Media Relations: Wesley McDade 212-761-2430 Investor Relations: Leslie Bazos 212-761-5352

Morgan Stanley Fourth Quarter and Full Year 2023 Earnings Results

Morgan Stanley Reports Fourth Quarter Net Revenues of $12.9 Billion, EPS of $0.85 and ROTCE of 8.4%;

Full Year Net Revenues of $54.1 Billion, EPS of $5.18 and ROTCE of 12.8%

NEW YORK, January 16, 2024 – Morgan Stanley (NYSE: MS) today reported net revenues of $12.9 billion for the fourth

quarter ended December 31, 2023 compared with $12.7 billion a year ago. Net income applicable to Morgan Stanley was $1.5

billion, or $0.85 per diluted share,

1

compared with $2.2 billion, or $1.26 per diluted share,

1

for the same period a year ago.

Pre-tax income for the fourth quarter includes $535 million of charges or $0.28 per diluted share

1,

2

: $286 million related to an

FDIC special assessment and a $249 million legal charge related to a specific matter.

Full year net revenues were $54.1 billion compared with $53.7 billion a year ago. Net income applicable to Morgan Stanley was

$9.1 billion, or $5.18 per diluted share,

1

compared with $11.0 billion, or $6.15 per diluted share,

1

a year ago.

Ted Pick, Chief Executive Officer, said, “In 2023, the Firm reported a solid ROTCE against a mixed market backdrop and a

number of headwinds. We begin 2024 with a clear and consistent business strategy and a unified leadership team. We are

focused on achieving our long-term financial goals and continuing to deliver for shareholders.”

