DOD IT BUSINESS CASE ANALYSIS TEMPLATE 22 OCTOBER 2014

Per SECDEF directive, include the cost estimate associated with preparing this BCA. See SECDEF

Memo of 27 Dec 2010, Subjec

t: Consideration of Costs in DoD Decision-Making, in Appendix H for

information and instructions.

UNCLASSIFIED

UNCLASSIFIED

Business Case Analysis:

<

Specify the Title of the IT Project Here

>

<Submittal Date >

< Version >

< Organization >

DEPARTMENT OF DEFENSE

DOD ENTERPRISE IT BUSINESS CASE ANALYSIS TEMPLATE

UNCLASSIFIED

<<Template Forward/Instructions>>

<<Delete this page when tailoring. All template guidance within<< >>

should be deleted prior to submission>>

<<Tailor per project appropriately given project scope, size,

state/documentation availability/time/other constraints for BCA

preparation>>

<<Ins

tructions regarding BCA Classification Marking:>>

<<UNCLASSIFIED: If the final BCA does not contain sensitive or classified information,

mark the front and back covers “UNCLASSIFIED” (as shown on this BCA template).>>

<<FO

UO: A “For Official Use Only” (FOUO) designation applies to unclassified

information sensitive in nature and exempt from public release under the Freedom of

Information Act. If the BCA contains such information, “FOUO” must appear on the front

and back covers (where UNCLASSIFIED now appears) and on the page(s) on which the

sensitive information exists.>>

<<CLASSIFIED: BCAs containing any CLASSIFIED information are to be handled through

