter stages of the financial year, initial booking levels and feedback are

encouraging. The overall delegate volumes for the year increased by 5% over the prior year to 5,081. Satisfaction scores for

Open Training have also increased year on year, with Net Promoter Score up 7.3 points to 44.9, and business relevance and

application of new skills in the workplace up 5.2 percentage points to 92.2% and 4.3 percentage points to 95.6%

respectively.

The majority of the growth for training came from the Business Solutions offering, creating customised capability

assessments and development programmes for organisations. The activity undertaken with the c.150 clients over the year

ranged from simple 1-day team training all the way through to global capability change programmes. This area of CIM’s

business is building well and the internal team will expand in 2023/24 in line with the growth in demand.

A new offering was also launched in the year called ‘Company Affiliate’. This is a 12-month relationship which unlocks

specific benefits for organisations wanting to develop their teams. These include group membership (where their employees

become members, paid for by the organisation), discounts on training and a single point of contact for all professional

development support. Although in its infancy, initial uptake and interest have been positive.

Moving forwards, we will continue to refine the existing portfolio, introduce additional online and partnership programmes,

as well as build on the momentum gained in 2022/23 in attracting a broader international audience. We will continue to

adapt appropriately, including testing different delivery models and a phased return to face to-face for selected courses.

Conference Centre

CIM Moor Hall had a slow start to the financial year with Q1 and Q2 underperforming against budget whilst Q3 was steady

and Q4 was ahead of budget which resulted in a strong finish to the end of the year. A change in leadership halfway

through the year meant that Moor Hall was able to focus its business performance on its key market of learning and

development within the professional setting of Moor Hall, and ensured that leisure distractions were no longer hindering the

progress of the site.

The Meeting and Events Industry, which Moor Hall predominantly works within, has seen major changes after Covid with

organisations operating in a very different way. Team away days are now team together days and the site has been able to

benefit from this change by providing a location to deliver this. A result of this change in business operations is that

companies are hosting larger events in person, while the smaller 8-10 person meetings have remained virtual.

Investment in the technology and Audio Visual equipment in the meeting rooms has enabled CIM Moor Hall to adapt to the

hybrid way that people operate. It has enabled the site to still deliver face to face meetings whilst attracting companies who

have international and national employees by having the infrastructure to support this. Identifying options for team building

and working with organisations in enabling individuals and teams to come together has resulted in a strong performance

over the summer months (April – July).

CIM | Report and Financial Statements 7

Recruitment still proves to be a challenge in hospitality, and this has resulted in resources being stretched and continuous

training having to be repeated throughout the year.

Marketing

The past year has been one of success for our organisation, characterised by numerous accomplishments and strategic

initiatives. Our key activities include events, podcasts, members' exclusive content, social media presence, advertising and

innovations. This summary presents key milestones and outcomes during this financial year, showcasing our dedication to

growth and excellence.

We have strengthened our brand's voice and increased our media exposure on topics of great importance to our members

and the larger marketing community. As a result, we secured more than 460 media features in prominent publications such

as the BBC, Campaign, Forbes, Marketing Week, Sky News and The Guardian. Additionally, we expanded our global

presence by announcing new partnerships and attending events that garnered media coverage in various countries,

including the USA, Ghana, Uganda, Sri Lanka, the UAE and India.

We chaired two debates in the House of Commons. These debates focused on the highly relevant topics, of the impact of

artificial intelligence and the metaverse on the marketing profession. Both proved valuable to members, with CIM reports

and thought leadership based on insight from these events.

Our podcasts have experienced substantial growth in engagement, available to both members and non-members, enabling

us to extend our voice beyond our current member base. The podcasts delivered over 53,723 downloads throughout the

year, further enhancing our industry influence. We are equally delighted with our social media community's expansion,

reaching an impressive milestone of over 340,000 followers across a number of platforms.

Our member exclusive webinars continue to grow, with over 6,500 total attendees within the year.

Our research and thought leadership went from strength to strength, working with leading global brands such as Boots,

Reuters, and Microsoft on various research projects throughout the year, driving widespread awareness and engagement in

national newspapers and our membership base.

As part of our commitment to assist marketers throughout their career journey, we have extended our support to

postgraduate students through the renowned student competition "The Pitch". Following a successful trial event organised

by CIM Scotland and sponsored by Highland Park, a leading global Whisky brand, one of the participating teams was offered

interviews for roles in a local marketing agency soon after the final. This year we intend to host a global competition for

undergraduates and postgraduates, enabling them to gain valuable employment skills and a glimpse of their potential future

in the marketing field.

We continued to champion senior marketers through the launch of our global CMO75 report, which featured insight from

some of the top CMOs across the world and included brands such as NatWest, Deutsche Bank, Decathlon, Hays, VCCP and

Cancer Research UK.

At the start of the calendar year, we introduced a new design framework, ensuring a consistent brand identity across all our

touchpoints. This initiative has strengthened our brand recognition and cohesion across various channels.

The implementation of dynamic advertising for all our products led to a notable increase in website traffic, demonstrating

the effectiveness of our advertising efforts. Timely paid campaigns, including PPC, Display advertising and Spotify ads,

played a crucial role in supporting our business objectives.

Our commitment to diversity and industry relevance was evident through the introduction of Company Affiliates, New

Specialist Awards, and our New L7 Sustainable qualification. These additions cater to various interests and requirements

within the marketing industry.

This year has been one of significant achievements for our organisation. Our dedication to providing value to our members,

promoting industry discussions and embracing innovation has resulted in a successful and eventful period. As we move

forward, we remain committed to excellence, growth, and sustainability, with a continued focus on empowering marketing

professionals.

Our People

The past year has seen CIM face a complex and dynamic set of challenges and external factors including economic

conditions, a competitive recruitment market and changing employment legislation which have all continued to shape our

HR practices. Attracting, developing and retaining talented people to the organisation has required agile solutions and our

employer branding has become a critical factor in attracting talent to CIM. We have increased our use of platforms, such as

CIM | Report and Financial Statements 8

Glassdoor, to showcase our company culture and employee experience, and this has helped to increase the number of

candidates applying for roles and has also enabled us to attract senior talent through our own search processes. Compared

to 2021/22, we have seen improved levels of retention, with employee satisfaction and engagement remaining high.

Embracing hybrid and remote working has allowed us to tap into a wider talent pool and fill roles that were previously

challenging, such as in the tech and IT sectors.

The past few years have seen radical changes to working practices, and expectations of flexible and hybrid working have

continued to reshape the workforce landscape. However, remote working can impact engagement, and we have had to find

ways to keep employee connections alive and strengthen our company culture. Like many organisations, we continue to

navigate this, aiming to balance the benefits of flexibility with the need for team collaboration in our physical workspaces,

whilst also focusing on employee wellbeing.

With CIM’s ambitious plans for growth, we will need to adapt to the technological development of our business and

changing roles and the introduction of AI in the workplace will widen skills gaps. To future-proof our workforce and

promote upskilling, we have launched a new learning platform facilitating learning in the flow of work, providing our people

with knowledge that is personalised, relevant and timely.

Looking to 2023/2024, HR will continue to be forward thinking and adaptable, monitoring and anticipating external factors

to align our activities to the evolving needs of the business. Our HR data-driven insights will continue to inform our products

and shape our employee experience.

Sustainability (Environmental, Social and Governance)

CIM remains committed to improving its sustainability credentials. This year has seen the introduction of Carbon Literacy

accreditation being rolled out across the organisation, as well as being incorporated within the staff induction programme

for all new joiners. Options have been reviewed to carry out a carbon footprint audit to determine what CIM’s baseline and

what will follow will be a series of actions that will be made to reduce this footprint to recognisable targets. An update to

CIM’s Sustainability hub on the website and a paper will be launched early in the new financial year highlighting the skills

gaps in sustainability marketing. In the meantime, we are continually improving our environmental performance as an

integral and fundamental part of our business strategy and operating methods.

As well as focusing on our own operations, CIM is also committed to supporting society and the broader marketing

community through promoting responsible and sustainable marketing practices.

Financial Report

Overall Results

The consolidated financial statements include the continuing subsidiaries of CIM: The Communication Advertising and

Marketing Education Foundation (CAM), a charity limited by guarantee, CIM Hong Kong Limited and CIM Enterprises

Limited.

Revenue of just under £14 million is 2.6% higher than last year with improvements in Training and Conference Centre

driving the increase.

Qualifications revenue showed a 8% reduction against 2022 down to £3.1m, mainly due to the lower level of assessment

bookings. Membership revenue showed a year-on-year decline of 5.7% to £3.7m. Training revenue continues to rise with a

4% increase on 2022, taking it to £4.9m. The Conference Centre revenue increased by £667k to £2.2m which was a 43%

increase on 2022.

Direct costs of sales at £7.3m were up by 11% resulting in a gross profit of £6.6m which was a decrease against the prior

year. Administrative expenses at £6.5m increased by 4% compared with last year.

As a result, CIM reported a consolidated operating profit before changes to impairment of £153k (2022: £817k).

The Directors have considered the market value of the investment property as at 30 June 2023 and, following the valuation

received in July 2023, have revalued the investment property to a value of £250,000. The change in the fair value of the

investment property of a gain of £50,000 has been credited to the profit and loss account. (2022: loss of £350,000).

After accounting for the impairment and net interest payable, there was a profit before tax of £208k (2022: £457k).

The defined benefit pension scheme showed an accounting surplus of £4.3m at the year end; although this asset has not

been and cannot be recognised in accordance with accounting standards. This compares to a surplus of £5.7m last year.

The main reason for the decrease in surplus over the year is due to lower than expected investment returns over the period,

CIM | Report and Financial Statements 9

which has been partially offset by a decrease in market views on long term inflation. This has been further offset by an

increase in corporate bond yields which led to a decrease in the value of the liabilities.

Balance sheet

The total net worth of CIM as at 30 June 2023 was £4.99m (2022: £4.8m) with unrestricted reserves accounting for £4.3m

(2022: £4.1m). The restricted reserves of £685k relate to CAM and are required to be utilised for its charitable purposes. As

its previous qualifications have ended, CAM continues to work on its proposition and strategy.

Capital expenditure of £1m was slightly lower than the prior year (2022: £1.1m) and related primarily to investment in the

new CRM system as part of the programme to reduce our technical debt.

Net current liabilities were £3.1m (2022: £2.4m). This includes the current portion of the Santander loan of £0.227m, which

is repayable within 5 years, £2.4m of deferred income (down £0.1m on last year) and Trade Creditors £0.9m (down £49k on

last year). Also, Trade and other Debtors were £0.6m (the same as last year).