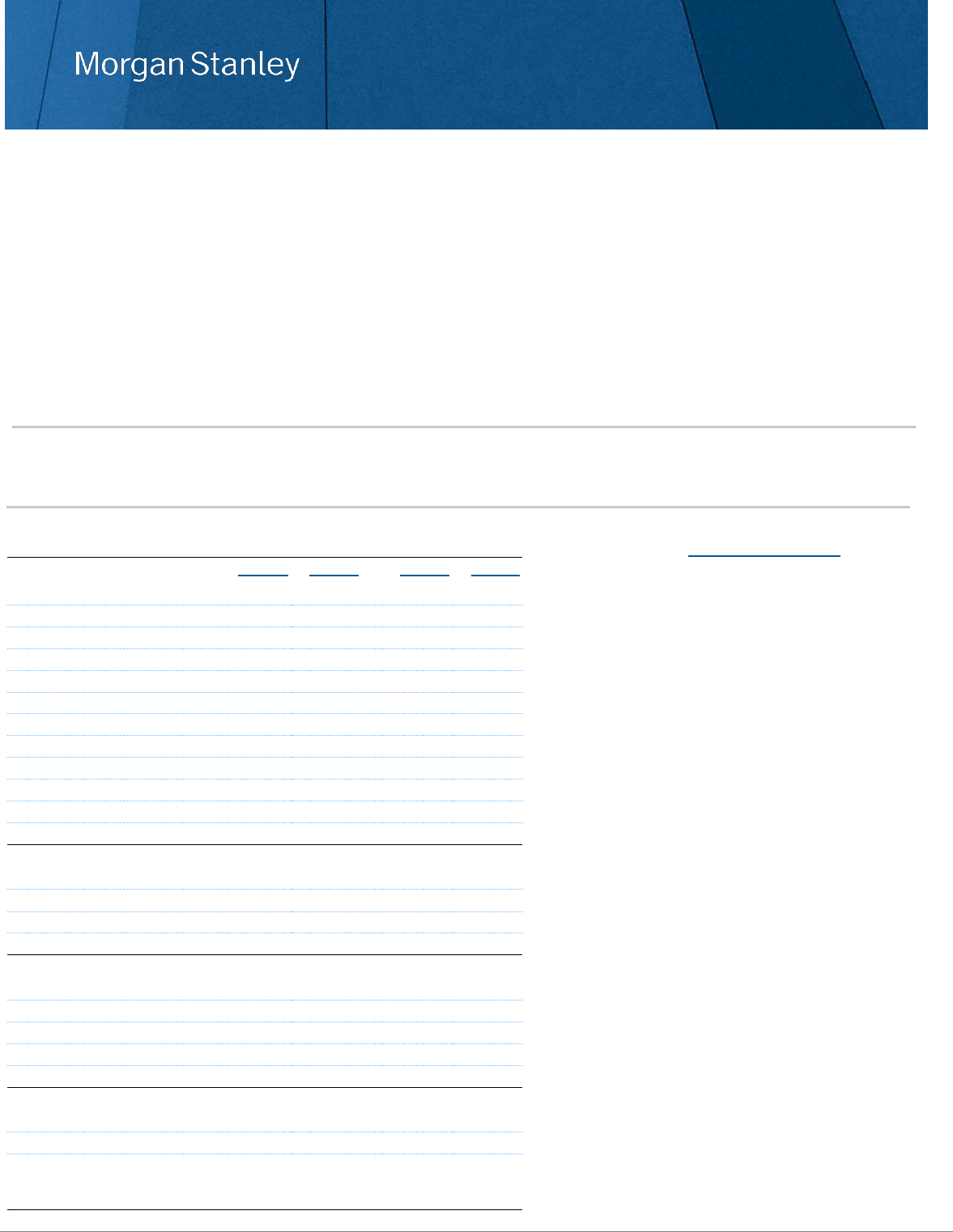

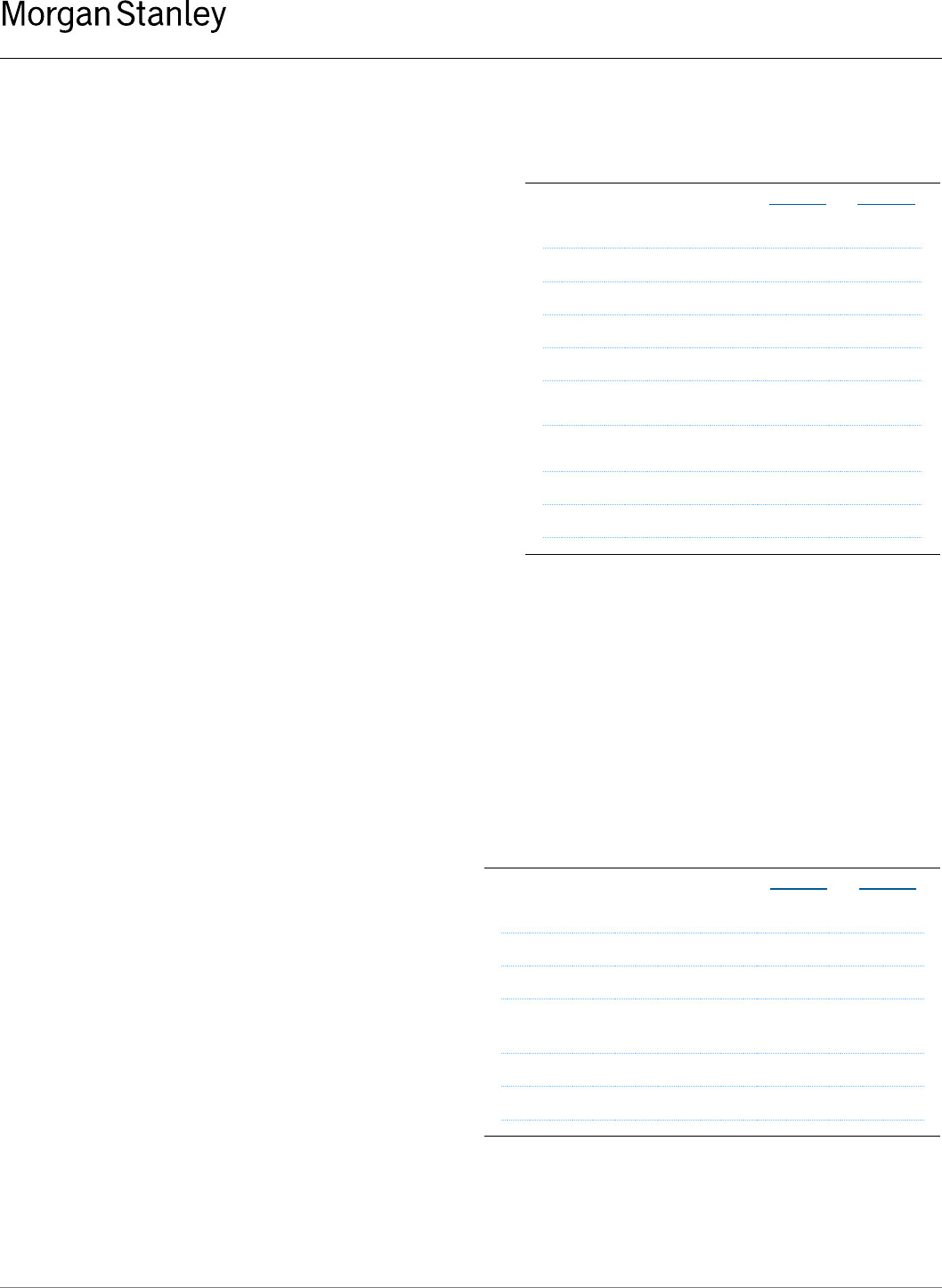

Financial Summary

3

,

4

Full Year Highlights

Firm ($MM, except per share data)

4Q 2023

4Q 2022

FY 2023

FY 2022

• The Firm reported full year net revenues of $54.1

billion and net income of $9.1 billion.

• The Firm delivered full year ROTCE of 12.8%.

5

• The full year Firm expense efficiency ratio was 77%.

9

The full year was negatively impacted by expenses

related to severance costs of $353 million, an FDIC

special assessment of $286 million, a $249 million

legal charge related to a specific matter, and

integration-related expenses of $293 million.

• Standardized Common Equity Tier 1 capital ratio was

15.2%.

18

• Institutional Securities reported full year net revenues

of $23.1 billion reflecting lower completed activity in

Investment Banking and lower results in Equity and

Fixed Income on reduced client activity and a less

favorable market environment compared to a year

ago.

• Wealth Management delivered full year net revenues

of $26.3 billion, reflecting mark-to-market gains on

investments associated with DCP versus losses a

year ago and higher net interest income.

6

The pre-tax

margin was 24.9%.

7,8

The business added net new

assets of $282 billion, representing a full-year 7%

annualized growth rate from beginning period

assets.

12

• Investment Management reported full year net

revenues of $5.4 billion and AUM increased to $1.5

trillion.

13

Net revenues

$12,896

$12,749

$54,143

$53,668

Provision for credit losses

$3

$87

$532

$280

Compensation expense

$5,951

$5,615

$24,558

$23,053

Non-compensation expenses

$4,846

$4,253

$ 17,240

$16,246

Pre-tax income

7

$2,096

$2,794

$11,813

$14,089

Net income app. to MS

$1,517

$2,236

$9,087

$11,029

Expense efficiency ratio

9

84%

77%

77%

73%

Earnings per diluted share

1

$0.85

$1.26

$5.18

$6.15

Book value per share

$55.50

$54.55

$ 55.50

$54.55

Tangible book value per share

$40.89

$40.06

$ 40.89

$40.06

Return on equity

6.2%

9.2%

9.4%

11.2%

Return on tangible equity

5

8.4%

12.6%

12.8%

15.3%

Institutional Securities

Net revenues

$4,940

$4,800

$23,060

$24,393

Investment Banking

$1,318

$1,252

$4,578

$5,235

Equity

$2,202

$2,176

$9,986

$10,769

Fixed Income

$1,434

$1,418

$7,673

$9,022

Wealth Management

Net revenues

$6,645

$6,626

$26,268

$24,417

Fee-based client assets ($Bn)

10

$1,983

$1,678

$1,983

$1,678

Fee-based asset flows ($Bn)

11

$41.6

$20.4

$109.2

$162.8

Net new assets ($Bn)

12

$47.5

$51.6

$282.3

$311.3

Loans ($Bn)

$146.5

$146.1

$146.5

$146.1

Investment Management

Net revenues

$1,464

$1,461

$5,370

$5,375

AUM ($Bn)

13

$1,459

$1,305

$1,459

$1,305

Long-term net flows ($Bn)

14

$(7.1)

$(6.0)

$(15.2)

$(25.8)

2

Fourth Quarter Results

Institutional Securities

Institutional Securities reported net revenues for the current quarter of $4.9 billion compared with $4.8 billion a year

ago. Pre-tax income was $408 million compared with $748 million a year ago.

7

Investment Banking revenues up 5% from a year ago:

• Advisory revenues were essentially unchanged from a year

ago reflecting completed M&A activity in the current

quarter.

• Equity underwriting revenues were essentially unchanged

from a year ago.

• Fixed income underwriting revenues increased 25% from a

year ago on higher investment grade issuances.

Equity net revenues:

• Equity net revenues were essentially unchanged from a

year ago. The absence of markdowns on certain strategic

investments versus a year ago were offset by increased

funding and liquidity costs.

Fixed Income net revenues:

• Fixed Income net revenues were essentially unchanged

versus a year ago reflecting higher revenues in

commodities driven by improved market conditions and

increased client activity partially offset by lower results in

credit products.

Other:

• Other revenues for the quarter reflect mark-to-market

losses on corporate loans, inclusive of loan hedges, of

$405 million. These losses were partially offset by net

interest income and fees on corporate loans of $248

million, mark-to-market gains on DCP and revenues from

our Japanese securities joint venture.

Total Expenses:

• Compensation expense increased from a year ago reflecting higher discretionary compensation, partially offset by

lower expenses related to outstanding deferred equity compensation and significantly lower severance costs due to

an employee action a year ago.

• Non-compensation expenses increased from a year ago primarily driven by higher legal expenses including a

specific matter of $249 million and an FDIC special assessment of $121 million.

