Detailed business case template

<Insert project title>

<Insert sponsoring agency>

<Insert date>

Document title Detailed business case template

Contact details Development Strategy, 08 8999 6035, EconomicInnovation.DTBI@nt.gov.au

Approved by

Date approved

Document review Annually

Version

Date

Author

Changes made

1.0 17 July 2019 First version

Acronyms

Full form

NT Northern Territory

NT Government Northern Territory Government

NTPDF Northern Territory Project Development Framework

Please read in outline view for best navigational experience.

Detailed business case template

What is a Detailed Business

Case?

The Detailed Business Case is a single complete

document used by senior decision makers to assess a

proposed project.

If approved, it confirms support and/or resourcing for

a recommended course of action (option).

A Detailed Business Case is developed to:

• gain agreement on the project scope and

approval to proceed with a project

• obtain resourcing for a project through

internal departmental processes, and

• to document what the project will accomplish

for the funding and how it will deliver

benefits.

Why use this document?

The guidance in this document aims to clarify the

NT Government’s expectations for Detailed Business

Cases as part of the Northern Territory Project

Development Framework (NTPDF).

Providing a framework for project development assists

in:

• the consistent assessment of Business Cases

to achieve the best value for Territorians

• reducing the costs and time taken to develop

Business Cases, and

• ensuring Business Cases meet NT and Federal

Government requirements.

When would you develop a

Strategic Business Case?

Approval to develop a Detailed Business Case is

usually obtained from the Project Sponsor, after an

initial Strategic Business Case has been completed and

approved.

The Detailed Business Case expands the proposal

developed to date in order to:

• obtain approval for resourcing for the

preferred option

• attain agreement on the scope of the project,

and

• gain authorisation to proceed to the next step

of the project.

The Detailed Business Case will be an important

document for developing the Project Plan as well as

other project documentation, and measuring the

success of the project.

What you need before you start:

• Agreement to proceed with the development

of the Business Case from the Project

Sponsor.

• Agreement establishing the scope of the

Detailed Business Case.

• Knowledge and understanding of the

development of a Business Case, as outlined

in the NTPDF.

Further help and additional

guidance

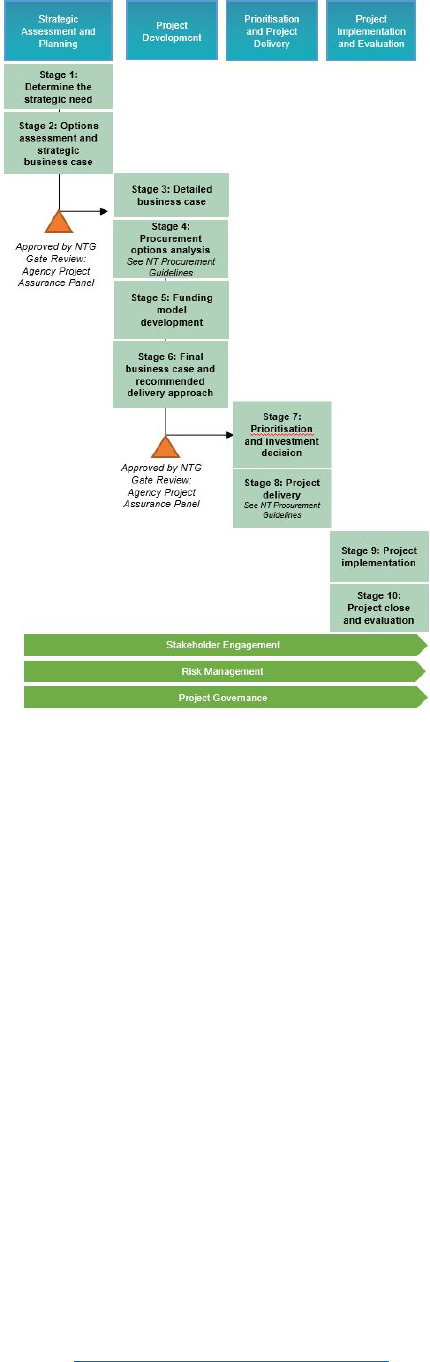

The NTPDF outlines details on project development in

the NT Government. The NTPDF is a tool to guide

project development to ensure government facilitated

and funded projects are well defined and that

government resources are invested in the right

projects.

Support can be provided at any stage of a project’s

lifecycle by the Department of Trade, Business and

Innovation by telephone on (08) 8999 6035 or via

email at economicinnovation.dtbi@nt.gov.au

The NT Government also encourages users of the

NTPDF to leverage the specialist skill sets available

across agencies to help validate, check and/or

collaborate on a project.

Detailed business case template

Contents

What is a Detailed Business Case? ................................................................................................................................. 3

Why use this document? ............................................................................................................................................... 3

When would you develop a Strategic Business Case? ............................................................................................ 3

What you need before you start:................................................................................................................................. 3

Further help and additional guidance ......................................................................................................................... 3

1. Executive Summary ....................................................................................................................................................... 6

1.1. Introduction .............................................................................................................................................................. 6

1.2. Outcomes ................................................................................................................................................................. 6

1.3. Scope ......................................................................................................................................................................... 6

1.4. Stakeholder Engagement ....................................................................................................................................... 6

1.5. Cost Estimate ........................................................................................................................................................... 6

1.6. Budget Impact Summary ....................................................................................................................................... 6

Project Development Funding ................................................................................................................................ 6

Indicative Project Costs ............................................................................................................................................ 7

Staffing Impacts Summary ....................................................................................................................................... 7

1.7. Summary Cost for each project phase (if applicable) ....................................................................................... 7

1.8. High-level Timeline/Duration ............................................................................................................................... 8

2. Project Outline ................................................................................................................................................................ 8

2.1. Background............................................................................................................................................................... 8

2.2. What Initiated the Project ..................................................................................................................................... 8

2.3. Why Do We Want To Do It .................................................................................................................................. 8

2.3.1. Strategic Intent and Alignment .................................................................................................................... 8

2.3.2. Key Project Drivers ........................................................................................................................................ 8

2.4. Project Options Analysis ........................................................................................................................................ 9

2.4.1. Options Assessment ...................................................................................................................................... 9

2.4.2. Stakeholder Impacts ....................................................................................................................................... 9

2.5. Outcome of Options Assessment ........................................................................................................................ 9

2.5.1. The Reference Project ................................................................................................................................... 9

2.5.2. Performance Measurement and Baselining .............................................................................................. 9

Target measures ................................................................................................................................................... 10

3. Financial and Commercial Assessment ................................................................................................................... 10

3.1. Detailed Cost Estimates and Risks.................................................................................................................... 10

3.2. Project Funding Analysis .................................................................................................................................... 12

4. Public Benefit Assessment ........................................................................................................................................ 13

4.1. Benefits .................................................................................................................................................................. 13

4.2. Costs ....................................................................................................................................................................... 13

4.3. Qualitative Analysis ............................................................................................................................................. 14

4.4. Quantitative Analysis .......................................................................................................................................... 14

Detailed business case template

4.4.1. Cost Benefit Analysis ................................................................................................................................... 14

5. Delivery and Funding Model Analysis .................................................................................................................... 14

5.1. Outline of Key Risks ............................................................................................................................................ 15