Cash at bank and in hand at the end of the year was £579k. There is also the £1.5m Government backed Coronavirus

Business Interruption Loan Scheme (CBILS) overdraft facility which was in place.

Summary and Outlook

In summary, the Board is very pleased with the progress CIM has made in 2022/2023 in maintaining financial stability as

well as embracing the elements that will deliver growth – both now and in the future. We are also very excited about the

implementation of the fresh strategy over the coming years and recognise how important this next year of transition will be.

We have full confidence in the Executive to deliver on this transition, and this remains an exciting time of opportunity for

CIM as it adapts to meet the challenges of the future.

The Board wishes to thank the CEO, the Senior Management Team and all CIM staff, our membership and the wider

stakeholder community for their commitment and dedication to maintaining a strong professional body that is robust, agile,

and capable.

June Dennis

Chair of the Board of Directors

Date: 10 November 2023

E-SIGNED by June Dennis

on 2023-11-16 17:09:46 GMT

CIM | Report and Financial Statements 10

Legal and administration information

For the year ended 30 June 2023

The Board of Directors

Dr June Dennis DipM FCIM Chartered Marketer - Chair

Michael Lynch DipM FCIM Chartered Marketer – Vice Chair

Andrew Yuille DipM FCIM Chartered Marketer – Vice

Chair

Gina Balarin FCIM Chartered Marketer

William Burton DipM FCIM Chartered Marketer (From

December 2022)

Matilda Crossman DipM MCIM FCCA (Until December 2022)

Nadi Dharmasiri DipM FCIM Chartered Marketer (Until

December 2022)

Mark Durkin FCIM (Until January 2023)

Natalie Gross DipM FCIM (Until December 2022)

Kate Hamilton DipM Hon FCIM Chartered Marketer (Until

December 2022)

Fiona Hawkins FCIM

Dr Dawn Holmes FCIM Chartered Marketer

Gus MacIver ACIM FCMA

Dr Ruchitha Perera DipM FCIM Chartered Marketer

(From December 2022)

Vice Presidents

Andrew Cosslett Hon FCIM

Fiona Dawson Hon FCIM

Martin Glenn Hon FCIM

Lord Michael Grade Hon FCIM

Strategy and Finance Committee

Gus MacIver ACIM FCMA – Chair

Dr June Dennis DipM FCIM Chartered Marketer

Professor Mark Durkin FCIM (Until January 2023)

Michael Lynch DipM FCIM Chartered Marketer (From April

2023)

Andrew Yuille DipM FCIM Chartered Marketer

The Appointments and Remuneration Committee

Andrew Yuille DipM FCIM Chartered Marketer – Chair

Carol Ashton Chartered MCIPD

William Burton DipM FCIM Chartered Marketer (From April

2023)

Dr June Dennis DipM FCIM Chartered Marketer

Richard Doe DipM FCIM (Until October 2022)

Dr Dawn Holmes FCIM Chartered Marketer (Until April

2023)

The Audit and Risk Committee

Gus MacIver ACIM FCMA – Acting Chair (From March

2023)

Matilda Crossman DipM MCIM FCCA (Until December

2022)

David Maltby FCIM

Kevin Smith FCCA

Johnny Smoes FCIM Chartered Marketer (From

December 2022)

CIM | Report and Financial Statements 11

The Constitution and Ethics Committee

Helen Anderson FCIM Chartered Marketer

Andrew Chalk DipM FCIM

Dr Dawn Holmes FCIM Chartered Marketer (Until April

2023)

Michael Lynch DipM FCIM Chartered Marketer (From April

2023)

Matt Waters ACIM Chartered Marketer

Regional Chairs

Marie Lake DipM MCIM - East of England

Andrea Snagg FCIM Chartered Marketer - Greater

London

Chris Gilroy FCIM - Ireland

Rachael Mabe DipM FCIM - Midlands

Kirsty Ramsey DipM MCIM - North East

Jennifer Baker MCIM - North West

Ellie Murphy FCIM - Scotland

Marie Wilcox DipM FCIM Chartered Marketer - South

East

Claire Bryant ACIM - South West & Channel Islands

Dr Gavin Davies FCIM Chartered Marketer – Wales

Claire Pryke DipM FCIM Chartered Marketer - Yorkshire

Principal Office

Moor Hall

Cookham

Maidenhead

Berkshire

SL6 9QH

Disciplinary Committee

In June 2023 the Disciplinary Committee heard a case

against a Member. The outcome was that the Member

was found to be in breach of clauses 1,3,4 and 10 of

CIM’s Code of Professional Conduct and due to the

serious nature of the allegations, was expelled from

Membership for a period of 10 years.

Auditors

MHA (MacIntyre Hudson LLP)

Victoria Court

17-21 Ashford Road

Maidstone

Kent

ME14 5DA

Banker

Santander UK plc

2 Triton Square

Regents Place

London

NW1 3AN

Solicitors

Governance Matters:

Farrer & Co

66 Lincoln’s Inn Fields

London

WC2A 3LH

Leadership Team

Chris Daly FCIM Chartered Marketer - Chief Executive

Anna D’Souza FCCA ACIM - Director of Finance,

Procurement and Risk

Maggie Jones DipM FCIM - Director of Qualifications and

Partnerships

Stu Kaley MCIM - Director of Customer Experience and

Digital

Sarah Lee-Boone Chartered FCIPD ACIM -

Director of People and Workplace

Joanne Saintclair-Abbott CG (Affiliated) - Institute

Secretary

James Sutton FCIM - Strategy and Commercial Director

CIM | Report and Financial Statements 12

Independent auditor’s report to Members of The

Chartered Institute of Marketing

Opinion on the financial statements

We have audited the financial statements of the Chartered Institute of Marketing (the ‘parent institute’) and its subsidiaries

(the ‘group’) for the year ended 30 June 2023 which comprise the consolidated profit and loss account and statement of

retained earnings, the consolidated balance sheet, the consolidated cash flow statement, the CIM balance sheet and notes

to the financial statements, including significant accounting policies. The financial reporting framework that has been

applied in their preparation is applicable law and United Kingdom Accounting Standards, including Financial Reporting

Standard 102 The Financial Reporting Standard applicable in the UK and Republic of Ireland (United Kingdom Generally

Accepted Accounting Practice).

In our opinion the financial statements:

• give a true and fair view of the state of the group’s and of the parent institute’s affairs as at 30 June 2023 and of

the group’s profit for the year then ended;

• have been properly prepared in accordance with UK Generally Accepted Accounting Practice; and

• have been prepared in accordance with the requirements of the Royal Charter.

Basis for opinion

We conducted our audit in accordance with International Standards on Auditing (UK) (ISAs (UK)) and applicable law. Our

responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial

Statements section of our report. We are independent of the group in accordance with the ethical requirements that are

relevant to our audit of the financial statements in the UK, including the FRC’s Ethical Standard, and we have fulfilled our

ethical responsibilities in accordance with those requirements. We believe that the audit evidence we have obtained is

sufficient and appropriate to provide a basis for our opinion.

Conclusions relating to going concern

In auditing the financial statements, we have concluded that the Directors' use of the going basis of accounting in the

preparation of the financial statements is appropriate.

Based on the work we have performed, we have not identified any material uncertainties relating to events or conditions

that, individually or collectively, may cast significant doubt on the group and the parent institute’s ability to continue as a

going concern for a period of at least twelve months from when the financial statements are authorised for issue.

Our responsibilities and the responsibilities of the directors with respect to going concern are described in the relevant

sections of this report.

Other information

The other information comprises the information included in the annual report other than the financial statements and our

auditor’s report thereon. The directors are responsible for the other information contained within the annual report. Our

opinion on the financial statements does not cover the other information and, except to the extent otherwise explicitly

stated in our report, we do not express any form of assurance conclusion thereon. Our responsibility is to read the other

information and, in doing so, consider whether the other information is materially inconsistent with the financial statements

or our knowledge obtained in the course of the audit, or otherwise appears to be materially misstated. If we identify such

material inconsistencies or apparent material misstatements, we are required to determine whether this gives rise to a

material misstatement in the financial statements themselves. If, based on the work we have performed, we conclude that

there is a material misstatement of this other information, we are required to report that fact.

We have nothing to report in this regard.

CIM | Report and Financial Statements 13

Responsibilities of directors

As explained more fully in the directors’ responsibilities statement, the directors are responsible for the preparation of the

financial statements and for being satisfied that they give a true and fair view, and for such internal control as the directors

determine is necessary to enable the preparation of financial statements that are free from material misstatement, whether

due to fraud or error.

In preparing the financial statements, the directors are responsible for assessing the group and parent institute’s ability to

continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis

of accounting unless the directors either intend to liquidate the group or the parent institute or to cease operations, or have

no realistic alternative but to do so.

Auditor’s responsibilities for the audit of the financial statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material

misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable

assurance is a high level of assurance but is not a guarantee that an audit conducted in accordance with ISAs (UK) will

always detect a material misstatement when it exists.

Misstatements can arise from fraud or error and are considered material if, individually or in aggregate, they could

reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements.

Irregularities, including fraud, are instances of non-compliance with laws and regulations. We design procedures in line with

our responsibilities, outlined above, to detect material misstatements in respect of irregularities, including fraud. The specific

procedures for this engagement and the extent to which these are capable of detecting irregularities, including fraud is

detailed below:

• Enquiry of management, those charged with governance around actual and potential litigation and claims;

• Performing audit work over the risk of management override of controls, including testing of journal entries and

other adjustments for appropriateness, evaluating the business rationale of significant transactions outside the

normal course of business and reviewing accounting estimates for bias;

• Reviewing minutes of meetings of those charged with governance;

• Reviewing financial statement disclosures and testing to supporting documentation to assess compliance with

applicable laws and regulations.

Because of the inherent limitations of an audit, there is a risk that we will not detect all irregularities, including those leading

to a material misstatement in the financial statements or non-compliance with regulation. This risk increases the more that

compliance with a law or regulation is removed from the events and transactions reflected in the financial statements, as we

will be less likely to become aware of instances of non-compliance. The risk is also greater regarding irregularities occurring

due to fraud rather than error, as fraud involves intentional concealment, forgery, collusion, omission or misrepresentation.

A further description of our responsibilities for the financial statements is located on the FRC’s website at:

www.frc.org.uk/auditorsresponsibilities . This description forms part of our auditor’s report.

CIM | Report and Financial Statements 14

Use of our report

This report is made solely to the institute’s members, as a body, in accordance with the requirements of its Royal Charter.