15

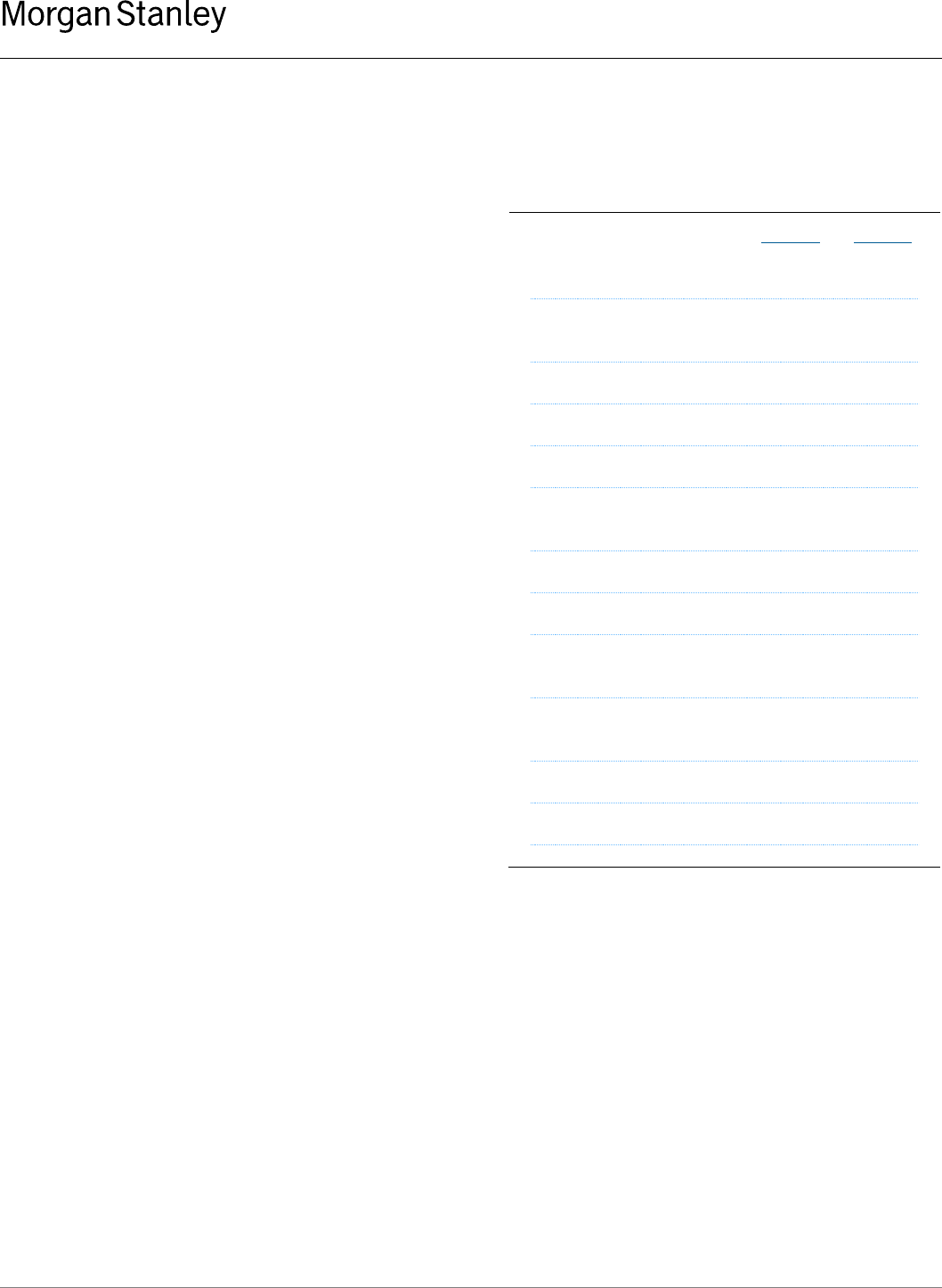

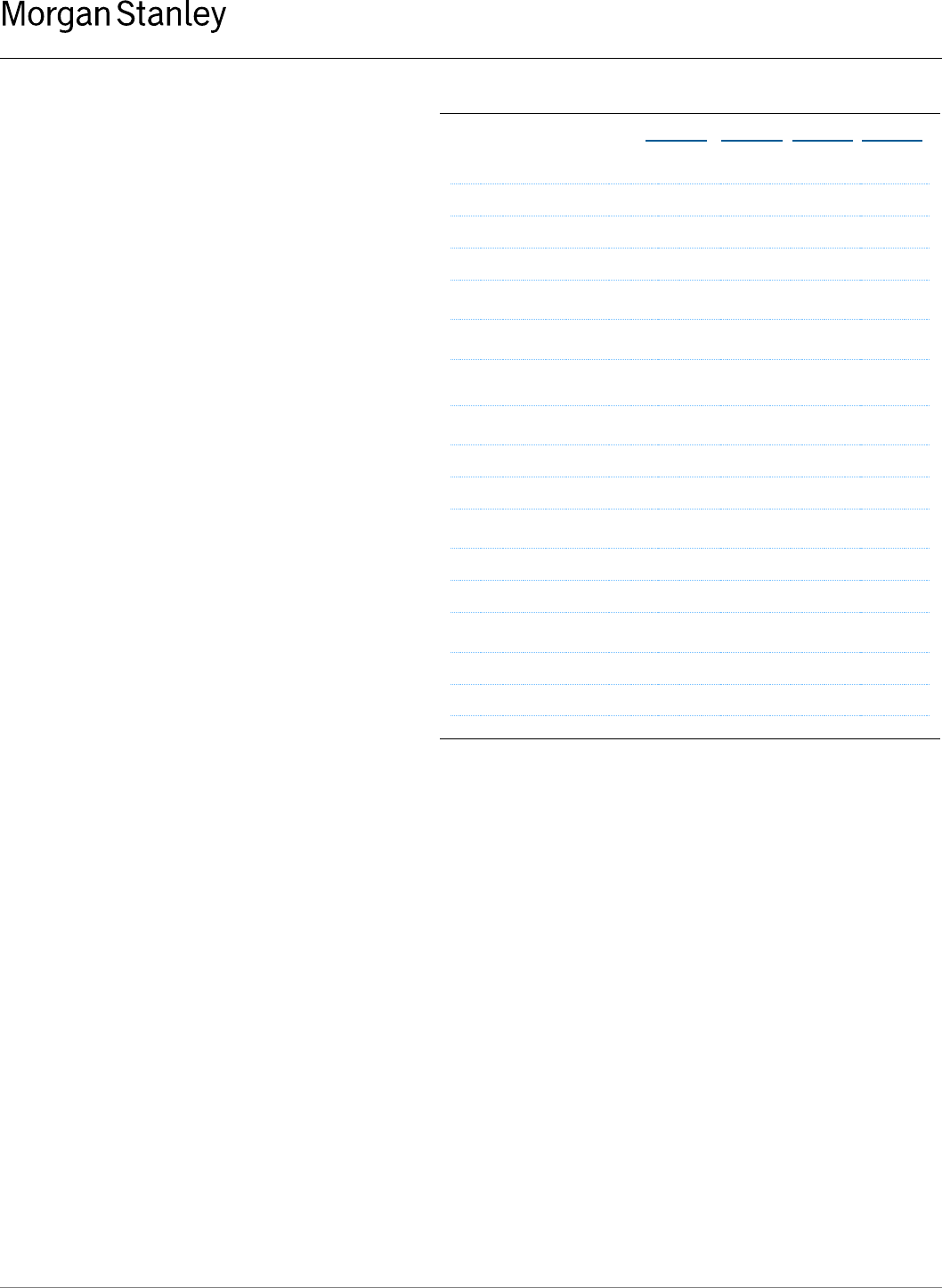

($ millions)

4Q 2023

4Q 2022

Net Revenues

$4,940

$4,800

Investment Banking

$1,318

$1,252

Advisory

$702

$711

Equity underwriting

$225

$227

Fixed income underwriting

$391

$314

Equity

$2,202

$2,176

Fixed Income

$1,434

$1,418

Other

$(14)

$(46)

Provision for credit losses

$22

$61

Total Expenses

$4,510

$3,991

Compensation

$1,732

$1,644

Non-compensation

$2,778

$2,347

3

Wealth Management

Wealth Management net revenues of $6.6 billion in the current quarter were essentially unchanged from a year ago.