5.2. Procurement Value Drivers ................................................................................................................................ 15

5.3. Delivery Model Assessment............................................................................................................................... 15

5.4. Funding Model ...................................................................................................................................................... 17

5.5. Recommended Delivery/Funding Model ........................................................................................................ 17

5.6. High-level Delivery Schedule ............................................................................................................................. 17

6. Project Governance and Assurance ........................................................................................................................ 17

6.1. Governance Arrangements ................................................................................................................................ 17

6.2. Communications Management ......................................................................................................................... 19

6.3. Risk Management ................................................................................................................................................. 20

Types of Risk ............................................................................................................................................................. 20

Likelihood Categories .............................................................................................................................................. 20

Impact Categories .................................................................................................................................................... 21

Matrix for Rating Risks ............................................................................................................................................ 21

Risk Exposure Categories ....................................................................................................................................... 22

Risk Management Strategies: Dominant Strategy ............................................................................................ 22

6.3.1. Risk Management Plan ................................................................................................................................ 23

7. Endorsement & Gate Review .................................................................................................................................... 24

Gate Review .................................................................................................................................................................. 24

8. Next Steps ..................................................................................................................................................................... 24

Post Implementation Review ..................................................................................................................................... 24

Detailed business case template

Department of

TRADE, BUSINESS AND INNOVATION

17 July 2019

| Version 1

Page 6 of 24

1. Executive Summary

1.1. Introduction

This section should cover:

• What the strategic need that is being addressed is

• What the Public Benefit is

• The likely outcome if Government does not take action to address the strategic need

• What the Detailed Business Case is proposing

• The project size

• Potential and/or expected funding sources

1.2. Outcomes

Brief summary of Section 2.4.1 Project Outcomes.

1.3. Scope

Brief summary of Section 2.4.2 Project Scope.

1.4. Stakeholder Engagement

Brief summary of Section 2.5 Stakeholder Engagement.

1.5. Cost Estimate

Summary of Section 3.1 Detailed Cost Estimate.

1.6. Budget Impact Summary

Project Development Funding

This section takes into account the cost of investigating options and scoping the project.

Budget Impact

Current Year

$000

Future Years

$000

Recurrent

Capital

Offset savings

Revenue

Implications

Net Funding

Requirements

Detailed business case template

Department of

TRADE, BUSINESS AND INNOVATION

17 July 2019

| Version 1

Page 7 of 24

Indicative Project Costs

Detail the high-level indicative project costs (construction and whole-of-life costs).

Budget Impact

Current Year

$000

Future Years

$000

Recurrent

Capital

Offset savings

Revenue

Implications

Net Funding

Requirements

Staffing Impacts Summary

Impact

2018-19

2019-20

2020-21

2021-22

Total Additional FTEs

1.7. Summary Cost for each project phase (if applicable)

Allocated Cost per Phase Outcomes to Phase

Phase 1 $x,xxx,xxx

<Sunk costs incurred on project set up>

<Business Case development and submission>

Phase 2 $x,xxx,xxx

<Milestone>

<Milestone>

Phase 3 $x,xxx,xxx

<Milestone>

<Milestone>

Phase 4 $x,xxx,xxx

<Milestone>

<Milestone>

Contingency $x,xxx,xxx

<Milestone>

<Milestone>

Total Requested $x,xxx,xxx

<Milestone>

<Milestone>

Estimated Total Cost

to Completion

$x,xxx,xxx Comments

The Estimated Cost to Completion (ECTC) represents the total funding envelope required from the

inception of the project through to the completion of the project.

Detailed business case template

Department of

TRADE, BUSINESS AND INNOVATION

17 July 2019

| Version 1

Page 8 of 24

1.8. High-level Timeline/Duration

Provide a high-level breakdown of the proposed key project dates currently known to the project.

<Include attachment of any schedules developed>

2. Project Outline

This section covers the details of the proposed project with a focus on the problem to be addressed or

opportunity to be harnessed.

2.1. Background

Expand details on the proposed project. Why has it been proposed and who has been involved in the

process?

2.2. What Initiated the Project

• What is the strategic issue or opportunity that is being addressed?

• What are high level project timeframes?

• What may occur if the investment is not undertaken and the impact?

2.3. Why Do We Want To Do It

Clearly articulate the problem or opportunity and the benefits which will be realised if the project is

progressed

2.3.1. Strategic Intent and Alignment

Describe the strategic intent of the project and what areas of policy and/or area of government or private

sector that are the driving force behind the project.

2.3.2. Key Project Drivers

This section should provide an overview of what the project aims to deliver and the impacts of the project

on NT Government, economy, business and wider community (as applicable).

Building on work already completed as part of the Strategic Business Case, clearly outline, among other

things:

1. why the project is considered important and implications of the project not proceeding;

2. what economy and/or jobs enhancing outcomes will be achieved by the project proceeding; and

3. all project constraints and how these are proposed to be addressed.

A completed Benefits Realisation Report should be attached to the final Detailed Business Case.

Detailed business case template

Department of

TRADE, BUSINESS AND INNOVATION

17 July 2019

| Version 1

Page 9 of 24

2.4. Project Options Analysis

This section is the critical section in the Detailed Business Case and is a detailed assessment of the risks,

benefits, opportunities and threats presented by each option. The assessment of options is expected to

result in articulation of the preferred option (the Reference Project) with the analysis clearly supporting

such identification.

2.4.1. Options Assessment

The section reviews the options analysis undertaken as part of the Strategic Business Case and:

1. summarises the shortlisting and filtering process undertaken to identify the options to deliver the

project outcome;

2. provides a detailed reassessment of the shortlisted options identified in the Strategic Business

Case;

3. assesses in detail options identified following the Strategic Business Case; and

4. explains the rationale for discarding any options identified in the Strategic Business Case.

2.4.2. Stakeholder Impacts

In relation to each of the options, describe the government and external (business/community)

stakeholders that are impacted by the proposed project, the nature and level of impact and, where there

are negative impacts, how these impacts will be managed and mitigated.

Stakeholder Effected

Impact <major,

moderate or minor>

How affected Proposed Mitigation

2.5. Outcome of Options Assessment

2.5.1. The Reference Project

Provide clear details of the scope of the Reference Project, what the Reference Project will accomplish,

clearly articulate what outcomes will be achieved, and what makes it the preferred approach to resolving

the issue or leveraging the opportunity.

2.5.2. Performance Measurement and Baselining

This section articulates the approach to be taken and framework to be established to measure how well

the Reference Project achieves project outcomes.

Benefit measurement needs to be evidence based. The approach for collecting data and measuring

performance needs to be able to be validated and agreed with all key stakeholders.

As part of project delivery, the performance baseline has to be established with data collected to enable

performance measurement over time.

Detailed business case template

Department of

TRADE, BUSINESS AND INNOVATION

17 July 2019

| Version 1

Page 10 of 24

Target measures

A target represents a desired level of performance for a specific outcome. For example, if travel speed is

the specific outcome, the target might be 40 kms/hr. Measurable and realistic targets, albeit ones that are

still challenging, need to be set during project planning.

In setting target measures, timeframes for the achievement of targets should consider the scale of

initiatives and realistic timeframes.