Our audit work has been undertaken so that we might state to the institute’s members those matters we are required to

state to them in an auditor’s report and for no other purpose. To the fullest extent permitted by law, we do not accept or

assume responsibility to anyone other than the institute and the institute’s members as a body, for our audit work, for this

report, or for the opinions we have formed.

David Boosey BA(Hons) FCA

(Senior Statutory Auditor)

for and on behalf of MHA, Statutory Auditor

Reigate, United Kingdom

XX November 2023

MHA is a trading name of MacIntyre Hudson LLP, a limited liability partnership in England and Wales (registered number

OC312313)

E-SIGNED by David Boosey

on 2023-11-16 21:49:59 GMT

CIM | Report and Financial Statements 15

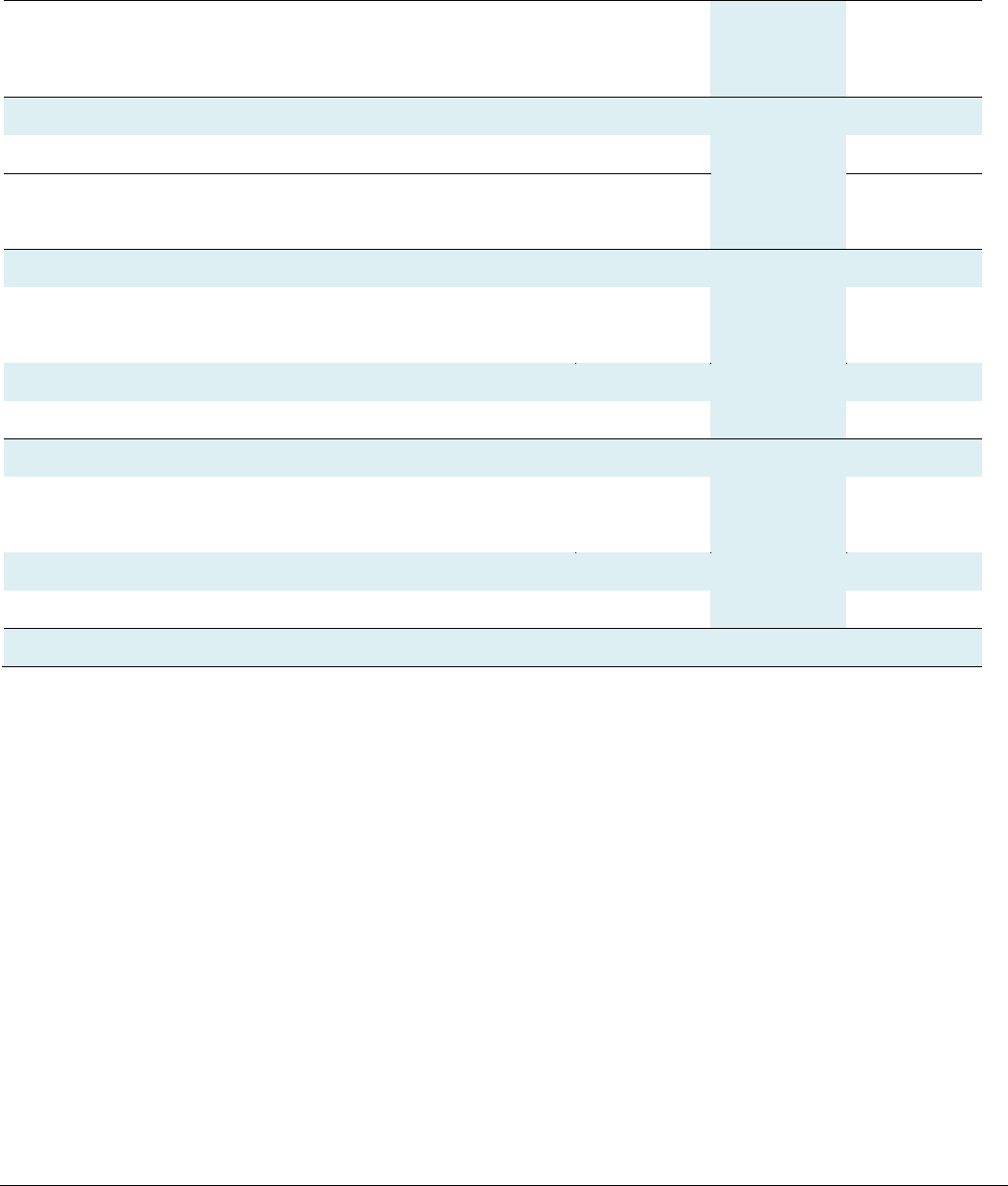

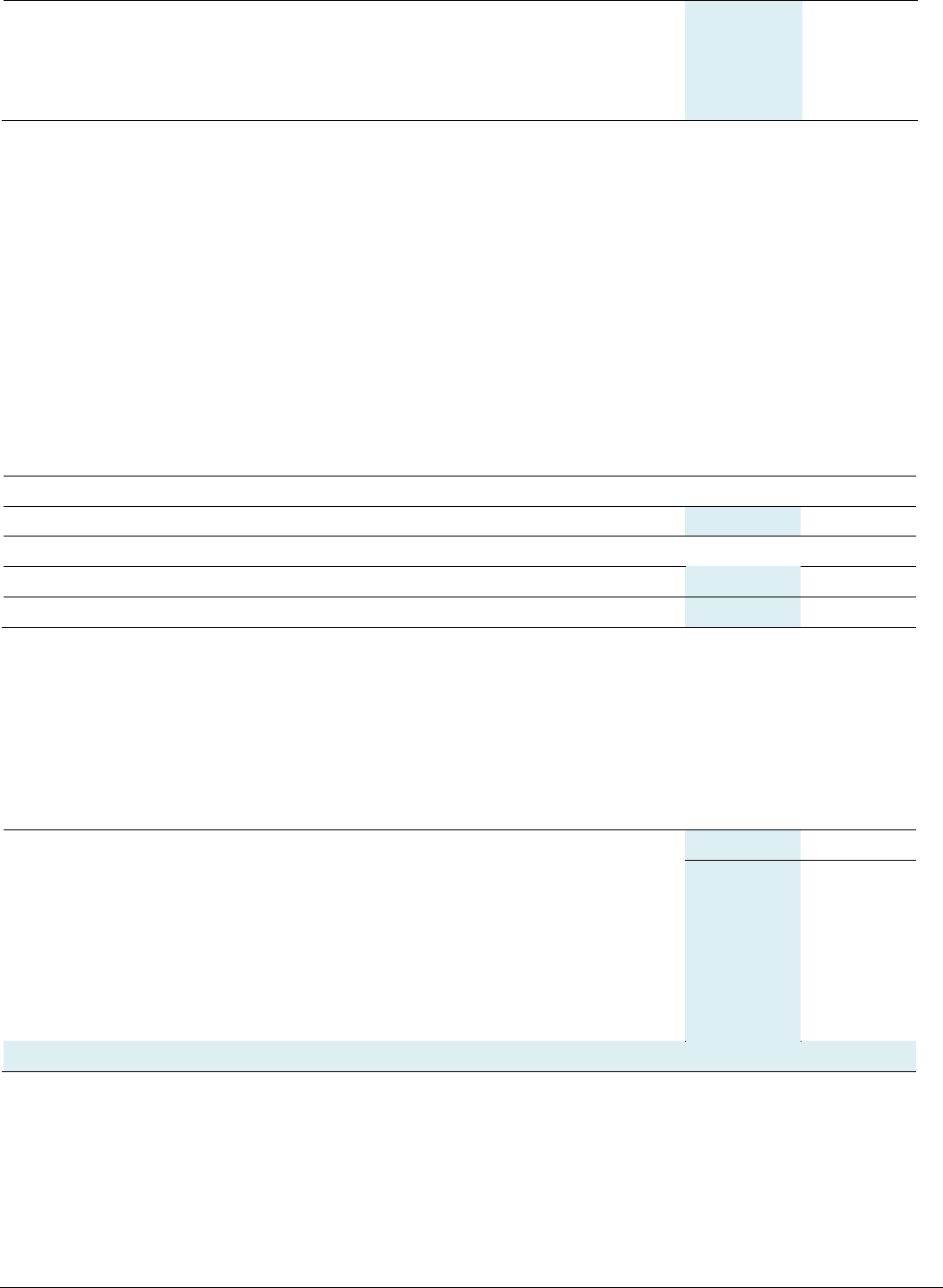

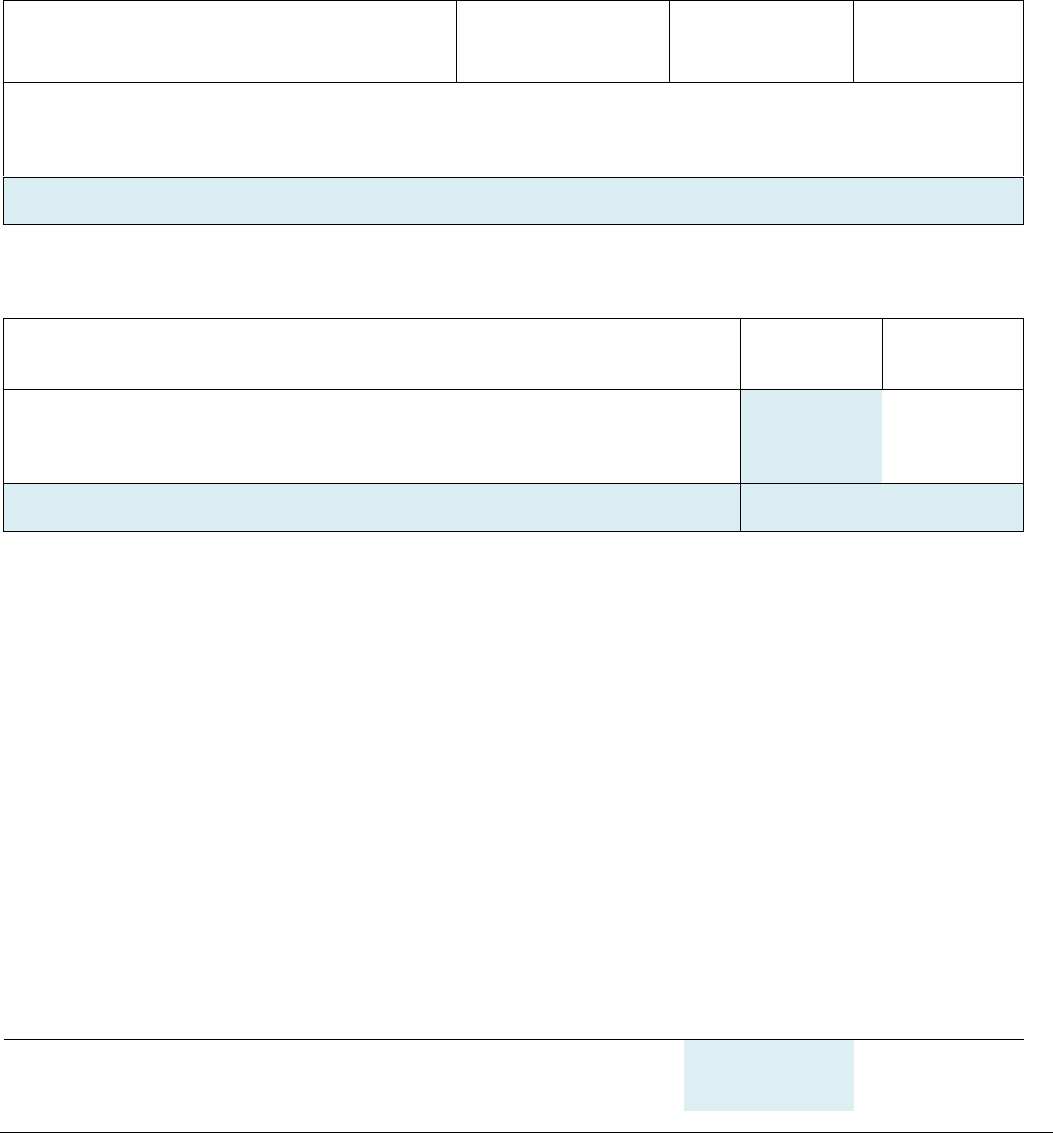

Consolidated profit and loss account

and statement of retained earnings

For the year ended 30 June 2023

Note

2023

£’000

2022

£’000

Turnover

3

13,954

13,600

Cost of sales

(7,305)

(6,535)

Gross profit

6,649

7,065

Administrative expenses

(6,496)

(6,248)

Group operating profit before changes to impairment

153

817

Gain/(Loss) on changes in fair value of investment property

10

50

(350)

Operating profit

203

467

Interest receivable

6

23

6

Interest payable

6

(18)

(16)

Profit on ordinary activities before taxation

208

457

Taxation

7

-

-

Profit after taxation

208

457

Other comprehensive income for the year:

Actuarial losses on defined benefit pension scheme

16

-

-

Total comprehensive income for year

208

457

Retained profits brought forward

4,785

4,328

Retained profits carried forward

4,993

4,785

All income and expenditure was derived solely from continuing activities. The notes on pages 19 to 30 form part of these

financial statements.