Pre-tax income of $1.4 billion

7

in the current quarter resulted in a pre-tax margin of 21.5%.

8

Net revenues:

• Asset management revenues increased from a year ago

reflecting higher asset levels and the impact of positive fee-

based flows.

• Transactional revenues were essentially unchanged

excluding the impact of mark-to-market on investments

associated with DCP.

6,16

• Net interest income decreased from a year ago driven by

changes in deposit mix, partially offset by higher interest

rates.

Total Expenses:

• Compensation expense increased from a year ago driven by

higher compensable revenues and higher expenses related

to DCP.

6

• Non-compensation expenses increased from a year ago

primarily driven by an FDIC special assessment of $165

million, partially offset by lower marketing and business

development costs.

15

Investment Management

Investment Management net revenues of $1.5 billion were essentially unchanged from a year ago. Pre-tax income was

$265 million compared with $214 million a year ago.

7

Net revenues:

• Asset management and related fees increased from a

year ago on higher average AUM driven by increased

asset values.

• Performance-based income and other revenues

decreased from a year ago primarily due to lower

accrued carried interest in our private funds partially

offset by mark-to-market gains on public investments

compared to losses a year ago.

Total Expenses:

• Compensation expense decreased from a year ago,

primarily driven by lower compensation associated with

carried interest.

($ millions)

4Q 2023

4Q 2022

Net Revenues

$6,645

$6,626

Asset management

$3,556

$3,347

Transactional

$1,088

$931

Net interest

$1,852

$2,138

Other

$149

$210

Provision for credit losses

$(19)

$26

Total Expenses

$5,236

$4,760

Compensation

$3,640

$3,343

Non-compensation

$1,596

$1,417

($ millions)

4Q 2023

4Q 2022

Net Revenues

$1,464

$1,461

Asset management and related fees

$1,403

$1,371

Performance-based income and other

$61

$90

Total Expenses

$1,199

$1,247

Compensation

$579

$628

Non-compensation

$620

$619

4

Full Year Results

Institutional Securities

Institutional Securities reported net revenues of $23.1 billion compared with $24.4 billion a year ago. Pre-tax income

was $4.5 billion compared with $6.7 billion a year ago.

7

Investment Banking revenues down 13%:

• Advisory revenues decreased driven by fewer completed

M&A transactions on lower market volumes.

• Equity underwriting revenues were essentially unchanged.

Higher secondary and convertible offerings were offset by

lower IPOs.

• Fixed income underwriting revenues were essentially

unchanged from a year ago as higher investment grade

issuances were offset by lower non-investment grade

issuances.

Equity net revenues down 7%:

• Equity net revenues decreased across businesses primarily

on lower client activity and increased funding and liquidity

costs compared to a year ago.

Fixed Income net revenues down 15%:

• Fixed Income net revenues decreased from a strong prior

year, primarily driven by declines in foreign exchange and

commodities on less favorable market conditions and lower

client activity.

Other:

• Other revenues for the year reflect net interest income and

fees on corporate loans of $1 billion and revenues from our

Japanese securities joint venture, partially offset by mark-

to-market losses on corporate loans, inclusive of loan

hedges, of $577 million.

Provision for credit losses:

• Provision for credit losses increased from a year ago primarily driven by deteriorating conditions in the commercial

real estate sector, including provisions for certain specific commercial real estate loans.

Total Expenses:

• Compensation expense was essentially unchanged from a year ago as higher expenses related to DCP and stock-

based compensation plans were offset by lower expenses related to outstanding deferred equity compensation.

6

• Non-compensation expenses increased from a year ago on investments in technology, an FDIC special assessment

of $121 million, and higher legal costs inclusive of $249 million related to a specific matter.