Example Table

Outcome KPI KPI Owner Benefit metric

Baseline

Measure

Target

Measure

The name of the

relevant

outcome

How the

outcome will be

evaluated

Stakeholder

responsible for

measurement

and reporting

Financial/non-

Financial

The starting

figure at

commencement

of the project

Your expected

figure after the

project

Increased

visitor nights

Darwin

overnight visits

increase

Tourism NT Non-financial xxx

Increase of 5%

by 2020

Improve road

safety

Reduced

fatalities

NT Police Non-financial

X number of

fatalities in

2017

10% reduction

in fatalities

from crashes

by 2020

Source: The Australian Transport Assessment and Planning Guidelines: T6 Benefits Management.

3. Financial and Commercial Assessment

The purpose of this section is to undertake a high-level financial assessment of shortlisted project options

to enable the financial and commercial implications of each shortlisted option to be clearly understood. A

more detailed financial assessment is to be undertaken of the Reference Project.

Completion of the financial analysis provides a set of baseline cash flows. This can be used in the

development of cost comparators which are used to assess value for money.

The business case should seek to place a quantifiable value on the extent of financial risks to the project

benefits as much as possible.

Detailed capital and operational cost estimates should be included as appendices to the business case.

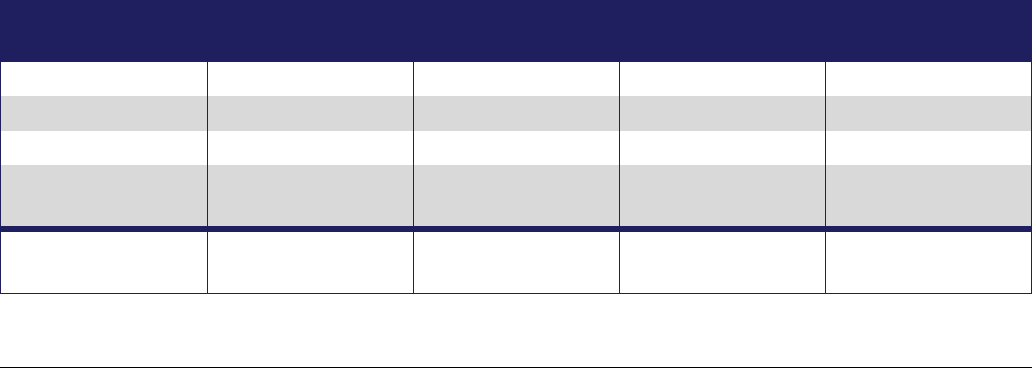

3.1. Detailed Cost Estimates and Risks

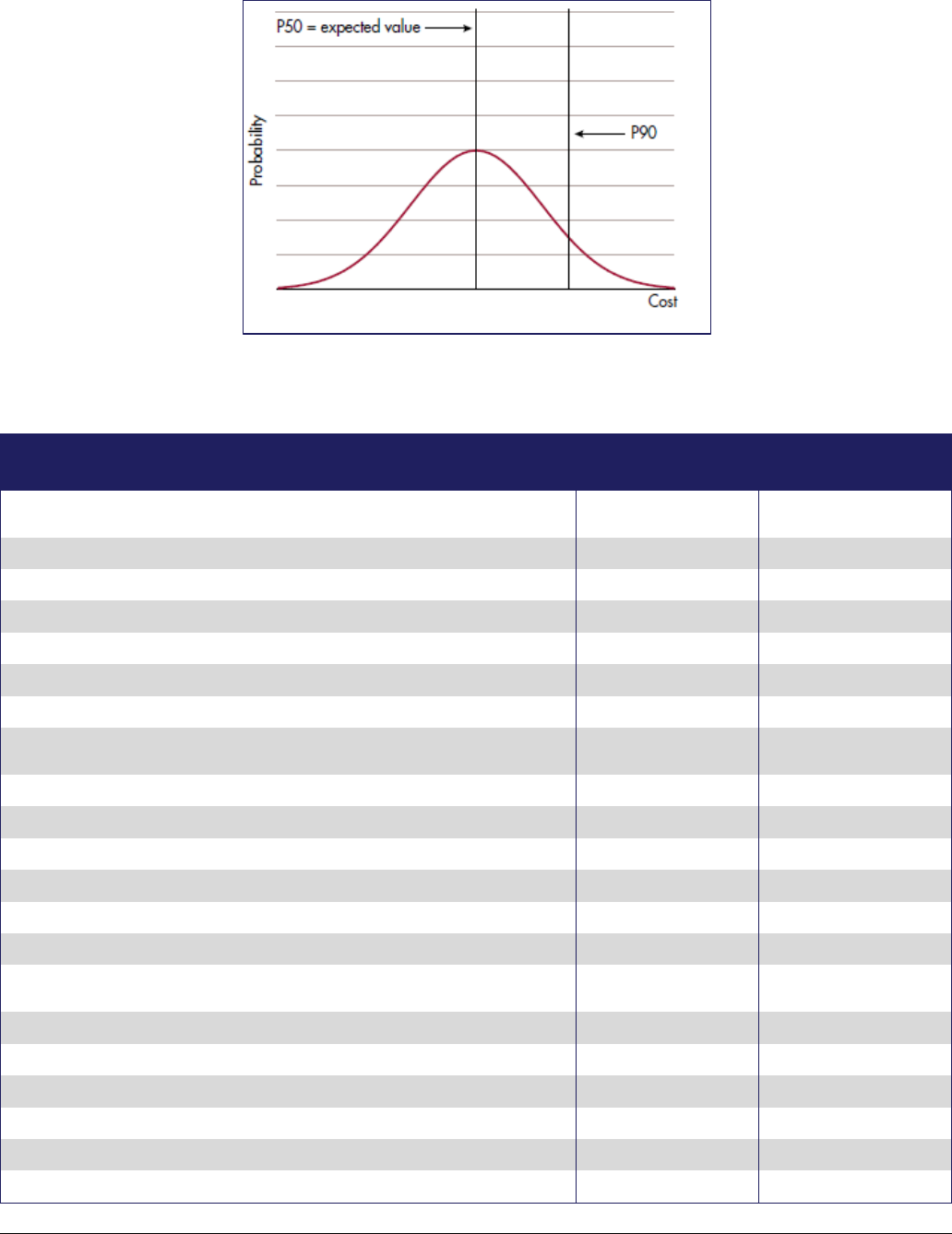

At this stage of project development, the cost estimates of the shortlisted options should be provided at

P50 level with cost estimates for the Reference Project provided at both the P50 and P90 levels of

confidence, capturing capital costs, whole-of-life operating and maintenance costs, and any savings that

would be realised by deviating from the base case. P50 costs and P90 costs are estimates of project costs

based on 50% and 90% probability respectively that the cost estimate will not be exceeded. The P50 cost

is the median of the cost distribution. See Graph 1 for an illustration of P50 and P90 costings.

Detailed business case template

Department of

TRADE, BUSINESS AND INNOVATION

17 July 2019

| Version 1

Page 11 of 24

Graph 1: Symmetrical Cost Distribution.