CIM | Report and Financial Statements 16

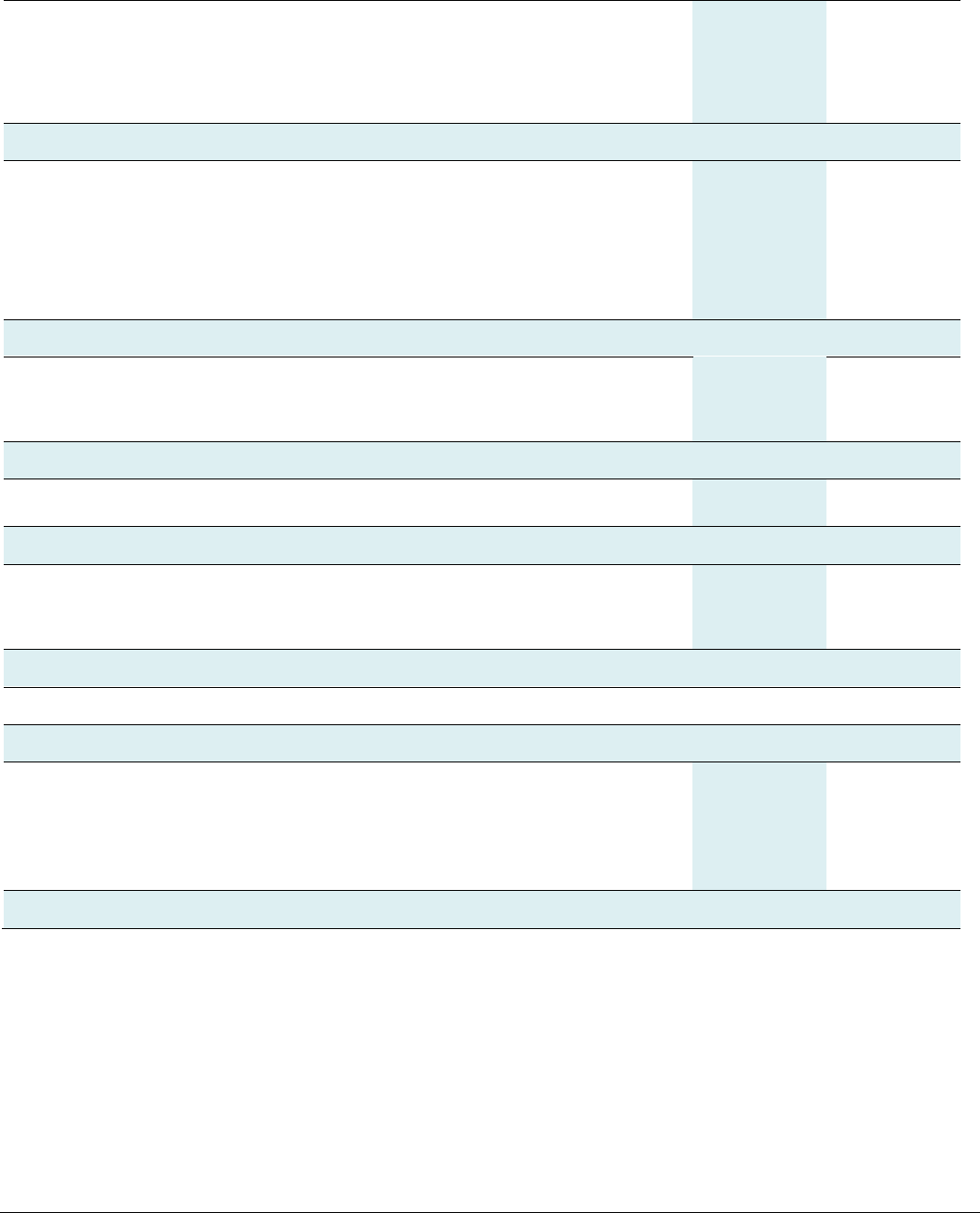

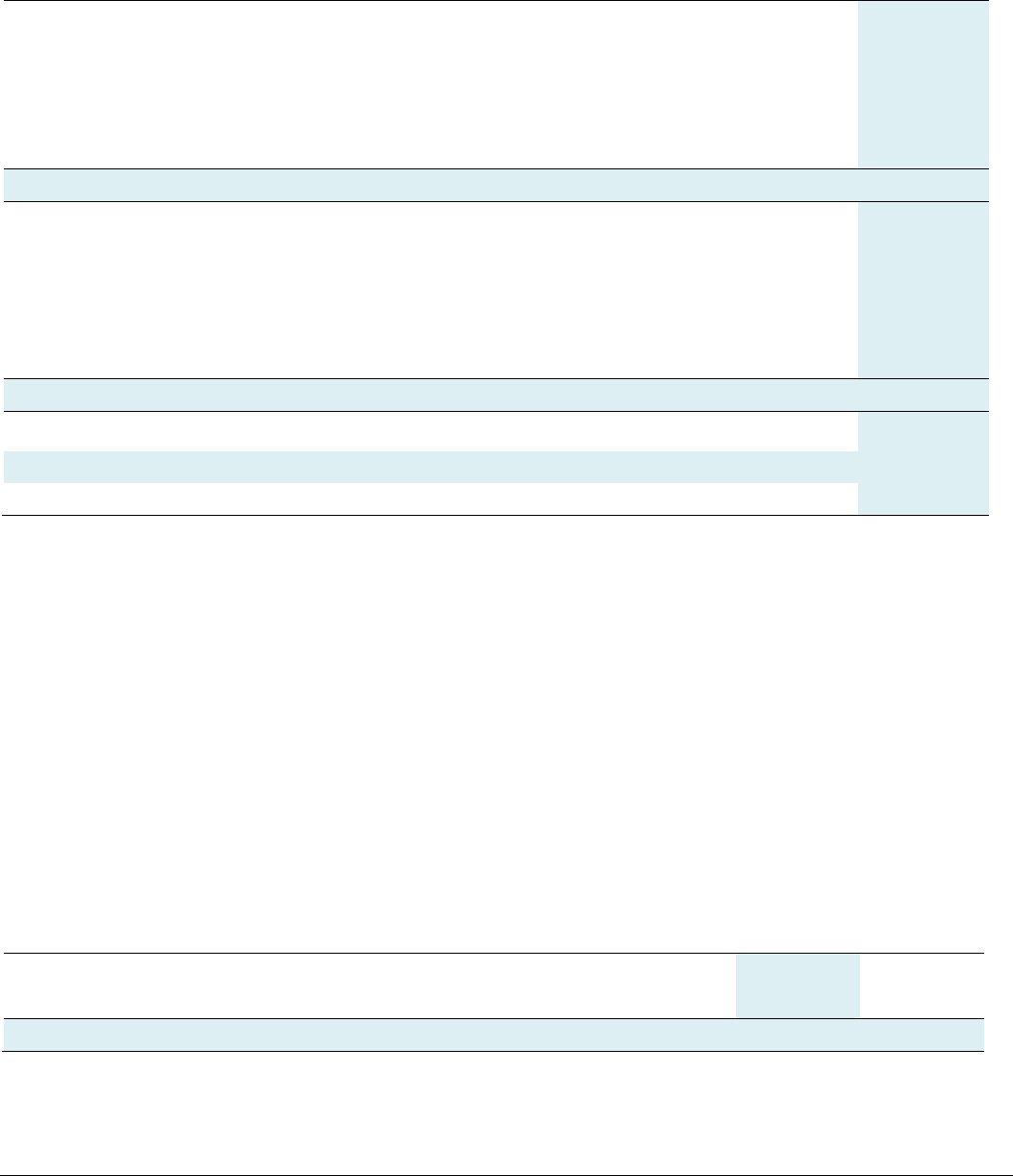

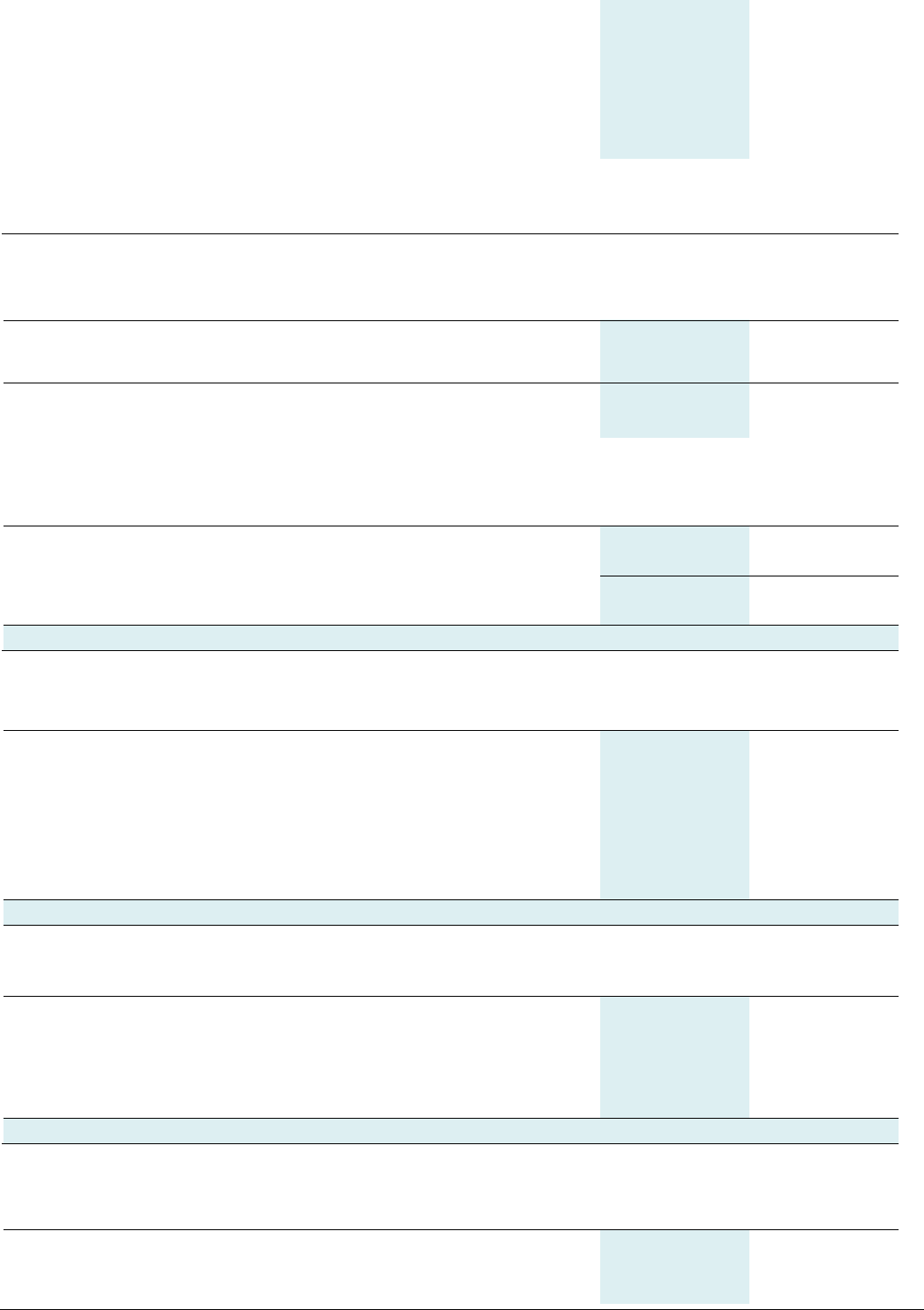

Consolidated balance sheet

At 30 June 2023

Note

2023

£’000

2022

£’000

Fixed assets

Tangible assets

9

7,868

7,233

Investments

10

250

200

8,118

6,998

Current assets

Stocks

20

20

Debtors - due within one year

11

1,010

842

Cash at bank and in hand

579

1,831

1,609

2,693

Current liabilities

Creditors – amounts falling due within one year

12

(4,734)

(5,114)

(4,734)

(5,114)

Net current liabilities

(3,125)

(2,421)

Total assets less current liabilities

4,993

5,012

Creditors

Amounts falling due after more than one year

13

-

(227)

Net assets excluding pension liability

4,993

4,785

Defined benefit pension liability

16

-

-

Net assets

4,993

4,785

Retained earnings

- CIM GROUP

4,308

4,156

- CAM – see note 1(j)

685

629

Total retained earnings

4,993

4,785

The notes on pages 19 to 30 form part of these financial statements.

These financial statements were approved and authorised by The Board of Directors on 10 November 2023.