15

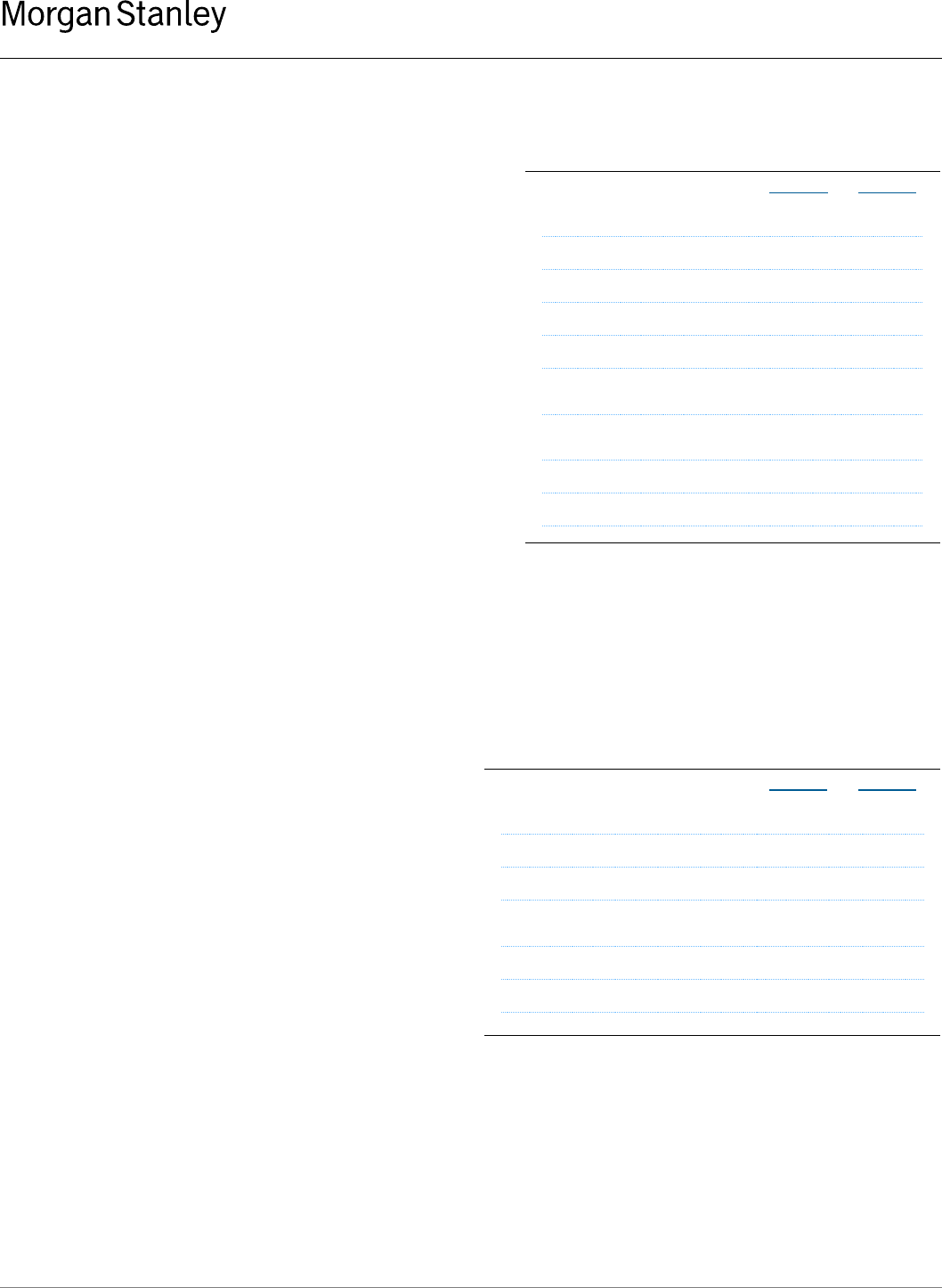

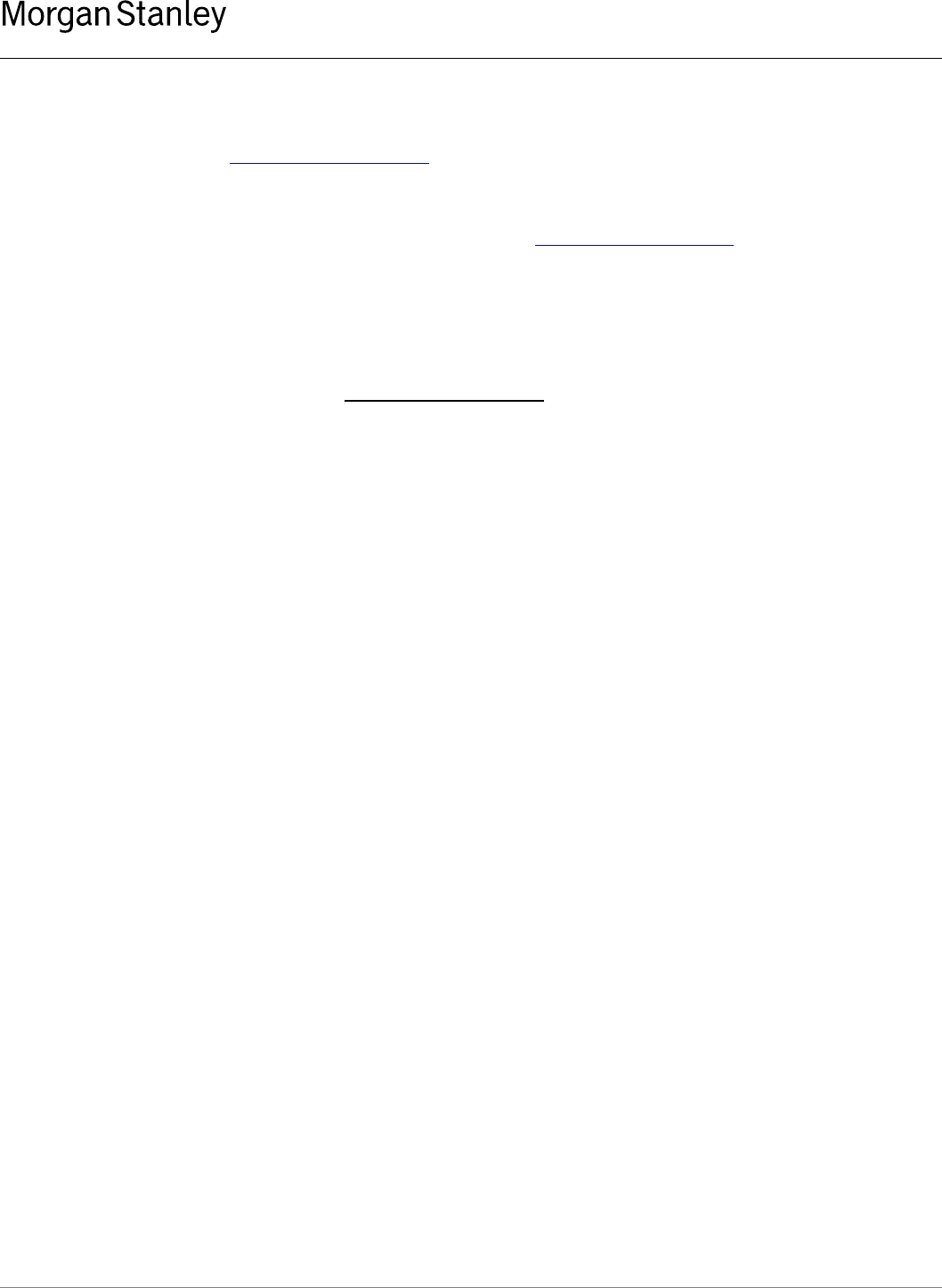

($ millions)

FY 2023

FY 2022

Net Revenues

$23,060

$24,393

Investment Banking

$4,578

$5,235

Advisory

$2,244

$2,946

Equity underwriting

$889

$851

Fixed income underwriting

$1,445

$1,438

Equity

$9,986

$10,769

Fixed Income

$7,673

$9,022

Other

$823

$(633)

Provision for credit losses

$401

$211

Total Expenses

$18,183

$17,467

Compensation

$8,369

$8,246

Non-compensation

$9,814

$9,221

5

Wealth Management

Wealth Management reported net revenues of $26.3 billion compared with $24.4 billion a year ago. Pre-tax income of

$6.5 billion

7

in the current year resulted in a pre-tax margin of 24.9%.

8

Net revenues up 8%:

• Asset management revenues increased from a year ago on

positive fee-based flows, partially offset by a reduction driven

by lower average asset levels due to declines in the markets

and changes in the mix of existing client portfolios.

• Transactional revenues were essentially unchanged

excluding the impact of mark-to-market gains of $282 million

in the current year versus mark-to-market losses of $858

million a year ago on investments associated with DCP.

6,

16

• Net interest income increased from a year ago on higher

interest rates, partially offset by changes in deposit mix.

Provision for Credit Losses:

• Provision for credit losses increased from a year ago

primarily driven by deteriorating conditions in the commercial

real estate sector, including provisions for specific

commercial real estate loans.

Total Expenses:

• Compensation expense increased driven by higher expenses related to DCP versus a year ago.

6

• Non-compensation expenses increased primarily driven by an FDIC special assessment of $165 million and higher

technology expenses and costs related to exits of real estate.

15

Investment Management

Investment Management net revenues of $5.4 billion were essentially unchanged from a year ago. Pre-tax income was

$842 million compared with $807 million a year ago.

7

Net revenues:

• Asset management and related fees decreased due to

a shift in the mix of average AUM, driven by the

cumulative effect of net flows.

13

• Performance-based income and other revenues

increased from a year ago on mark-to-market gains

compared to losses a year ago on investments

associated with DCP and on public investments,

partially offset by lower accrued carried interest in our

private funds.

6

Total Expenses:

• Compensation expense decreased from a year ago driven by lower compensation associated with carried interest,

partially offset by gains related to DCP compared with losses a year ago.

6

($ millions)

FY 2023

FY 2022

Net Revenues

$26,268

$24,417

Asset management

$14,019

$13,872

Transactional

$3,556

$2,473

Net interest

$8,118

$7,429

Other

$575

$643

Provision for credit losses

$131

$69

Total Expenses

$19,607

$17,765

Compensation

$13,972

$12,534

Non-compensation

$5,635

$5,231

($ millions)

FY 2023

FY 2022

Net Revenues

$5,370

$5,375

Asset management and related fees

$5,231

$5,332

Performance-based income and other

$139

$43

Total Expenses

$4,528

$4,568

Compensation

$2,217

$2,273

Non-compensation

$2,311

$2,295

6

Other Matters

• The Firm repurchased $1.3 billion of its

outstanding common stock during the quarter, and

$5.3 billion during the year as part of its Share

Repurchase Program.