Source: Infrastructure Australia’s Assessment Framework, June 2017, p.41

Table 1: Example of Capital Cost Estimates

Capital Cost Estimates

P50 Cost

$m

P90 Cost

$m

OPTION 1 – REFERENCE PROJECT

Design, project management, other fees 5 7

Land 6 10

Demolition 1 1

Building works 30 45

Contigencies

38

20

Total

80

90

OPTION 2

Design, project management, other fees

5

Land 6

Demolition 1

Building works 40

Contigencies 46

Total

98

OPTION 3 – BASE CASE

Design, project management, other fees 5

Land

Demolition

Building works 60

Contigencies 46

Total 111

Detailed business case template

Department of

TRADE, BUSINESS AND INNOVATION

17 July 2019

| Version 1

Page 12 of 24

Budget Impact

Current Year

$000

Year 0 Year 1

Future Years

$000

Year 2 Year 3

CAPITAL COSTS

Design, project

management, other fees

2 2 1

Land 6

Demolition 1

Building works

15

15

OPERATIONAL COSTS

Staffing costs 2 5

Operating costs 1 2 4

Design, develop and

implement IT system

2 2

Repair and Maintenance

OFFSET SAVINGS

Redirected staffing

resources

1 3

REVENUE

User charges

NET FUNDING

REQUIREMENT

9 20 21 6

3.2. Project Funding Analysis

Outline the proposed funding sources for the project. This should include consideration of the ability to:

• charge users

• leverage Commonwealth or local government funding sources, and/or

• co-fund the project with non-government organisations.

Detailed business case template

Department of

TRADE, BUSINESS AND INNOVATION

17 July 2019

| Version 1

Page 13 of 24

Current Year

$000

Future Years

$000

Funding requirement

Capital

Operating

Total

Funding sources

NTG – Additional

NTG – Savings

Commonwealth

Other

Other

Other

Total

4. Public Benefit Assessment

The public benefit of the project needs to be clearly articulated and compared with the costs of proceeding

with the project. The depth of analysis and detail of reporting should be commensurate with project size

and/or the significance of the impacts/risks.

The broader impacts of projects are often key drivers for project selection in the NT. Matters such as social

equity in the availability of government services, accessibility to major employment hubs and connectivity

may not have measures that can be easily included in a quantitative Cost Benefit Analysis but are

important considerations in the development and assessment of projects and therefore should be included

in as much detail as possible in the Public Benefit Assessment.

4.1. Benefits

• What are the benefits of addressing the problem/harnessing the opportunity?

• This can include the costs avoided in developing the project, the direct benefits of the project

(e.g. reduced waiting times) and broader benefits (lower mortality rates from preventable illness)?

• The benefits need to be realistic, evidence-based and achievable.

4.2. Costs

• What are the costs of addressing the problem/harnessing the opportunity?

• Costs generally include the estimated capital and operating costs of delivering the project

(outlined in Section 3), regardless of who funds the project.

• This section should also discuss other broader costs that the project may generate as a result of the

project proceeding. These might include reduced amenity, carbon emissions etc.

The below provides further guidance on how to determine and present benefits and costs to provide a

view on the overall net public benefit of the project.

Detailed business case template

Department of

TRADE, BUSINESS AND INNOVATION

17 July 2019

| Version 1

Page 14 of 24

4.3. Qualitative Analysis

Outline the qualitative benefits, which may include environmental, social or regional considerations. These

can be a significant component of the project rationale, particularly in the NT context.

4.4. Quantitative Analysis

Quantitative analysis includes an assessment of the outcomes of the project in a manner that can be

reliably measured. e.g. the reduction in surgery waiting times as a result of a constructing a new operating

theatre, the increase in days a town has accessibility as a result of flood immunity works.

There are a range of quantitative tools that can be suitable to assist in assessing the public benefit of a

project, depending on the nature of the expected benefits and costs that the project is expected to

generate.

4.4.1. Cost Benefit Analysis

A Cost Benefit Analysis (CBA) is an assessment tool used to determine whether an option is beneficial

relative to the base case (‘do minimal or business-as-usual’).

The key principle of a cost-benefit analysis is to convert the costs and benefits into dollar terms, allowing

them to be weighed up against each other. An option will be considered more desirable if it delivers

benefits over and above its costs, which is typically expressed in net present value (“NPV”) terms.

The cost-benefit analysis differs from traditional financial analysis in that it is performed from the

viewpoint of society; specifically the NT community. For example, it could consider the road safety

benefits of a road improvement project. It goes beyond just looking at the fiscal impacts by also examining

social welfare impacts.

However, benefits and costs must be able to be converted into dollar terms for the analysis to be effective.

Continuing the example above, a road improvement project may also have a range of other benefits such

as improving accessibility to healthcare, education, job opportunities, trade and commerce etc. Such

indirect benefits are key drivers of projects in in regional and remote areas of the Northern Territory,

which are typically much more difficult to robustly estimate under a CBA.

Guidance material on cost benefit analysis can be found at the following links:

• the Department of Finance and Deregulation Finance Circular 2006/01, Australian Government

Introduction to Cost-Benefit Analysis and Alternative Evaluation Methodologies and Handbook of

Cost-Benefit Analysis

http://webarchive.nla.gov.au/gov/20080726194641/http://www.finance.gov.au/publications/fina

nce-circulars/2006/01.html

• The Green Book – Appraisal and Evaluation in Central Government, Treasury Guidance, London

2004 : http://www.hm-treasury.gov.uk/data_greenbook_index.htm

5. Delivery and Funding Model Analysis

This section identifies how the project will be delivered, funded and project delivery risks managed to

enable the Detailed Business Case to justify the delivery decision based on facts and analysis. The level of

detail involved in the analysis of options should reflect the size, scope and nature of the project.

Detailed business case template

Department of

TRADE, BUSINESS AND INNOVATION

17 July 2019

| Version 1

Page 15 of 24

Projects valued at $100 million or more must comply with the National Public Private Partnership (PPP)

Guidelines and consider a PPP approach for delivery.

In this section, key project risks and desired risk allocations are determined, and the relative importance of

various procurement criteria is established. Delivery options are identified, with an assessment of the

options against the evaluation criteria. Funding models are explored. A recommended delivery model will

be identified, and implications for procurement and a high-level delivery schedule provided.

5.1. Outline of Key Risks

Identify key project risks and desired risk allocations.

• Outline the process undertaken for risk management, i.e. was a Risk Workshop undertaken and

who participated?

• Attach a copy of the project’s Risk and Issues Register. The register should capture all relevant

project risks across all government agencies.

• Attach a Risk Management Plan which highlights the process to identify, assess, allocate and

monitor current, anticipated and emerging risks.

5.2. Procurement Value Drivers

Address the relative importance of each of the following criteria in the selection of the appropriate

delivery model:

• Time to Market: does the project need to meet a particular timeframe (government commitment,

closure of current facility etc.)?

• Flexibility: will the project benefit from a more flexible delivery model that accommodates

uncertainty and variation?

• Price certainty: Is fixed price certainty critical? To what extent would the project benefit from the

integration of outcomes beyond construction?

• Risk transfer: to what extent is the project suited to the transfer of risk to the contractual

counter-party?

• Contractor’s innovation and incentive: to what extent does the project provide opportunities to

drive innovation and incentivise the counter-party?

Develop a framework for the comparative analysis of the different procurement options, which

incorporates evaluation criteria and a system for rating each option against the criteria.