June Dennis

Director and Chair

Date: 10 November 2023

CIM | Report and Financial Statements 17

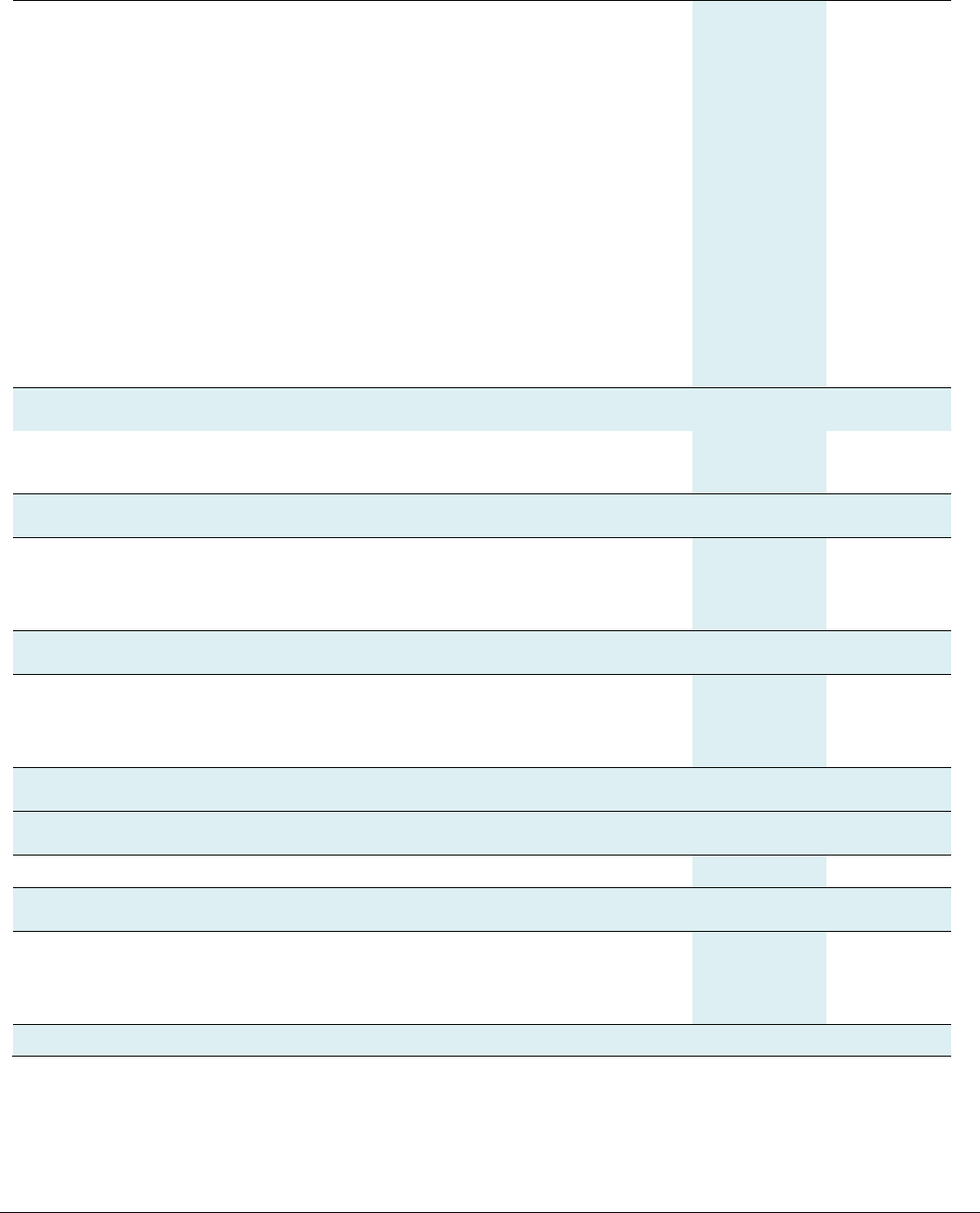

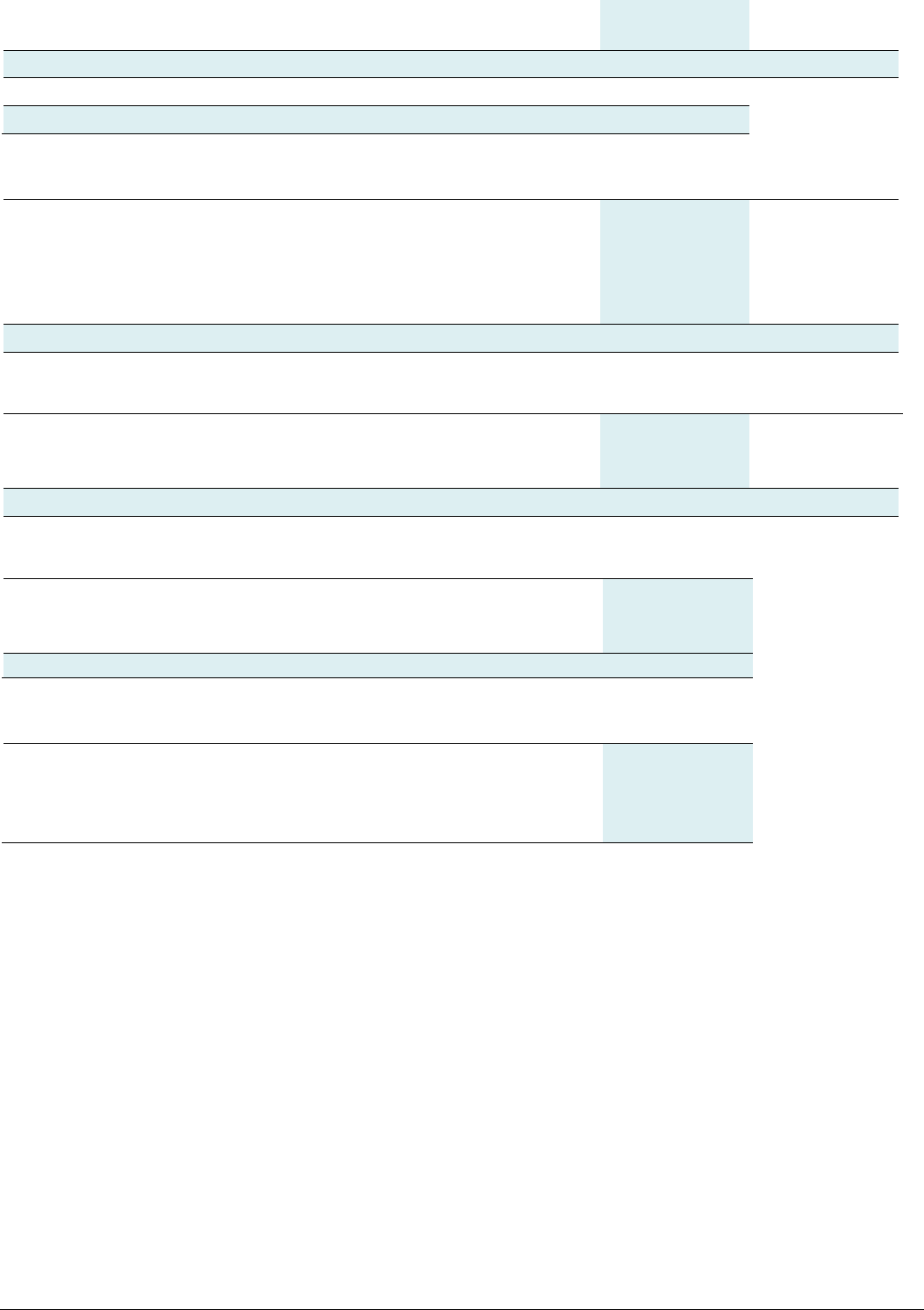

Consolidated cash flow statement

For the year ended 30 June 2023

Note

2023

£’000

2022

£’000

Cash flow from operating activities:

Profit/(Loss) for the financial year

208

457

Adjustments for:

Depreciation and amortisation of fixed assets

9

379

353

(Gain)/Loss from changes in fair value of investment property

10

(50)

350

Loss on disposal of fixed assets

-

3

Net interest (receivable)/payable

6

(5)

10

Decrease/(Increase) in:

Trade and other debtors

(168)

250

Trade and other creditors

(380)

(45)

(Increase) in stock

-

(4)

Cash from operations

(16)

1,374

Interest received

23

7

Interest paid

(18)

(16)

Net cash generated from operating activities

(11)

1,365

Cash flows from investing activities:

Purchases of tangible fixed assets

(1,014)

(1,055)

Net cash generated (used in) / from investing activities

(1,025)

310

Cash flows from financing activities:

Loan repayments

(227)

(227)

Net cash used in financing activities

(227)

(227)

(Decrease) / Increase in cash and cash equivalents

(1,252)

83