separate channels, in accordance with the submitting organization’s CLASSIFIED

handling process and all applicable security policy procedures.>>

<POC >

DOD ENTERPRISE IT BUSINESS CASE ANALYSIS TEMPLATE

2

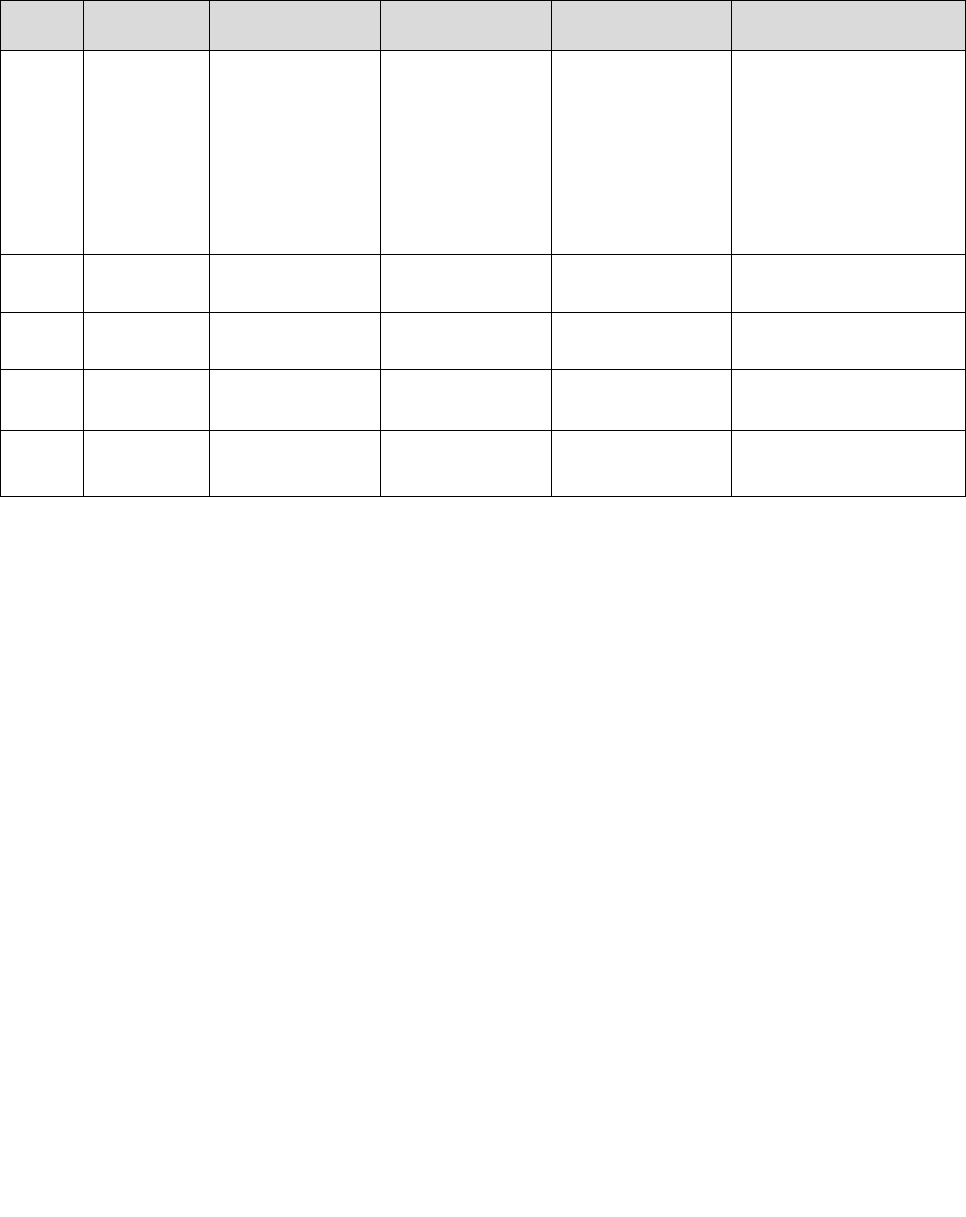

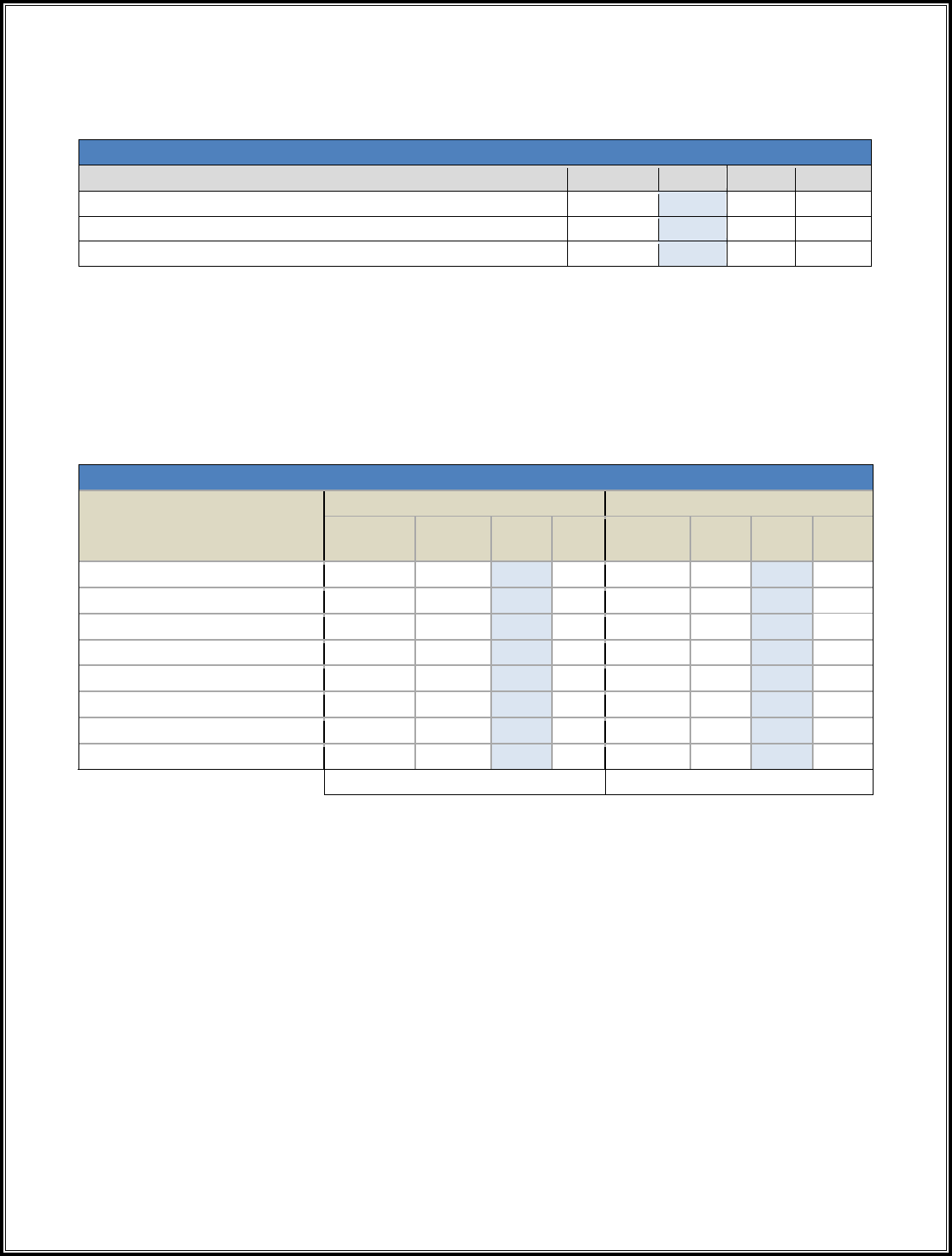

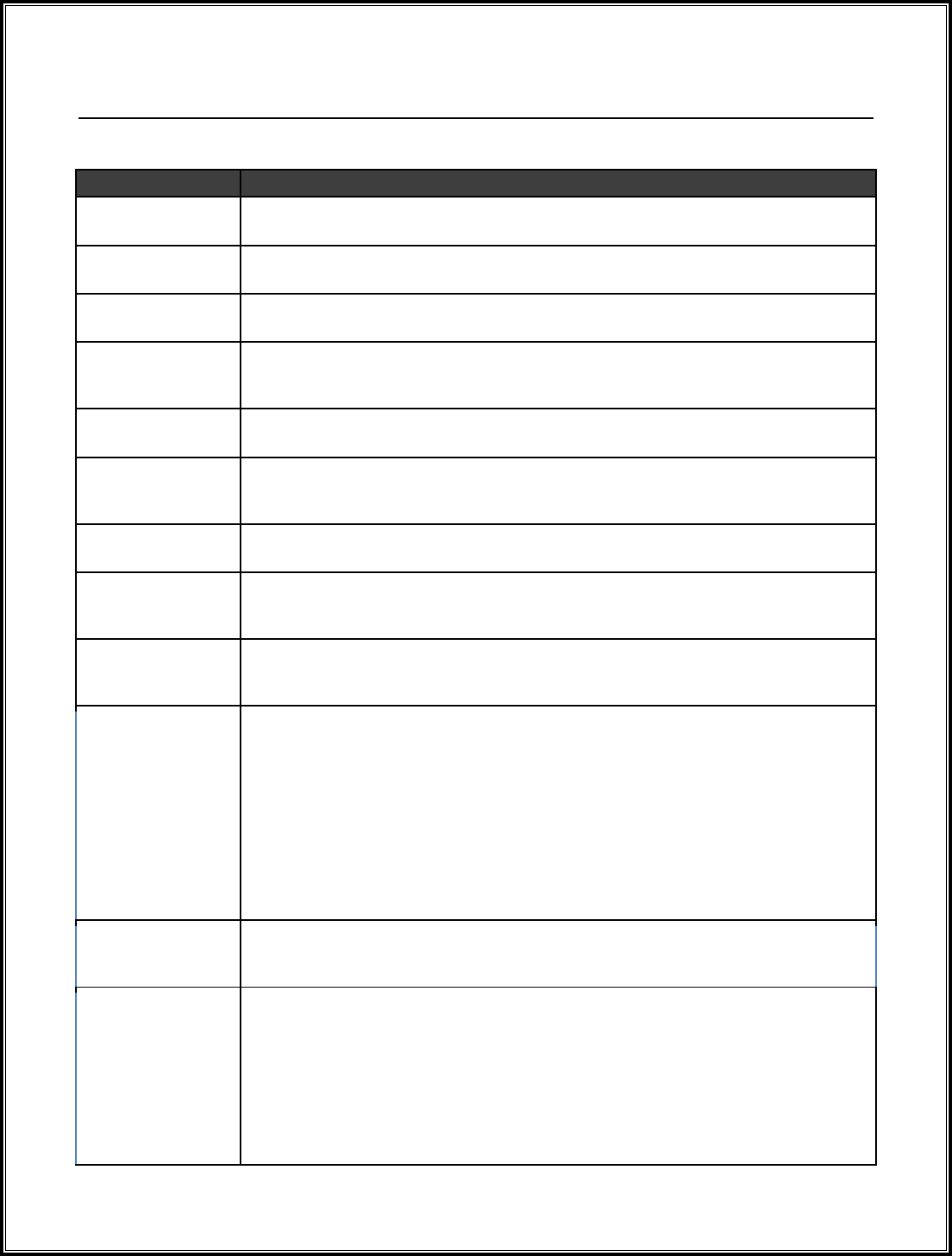

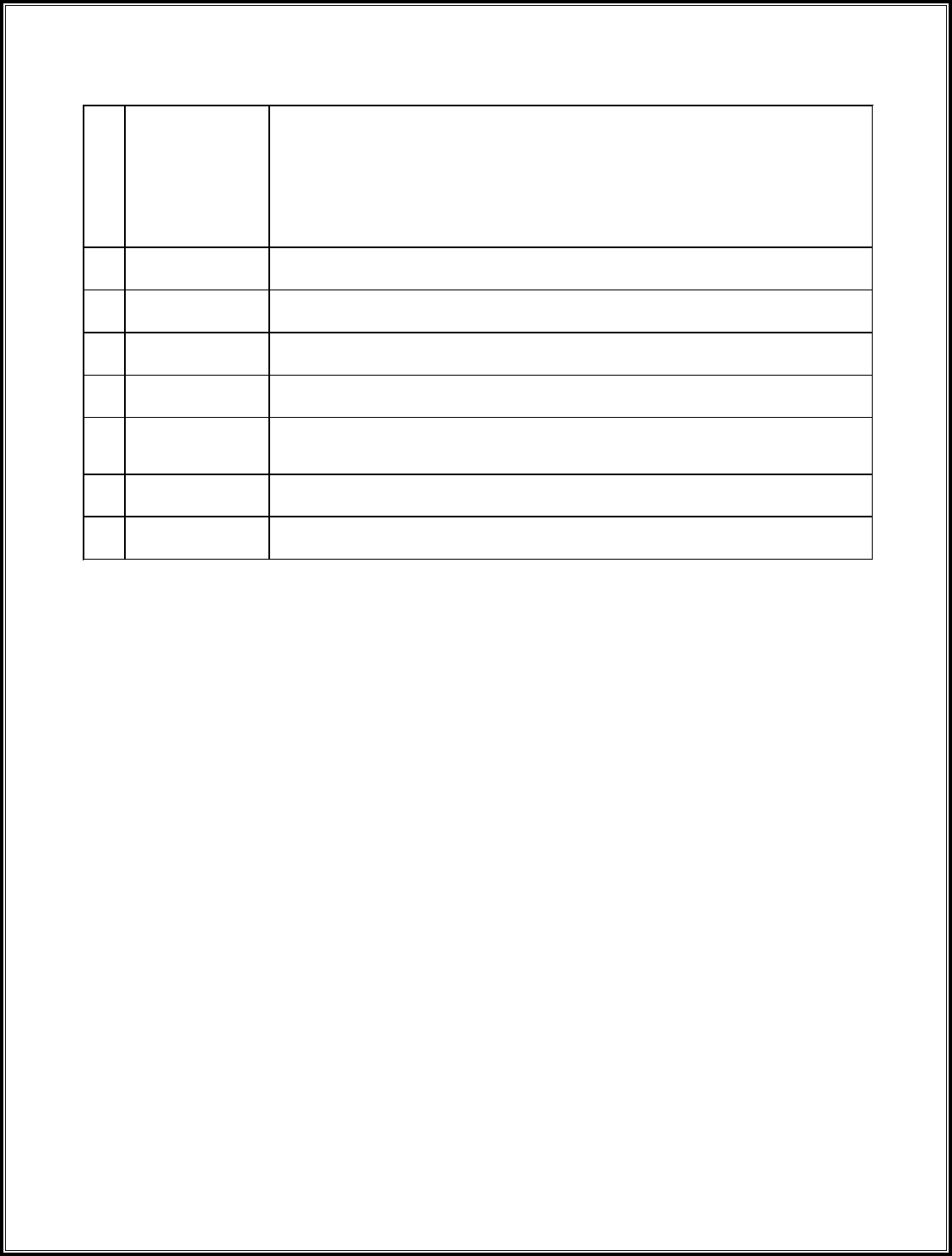

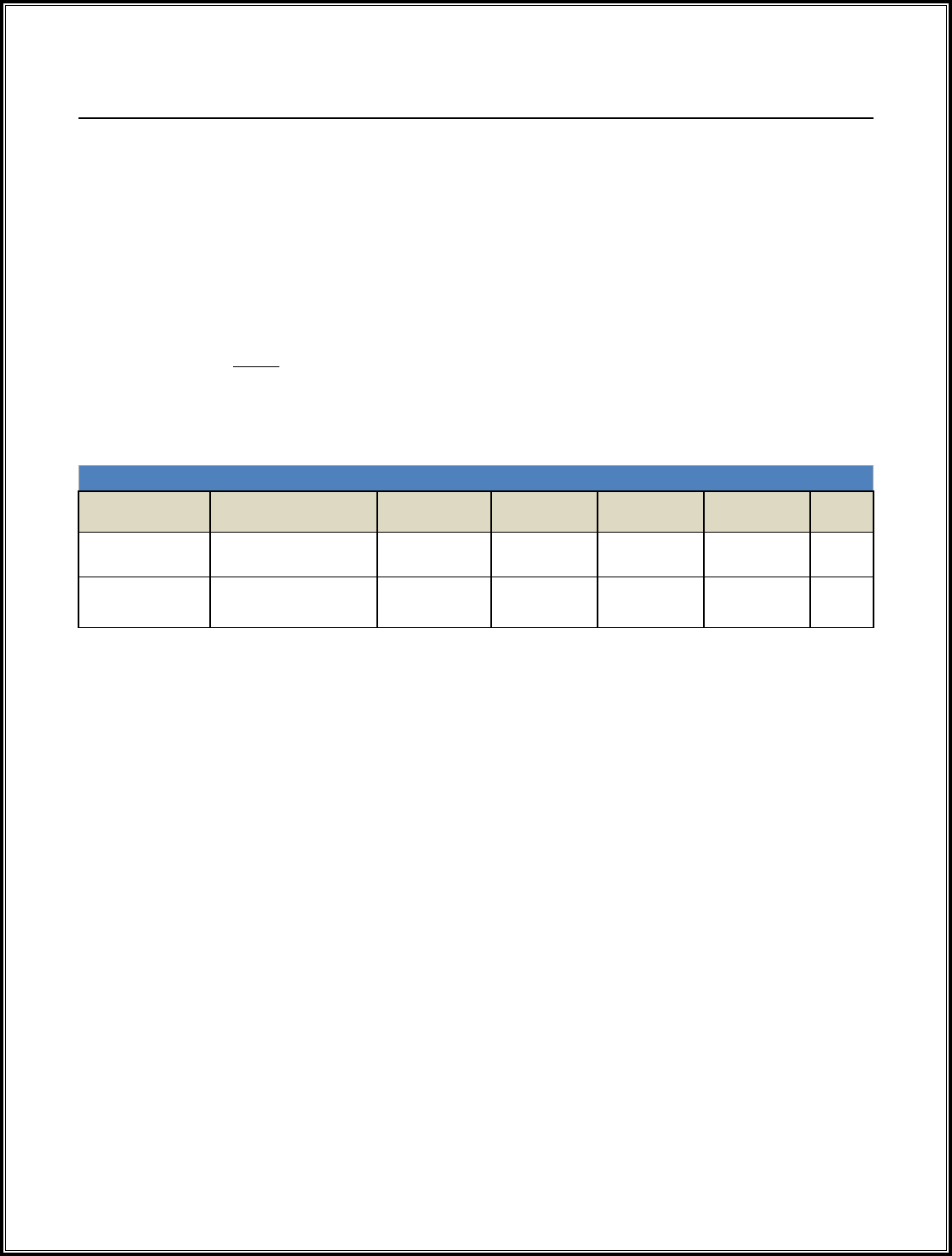

Approval and Change Summary for the

[BCA name]

Business Case Analysis

Ver.

No,

Version

Date

Change Type

Change

Authority

Disposition

Reference

X.XX.XX

DD-MM-YY

[Initial approval,

decision authority

directed change;

governance board

directed change;

minor update;

administrative

change; new major

version; other]

[Decision authority;

governance board;

integrated product

team; project lead;

other]

<<Provide name

and title>>

[Approved; approved

with conditions;

disapproved; cancel;

other]

[Decision authority decision

memorandum; governance

board meeting minutes;

integrated product team or

project lead or program

manager email/

memorandum]

<<Provide link to document

or document location.>>

DOD ENTERPRISE IT BUSINESS CASE ANALYSIS TEMPLATE

1

Table of Contents

Table of Contents ................................................................................................................ 1

Executive Summary ............................................................................................................ 3

1.0 Overview ........................................................................................................................ 4

1.1 Purpose ................................................................................................................................................ 4

1.2 Problem Statement .............................................................................................................................. 4

1.3 Background and Context ...................................................................................................................... 4

1.4 Project Initiative Description and Requirement(s) ................................................................................ 4

1.5 Benefits ................................................................................................................................................ 4

1.6 Scope ................................................................................................................................................... 4

1.7 Assumptions and Constraints .............................................................................................................. 4

1.8 POCs and Roles & Responsibilities ..................................................................................................... 4

2.0 Assumptions, Constraints, and Evaluation Methodologies ...................................... 5

2.1 Costing Assumptions and Constraints ................................................................................................. 5

2.2 Non-Financial Assumptions and Constraints ....................................................................................... 5

2.3 Other Constraints ................................................................................................................................. 5

2.4 Economic Viability Assessment Methodology ...................................................................................... 5

2.5 Non-Financial Measure Scoring Methodologies .................................................................................. 5

3.0 Alternatives Considered ............................................................................................... 7

3.1 Baseline and Alternatives Overview .................................................................................................... 7

3.2 Alternative 1 (Baseline) Overview ........................................................................................................ 7

3.2.1 Cost and Economic Viability ......................................................................................................... 7

3.2.2 Requirements Summary .............................................................................................................. 8

3.2.3 Qualitative Benefits ...................................................................................................................... 9

3.2.6 Risk Summary .............................................................................................................................. 9

3.3 [Short Descriptive Name of Alternative 2] Overview .......................................................................... 10

3.3.1 Cost and Economic Viability ....................................................................................................... 10

3.3.2 Requirements Summary ............................................................................................................ 11

3.3.3 Qualitative Benefits .................................................................................................................... 11

3.3.6 Risk Summary ............................................................................................................................ 12

3.4 <Short Descriptive Name of Third Alternative> Overview ................................................................. 12

4.0 Comparison of Alternatives....................................................................................... 13

4.1 Comparison of Alternatives’ Economic Viability Measures ................................................................ 13

4.2 Comparison of Costs and Savings ..................................................................................................... 13

4.3 Comparison of Overall Requirements Satisfaction ............................................................................ 13

4.4 Comparison of Mission and Operational Benefits/Impacts ................................................................ 14

4.5 Risk Comparisons .............................................................................................................................. 14

4.6 Sensitivity Analysis (Optional) ........................................................................................................ 15

4.7 Other Considerations ......................................................................................................................... 15

5.0 Conclusions and Recommendations ....................................................................... 16

5.1 Summary Comparison and Recommendation ................................................................................... 16

5.2 Funding Needs and Sources.............................................................................................................. 16

Appendix A: Glossary ...................................................................................................... 18

DOD ENTERPRISE IT BUSINESS CASE ANALYSIS TEMPLATE

2

Appendix B: Cost Element Structure ............................................................................. 20

Appendix C: Requirements ............................................................................................. 23

Appendix D: OFF-SET Detail ........................................................................................... 26

Appendix E: Project Plan ................................................................................................. 27

Appendix F: Performance Measures .............................................................................. 28

Appendix G: Economic Viability Assessment ............................................................... 29

Appendix H: Reference Documents ............................................................................... 30

DOD ENTERPRISE IT BUSINESS CASE ANALYSIS TEMPLATE

3

EXECUTIVE SUMMARY

<<Present an executive-level overview in 1-2 pages that describes:

A validated need/requirement. (Should be substantiated with statute, regulations, policy, strategic

priorities, etc.)

Evidence that the need is not being met, including the magnitude and quantifiable measure(s) of

the problem/gap, and which mission/functional areas are affected.

The proposed project/initiative that will address this problem and the organization/person(s)

leading it; what mission outcomes, key objectives (preferably measurable) it satisfies; cost,

savings, process improvements, other benefits and overall implementation timeline.

A summary of the project/initiative’s requirements.

Boundaries/scope of the project -- what is included and excluded. (If project will be executed in

phases/spirals, identify how this BCA fits into a larger plan).

Summary of the comparison of alternatives. (Briefly describe alternatives considered and

rationale for final selection).

High level implementation strategy and key milestones (e.g., start and delivery dates).

Key assumptions and constraints foundational to the analysis (may be referenced if difficult to

summarize).

Contract vehicle(s) that could be utilized to host the proposed solution; and

For cloud outsourcing/hosting situations, include a clear statement regarding any contract issues

that impact this proposal (e.g., incorporating language into contract to mitigate known risks).

Recommendation and justification for the selected alternative.As appropriate, include a summary level

comparison chart/graph/table of status quo and primary alternatives to presenting the

recommendation.>>

<<Ke

ep information at a summary level and focus on the most important points. Reference

detailed discussion, if necessary. DO NOT EXCEED 1-2 PAGES

.>>

<< T

he executive summary should be written last to make sure the analysis supports the

recommendation rather than the other way around.>>

DOD ENTERPRISE IT BUSINESS CASE ANALYSIS TEMPLATE

4

1.0 OVERVIEW

1.1 Purpose

<<Clearly state the purpose of the Business Case Analysis (BCA), including subject, to whom submitted,

and any other clarifying information. For example:

This Business Case Analysis (BCA) for [name of business case] includes an objectively

documented analysis, comparison of alternatives and recommendation to address [describe a

critical mission need(s), requirement(s), gap(s), or problem]. It is being submitted to the [decision

authority name] for review, feedback and final decision>>

1.2 Problem Statement

<<Describe the gap/problem(s), its magnitude (i.e., which mission/functional areas, people, organizations,

processes, etc. are affected) and the primary mission or business impacts if not corrected.>>

1.3 Background and Context

<<Provide additional context that explains the current situation (e.g., policy, process, environmental

factors). Identify root causes (if known) and contributors to the observed problem(s). Include relevant

research and information on industry or market conditions as appropriate. Keep the focus strategic.>>

1.4 Project Initiative Description and Requirement(s)

<<Provide a short, high level description of the project -- what it is and what it is intended to accomplish.