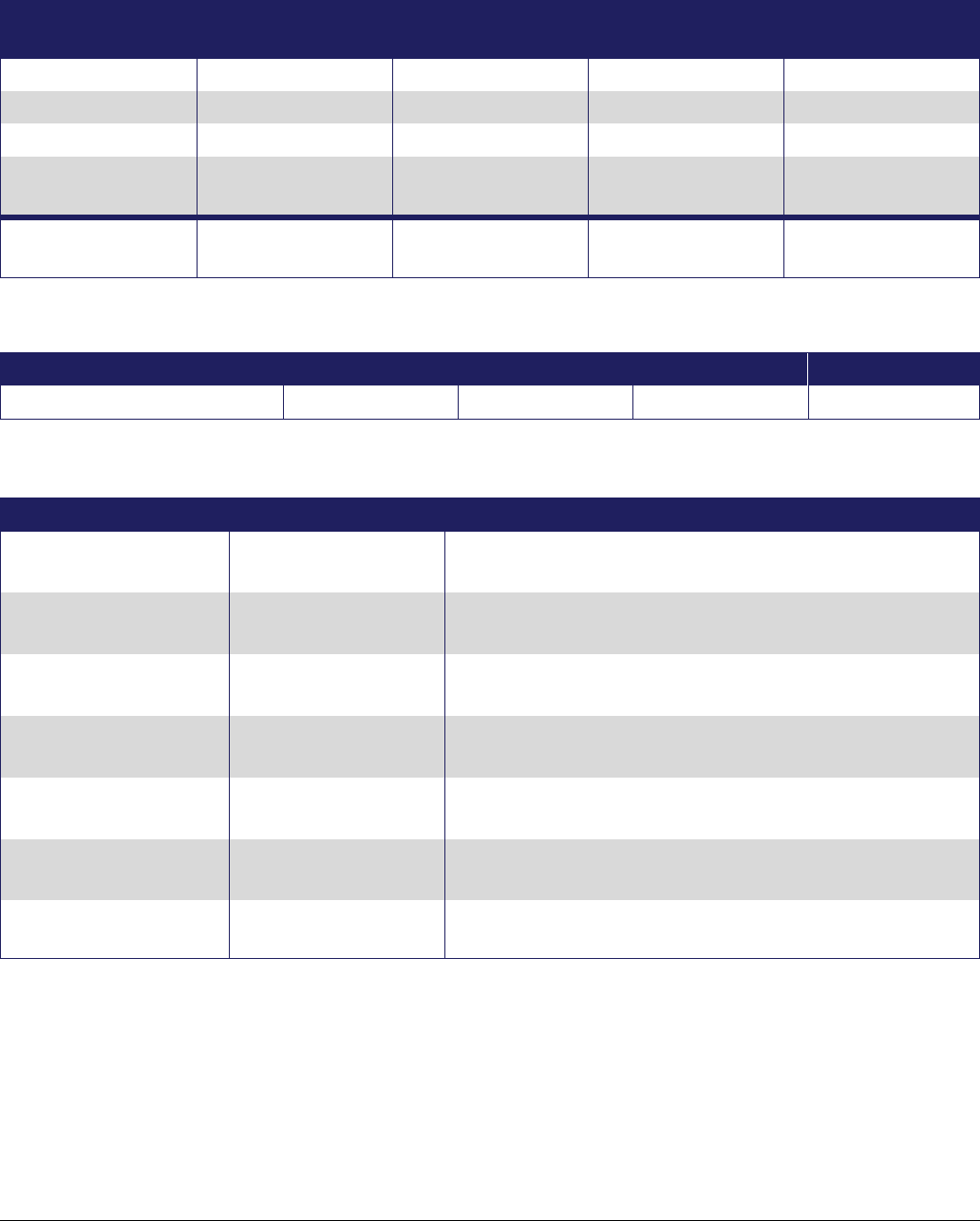

5.3. Delivery Model Assessment

Identify the different delivery options to be considered.

Design and construct is a common delivery model used by the NT Government, due to its clear scope and

comparatively low risk profile. This model is particularly common amongst smaller scale Level 2 and 3

projects. Projects that are larger-scale and more complex (i.e. have the potential for significant innovation

and may benefit from transferring operational risks to the private sector) may be better suited to another

model.

Detailed business case template

Department of

TRADE, BUSINESS AND INNOVATION

17 July 2019

| Version 1

Page 16 of 24

Delivery model options that can be assessed in this section include:

• Construct

• Design and Construct

• Design Construct Maintain

• Design Construct Maintain Operate

• Managing Contractor

• Alliance

• Public Private Partnerships PPP (Availability)

• PPP (Build Own Operate Transfer)