• The Board of Directors declared a $0.85 quarterly

dividend per share, payable on February 15, 2024

to common shareholders of record on January 31,

2024.

• The effective tax rate for the current quarter was

26.5% and for the full year was 21.9%. The higher

current quarter rate primarily reflects the non-

deductibility of a specific legal matter.

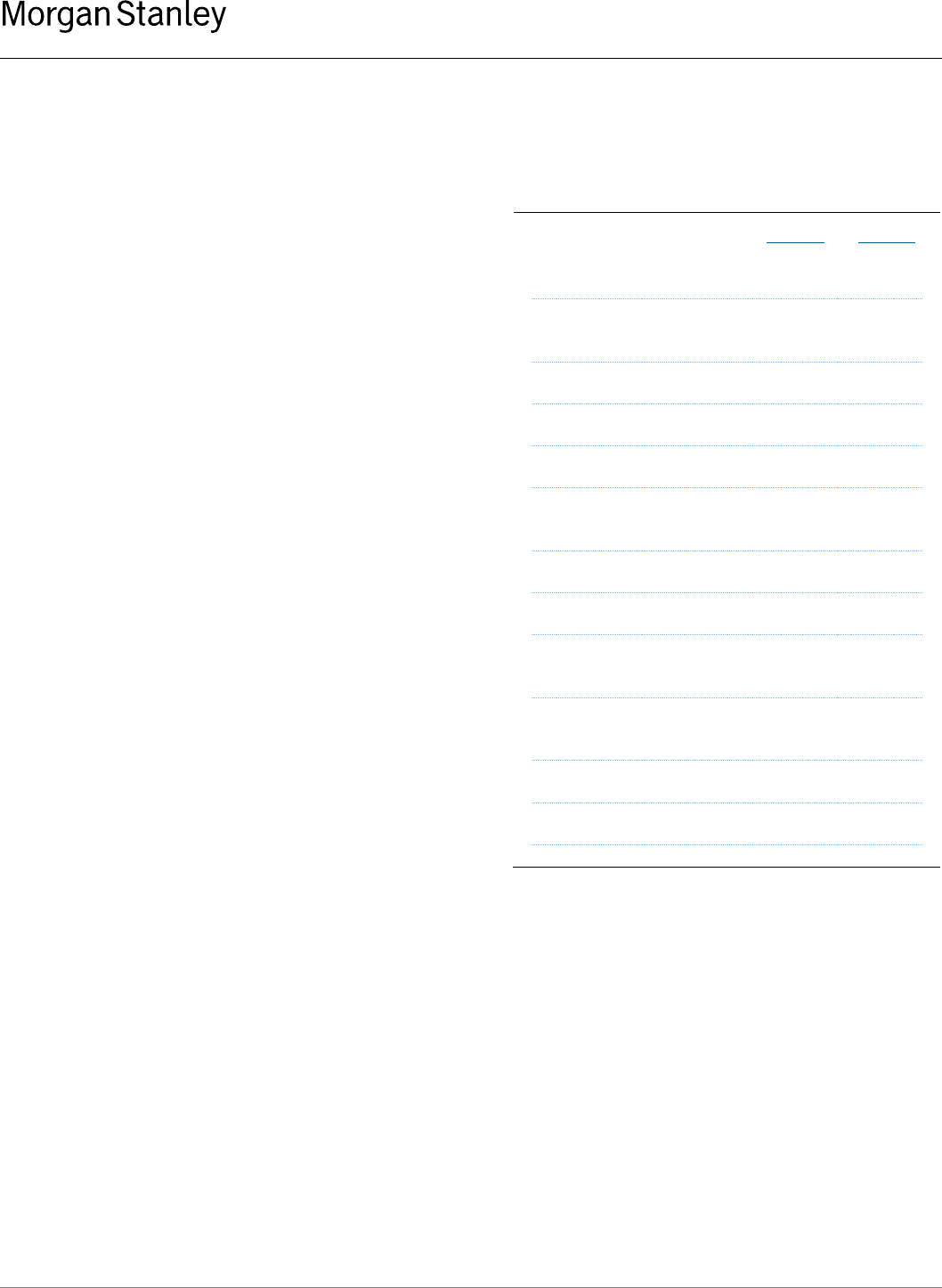

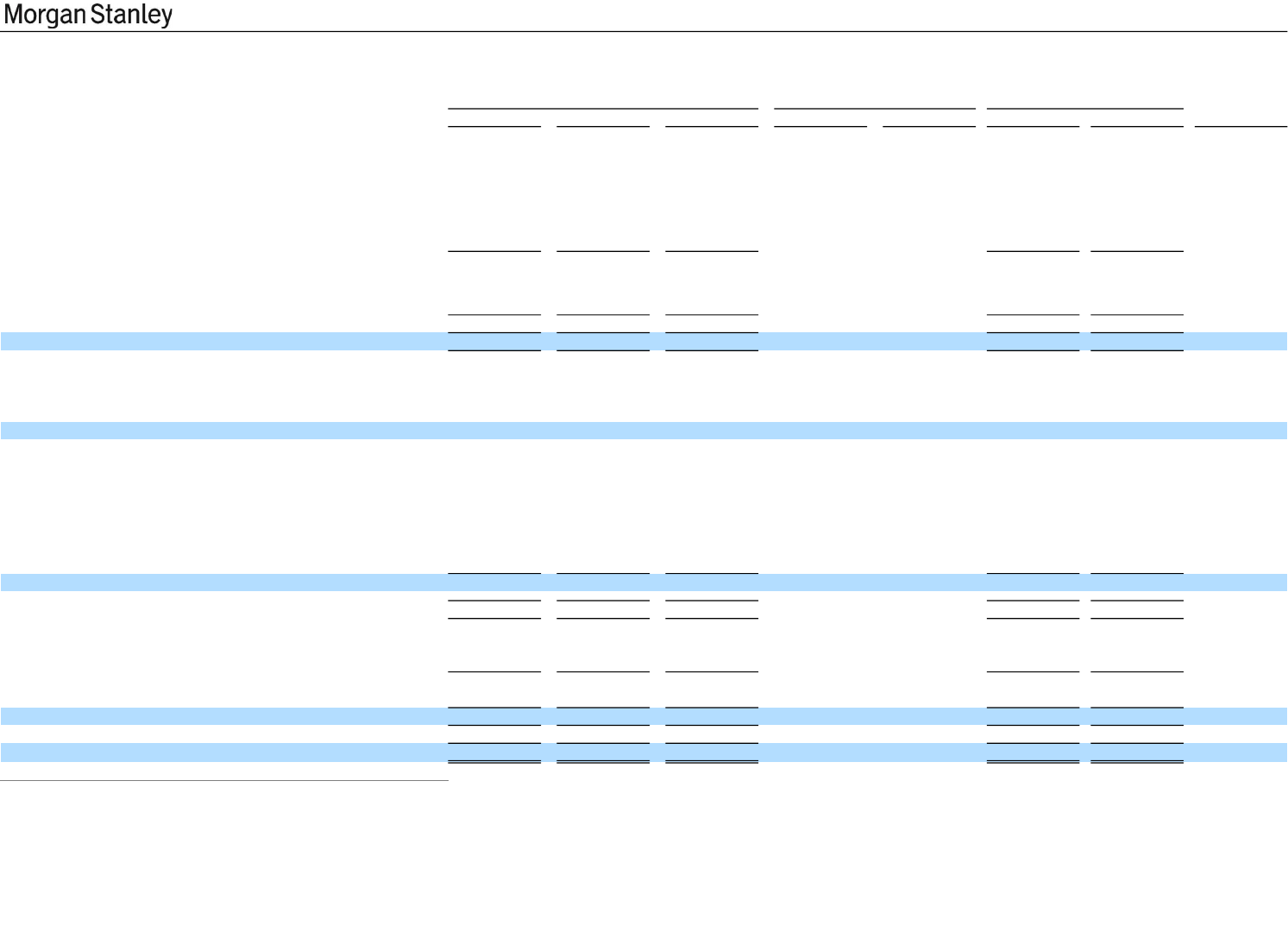

4Q 2023

4Q 2022

FY 2023

FY 2022

Common Stock Repurchases

Repurchases ($MM)