Address high level requirement(s), to include: strategic aligment, mission needs, mandates, functional

needs, Data Impact Level Assessment per DoD Risk Management Framework, and DoD Cloud Security

Model and Mission Impact Assessment. Detailed requirements are provided in Appendix C. Provide key

baseline value(s), overall objectives (strategic and operational) and high level timeline (start and end

dates). Explain if objectives are to be achieved in increments.>>

1.5 Benefits

<<Describe the desired/expected outcomes, positive results, benefits, efficiencies, and cost savings of

implementing this project/program (in measureable terms if possible).>>

1.6 Scope

<<Define the project/initiative’s boundaries (e.g., technology, organizations, users, processes, functions,

etc.). Explain what it includes and excludes.>>

1.7 Assumptions and Constraints

<<Briefly explain key assumptions and constraints essential to understanding the basis of the analysis

contained in the business case. Include timeframe of fiscal years used in the analysis. If root causes

were not identified in 1.3 because they are unknown, assumptions concerning root causes should be

noted here.>>

1.8 POCs and Roles & Responsibilities

<<Include contact information for: the person and organization leading the effort, the functional and

technical experts and BCA developers who wrote or were consulted in the writing of the BCA, the

financial person/organization who/that validated the financial measures, and other persons who may be

contacted to answer questions about the BCA. Specify POC roles and responsibility in the writing of the

BCA so that any questions can be more quickly addressed. For example:

The following personnel were involved with the development of this BCA and may be contacted.>>

DOD ENTERPRISE IT BUSINESS CASE ANALYSIS TEMPLATE

5

2.0 ASSUMPTIONS, CONSTRAINTS, AND

EVALUATION METHODOLOGIES

<<Sections 2.1-2.3 below describe assumptions and constraints (financial and non-financial) critical to the

business case analysis. An assumption is an informed position about what is believed to be true for a

situation in which explicit factual knowledge is unobtainable. Examples of assumptions include:

• Extrapolation of facts from a limited data set (e.g., survey),

• Expectations of future outcomes based on historical precedence or other rationale,

• Information believed to be true based on credible authorities.

Constraints are factors that limit the analysis, possible solutions and/or expected outcomes. Examples of

constraints include:

• Availability of data and information, expertise, funding, manpower, etc.;

• Requirement to satisfy legislation, regulations, and policy;

• Technical capability of a solution.

Keep the assumptions and constraint descriptions at fairly high level. Add appendices as needed or refer

to other documents for detailed computations. Assumptions and constraints unique to specific alternatives

should be explained in Chapter 3, where each alternative is described in detail.>>

2.1 Costing Assumptions and Constraints

<<Assumptions represent a set of judgments about past, present, or future conditions postulated as true

in the absence of positive proof. Describe key costing assumptions and constraints critical to the BCA.

Define the life cycle period for the analysis, which will impact the cost estimate tables used in the BCA.

Include all applicable fiscal years within the life cycle for each Alternative. Document discount rate and

inflation rates used along with applicable dates/sources. Explain the confidence level in values and

whether they represent low-, mid- or high-range estimates. Reference where more detailed costing

information can be obtained.>>

2.2 Non-Financial Assumptions and Constraints

<<Describe non-costing related assumptions and constraints critical to the BCA. Explain why they are

important and the extent to which they could affect the analysis or project results if they change.

Examples of non-financial constraints include government mandates, technological limitations and

synchronization with other projects/initiatives. >>

2.3 Other Constraints

<<Document any additional constraints, such as schedule or budgetary constraints provided by senior

leadership direction.>>

2.4 Economic Viability Assessment Methodology

<<Explain the economic viability measurement methodology used to compare alternative solutions.>>

<<Metrics should be generated for: net present value (NPV), break-even (BE), benefit cost ratio (BCR)

and financial return on investment (ROI) using Appendix G as a guide.>>

2.5 Non-Financial Measure Scoring Methodologies

<<If the formats included in this BCA template are used, the standard language provided below may be

used and/or tailored as desired. For example:

In addition to making financial comparisons between the [current state name] and each alternative,

non-financial comparisons were also performed and scored as follows:

Requirements satisfaction: The degree to which each alternative satisfied mandatory requirements

was scored on a scale of 1 (low) to 5 (high)). Weighting was [not used/used] for high priority

DOD ENTERPRISE IT BUSINESS CASE ANALYSIS TEMPLATE

6

requirements. [If weighting was used, explain rationale]. Specific requirements areas scored include:

[list in bullets and indicate which were weighted, as applicable].

Operational Impacts: The expected positive and negative impacts of implementing each alternative

were evaluated across the following operational/business function areas: [list: e.g., mission/business

function, interoperability, customer benefit, efficiency, information assurance/security,

reliability/quality, sustainability, etc.] and scored on a scale of -5 (negative) to +5 (positive).

Risk: Potential areas of risk for [list risk areas] were identified. The probability of occurring (certain,

probable, possible, improbable) and the impact if realized (catastrophic, high, moderate, low) were

assessed for each alternative. Risk Management strategies were identified and all risks were

rescored as if the risk management action had been implemented to assess effectiveness. >>

DOD ENTERPRISE IT BUSINESS CASE ANALYSIS TEMPLATE

7

3.0 ALTERNATIVES CONSIDERED

3.1 Baseline and Alternatives Overview

<<Alternative 1, Baseline, Status Quo, and As Is are synonymous terms. State up front how many

additional alternatives were considered for the BCA. For example:

The following [cite number] alternatives were considered for this BCA:

• Alternative 1 – [Baseline/Status Quo/As Is] – [short description]

• Alternative 2 – [short name] – [short description]

• Alternative 3 – [short name] – [short description]

<<A minimum of three alternatives are recommended for BCA. >>

<<Consider criteria in formulating and evaluating possible alternatives to the problem. Criteria are based

on mission need and required capability from the problem statement as well as on facts, assumptions,

and the Voice of the Stakeholder or anything else that provides separation between alternatives. There

are two types of criteria: screening and selection / evaluation criteria. Screening criteria are used to

assess the viability of the alternatives, and can be used to constrain the number of alternatives to be

evaluated. Selection / evaluation criteria are developed in order to differentiate among alternatives under

consideration. Some examples of screening criteria include:>>

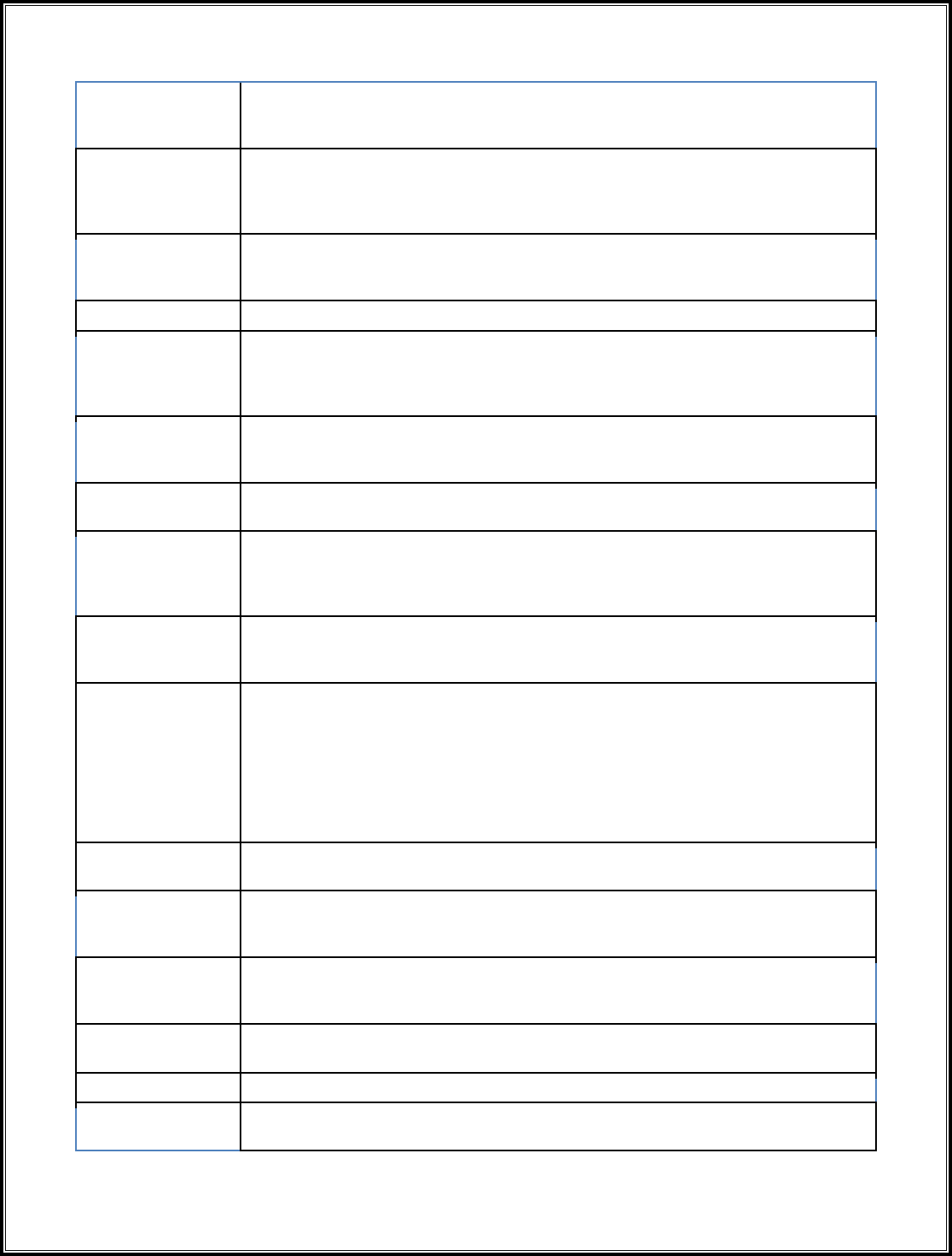

Screening Criteria

Definition

Suitability

Solves the problem and is legal and ethical. The alternative can accomplish

the mission within the decision-maker's intent and guidance

Feasibility Fits within available resources

Acceptability Is worth the cost or risk

Distinguishability Differs significantly from other solutions

Completeness Contains the critical aspects of solving the problem from start to finish

<<Explain very generally why the alternatives were selected (e.g., alignment to goals, feasibility, cost,

etc.) Additional detail is provided below. As appropriate, provide information on comparable projects

and/or benchmark models if available.>> For example:

These alternatives were selected because [state reason(s)]. Each of these alternatives is described

below in more detail and assessed across the following dimensions: cost, savings and economic

viability; requirements satisfaction; operational impacts; and risk. Consistent formats and scoring

methodologies were used so results can be easily compared.