• Project Management Agreement

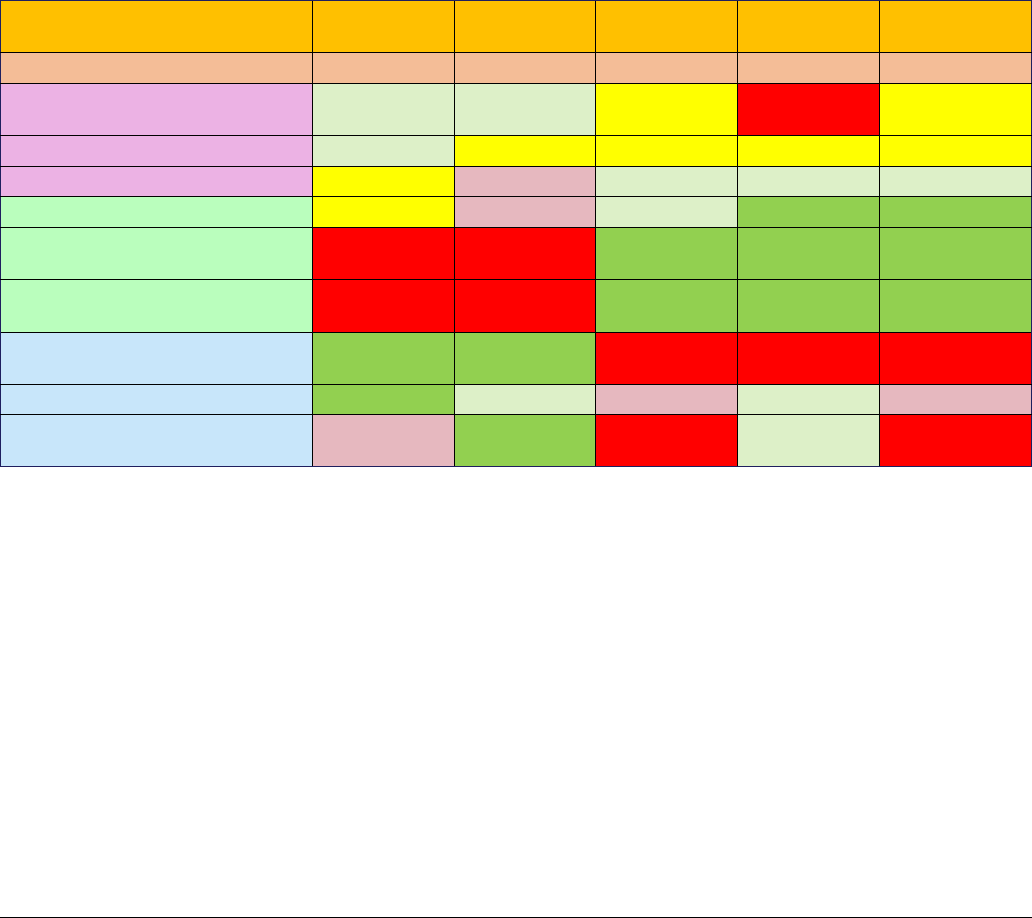

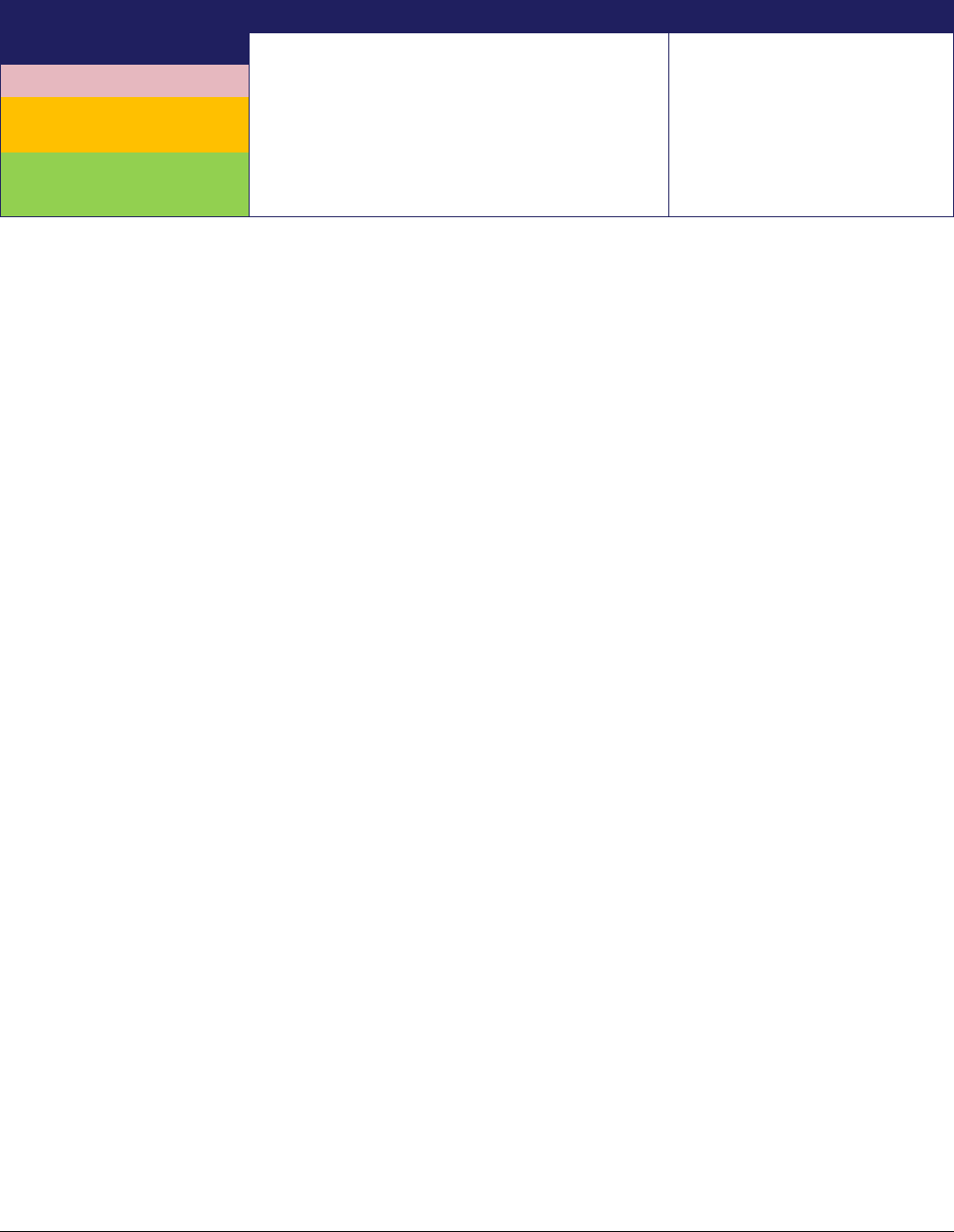

The following figure describes how value drivers can be aligned with the delivery model that achieves the

‘best fit’.

Delivery Model

Time to

Market

Flexibility Price Certainty

Innovation &

Incentive

Risk Transfer

Package drivers H/M/L H/M/L H/M/L H/M/L H/M/L

Construct Only Suitable Suitable Indifferent

Highly

unsuitable

Indifferent

Design & Construct Suitable Indifferent

Indifferent

Indifferent

Indifferent

Design Construct Maintain Indifferent

Unsuitable Suitable Suitable Suitable

Design Construct Maintain Operate Indifferent

Unsuitable Suitable Highly suitable Highly suitable

PPP (Availability)

Highly

unsuitable

Highly

unsuitable

Highly suitable Highly suitable Highly suitable

PPP (BOOT)

Highly

unsuitable

Highly

unsuitable

Highly suitable Highly suitable Highly suitable

Project Management Agreement Highly suitable Highly suitable

Highly

unsuitable

Highly

unsuitable

Highly

unsuitable

Managing Contractor Highly suitable Suitable Unsuitable Suitable Unsuitable

Alliance Unsuitable Highly suitable

Highly

unsuitable

Suitable

Highly

unsuitable

Source: ACT government SAF Guidelines

When evaluating the options, the following should be considered:

• Set timeframes associated with delivery options and assess their achievability

• Assess and rank each of the delivery options against the evaluation criteria

• Assess the potential value for money associated with each delivery option

A market analysis will be required for Level 1 projects, and at times Level 2 projects. Engage the market

through market soundings to:

• Identify key players

• Determine market capacity

• Determine market appetite, and

• Consider whether there is sufficient competition to drive value for money outcomes.

Detailed business case template

Department of

TRADE, BUSINESS AND INNOVATION

17 July 2019

| Version 1

Page 17 of 24

5.4. Funding Model

Summarise the range of potential funding and financing options that achieve best value for money for the

NT. Outline the likely funding risk for the proposed activity. Where alternative funding and financing

sources, such as Public-Private Partnerships (PPP), have been explored and are proposed, a more detailed

report of the options for funding should be incorporated into the business case and specialist advice

sought.

Key elements to consider include:

• Which potential options are most desirable? An outright private funding, joint government funding,

combined arrangement or alternative models including user pays or outcomes-based funding.

• What would be the likely extent of the financial exposure, co-investment and risk borne by the

NT Government under each arrangement?

• What would be the indicative net debt impact on the NT Government?

• What is the feasibility of adopting the funding model type?

5.5. Recommended Delivery/Funding Model

Summarise the recommended delivery model and the implications for procurement.

5.6. High-level Delivery Schedule

Provide a high-level delivery schedule that includes proposed procurement and delivery milestones.