$1,300

$1,700

$5,300

$9,865

Number of Shares (MM)

17

20

62

113

Average Price

$75.23

$86.07

$85.35

$87.25

Period End Shares (MM)

1,627

1,675

1,627

1,675

Tax Rate

26.5%

18.9%

21.9%

20.7%

Capital

17

Standardized Approach

CET1 capital

18

15.2%

15.3%

Tier 1 capital

18

17.1%

17.2%

Advanced Approach

CET1 capital

18

15.4%

15.6%

Tier 1 capital

18

17.4%

17.6%

Leveraged-based capital

Tier 1 leverage

19

6.7%

6.7%

SLR

20

5.5%

5.5%

7

Morgan Stanley is a leading global financial services firm providing a wide range of investment banking, securities,

wealth management and investment management services. With offices in 42 countries, the Firm’s employees serve

clients worldwide including corporations, governments, institutions and individuals. For further information about

Morgan Stanley, please visit www.morganstanley.com.

A financial summary follows. Financial, statistical and business-related information, as well as information regarding

business and segment trends, is included in the financial supplement. Both the earnings release and the financial

supplement are available online in the Investor Relations section at www.morganstanley.com.

NOTICE:

The information provided herein and in the financial supplement, including information provided on the Firm’s earnings

conference calls, may include certain non-GAAP financial measures. The definition of such measures or reconciliation

of such measures to the comparable U.S. GAAP figures are included in this earnings release and the financial

supplement, both of which are available on www.morganstanley.com.

This earnings release may contain forward-looking statements, including the attainment of certain financial and other

targets, objectives and goals. Readers are cautioned not to place undue reliance on forward-looking statements, which

speak only as of the date on which they are made, which reflect management’s current estimates, projections,

expectations, assumptions, interpretations or beliefs and which are subject to risks and uncertainties that may cause

actual results to differ materially. For a discussion of risks and uncertainties that may affect the future results of the

Firm, please see “Forward-Looking Statements” preceding Part I, Item 1, “Competition” and “Supervision and

Regulation” in Part I, Item 1, “Risk Factors” in Part I, Item 1A, “Legal Proceedings” in Part I, Item 3, “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7 and “Quantitative and

Qualitative Disclosures about Risk” in Part II, Item 7A in the Firm’s Annual Report on Form 10-K for the year ended

December 31, 2022 and other items throughout the Form 10-K, the Firm’s Quarterly Reports on Form 10-Q and the

Firm’s Current Reports on Form 8-K, including any amendments thereto.

8

1

Includes preferred dividends related to the calculation of earnings per share for the fourth quarter of 2023 and 2022 of approximately $134

million and $123 million, respectively. Includes preferred dividends related to the calculation of earnings per share for the years ended 2023

and 2022 of approximately $557 million and $489 million, respectively.

2

The Firm recorded a one-time FDIC Special Assessment of $286 million pre-tax ($218 million post-tax) and a legal charge related to a

specific matter of $249 million pre-tax ($234 million post-tax) which negatively impacted earnings per diluted shares by $0.28.

3

The Firm prepares its Consolidated Financial Statements using accounting principles generally accepted in the United States (U.S.

GAAP). From time to time, Morgan Stanley may disclose certain “non-GAAP financial measures” in the course of its earnings releases,

earnings conference calls, financial presentations and otherwise. The Securities and Exchange Commission defines a “non-GAAP financial

measure” as a numerical measure of historical or future financial performance, financial position, or cash flows that is subject to adjustments

that effectively exclude, or include amounts from the most directly comparable measure calculated and presented in accordance with U.S.

GAAP. Non-GAAP financial measures disclosed by Morgan Stanley are provided as additional information to analysts, investors and other

stakeholders in order to provide them with greater transparency about, or an alternative method for assessing our financial condition,

operating results, or capital adequacy. These measures are not in accordance with, or a substitute for U.S. GAAP, and may be different

from or inconsistent with non-GAAP financial measures used by other companies. Whenever we refer to a non-GAAP financial measure, we

will also generally define it or present the most directly comparable financial measure calculated and presented in accordance with U.S.

GAAP, along with a reconciliation of the differences between the non-GAAP financial measure we reference and such comparable U.S.

GAAP financial measure.

4

Our earnings releases, earnings conference calls, financial presentations and other communications may also include certain metrics

which we believe to be useful to us, analysts, investors, and other stakeholders by providing further transparency about, or an additional

means of assessing, our financial condition and operating results.

5

Return on average tangible common equity is a non-GAAP financial measure that the Firm considers useful for analysts, investors and

other stakeholders to allow comparability of period-to-period operating performance and capital adequacy. The calculation of return on

average tangible common equity represents full year or annualized net income applicable to Morgan Stanley less preferred dividends as a

percentage of average tangible common equity. Tangible common equity, also a non-GAAP financial measure, represents common equity

less goodwill and intangible assets net of allowable mortgage servicing rights deduction.

6

“DCP” refers to certain employee deferred cash-based compensation programs. Please refer to "Management’s Discussion and Analysis

of Financial Condition and Results of Operations – Other Matters – Deferred Cash-Based Compensation” in the Firm’s Annual Report on

Form 10-K for the year ended December 31, 2022.

7

Pre-tax income represents income before provision for income taxes.

8

Pre-tax margin represents income before provision for income taxes divided by net revenues.

9

The expense efficiency ratio represents total non-interest expenses as a percentage of net revenues.

10

Wealth Management fee-based client assets represent the amount of assets in client accounts where the basis of payment for services is

a fee calculated on those assets.

11

Wealth Management fee-based asset flows include net new fee-based assets (including asset acquisitions), net account transfers,

dividends, interest, and client fees, and exclude institutional cash management related activity.

12

Wealth Management net new assets represent client inflows, including dividends and interest, and asset acquisitions, less client outflows,

and exclude activity from business combinations/divestitures and the impact of fees and commissions.

13

AUM is defined as assets under management or supervision.

14

Long-term net flows include the Equity, Fixed Income and Alternative and Solutions asset classes and excludes the Liquidity and Overlay

Services asset class.

15

Following the failures of certain banks and resulting losses to the FDIC’s Deposit Insurance Fund in the first half of 2023, the FDIC

adopted a final rule on November, 16 2023 to implement a special assessment to recover the cost associated with protecting uninsured

depositors. We recorded the cost of the entire special assessment of $286 million in the fourth quarter of 2023. Of the $286 million, $121

million was recorded in the Institutional Securities segment and $165 million was recorded in the Wealth Management segment.