3.2 Alternative 1 (Baseline) Overview

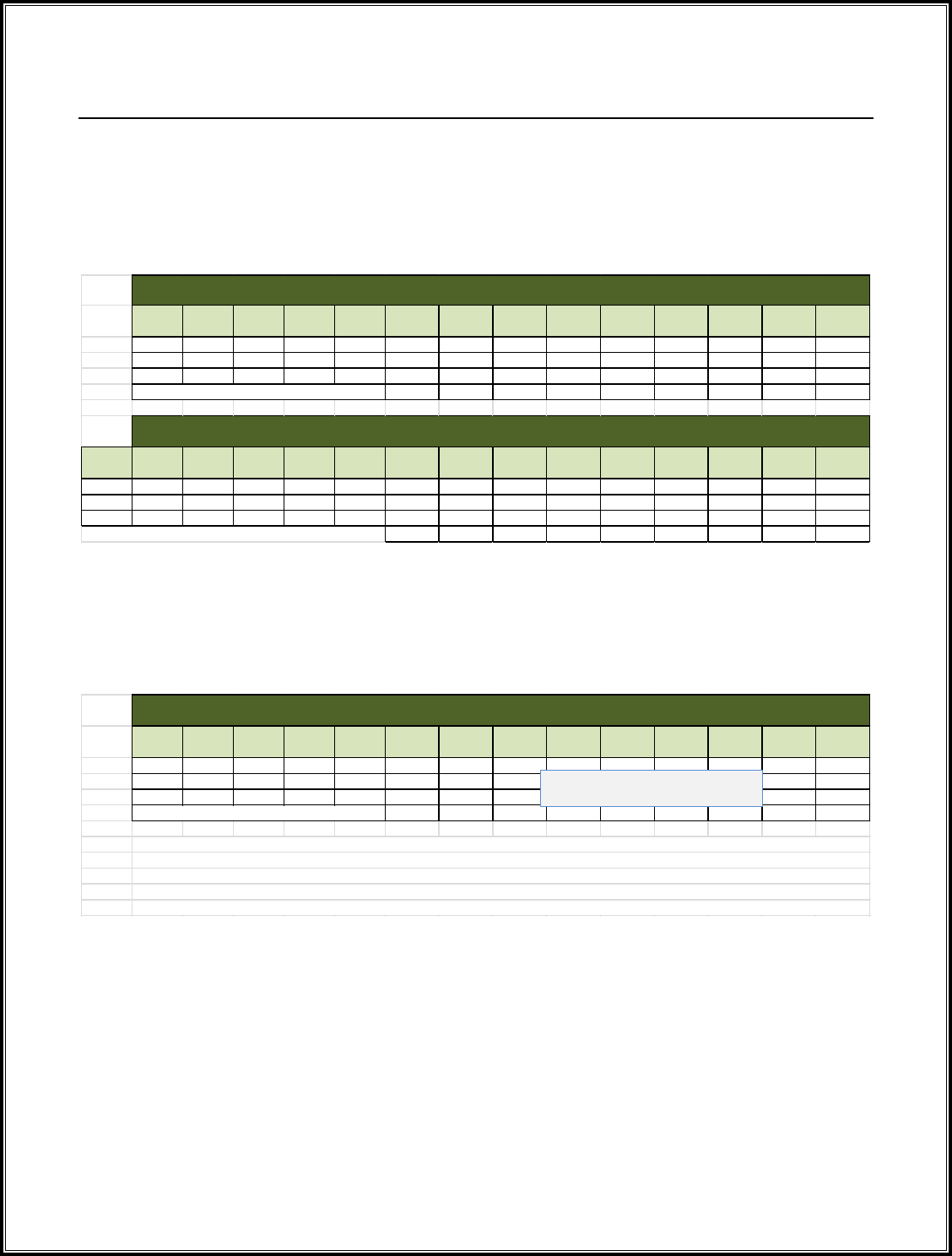

3.2.1 Cost and Economic Viability

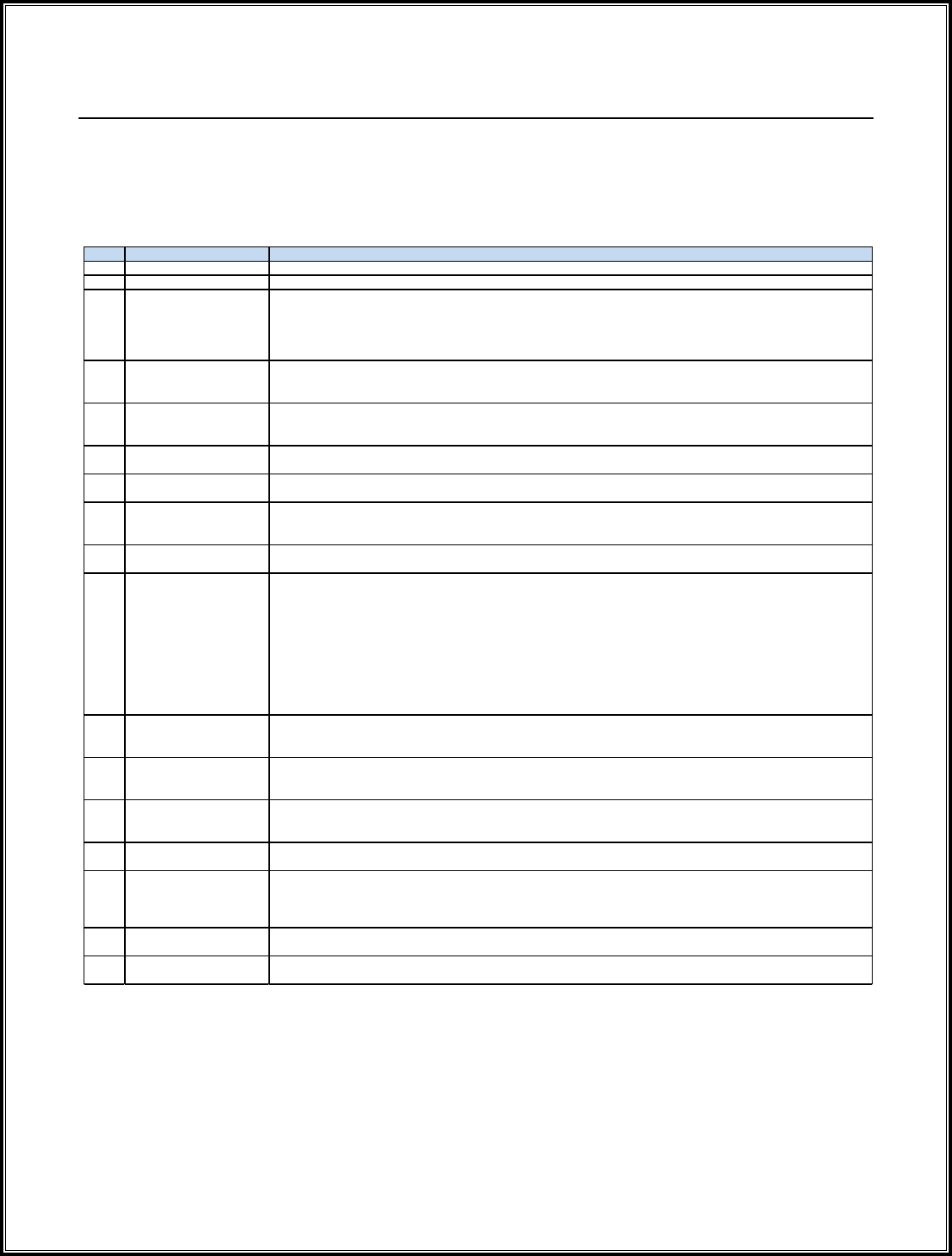

<<Develop a life-cycle cost estimate (LCCE) by resource type (DME/O&S) and appropriation, for

Alternative 1 (baseline/status quo/As-Is state) using the cost element structure in Appendix B as a guide.

Life-cycle cost estimates for each alternative will be compared with the baseline/status quo/As-Is

estimate. Clearly state key cost/economic information for the alternative being discussed. For example:

The total cost (understood to be synonymous with Total Cost of Ownership) of this alternative is [state

cost and timeframe]. It includes Direct, Indirect, and G&A costs for [explain materiel and non-materiel

costs included]. Estimates are [explain: confidence in estimates; whether they represent high, medium, or

low values; sensitivity (see definition)].>>

DOD ENTERPRISE IT BUSINESS CASE ANALYSIS TEMPLATE

8

<

<If the cost element structure in Appendix B is known, then the DME row in this table will equal the As-Is

Investment row from the structure in Appendix B. In the write-up, articulate the appropriations included in

the ‘Other’ rows of this table. It is acceptable to include extra rows for additional appropriations vice

summing to ‘other’.>>

<

<Apply discounting and economic analysis formulas per guidance in Appendix G to develop Economic

Viability metrics.>>

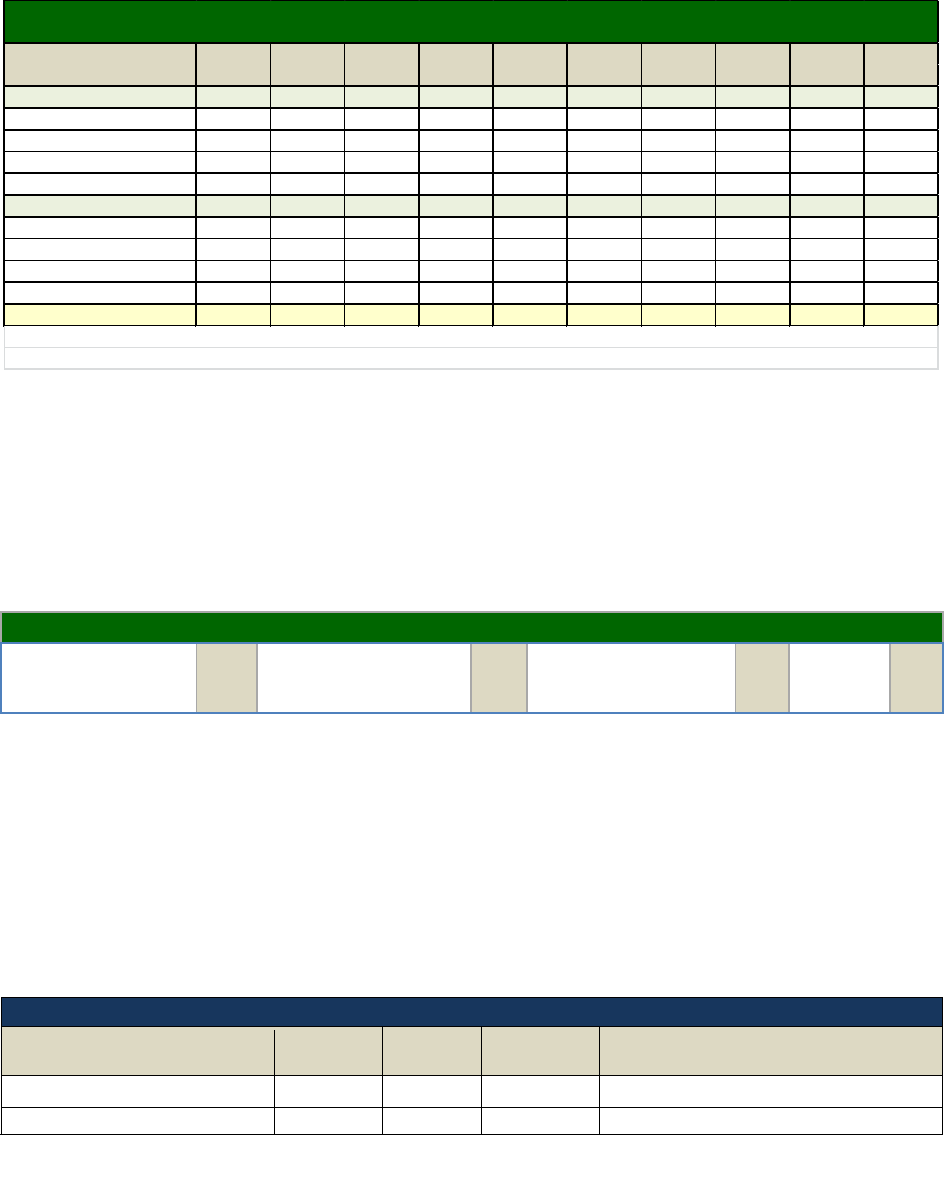

Alternative 1 - Economic Viability

Net Present Value

(NPV) =

Break Even

(Discounted) =

Benefit Cost Ratio

(BCR) =

Return on

Investment

(ROI) =

3.2.2 Requirements Summary

<< Provide a summary for how Alternative 1 satisfies requirements. For example:

This alternative satisfies [all, most, some] known requirements. Its greatest strengths are in [explain

what they are and why they are important]. Its greatest limitations are [explain what they are and why

they are an issue]. Expectations regarding how well this alternative is expected to satisfy each

requirement have been scored and provided in the table below.>>

<< Scores, weights, and justification for the assigned Weights should be developed through a

collaborative process with stakeholders and documented in this section. Sum of weights should =

100%.>>

Alternative # 1: Requirements Satisfaction

Requirement

Score

(0 to 5)

1

Weight

2

Weighted

Score

3

Score Rationale

[Describe requirement]

[Describe requirement]

Total Score

4

1. Score range is: 0 (does not meet requirement), 1 (minimally meets requirement) to 5 (greatly exceeds requirement).

2. Weighting factor for high priority requirements

3. Weighted score = “score” multiplied by “weight factor”

4. The unweighted and weighted scores are summed to establish the total score

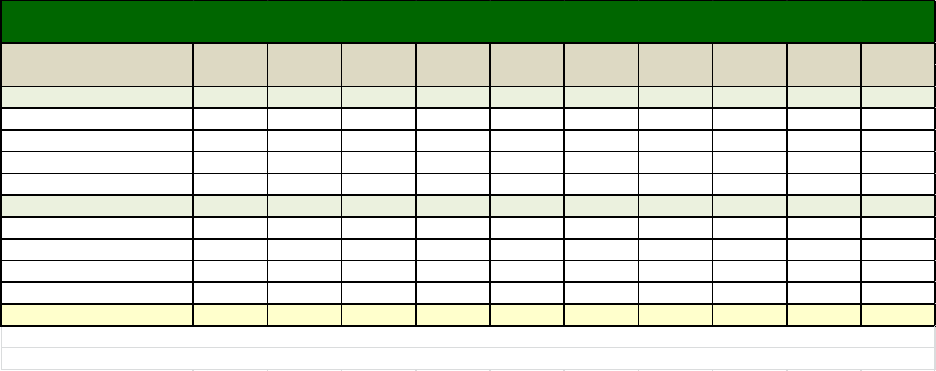

Resource Type (DME/O&S)

Appropriation

DME 2 2 2 0 0 0 0 6

RDT&E

Procurement

O&M

Other

O&S 4 4 4 4 4 4 4 28

RDT&E

Procurement

O&M

Other

TOTAL $6 $6 $6 $4 $4 $4 $4 $34

To

Complete

LCCE

DME = Development, Modernization, or Enhancement

O&S = Operations and Sustainment

Alternative 1 (Baseline) Life Cycle Costs

(dollars in millions)

Prior

FY15

FY16

FY17

FY18

FY19

FY20

FY21

DOD ENTERPRISE IT BUSINESS CASE ANALYSIS TEMPLATE

9

3.2.3 Qualitative Benefits

<<Clearly state the nature of any operational impacts the alternative under discussion presents.>> For example:

This alternative had [significant, moderate, minimal, no] negative

operational impacts in the areas of

[list], and [significant, moderate, minimal, no] positive benefits in the areas of [list].