Key Deliverable Change/Impact that will occur

<Business case> <Evidence to governance committees of merits of the project>

<Release EOI to market >

<Market/public are aware of intended project>

<Release of tender

documents to market>

<NT Government is committed to the project>

<Exchange of contracts> <This will enable parties to commence works>

6. Project Governance and Assurance

6.1. Governance Arrangements

This section outlines project governance arrangements that will be followed for the next phase of the

project. This will be confirmed as part of the Phase 2 approval process.

<Insert governance model used for the project describing the involvement of each party>

Detailed business case template

Department of

TRADE, BUSINESS AND INNOVATION

17 July 2019

| Version 1

Page 18 of 24

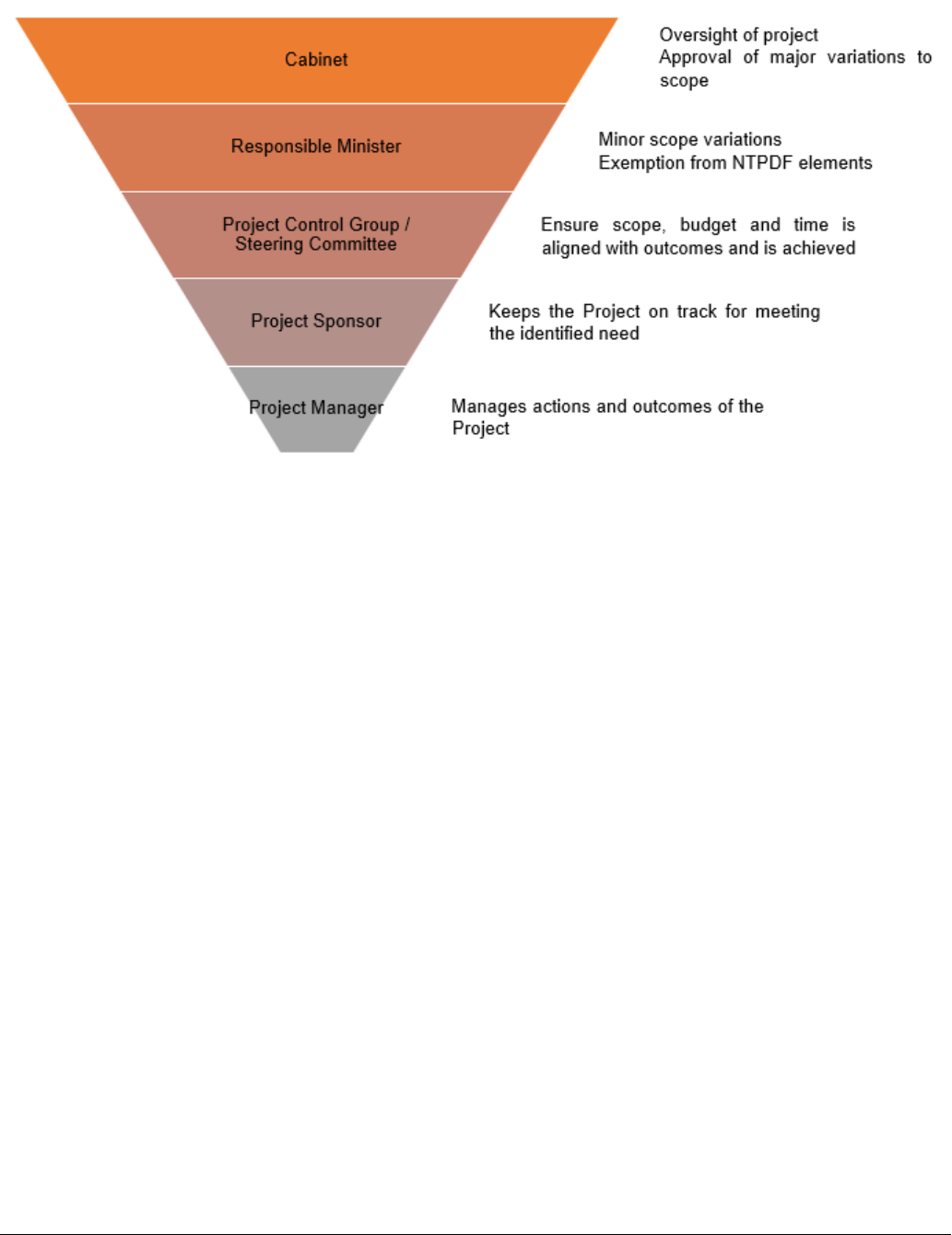

The typical governance structure is set out below:

Cabinet

Considers business case and makes investment decision

Responsible Ministers

Provides oversight of items raised for approval by the Cabinet.

Project Control Group / Steering Committee

The Project Control Group/Steering Committee includes a representative from relevant business areas or

agencies with the appropriate authority to take ownership of the operational decisions for their areas. The

Group/Committee will provide assurance and independence to the decision making process.

Project Team

The project shall employ the following project team roles (add/remove as needed).

• A Program Manager and/or Project Director

• A Project Manager for each area

• Procurement Officer

The above list is not exhaustive and provides an indication only of resource requirements. The allocation of

these roles could be sourced through a combination of internally and externally provided resources.

External Partnerships

If an external partnership is part of this project, describe what resources they shall be providing.

Outline the details of their participation in the project and how their actions will be governed.

Detailed business case template

Department of

TRADE, BUSINESS AND INNOVATION

17 July 2019

| Version 1

Page 19 of 24

An external professional services agency may be engaged to review and validate project progress on time,

budget and quality reviewing deliverables.

Project Documentation

Set out the milestones and project documents that will be examined to ensure that the project remains on-

track for success, as well as highlighting any potential shortcomings and/or corrective actions the project

may need to undertake.

6.2. Communications Management

The communications plan will identify the parties with an interest in the project and define the most

suitable means and frequency of project communications with them. The high-level approach the project

will adopt for reporting and review is shown in the table below. A full plan will be developed as part of the

Project Management Plan.

Communication Item Description Detail

Progress report – NTPDF

Highlight/Status Report

Rolled up status report showing

status, schedule progress versus

plan, budget actuals versus

forecast and significant risks or

issues for information of or

requiring governance decision or

assistance.

<Duration>

<Frequency>

<Audience>

<Owner>

Internal Communications

Communicate the planned work

and ensure all users are aware of

the requirements.

<Duration>

<Frequency>

<Audience>

<Owner>

Project team review meetings

Meetings to discuss current

status, review open issues, risks,

evaluate the impact of change

items to the project schedule, re-

negotiate commitments, and

review near-term project events.

<Duration>

<Frequency>

<Audience>

<Owner>

Other Agency review meetings Meetings with other identified

agencies to discuss current

status, review open issues,

evaluate the impact of change

items to the project schedule, re-

negotiate commitments, and

review near-term project events.

<Duration>

<Frequency>

<Audience>

<Owner>

External Clients

Communicate high-level work

plan where relevant.

<Duration>

<Frequency>

<Audience>

<Owner>

Detailed business case template

Department of

TRADE, BUSINESS AND INNOVATION

17 July 2019

| Version 1

Page 20 of 24

6.3. Risk Management

Identifying, monitoring and mitigating project issues and risks is a fundamental element of project

development. Risks should be considered and identified early in the planning process to ensure that

activities can be planned to reduce the likelihood and impact of the risk occurring. Level 1 and Level 2

projects should use the NTPDF Project Risks Register template to identify risks and potential ways to

manage those risks (mitigation strategies).