Cash and cash equivalents at beginning of year

1,831

1,748

Cash and cash equivalents at end of year

15

579

1,831

Cash and cash equivalents comprise:

Cash at bank and in hand

579

1,831

579

1,831

The notes on pages 19 to 30 form part of these financial statements.

CIM | Report and Financial Statements 18

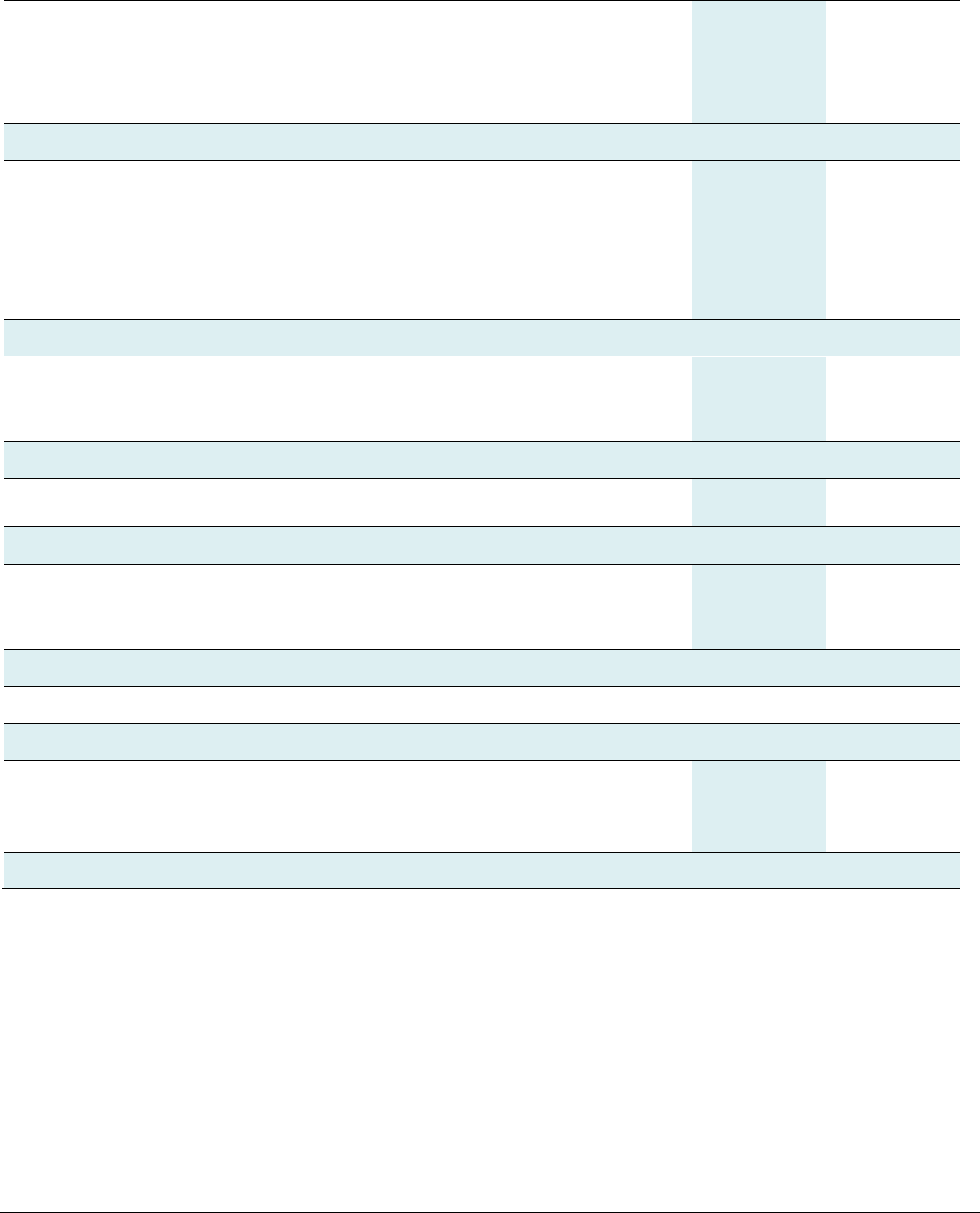

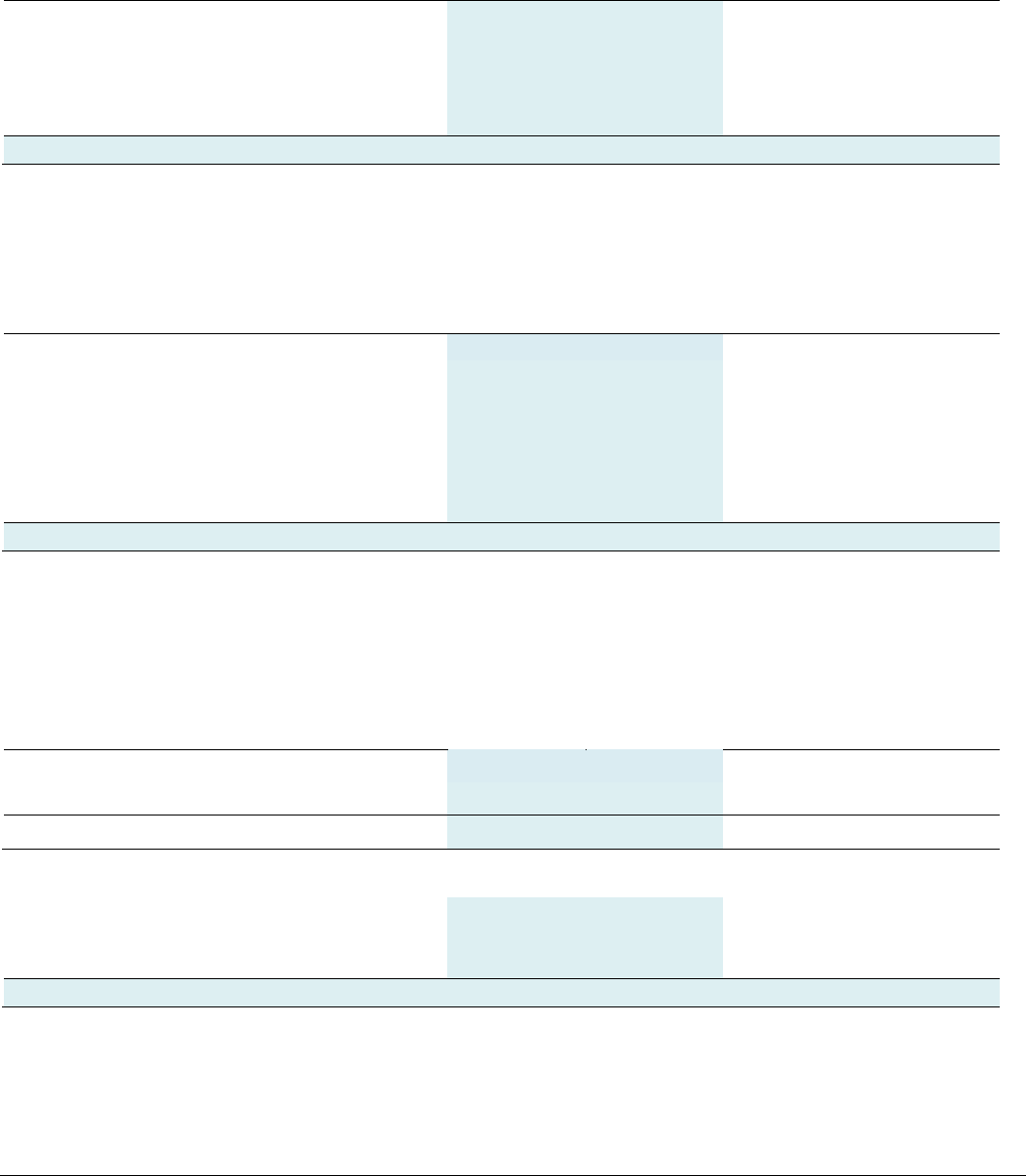

CIM balance sheet

At 30 June 2023

Note

2023

£’000

2022

£’000

Fixed assets

Tangible assets

9

7,868

7,233

Investments

10

250

200

8,118

7,433

Current assets

Stocks

20

20

Debtors - due within one year

11

1,128

955

Cash at bank and in hand

453

1,820

1,601

2,795

Current liabilities

Creditors – amounts falling due within one year

12

(4,956)

(5,299)

(4,956)

(5,299)

Net current liabilities

(3,355)

(2,504)

Total assets less current liabilities

4,763

4,929

Creditors

Amounts falling due after more than one year

13

(500)

(827)

Net assets excluding pension liability

4,263

4,102

Defined benefit pension liability

16

-

-

Net assets

4,263

4,102

Retained earnings

Profit and loss account

4,263

4,102

Total retained earnings

4,213

4,102

The notes on pages 19 to 30 form part of these financial statements.