9

16

Transactional revenues include investment banking, trading, and commissions and fee revenues.

17

Capital ratios are estimates as of the press release date, January 16, 2024.

18

CET1 capital is defined as Common Equity Tier 1 capital. The Firm’s risk-based capital ratios are computed under each of the (i)

standardized approaches for calculating credit risk and market risk risk‐weighted assets (RWAs) (the “Standardized Approach”) and (ii)

applicable advanced approaches for calculating credit risk, market risk and operational risk RWAs (the “Advanced Approach”). For

information on the calculation of regulatory capital and ratios, and associated regulatory requirements, please refer to "Management’s

Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources – Regulatory Requirements" in

the Firm’s Annual Report on Form 10-K for the year ended December 31, 2022.

19

The Tier 1 leverage ratio is a leverage-based capital requirement that measures the Firm’s leverage. Tier 1 leverage ratio utilizes Tier 1

capital as the numerator and average adjusted assets as the denominator.

20

The Firm’s supplementary leverage ratio (SLR) utilizes a Tier 1 capital numerator of approximately $78.2 billion and $77.2 billion, and

supplementary leverage exposure denominator of approximately $1.43 trillion and $1.40 trillion, for the fourth quarter of 2023 and 2022,

respectively.

Consolidated Income Statement Information

(unaudited, dollars in millions)

Quarter Ended

Percentage Change From:

Twelve Months Ended

Percentage

Dec 31, 2023

Sep 30, 2023

Dec 31, 2022

Sep 30, 2023

Dec 31, 2022

Dec 31, 2023

Dec 31, 2022

Change

Revenues:

Investment banking

1,415

$

1,048

$

1,318

$

35%

7%

4,948

$

5,599

$

(12%)

Trading

3,305

3,679

3,017

(10%)

10%

15,263

13,928

10%

Investments

189

144

85

31%

122%

573

15

*

Commissions and fees

1,110

1,098

1,169

1%

(5%)

4,537

4,938

(8%)

Asset management

5,041

5,031

4,803

--

5%

19,617

19,578

--

Other

(61)

296

38

*

*

975

283

*

Total non-interest revenues

10,999

11,296

10,430

(3%)

5%

45,913

44,341

4%

Interest income

14,058

13,305

9,232

6%

52%

50,281

21,595

133%

Interest expense

12,161

11,328

6,913

7%

76%

42,051

12,268

*

Net interest

1,897

1,977

2,319

(4%)

(18%)

8,230

9,327

(12%)

Net revenues

12,896

13,273

12,749

(3%)

1%

54,143

53,668

1%

Provision for credit losses

3

134

87

(98%)

(97%)

532

280

90%

Non-interest expenses:

Compensation and benefits

5,951

5,935

5,615

--

6%

24,558

23,053

7%

Non-compensation expenses:

Brokerage, clearing and exchange fees

865

855

851

1%

2%

3,476

3,458

1%

Information processing and communications

987

947

933

4%

6%

3,775

3,493

8%

Professional services

822

759

853

8%

(4%)

3,058

3,070

--

Occupancy and equipment

528

456

443

16%

19%

1,895

1,729

10%

Marketing and business development

224

191

295

17%

(24%)

898

905

(1%)

Other

1,420

851

878

67%

62%

4,138

3,591

15%

Total non-compensation expenses

4,846

4,059

4,253

19%

14%

17,240

16,246

6%

Total non-interest expenses

10,797

9,994

9,868

8%

9%

41,798

39,299

6%

Income before provision for income taxes

2,096

3,145

2,794

(33%)

(25%)

11,813

14,089

(16%)

Provision for income taxes

555

710

528

(22%)

5%

2,583

2,910

(11%)

Net income

1,541

$

2,435

$

2,266

$

(37%)

(32%)

9,230

$

11,179

$

(17%)

Net income applicable to nonredeemable noncontrolling interests

24

27

30

(11%)

(20%)

143

150

(5%)

Net income applicable to Morgan Stanley

1,517

2,408

2,236

(37%)

(32%)

9,087

11,029

(18%)

Preferred stock dividend

134

146

123

(8%)

9%

557

489

14%

Earnings applicable to Morgan Stanley common shareholders

1,383

$

2,262

$

2,113

$

(39%)

(35%)

8,530

$

10,540

$

(19%)

Notes:

-

-

-

10

Firm net revenues excluding mark-to-market gains and losses on deferred cash-based compensation plans (DCP) were: 4Q23: $12,527 million, 3Q23: $13,475 million, 4Q22: $12,555 million, 4Q23 YTD: $53,709 million,

4Q22 YTD: $54,866 million.

Firm compensation expenses excluding DCP were: 4Q23: $5,597 million, 3Q23: $5,992 million, 4Q22: $5,426 million, 4Q23 YTD: $23,890 million, 4Q22 YTD: $23,769 million.

The End Notes are an integral part of this presentation. Refer to pages 12 - 17 of the Financial Supplement for Definition of U.S. GAAP to Non-GAAP Measures, Definition of Performance Metrics and Terms, Supplemental Quantitative Details

and Calculations, and Legal Notice.

Consolidated Financial Metrics, Ratios and Statistical Data

(unaudited)

Quarter Ended Percentage Change From: Twelve Months Ended Percentage

Dec 31, 2023

Sep 30, 2023

Dec 31, 2022

Sep 30, 2023

Dec 31, 2022

Dec 31, 2023

Dec 31, 2022

Change

Financial Metrics:

Earnings per basic share

0.86

$

1.39

$

1.28

$

(38%)

(33%)

5.24

$

6.23

$

(16%)

Earnings per diluted share

0.85

$

1.38

$

1.26

$

(38%)

(33%)

5.18

$

6.15

$

(16%)

Return on average common equity

6.2%

10.0%

9.2%

9.4%

11.2%

Return on average tangible common equity

8.4%

13.5%

12.6%

12.8%

15.3%

Book value per common share

55.50

$

55.08

$

54.55

$

55.50

$

54.55

$

Tangible book value per common share

40.89

$

40.53

$

40.06

$

40.89

$

40.06

$

Financial Ratios:

Pre-tax profit margin

16%

24%

22%

22%

26%

Compensation and benefits as a % of net revenues

46%

45%

44%

45%

43%

Non-compensation expenses as a % of net revenues

38%

31%

33%

32%

30%

Firm expense efficiency ratio

84%

75%

77%

77%

73%

Effective tax rate

26.5%

22.6%

18.9%

21.9%

20.7%

Statistical Data:

Period end common shares outstanding (millions)

1,627

1,642

1,675

(1%)

(3%)

Average common shares outstanding (millions)

Basic

1,606

1,624

1,652

(1%)

(3%)

1,628

1,691

(4%)

Diluted

1,627

1,643

1,679

(1%)

(3%)

1,646

1,713

(4%)

Worldwide employees

80,006

80,710

82,427

(1%)

(3%)

11

The End Notes are an integral part of this presentation. Refer to pages 12 - 17 of the Financial Supplement for Definition of U.S. GAAP to Non-GAAP Measures, Definition of Performance Metrics and Terms, Supplemental

Quantitative Details and Calculations, and Legal Notice.