Once risks and their mitigation strategies have been identified and documented they must be scheduled

for regular review throughout the life of the project. Continuously reviewing the risk register allows for

active monitoring of the effectiveness of mitigation strategies and the consideration and inclusion of new

risks as they may arise

Types of Risk

• Strategic Delivery - is the overall

performance of the project and its ability

to meet objectives or commitments

• Personnel - are those that impact on

people including WHS and resourcing

risks

• Legal/regulatory - those that result in a

breach of statutory/regulatory or

contractual compliance

• Technical – include design and

engineering, manufacturing, test

procedure risks

• Reputation/Stakeholder - include political

risks and the reputation of not only the

department but the government

• Finance - risks that may result in a loss of

funds

• Other

Likelihood The estimated probability that the risk will occur (Scale: unlikely, possible, likely, almost

certain)

Impact The estimated impact of the risk if it did occur (Scale: minor, moderate, major,

catastrophic)

Risk Ratings The overall risk rating: Low (L), Medium (M), High (H) or Extreme (E) is determined from

the combined likelihood and impact values. The highest risks are those with high values

for likelihood and impact, while the lowest risks have the lowest values.

Likelihood Categories

Probability

Definition

Almost Certain

Is expected to occur in most circumstances.

90% or greater chance of occurring over the life of the project.

Likely

Will probably occur in most circumstances.

65-90% chance of occurring over the life of the project.

Possible

Might occur at some time.

35-65% chance of occurring over the life of the project.

Unlikely

Could occur at some time.

Less than 35% chance of occurring over the life of the project.

Detailed business case template

Department of

TRADE, BUSINESS AND INNOVATION

17 July 2019

| Version 1

Page 21 of 24

Impact Categories

Strategic Delivery

Finance, Legal and Regulatory

Reputation / Stakeholder

LEVEL 4. CATASTROPHIC

Community outrage

Large scale class action; Material

breach of legislation with very

significant financial or

reputational consequences

Extended NT-wide adverse

media coverage

Major adverse quality problem

Direct loss or cost overrun >20%

of project value

Intervention by Minister

Major milestone missed by > 1

year

LEVEL 3. MAJOR

Failure to achieve some

performance targets

Regulatory breach with material

consequences but which cannot

be readily rectified

On-going local, or NT- wide

adverse media coverage

Major milestone missed by 6 - 12

months

Direct loss or cost overrun of 10-

20% of project value

On-going local, or NT- wide

adverse media coverage

LEVEL 2. MODERATE

Some reduction in performance

Regulatory breach with minimal

consequences but which cannot

be readily rectified

Individual complaints

Major milestone or deadline

missed by 1 - 6 months

Direct loss or cost overrun 5-

10% of project value

Local temporary adverse media

LEVEL 1. MINOR

Negligible performance

reduction

Regulatory breach with minimal

consequences and readily

rectified

Negligible activity

Milestone missed by <1 month

Direct loss or cost overrun 0-5%

of project value

Negligible activity

Matrix for Rating Risks

Likelihood Consequence (Impact)

1. Minor 2. Moderate 3. Major 4. Catastrophic

4. Almost Certain

Low

Medium

High

Extreme

3. Likely

Low Medium Medium High

2. Possible Low Low Medium Medium

1. Unlikely Very Low Low Low Low

Detailed business case template

Department of

TRADE, BUSINESS AND INNOVATION

17 July 2019

| Version 1

Page 22 of 24

Risk Exposure Categories

Risk Category

Description

Score

Extreme Immediate action required Score of 16

High Senior Management attention needed Score between 10-15

Medium

Management Responsibility must be

specified

Score between 5-9

Low Manage by Routine procedures Score between 2-4

Risk has been considered Score of 1

Risk Management Strategies: Dominant Strategy

Risk Management Strategies are used to control a risk by reducing the likelihood or impact of a risk,

avoiding a risk situation arising or transferring the responsibility of the risk to another party. Under each

dominant strategy, specific actions should be identified and assigned to an Action Officer.

1. Likelihood Reduction – eliminating sources of risk or substantially reducing the likelihood of their

occurrence.

2. Risk Avoidance – a particular case of likelihood reduction, where undesired events are avoided by

undertaking a different course of action.

3. Impact Mitigation – minimising the consequences of the risk.

4. Risk Transfer – shifting responsibility of the risk to another party (also called risk sharing because

risks can rarely be transferred or shed entirely).

Detailed business case template

Department of

TRADE, BUSINESS AND INNOVATION

17 July 2019

| Version 1

Page 23 of 24

6.3.1. Risk Management Plan

Risks have been used to formulate that basis of contingency allocation. Risks that are identified will be reviewed and updated regularly with stakeholder

groups.

Risk

No.

Type of Risk Description of Risk Consequence

Likelihood

of Risk

Impact of

Risk

Exposure

Risk

Mitigation

Actions

Review Date Owner

1 Strategic

Delivery

Potential impact to

schedule (delays) and

or cost estimates

Possible Major Medium

2 Finance

Potential impact to

schedule (delays) and

or cost estimates

Almost

Certain

Major High

3

Reputation/

Stakeholder

Potential impact to

schedule (delays) and

or cost estimates

Possible

Moderate

Low

Detailed business case template

Department of

TRADE, BUSINESS AND INNOVATION

17 July 2019

| Version 1

Page 24 of 24

7. Endorsement & Gate Review

Seek agency endorsement in accordance with specific agency requirements.

Gate Review

Throughout the development of projects valued at $30 million and above, there are key decisions that

must be approved by the appropriate governance body. Agencies must submit strategic and detailed

business cases and related proposal documents for such projects to the Project Appraisal Board for review

and endorsement prior to seeking Cabinet approval for funding and progressing to the next stage of

project development.

Under the NTPDF, the Project Appraisal Board is comprised of senior officials from relevant agencies and

will ensure adequate details are provided in business cases.

The Project Appraisal Board has an assurance role which requires major project proposals to be critically

analysed in terms of the quality of the business case, particularly estimates of cost, time and resources; and

the level of confidence that the project will be successfully delivered on time, on budget and with planned

benefits realised.

8. Next Steps

Should this Detailed Business Case be approved, the next stage is to utilise agency-specific project

management tools to implement the project, including the performance measurement framework and

collection of data for the performance baseline.

All projects valued at $30 million or more are required, and other projects encouraged, to utilise the

NTPDF Benefits Realisation template to evaluate the benefits that were originally expected from a given

project. The document seeks to ensure/facilitate traceability of benefits throughout and post project

delivery.

Post Implementation Review

Once all deliverables have been finalised and the asset has been commissioned and in operation, a post

implementation review of the overall project should be undertaken.

The review will focus on the success factors and opportunities for improvement, including but not limited

to:

• Review of final scope compared to original scope

• Analyse the actual outcomes of the project against the expected outcomes set out in Section 2.4.1.

• Assurance that the contract management plan captures the relevant contractual information

• Financial control and accuracy for project duration

• Influencing factors that changed, altered, impaired or improved the delivery of the project

• What opportunities remain going forward, and

• Complete a NTPDF ‘Lessons Learned’ Register.