These financial statements were approved and authorised for issue by The Board of Directors on 10 November 2023.

June Dennis

Director and Chair

Date: 10 November 2023

E-SIGNED by June Dennis

on 2023-11-16 17:10:11 GMT

CIM | Report and Financial Statements 19

Notes to the financial statements

For the year ended 30 June 2023

1. Accounting policies

a)

Basis of accounting

CIM is a company incorporated in England & Wales under Royal Charter. The address of the principal office is given on the

Legal and Administration Information page and the nature of the Group’s operations and its principal activities are set out

in the Directors’ Report. The financial statements have been prepared under the historical convention and in accordance

with the Financial Reporting Standard 102, the Financial Reporting Standard applicable in the United Kingdom and the

Republic of Ireland.

The financial statements are presented in the currency of the primary economic environment in which CIM operates, which

is the Pound Sterling and are rounded to the nearest £1.

The preparation of financial statements in compliance with FRS 102 continues to require the use of certain critical

accounting estimates. It also requires Group management to continue exercising judgment in applying the Group's

accounting policies.

b)

Going concern

The Group made a profit after tax of £208k during the year (2022: £457k) and had net current liabilities of £3.1m (2022:

£2.4m), with the major components of current liabilities consisting of £2.4m (2022: £2.5m) of Deferred Income, and £227k

of the Santander loan which is disclosed as due within one year at 30 June 2023. The 2023/24 budget reflects investment

required by CIM in order for future growth to be achieved, resulting in a surplus of £187k for the year. Given the strength of

the balance sheet and availability of a 15 year mortgage from HSBC for £1.5m in place from August 2023, the directors

believe that there are no material uncertainties and CIM is able to continue as a going concern. Accordingly the directors

have prepared the accounts on a going concern basis.

c)

Parent company disclosure exemptions

In preparing the separate financial statements of the parent company, advantage has been taken of the following disclosure

exemptions available in FRS 102:

•

No cash flow statement has been presented for the parent company

•

No disclosure has been given for the aggregate remuneration of the key management personnel of the parent

entity as their remuneration is included in the totals for the Group as a whole

d)

Basis of consolidation

The financial statements include the results of CIM, those branches over which CIM can exert dominant influence and which

would have a material impact on its results and all of its subsidiary undertakings. In the case of other branches, the

amounts advanced have been treated as part of total expenditure. A separate profit and loss account for CIM itself has not

been presented. Intercompany transactions and balances between Group companies are eliminated in full.

CIM | Report and Financial Statements 20

e)

Revenue

The main income streams are divided into four areas:

i.

Qualification services include all examination fees and accreditation fees

ii.

Membership services include professional and student membership fees, members events and advertising income

received through

Catalyst

magazine

iii.

Training, which covers CIM’s trading activities including corporate and individual training courses and bookshop

sales

iv.

Conference Centre services include corporate events, hotel accommodation, weddings and other social events held

at Moor Hall

Accounting for incoming resources:

Income is deferred where it relates to membership subscriptions and training course income which apply to the next

financial year. All deferred income will be released to revenue within the following financial year. Revenue is recognised as

follows:

i.

Qualification income from examination fees is recognised in the period in which the exams are sat

ii.

Membership income from subscriptions is recognised over the period to which it relates

iii.

Training income is recognised at the date of delivery of the service / goods apart from corporate training which is

recognised over the period to which it relates. E-Learning income is recognised when significant risks and rewards

have been transferred to the customer

iv.

Conference Centre services are recognised when the relevant events take place

f)

Tangible fixed assets

Tangible fixed assets are stated at historical cost less accumulated depreciation and any accumulated impairment losses.

Historical cost includes expenditure that is directly attributable to bringing the asset to the location and condition necessary

for it to be capable of operating in the manner intended by management.

The Group adds to the carrying amount of an item of fixed assets the cost of replacing part of such an item when that cost

is incurred if the replacement part is expected to provide incremental future benefits to the Group. The carrying amount of

the replaced part is derecognised. Repairs and maintenance are charged to the profit and loss account during the period in

which they are incurred.

Depreciation:

Land is not depreciated. Depreciation on other assets is charged so as to allocate the cost of assets less their residual value

over their estimated useful lives, using the straight-line method. The estimated useful lives range as follows:

Freehold buildings and improvements

-

50 years

Plant, machinery and vehicles

-

3-15 years

Computer equipment and software

-

3-5 years

Furniture, fixtures and equipment

-

5-10 years

The assets' residual values, useful lives and depreciation methods are reviewed and adjusted, prospectively if appropriate, if

there is an indication of a significant change since the last reporting date.

Impairment of fixed assets:

Assets that are subject to depreciation or amortisation are assessed at each reporting date to determine whether there is

any indication that the assets are impaired. Where there is any indication that an asset may be impaired, the carrying value

of the asset is tested for impairment. An impairment loss is recognised for the amount by which the asset's carrying amount

exceeds its recoverable amount. The recoverable amount is the higher of an asset's fair value less costs to sell and value

in use.

CIM | Report and Financial Statements 21

g)

Investment property

Investment property is carried at fair value. The directors consider any changes in fair value on an annual basis, with

reference to external data available and the valuation is adjusted if necessary. No depreciation is provided and changes in

fair value are recognised in the profit and loss account.

h)

Foreign currency translation

Functional and presentation currency:

Items included in the financial statements of each of the Group's entities are measured using the currency of the primary

economic environment in which the entity operates (‘the functional currency'). The consolidated financial statements are

presented in Pound Sterling, which is CIM's functional and the Group's presentation currency.

On consolidation, the results of overseas operations are translated into Sterling at rates approximating to those ruling when

the transactions took place. All assets and liabilities of overseas operations are translated at the rate ruling at the reporting

date.

Transactions and balances:

Foreign currency transactions are translated into the Group entity's functional currency using the exchange rates prevailing

at the dates of the transactions. Foreign exchange gains and losses resulting from the settlement of such transactions and

from the translation at year-end exchange rates of monetary assets and liabilities denominated in foreign currencies are

recognised in the profit and loss account.

Foreign exchange gains and losses that relate to borrowings and cash and cash equivalents are presented in the profit and

loss account within ‘finance income or costs'. All other foreign exchange gains and losses are presented in the profit and loss

account within ‘other operating income'.

i)

Pension costs

The difference between the fair value of the assets held in the Group's defined benefit pension scheme and the scheme's

liabilities measured on an actuarial basis using the projected unit method are recognised in the Group's balance sheet as a

pension asset or liability as appropriate. The carrying value of any resulting pension scheme asset is restricted to the extent

that the Group is able to recover the surplus either through reduced contributions in the future or through refunds from

the scheme.

Contributions to the Group’s defined contribution scheme are charged to the profit and loss account in the year in which

they become payable.

j)

Fund accounting

Retained profits held by CIM are unrestricted general funds which can be used in accordance with CIM’s objects at the

discretion of the Directors and restricted funds which relate to the net funds of the Communication Advertising and

Marketing Education Foundation (CAM) which is a charitable subsidiary company whose funds are only available to further

that entity’s charitable objectives.

k)

Current and deferred taxation

The Group suffers taxation on any activity that does not directly benefit the members of CIM or furthers the charitable

objectives of CAM. The current income tax charge is calculated on the basis of tax rates and laws that have been enacted or

substantively enacted by the reporting date in the countries where CIM and its subsidiaries operate and generate

taxable income.

Deferred tax is not currently recognised in the financial statements due to the uncertainty of sufficient future taxable profits

being generated against which current losses can be offset.

l)

Holiday pay accrual

A liability is recognised to the extent of any unused holiday pay entitlement which has accrued at the balance sheet date

and carried forward to future periods. This is measured at the undiscounted salary cost of the future holiday entitlement so

accrued at the balance sheet date.

CIM | Report and Financial Statements 22

m)

Financial instruments

The Group only enters into basic financial instruments transactions that result in the recognition of financial assets and

liabilities like trade and other debtors and creditors, loans from banks and other third parties and loans to related parties.

Debt instruments (other than those wholly repayable or receivable within one year), including loans and other accounts

receivable and payable, are initially measured at the present value of the future cash flows and subsequently at amortised

cost using the effective interest method. Debt instruments that are payable or receivable within one year, typically trade

debtors and creditors, are measured, initially and subsequently, at the undiscounted amount of the cash or other

consideration expected to be paid or received.

Financial assets that are measured at cost and amortised cost are assessed at the end of each reporting period for objective

evidence of impairment. If objective evidence of impairment is found, an impairment loss is recognised in profit and loss.

n)

Grant income

Payments received from the government for furloughed employees are a form of grant. This grant money is receivable as

compensation for expenses already incurred, and where this is not in respect of future related costs, is recognised in income

in the period in which it becomes receivable and the related expenses incurred.