<<Expand on significant issues, areas of concern and/or strengths and how they are likely to affect the

success of the project. The table below may be tailored to add/remove operational areas. For example:

Expectations regarding how this alternative will impact operations are scored below. This list is an

example, and will not apply to all projects. The operational areas must be distinct to avoid harmful

correlation.>>

Alternative 1 - Operational Benefits/Impacts

Operational Area

Score

1

Rationale

Mission/business function

Interoperability

Customer/User benefit

Efficiency

Info Assurance/Security

Reliability/ Quality

Sustainability

Other

Total Score:

NOTE 1: Scores range from -5 to +5. Negative scores of -4 or -5 are red; high positive impact scores of +4 or +5 are green.

3.2.6 Risk Summary

<<Use narrative to summarize risks. Identify risk management actions and evaluate risk before and after

risk management to determine which strategies are likely to have the most impact. Identify costs

associated with risk management actions. Include any risks associated with assumptions. For example:

This alternative has been evaluated to be [high, medium, low] risk. Areas of greatest risk were [list and

explain]. Areas of lowest risk were [list and explain]. If actions are taken to [describe risk management

actions], it is believed that risk related to [risk factor name] [could or could not] be reduced to an

acceptable level because [explain]. >>

Risk

Factor

Pre-Risk Mgmt Analysis

Risk Management Strategy

Post- Risk Mgmt Analysis

1.

Probability

2

Impact

3 Areas

Impacted

1.

Probability

2.

Impact

3. Areas

Impacted

Insufficient

Budget

Certain

Catastro

phic

C

Divide system into mandatory and

desirable features and only implement

mandatory features

Possible

Mod

C

Requirement

Change

Possible

Mod

C, P, T, S,

R

Lock down technical requirements for

spiral one on XX date

Possible

Mod

C,P,S,R

Dependency

on XXX

Possible

High

S, R, C

Focus on aspects of project that do not

depend on system xxx

Possible

Mod

C, S

[Notional Risk Analysis & Management Examples]

Risk Table Legend

1. Probability

2. Impact

3. Areas of Impact

70-100%

Certain

Project failure

Catastrophic (Cat)

Business:

Programmatic (P)

40-69%

Probable

Failure to meet major requirements, major cost

increase or schedule delay

High

IT System:

Technical (T)

5-39%

Possible

Extensive adjustments needed to meet schedule

Moderate (Mod)

Delays &

Slippages:

Schedule (S)

Near 0%

Improbable

Minor adjustments needed to meet goals

Low

Staff & Equipment:

Resources (R)

Funding Shortfall:

Cost (C)

DOD ENTERPRISE IT BUSINESS CASE ANALYSIS TEMPLATE

10

3.3 [Short Descriptive Name of Alternative 2] Overview

<<Identify and describe the Alternative 2. Give it a short name and summarize what it is, what it includes,

and how it differs from the other alternatives. If relevant, expand upon the reasons stated above for

selecting this alternative for consideration.>>

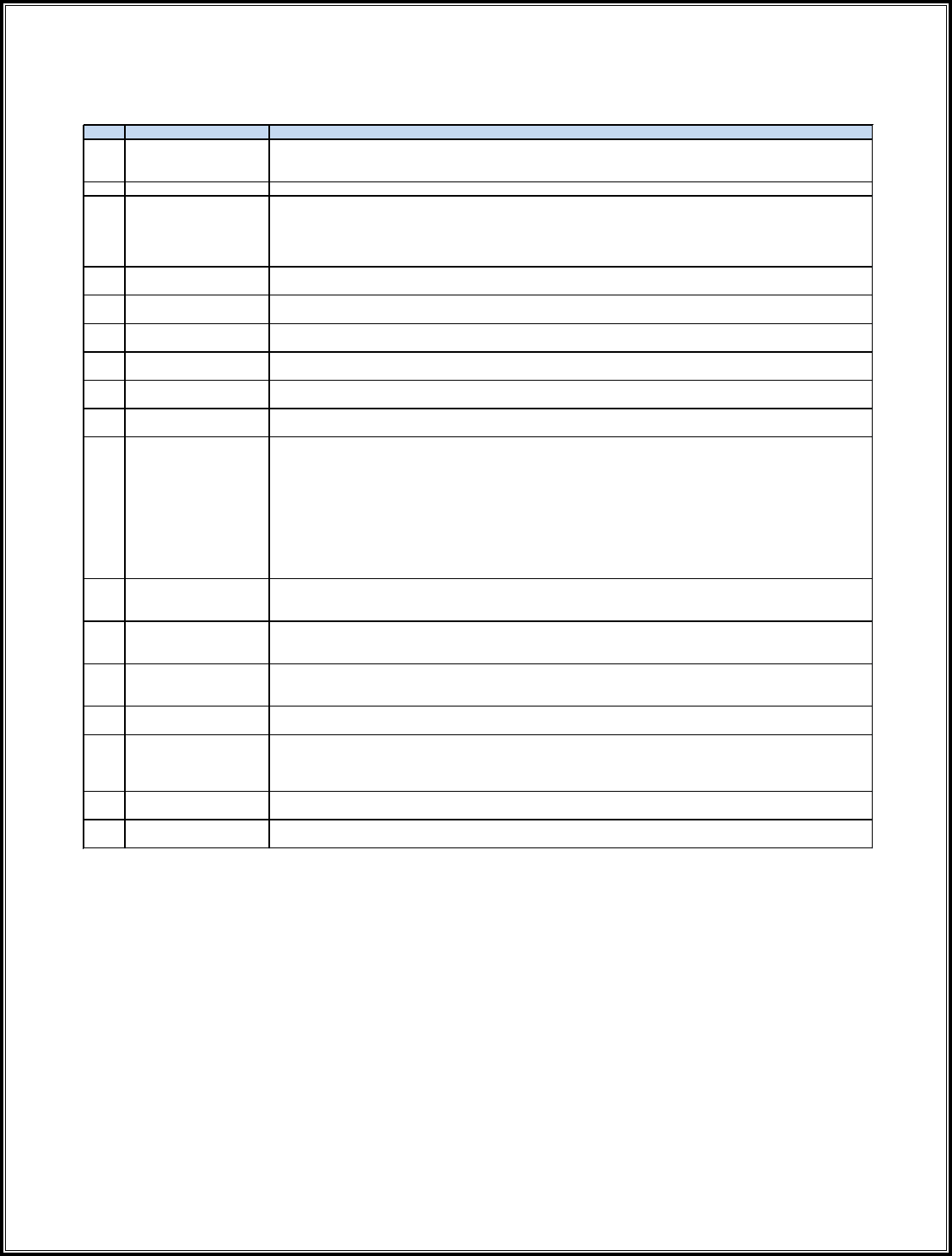

3.3.1 Cost and Economic Viability

<< Clearly state key cost/economic information for the alternative being discussed. For example:

The total cost of this alternative is [state cost and timeframe]. It includes Direct, Indirect, and G&A

costs for [explain materiel and non-materiel costs included]. Estimates are [explain: confidence in

estimates; whether they represent high, medium, or low values; sensitivity (see definition)].>>

[Notional Data]

<< If the cost element structure in Appendix B is known, then the DME row in this table will equal the As-

Is Investment row from the structure in Appendix B. In the write-up, articulate the appropriations included

in the ‘Other’ rows of this table. It is acceptable to include extra rows for additional appropriations vice

summing to ‘other.>>

<<Calculate the difference between the Status Quo and the Alternative to estimate the cost delta between

the two Alternatives. Negative #’s will show additional cost and positive # will show cost benefit. >>

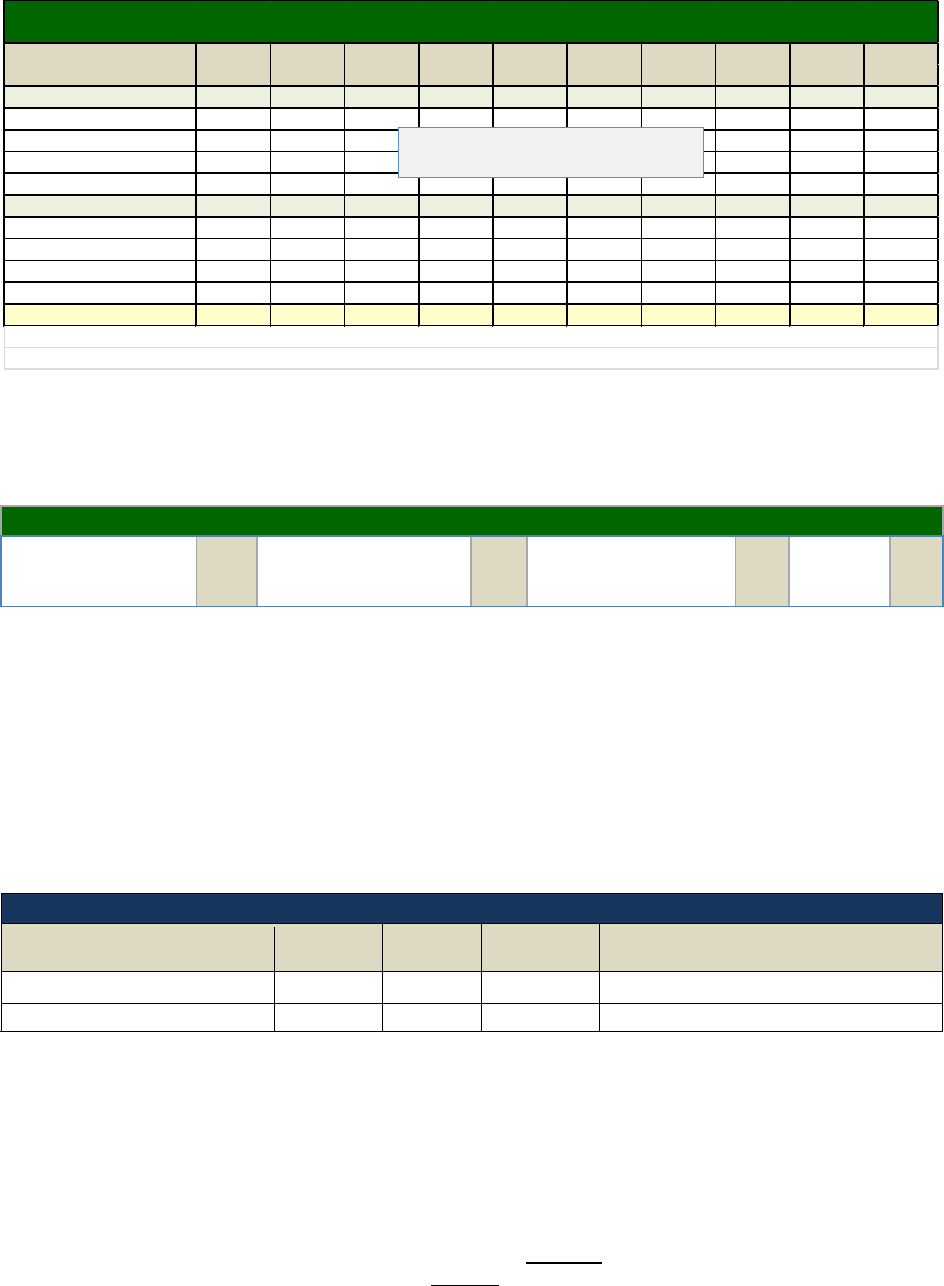

Resource Type (DME/O&S)

Appropriation

DME 2 2 2 0 0 0 0 6

RDT&E

Procurement

O&M

Other

O&S 4 4 4 4 4 4 4 28

RDT&E

Procurement

O&M

Other

TOTAL $6 $6 $6 $4 $4 $4 $4 $34

To

Complete

LCCE

DME = Development, Modernization, or Enhancement

O&S = Operations and Sustainment

Alternative 2 Life Cycle Costs

(dollars in millions)

Prior

FY15

FY16

FY17

FY18

FY19

FY20

FY21

DOD ENTERPRISE IT BUSINESS CASE ANALYSIS TEMPLATE

11

[Notional Data]

<<Apply discounting and economic analysis formulas per guidance in Appendix G to develop Economic

Viability metrics.>>

Alternative 2 - Economic Viability

Net Present Value

(NPV) =

Break Even

(Discounted) =

Benefit Cost Ratio

(BCR) =

Return on

Investment

(ROI) =

3.3.2 Requirements Summary

<< Provide a summary for the alternative discussed. For example:

This alternative satisfies [all, most, some] known requirements. Its greatest strengths are in [explain

what they are and why they are important]. Its greatest limitations are [explain what they are and why

they are an issue]. Expectations regarding how well this alternative is expected to satisfy each

requirement have been scored and provided in the table below.>>

<<The table below, should include the key requirements>>

<< Scores and Weights should be developed through a collaborative process with stakeholders and

documented in this section. Sum of weights should = 100%.>>

Alternative # 2: Requirements Satisfaction

Requirement

Score

(0 to 5)

1

Weight

2

Weighted

Score

3

Rationale

[Describe requirement]

[Describe requirement]

Total Score

4

1. Score range is: 0 (does not meet requirement), 1 (minimally meets requirement) to 5 (greatly exceeds requirement).

2. Weighting factor for high priority requirements

3. Weighted score = “score” multiplied by “weight factor”

4. The unweighted and weighted scores are summed to establish the total score

3.3.3 Qualitative Benefits

<<Clearly state the nature of any operational impacts the alternative under discussion presents.>> For example:

This alternative had [significant, moderate, minimal, no] negative

operational impacts in the areas of

[list], and [significant, moderate, minimal, no] positive benefits in the areas of [list].