2. Judgments in applying accounting policies and key sources of estimation uncertainty

In preparing these financial statements, the Directors have made the following judgments:

•

Determine whether there are indicators of impairment of the Group's tangible assets. Factors taken into

consideration in reaching such a decision include the economic viability and expected future financial performance

of the asset and where it is a component of a larger cash-generating unit, the viability and expected future

performance of that unit

•

Determine whether appropriate assumptions have been made to value the assets and liabilities of the defined

benefit pension scheme

•

Consider the appropriateness of non-recognition of a deferred tax asset in respect of unutilised cumulative

tax losses

Other key sources of estimation uncertainty:

•

Tangible fixed assets (see note 9)

•

Valuation of investment property (see note 10)

•

Recoverability of debtors (see note 11)

Tangible fixed assets are depreciated over their useful lives, taking into account residual values where appropriate. The

actual lives of the assets and residual values are assessed annually and may vary depending on a number of factors. In

reassessing asset lives, factors such as technological innovation, product life cycles and maintenance programmes are taken

into account. Residual value assessments consider issues such as future market conditions, the remaining life of the asset

and projected disposal values.

The valuation of investment property is carried out at fair value in consultation with external valuers.

Provision is made for non-recoverability of trade debtors where they remain unpaid beyond the average time to collect,

generally 90 days.

CIM | Report and Financial Statements 23

3. Analysis of turnover

2023

£’000

2022

£’000

Analysis by class of business:

Qualifications

3,145

3,420

Membership

3,669

3,890

Training

4,930

4,747

Conference Centre

2,210

1,543

13,954

13,600

4. Operating profit

2023

£’000

2022

£’000

This is arrived at after charging/(crediting):

Depreciation of tangible fixed assets

379

353

Fees payable to CIM's auditors for the audit of the CIM's annual accounts

42

40

Fees payable to the Group's auditors for other services to the Group:

Taxation compliance services

4

6

Defined contribution pension cost

305

221

5. Employees

2023

£’000

2022

£’000

Staff costs (including senior management) consist of:

Wages and salaries

6,019

5,707

Social security costs

638

607

Defined contribution pension cost

305

221

6,962

6,535

The average number of employees (including senior management) during the year was:

2023

Number

2022

Number

Qualifications

18

15

Membership

55

55

Training

22

22

Conference Centre

18

16

Administration

44

44

157

152

CIM | Report and Financial Statements 24

The number of higher paid employees was:

2023

Number

2022

Number

£80,001 - £110,000

1

4

£110,001 - £140,000

4

5

£140,001 - £170,000

3

1

>£170,001

1

-

The above remuneration bands include benefits-in-kind, bonuses and employers pension contributions.

No Directors received any remuneration or benefits from the Group.

Key management personnel include the Senior Management Team who together have authority and responsibility for

planning, directing and controlling the activities of the Group. The total compensation including employers pension

contributions paid to key management personnel for services provided to the Group was £1,061k (2022: £995k). The

increase in employers contributions year on year follows the introduction of salary sacrifice for pension contributions, so

contributions previously attributed to the employee are now falling under employer contributions.

6. Interest receivable and interest payable

2023

£’000

2022

£’000

Interest receivable

Interest receivable on short term deposits

23

6

Interest payable

Loans and overdrafts

(18)

(16)

Net interest receivable/(payable)

5

(10)

7. Taxation

There is no taxation payable for the current year. An analysis is shown below to reconcile the result for the year to the

tax charge:

2023

£’000

2022

£’000

Profit on ordinary activities before taxation

208

457

Tax on profit on ordinary activities at standard CT rate of 19.00%

43

87

Expenses not deductible for tax purposes

1,266

1,274

Income not taxable for tax purposes

(1,402)

(1,389)

Fixed asset differences

31

(14)

Remeasurement of deferred tax for change in tax rates

(14)

(13)

Deferred tax not recognised

76

55

Current tax charge/(credit)

-

-

No deferred tax assets are currently recognised on the balance sheet. CIM has unutilised cumulative tax losses of

£9,184,657 available to carry forward against future profits from commercial activities.

CIM | Report and Financial Statements 25

8. Parent company profit for the year

In accordance with permitted exemptions CIM has not presented its own profit and loss account in these financial

statements. The profit after tax of CIM itself for the year was £161k (2022: £423k - profit).

9. Tangible fixed assets

Freehold land

and buildings

£'000

Plant,

machinery

and vehicles

£'000

Computer

equipment

and software

£'000

Furniture,

fixtures and

equipment

£'000

Total

£'000

Cost or valuation

At 1 July 2022

5,764

1,779

2,215

402

10,160

Transfers

457

(457)

-

-

-

Additions

-

372

642

-

1,014

Disposals

-

(66)

-

-

(66)

At 30 June 2023

6,221

1,628

2,857

402

11,108

Depreciation

At 1 July 2022

470

879

1,269

309

2,927

Transfers

355

(355)

-

-

-

Charge for the year

91

102

152

34

379

Disposals

-

(66)

-

-

(66)

At 30 June 2023

916

560

1,421

343

3,240

Net book value

At 30 June 2023

5,305

1,068

1,436

59

7,868

At 30 June 2022

5,294

900

946

93

7,233

The freehold land and buildings are subject to a fixed charge as security for the Santander loan. All tangible fixed assets

are owned by CIM. On transition to FRS 102, CIM took the option of treating the previously revalued amount (at 30 June

2014) of freehold land and buildings as deemed cost. Transfers are the reclassification of plant to buildings.

10. Fixed asset investments

The Directors have considered the market value of the investment property at 30 June 2023 and following a professional

independent valuation received in July 2023 have increased the value of the investment property to £250,000. The gain on

this revaluation of £50,000 has been credited to the profit and loss account.

If the investment property had been accounted for under the historic cost accounting rules, the property would have been

measured as follows:

Group

and CIM

2023

£’000

Group

and CIM

2022

£’000

Historic cost

350

350

Accumulated depreciation

(63)

(56)

Net book value

287

294

CIM | Report and Financial Statements 26

The following subsidiaries were active in the year and are 100% subsidiaries of CIM:

•

Communication Advertising & Marketing Education Foundation (CAM), incorporated in England

•

The Chartered Institute of Marketing Hong Kong Limited, incorporated in Hong Kong

•

CIM Enterprises Limited, incorporated in England

11. Debtors: Due within one year

2023

2022

Group

£’000

CIM

£’000

Group

£’000

CIM

£’000

Trade debtors

589

589

569

569

Owed by Group companies

-

118

-

113

Other debtors

45

45

27

27

Prepayments

353

353

228

228

Accrued income

23

23

18

18

1,010

1,128

842

955

12. Creditors: Amounts falling due within one year

2023

2022

Group

£’000

CIM

£’000

Group

£’000

CIM

£’000

Loan (see note 14)

227

227

227

227

Trade creditors

867

867

916

916

Owed to Group companies

-

10

-

10

Taxation and social security

283

283

242

242

Other creditors

76

76

62

62

Accruals

913

1,125

1,145

1,320

Deferred income

2,368

2,368

2,522

2,522

4,734

4,956

5,114

5,299

13. Creditors: Amounts falling due after more than one year

2023

2022

Group

£’000

CIM

£’000

Group

£’000

CIM

£’000

CAM Loan (see note 14)

-

500

-

600

Loans (see note 14)

227

-

227

227

227

500

227

827

The maturity of sources of debt finance was:

Within one year or on demand

227

227

227

227

In 1-2 years

-

500

226

827

In 2-5 years

-

-

-

-

227

727

453

1,054

CIM | Report and Financial Statements 27

14. Loans and Overdraft Facility

On 5 May 2019 CIM took out a £1.0m loan from Santander, which is secured on the freehold land and buildings at Moor Hall

and repayable by instalments over a term of 60 months. This term loan bears interest at 2.5% above the Bank of England

base rate.

On 26 August 2020 CIM took out a three-year £1,500,000 overdraft facility with Santander under the Government backed

Coronavirus Business Interruption Loan Scheme (CBIL Scheme), payable on demand with interest chargeable at 2.95% (0%

for the first 12 months) above the Bank of England base rate. This facility had not been utilised by the year end.

On 31 July 2022 £100,000 of the outstanding loan from CAM was repaid and a loan of £500,000 was renewed with CAM on

31 July 2022 for 2 years to 31 July 2024, at an interest rate of 4%.

15. Reconciliation of net cash flow to movement in net debt

Analysis of changes in net debt - Group

At 1 July 2022

£’000

Cashflow

£’000

At 30 June 2023

£’000

Santander Loan

(453)

226

(227)

Cash at bank and in hand

1,831

(1,252)

579

Total

1,378

(1,026)

352

Net debt is defined as the net of cash and cash equivalents, other financial assets, bank overdrafts, loan notes and

bank loans.

Reconciliation of net cash flow to movement in net debt - Group

2023

£’000

2022

£’000

(Decrease)/Increase in cash in the year

(1,026)

310

Net position at the beginning of the year

1,378

1,068

Net position at the end of the year

352

1,378

16. Pensions

CIM (the “Employer”) operates a closed defined benefit pension arrangement called the CIM Holdings Limited Retirement

Benefits Scheme (the “Scheme”). The Scheme provides benefits based on final salary and length of service on retirement,

leaving service or death. The Employer also operates a defined contribution scheme but this is not included in

these disclosures.

The Scheme is subject to the Statutory Funding Objective under the Pensions Act 2004. A valuation of the Scheme is carried

out at least once every three years to determine whether the Statutory Funding Objective is met. As part of the process CIM

must agree with the Directors of the Scheme the contributions to be paid to address any shortfall against the Statutory

Funding Objective.

The most recent comprehensive actuarial valuation of the Scheme was carried out as at 30 June 2020 and the next

valuation of the Scheme was due as at 30 June 2023. However, the Scheme Trustees are looking at buy-out and therefore

the actuarial valuation has not been carried out. The Employer expects to pay no contributions in the year to June 2024 as

the Scheme was in surplus at the previous actuarial date.

There were no plan amendments, curtailments or settlement during the period.

The assumptions used for calculating the liabilities were:

2023

2022

Discount rate

5.3%

3.7%

Inflation assumption (RPI)

3.3%

3.4%

CIM | Report and Financial Statements 28

Inflation assumption (CPI)

2.7%

2.7%

Pre-1995 pension increases

5.0%

5.0%

Post 1995 pension increases

3.2%

3.3%

Post 1 July 2007 pension increases

2.3%

2.3%

Salary increases

2.8%

2.8%

Commutation - No allowance has been made for members to take tax free cash.

Expenses – Up until 30

th

April 2023 CIM met expenses directly. From 1

st

May 2023 these expenses have been met by the

Scheme.

Mortality assumptions

2023

2022

Mortality tables

S3NA CMI 2019

projections LTR

1.25%

S3NA CMI 2019

projections LTR

1.25%

Life expectancy of pensioners at age 65

Males:

22.4 years

22.3 years

Females:

24.8 years

24.7 years

Amounts recognised in the Balance Sheet

2023

£’000

2022

£’000

Fair value of assets

20,869