Resource Type (DME/O&S)

Appropriation

DME 2 2 2 0 0 0 0 6

RDT&E

Procurement

O&M

Other

O&S 4 4 4 4 4 4 4 28

RDT&E

Procurement

O&M

Other

TOTAL $6 $6 $6 $4 $4 $4 $4 $34

To

Complete

LCCE

DME = Development, Modernization, or Enhancement

O&S = Operations and Sustainment

Alternative 1 (Baseline) Life Cycle Costs minus Alternative 2 Life Cycle Costs

(dollars in millions)

Prior

FY15

FY16

FY17

FY18

FY19

FY20

FY21

Table will display mathtical deltas between

Alternative 1 (Baseline) and Alternative 2

DOD ENTERPRISE IT BUSINESS CASE ANALYSIS TEMPLATE

12

<< Expand on significant issues, areas of concern and/or strengths and how they are likely to affect the

success of the project. The table below may be tailored to add/remove operational areas. For example:

Expectations regarding how this alternative will impact operations are scored below. This list is an

example, and will not apply to all projects. The operational areas must be distinct to avoid harmful

correlation.>>

Alternative 2 - Operational Benefits/Impacts

Operational Area

Score

1

Rationale

Mission/business function

Interoperability

Customer/User benefit

Efficiency

Info Assurance/Security

Reliability/ Quality

Sustainability

Other

Total Score:

NOTE 1: Scores range from -5 to +5. Negative scores of -4 or -5 are red; high positive impact scores of +4 or +5 are green.

3.3.6 Risk Summary

<<Use narrative to summarize risks. Identify risk management actions and evaluate risk before and after

risk management to determine which strategies are likely to have the most impact. Identify costs

associated with risk management actions. Include any risks associated with assumptions. For example:

This alternative has been evaluated to be [high, medium, low] risk. Areas of greatest risk were [list and

explain]. Areas of lowest risk were [list and explain]. If actions are taken to [describe risk management

actions], it is believed that risk related to [risk factor name] [could or could not] be reduced to an

acceptable level because [explain]. >>

Risk

Factor

Pre-Risk Mgmt Analysis

Risk Management Strategy

Post- Risk Mgmt Analysis

1.

Probability

2

Impact

3 Areas

Impacted

1.

Probability

2.

Impact

3. Areas

Impacted

Insufficient

Budget

Certain

Catastro

phic

C

Divide system into mandatory and

desirable features and only implement

mandatory features

Possible

Mod

C

Requirement

Change

Possible

Mod

C, P, T, S,

R

Lock down technical requirements for

spiral one on XX date

Possible

Mod

C,P, S, R

Dependency

on XXX

Possible

High

S, R, C

Focus on aspects of project that do not

depend on system xxx

Possible

Mod

C, S

[Notional Risk Analysis & Management Examples]

Risk Table Legend

4. Probability

5. Impact

6. Areas of Impact

70-100%

Certain

Project failure

Catastrophic (Cat)

Business:

Programmatic (P)

40-69%

Probable

Failure to meet major requirements, major cost

increase or schedule delay

High

IT System:

Technical (T)

5-39%

Possible

Extensive adjustments needed to meet schedule

Moderate (Mod)

Delays &

Slippages:

Schedule (S)

Near 0%

Improbable

Minor adjustments needed to meet goals

Low

Staff & Equipment:

Resources (R)

Funding Shortfall:

Cost (C)

3.4 <Short Descriptive Name of Third Alternative> Overview

<< For other alternatives, follow the same structure as above. >>

13

4.0 COMPARISON OF ALTERNATIVES

4.1 Comparison of Alternatives’ Economic Viability Measures

<<Identify the alternative(s) with the best viability. Assess overall economic viability and provide rationale,

taking into consideration: (1) degree of confidence in financial assumptions and estimates, (2) sensitivity

of the data, and (3) economic realities such as availability of funds. For example:

The most economically viable alternative is [alternative number and short name]. Its overall economic

viability is assessed as [strong, moderate, weak, not viable] based on [explain].

<<If only one alternative is being considered, there will only be one set of economic viability measures..>>

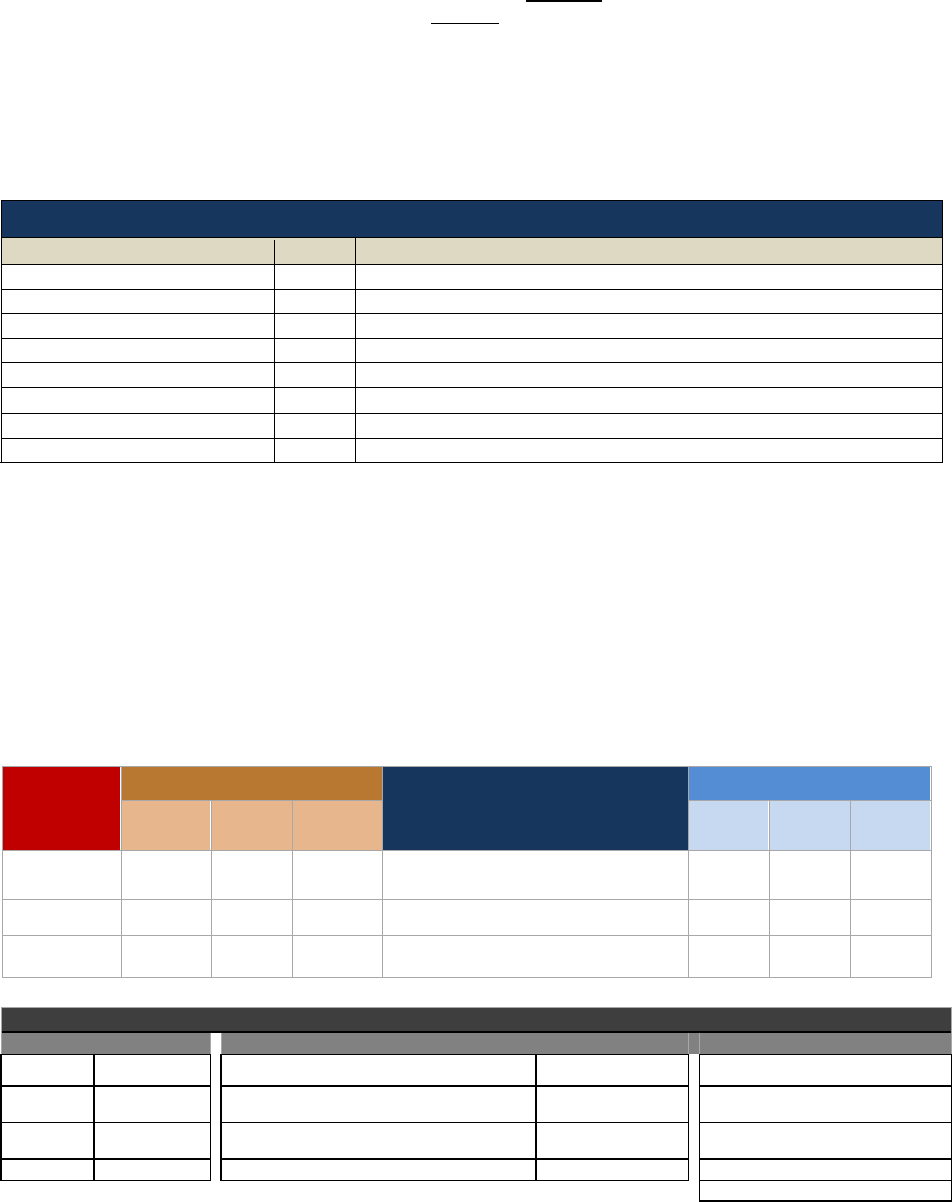

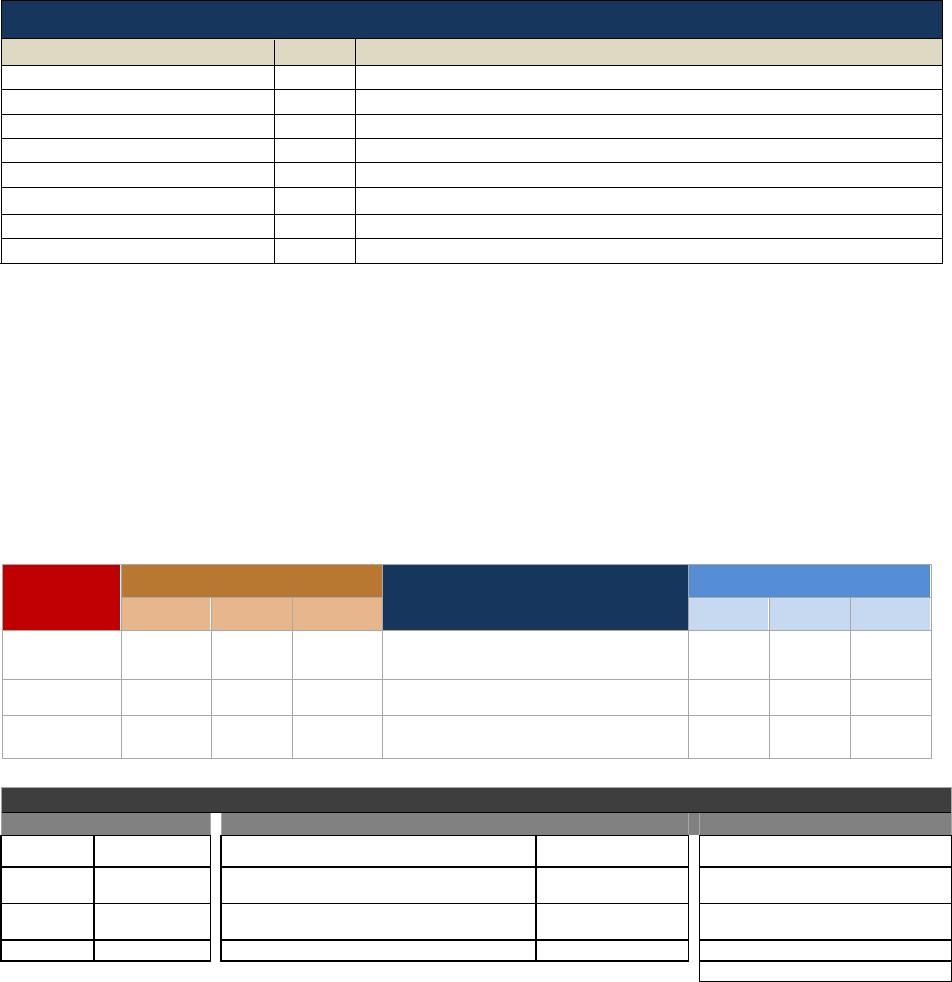

Alternative Economic Viability Comparison

Most

Viable

Alternative 2

NPV =

Discounted Payback Pd =

BCR =

ROI =

Alternative 3

NPV =

Discounted Payback Pd =

BCR =

ROI =

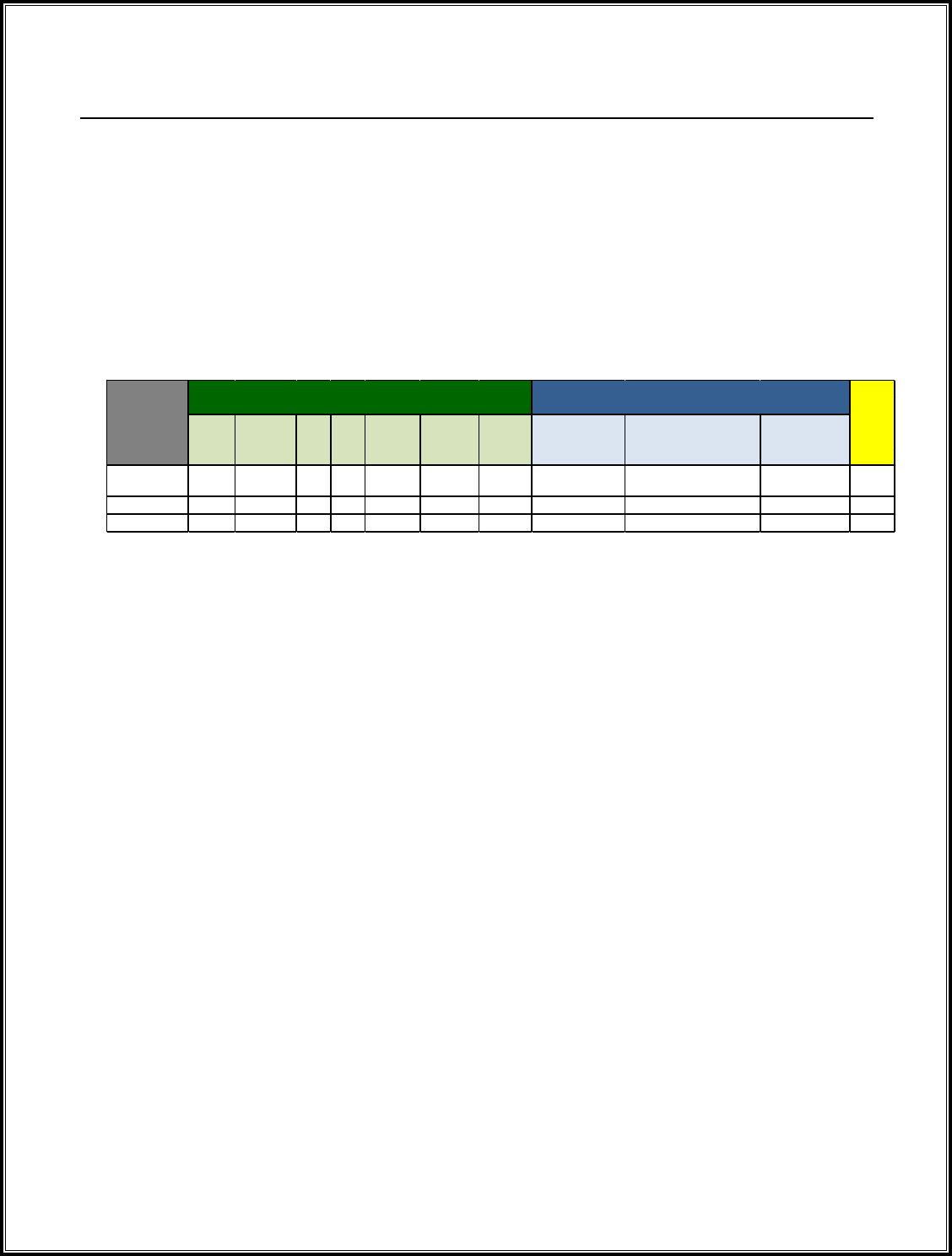

4.2 Comparison of Costs and Savings

<<Identify the alternative that requires the lowest overall life cycle costs (investment & O&S). For

example:

Of the [number of] alternatives considered, Alternative [number and short name] requires the lowest

overall life cycle costs. >>

Life Cycle Cost Comparison

(dollars in millions)

Prior FY15 FY16 FY17 FY18 FY19 FY20 FY21

To

Complete

LCCE

Lowest

LCC$

Alternative 1 $_ $_ $_ $_ $_ $_ $_ $_

Alternative 2

Alternative 3

<<Provide the amounts listed in the ‘Total’ line for each alternative (Sections 3.2.1, 3.3.1, etc.)>>

<<Explain the relationship between lifecycle costs and net cost increase or savings. For example:

Taking into consideration the overall lifecycle costs required and the net cost increases/savings of

each alternative, Alternative [number] is most feasible from a funding availability standpoint and

provides a [strong, moderate, or weak] financial benefit and return. If this option is implemented, status

quo costs can be reduced by [explain assumptions, amounts, and timeframes] and realigned to help

fund the alternative. Additionally, other savings not directly related to the cost of this alternative from

[explain other savings if applicable] can be applied to help offset the total cost. >>

Red

=budget/cost increase; black = budget decrease (savings)

4.3 Comparison of Overall Requirements Satisfaction

<< Compare how each alternative satisfies each requirement. Identify the alternative that best meets

overall requirements. Document all methodologies used to make the determinations. For example:

Net Cost Increase or Savings

(dollars in millions)

In millions Prior FY15 FY16 FY17 FY18 FY19 FY20 FY21

To

Complete

LCCE

Greatest

Savings

Alternative 2 $/$ $/$ $/$ $/$ $/$ $/$ $/$ $/$ $/$ $/$

Alternative 3 $/$ $/$ $/$ $/$ $/$ $/$ $/$ $/$ $/$ $/$

DOD ENTERPRISE IT BUSINESS CASE ANALYSIS TEMPLATE

14

The [alternative number and name] most fully satisfies the statutory, functional, and technical

requirements specified for this project. Comparative results are provided below.>>

Requirements Comparison

Requirement

As Is/Alt 1

Alt 2

Alt 3

Alt 4

[Describe requirement]

[Describe requirement]

Total Score

Best

4.4 Comparison of Mission and Operational Benefits/Impacts

<<Identify the alternative that has the highest weighted operational score. For example:

[Alternative number and name] has the highest weighted operational score, particularly in the areas of

[list areas]. Comparative results are provided below.>>

Operational Benefits/Impacts If Implemented (or not Implemented)

Operational Area

Unweighted Scores

Weighted Scores

As Is/Alt 1

Alt. 2 Alt. 3 Alt.4

As Is/Alt

1

Alt.2 Alt. 3 Alt. 4

Mission/business function

Interoperability

Customer/User benefit

Efficiency

Info Assurance/Security

Reliability/ Quality

Sustainability

Other

Total Scores

Best

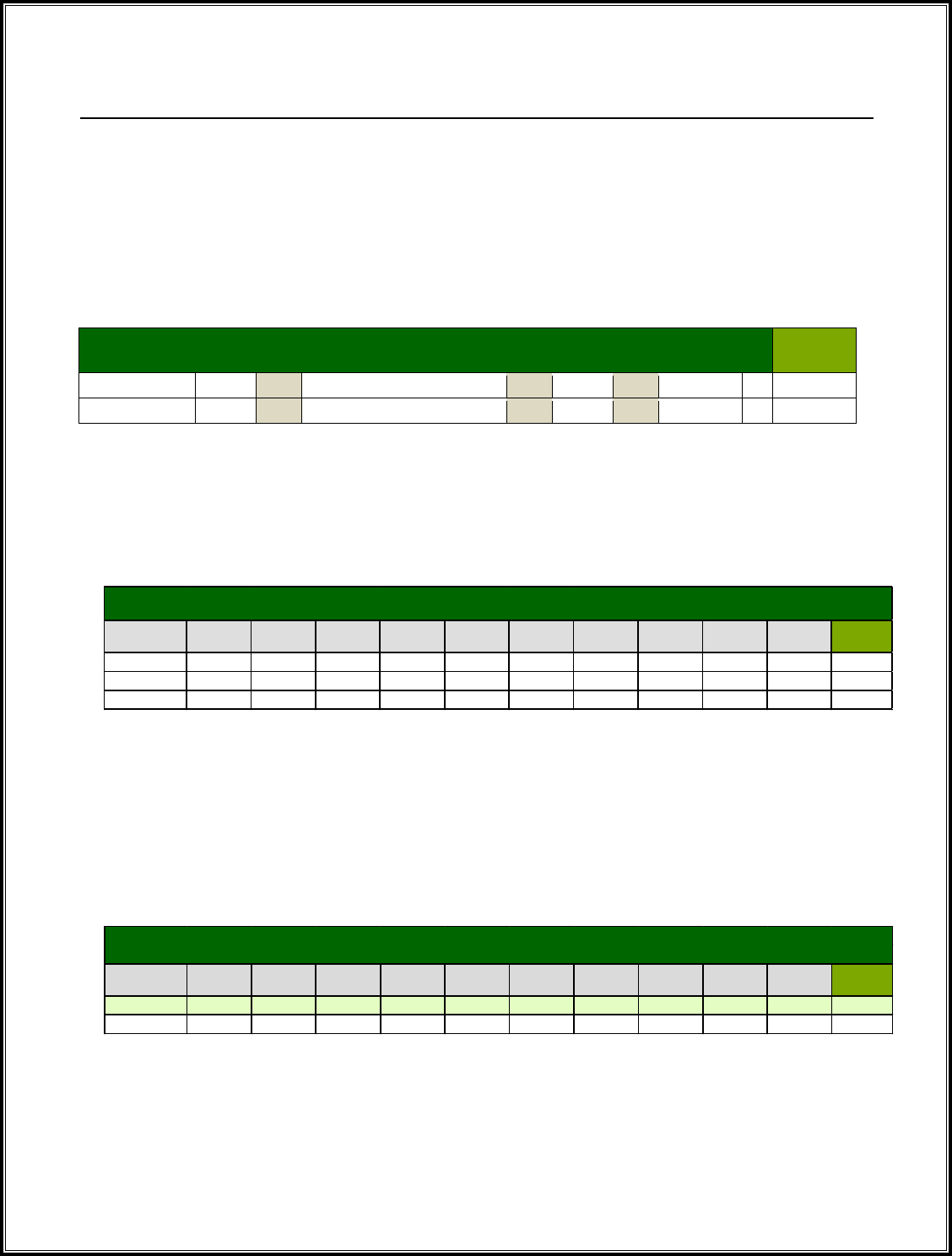

4.5 Risk Comparisons

<<Identify which alternative offers the lowest risk and which offers the highest risk, and whether risks

identified are considered acceptable or not acceptable after risk management efforts. For example:

Post-risk management, [Alternative number and name] appears to have the lowest risk and

[Alternative number and name] appears to have the highest risk. Considering the types of risks,

their possible impacts and probability of occurring, the risks for [Alternate with lowest risk] after risk

management actions are considered [acceptable or not acceptable]. Considering the types of risks,

their possible impacts and probability of occurring, the risks for [Alternate with highest risk] after risk

management actions are considered [acceptable or not acceptable]. The risk cubes below

summarize the risk profiles for each alternative after risk management actions.>>

DOD ENTERPRISE IT BUSINESS CASE ANALYSIS TEMPLATE

15

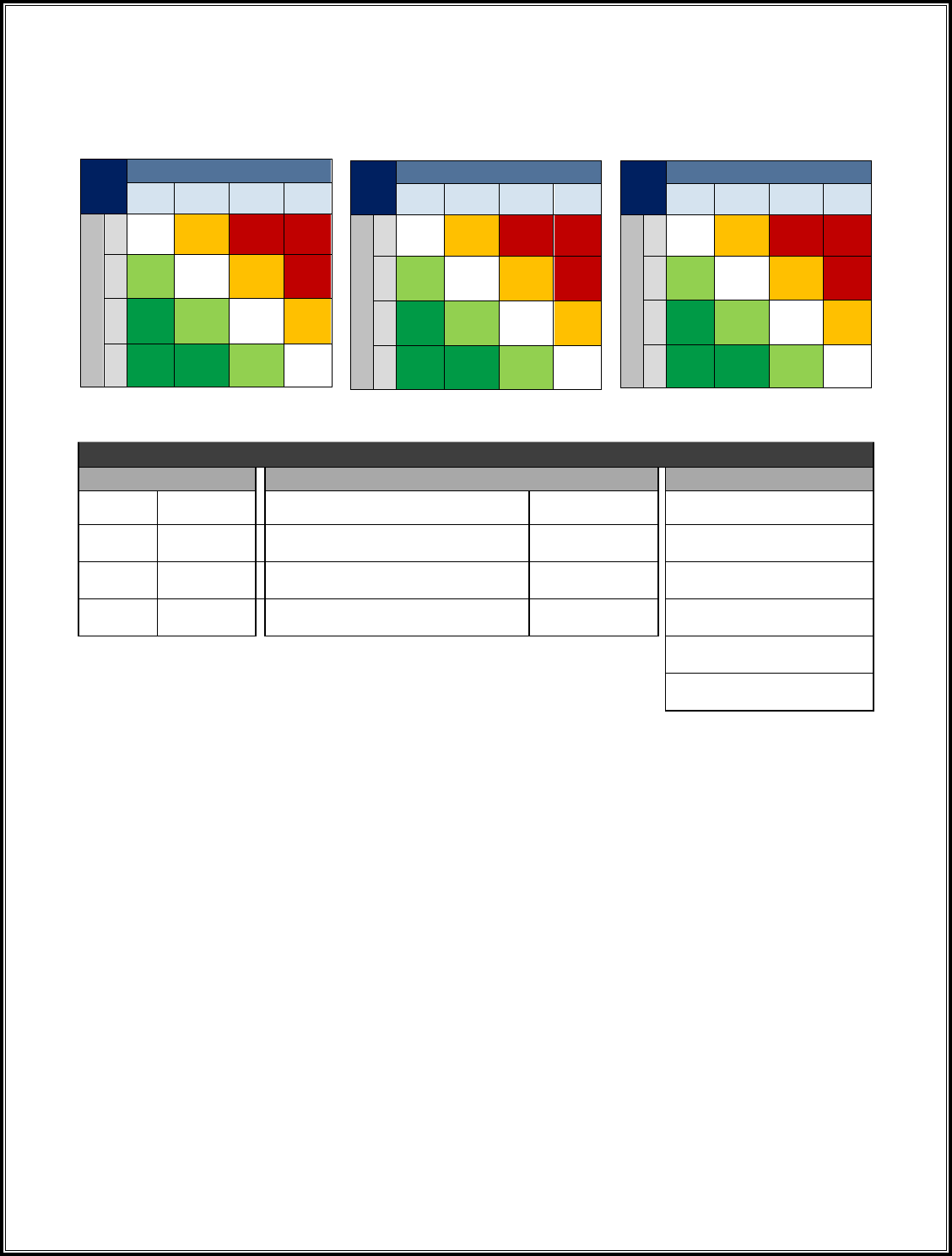

<< The following risk cubes should be used, and tailored as appropriate.>>

Alternative 1 Alternative 2 Alternative 3

(Cat = catastrophic)

[Examples here are notional.]

Risk Cube Legend

Probability

Impact

Areas of Impact

70-100%

Certain

Project failure

Catastrophic (Cat)

Business

Programmatic

(P)

40-69%

Probable

Failure to meet major requirements,

major cost increase or schedule delay

High

IT system

Technical

(T)

5-39%

Possible

Extensive adjustments needed to meet

schedule

Moderate (Mod)

Delays &

Slippages

Schedule

(S)

Near 0%

Improbable

Minor adjustments needed to meet

goals

Low

Staff &

Equipment

Resources

(R)

Funding

shortfall

Cost

(C)

Contract

Issues

Business &

Secuirty (V)

4.6 Sensitivity Analysis (Optional)

<<The primary objective of Sensitivity Analysis is to determine whether the cost ranking of the alternatives

change as a result of varying certain factors. Its value lies in the additional information and understanding it

brings to bear on the decision. For decision makers facing an investment decision, sensitivity analysis is a

tool for determining how changes in costs or benefits affect the recommendation. Sensitivity Analysis

reveals how the cost estimate is affected by a change in a single assumption. It examines the effect of

changing one assumption or cost driver at a time while holding all other variables constant. By doing so, it is

easier to understand which variable most affects the cost estimate. Consult references in Appendix H for

assistance with conducting sensitivity analysis.>>

4.7

Other Considerations

<< Optional. Explain any other information not previously addressed that should be considered when

making a selection recommendation.>>

Alt 1

Probability

Improb-

able

Possible

Probable

Certain

Impact

Cat

Hig

C, S,

P, T

C

Me

C

Low

Alt 2

Probability

Improb-

able

Possible

Probable

Certain

Impact

Cat

Hig

C, R

C

Me

P S

Low

S, T

Alt 3

Probability

Improb-

able

Possible

Probable

Certain

Impact

Cat

S C

Hig

R C R

Me

S

Low

DOD ENTERPRISE IT BUSINESS CASE ANALYSIS TEMPLATE

16

5.0 CONCLUSIONS AND RECOMMENDATIONS

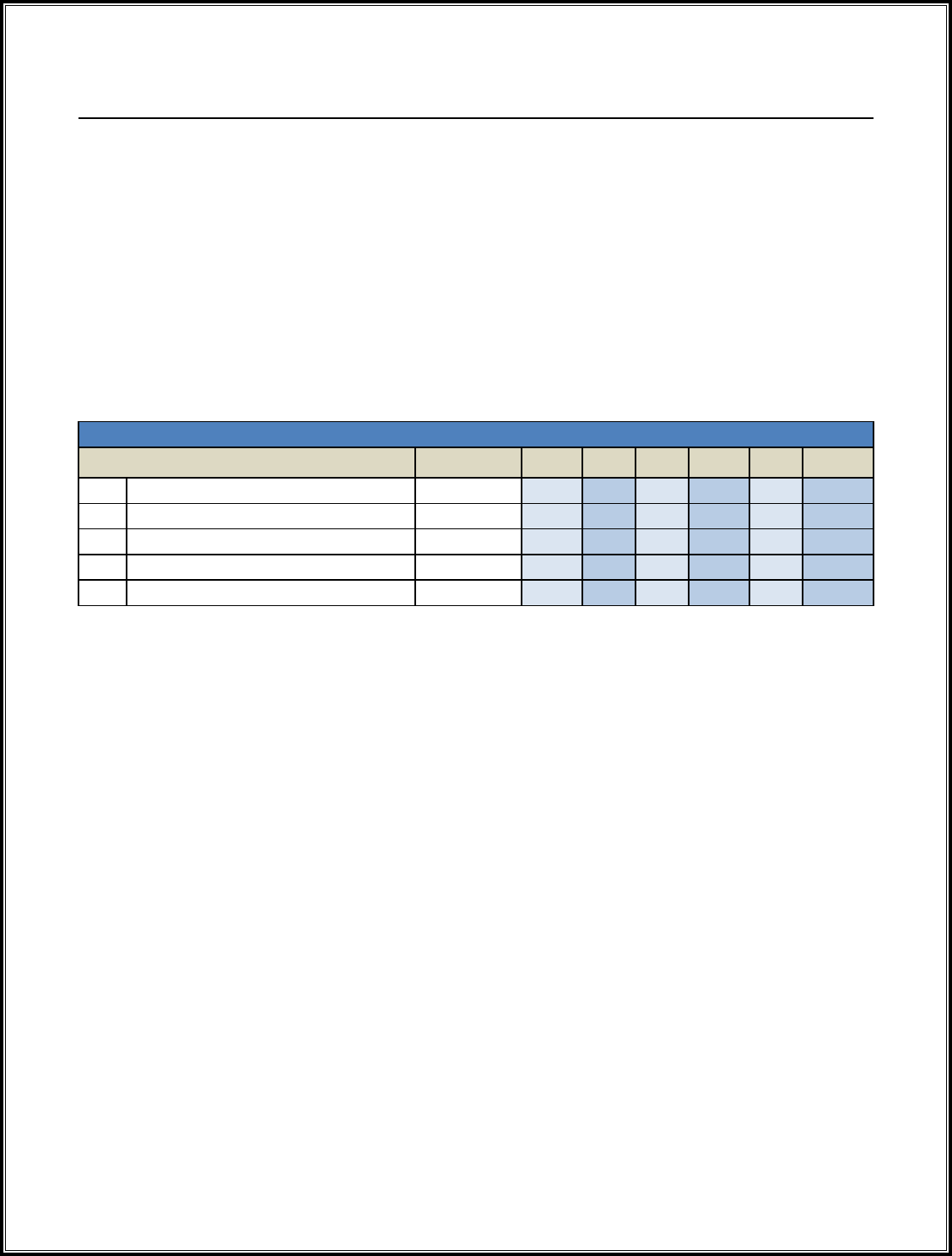

5.1 Summary Comparison and Recommendation

<<Identify the alternative found to be the best option, discuss merits of each alternative and rational for

recommended alternative, with summary rationale data. For example:

After performing an analysis of the financial and non-financial benefits and risks of various

alternatives, [alternative number and name] is assessed to be the most viable option. It generates

the greatest savings [note amount and timeframe], fully satisfies all requirements, provides the

greatest operational benefits/impacts, and involves risks that, once managed, are considered

acceptable.

The following example table summarizes and compares the alternatives across financial and non-

financial dimensions.>>

Financial

Non-Financial

Overall

Comparison of

Alternatives

Best

Option

Cost

(FY15-21)

$M

Unfunded

Requirements

(Exceeds, Meets,

Not Acceptable)

Operational

Benefits

(Significant, Moderate, Low,

None)

Managed Risk

(Low, Med,

High,

Break

Even

Savings

(FY15-21)

$M

NPV BCR ROI

(FY15-21)

$M

Alternative 1

(As-Is)

N/A N/A N/A N/A N/A N/A

Alternative 2

Alternative 3

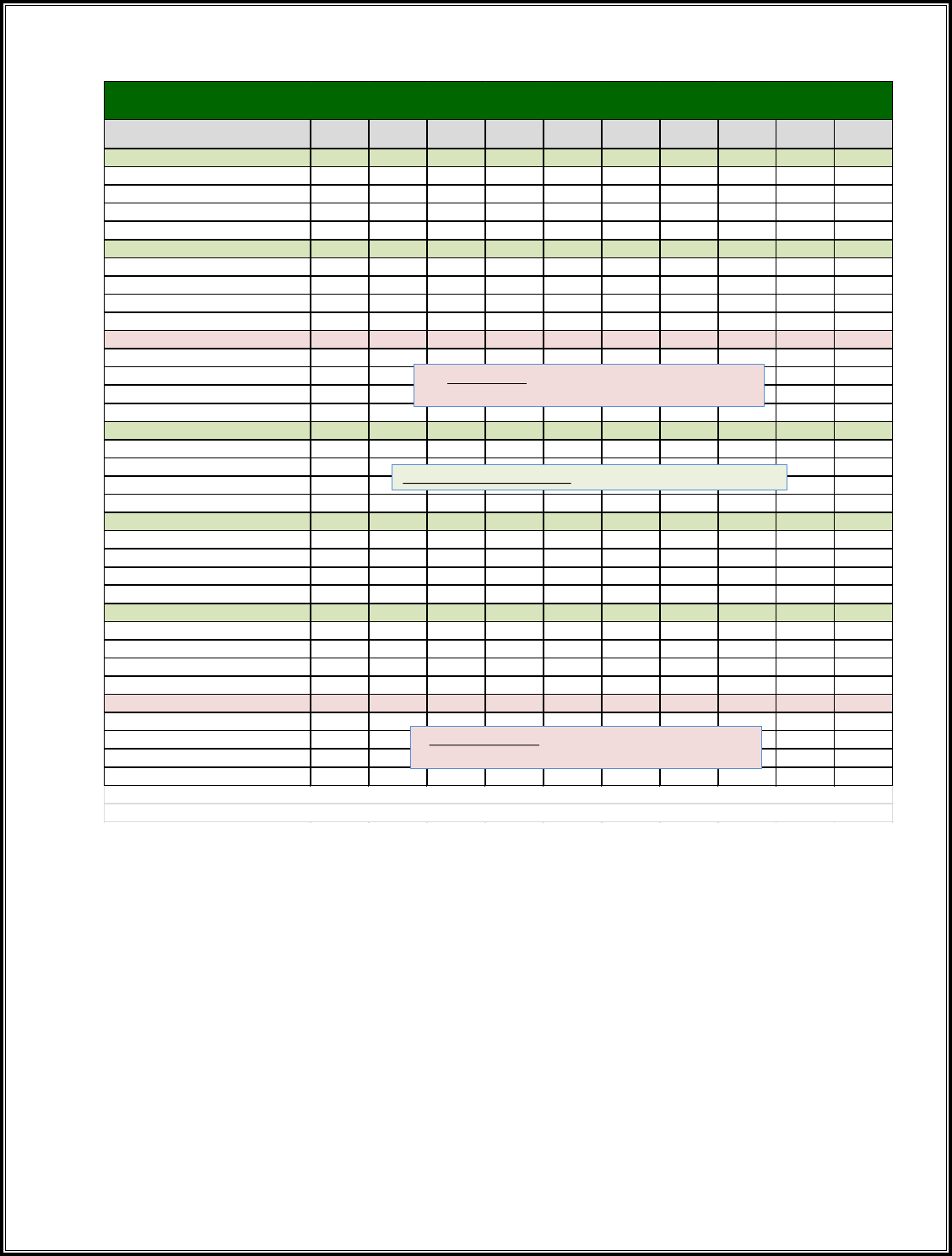

5.2 Funding Needs and Sources

<<Identify the total funding required for the recommended alternative. For example:

The table below identifies the total funding required for the recommended alternative as presented in

the alternatives “Cost” section. It includes costs for materiel [list] and non-materiel [list] requirements.

>>

<<If deltas exist between the ‘Total Requirement’ and amounts currently programmed/budgeted,

identify all off-sets required to fully fund the alternative. Provide additional off-set details in Appendix

D.>>

<<I

f additional funding is required, explain logical funding sources based on expected cost

savings/avoidance. As necessary, provide additional detail re: reprogramming actions in Appendix D. For

example:

This project is expected to generate cost avoidance in the amount of [amount and timeframe] from

[describe the efficiency that creates the cost avoidance]. To cover the remaining unfunded costs,

funding equal to the cost avoidance could be recouped through budget marks against [state logical

source (provide APPN, BA, PE, BLI, and UII)]. If this is done, the final net unfunded amount for this

initiative would be [state amount].>>

DOD ENTERPRISE IT BUSINESS CASE ANALYSIS TEMPLATE

17

Funding Required/Available

(dollars in millions)

To

Prior FY15 FY16 FY17 FY18 FY19 FY20 FY21 LCC

Complete

Total Required

RDT&E

Procurement

O&M

Other

Currently Programmed/Budgeted

RDT&E

Procurement

O&M

Other

Unfunded Requirements (UFR)

RDT&E

Procurement

Net Unfunded will display mathtical deltas between

O&M

'Total Requirement' and 'Currently Programmed/Budgeted'

Other

Off-sets from Reprogramming

RDT&E

Procurement

Off-Sets from Reprogramming can only correct execution year UFRs.

O&M

Other

Off-sets from POM/PBR

RDT&E

Procurement

O&M

Other

Off-sets from Cost Savings/Avoidance

RDT&E

Procurement

O&M

Other

Final NET Unfunded

RDT&E

Procurement

Final NET Unfunded will display mathtical deltas between

O&M

'NET Unfunded' and 'Off-sets'

Other

POM - Component Program Objectives Memorandum

PBR - DoD Program and Budget Review

NOTE: Investment (Invest.)” reflects all one-time/non-recurring costs, regardless of appropriation expected to be incurred to

implement the preferred alternative. Consists of sustainment costs incurred from the initial system deployment

through the end of system operations. Includes all costs of operating, maintaining, and supporting a

fielded system. Specifically, this consists of the costs (organic and contractor) of personnel, equipment,

supplies, software, and services associated with operating, modifying, maintaining, supplying, and

otherwise supporting a system in the DoD inventory.

DOD ENTERPRISE IT BUSINESS CASE ANALYSIS TEMPLATE

18

APPENDIX A: GLOSSARY

<<These definitions may be augmented/changed as needed to support a particular BCA.>>

Term

Description

Analysis of

Alternatives

Evaluation of different choices available for achieving an objective, usually requiring a

cost benefit analysis, life cycle costing and sensitivity analysis.

Assumption

An assumption is an informed position about what is believed to be true for a situation

where explicit factual knowledge is unobtainable.

Baseline

A description of the beginning condition in measureable terms and a start date from

which progress can be measured. Synonymous with As Is and Status Quo.

Benefit-Cost Ratio

(BCR)

BCR is the index resulting from dividing discounted benefits (savings/cost avoidances)

by discounted investment. Therefore, an initiative must have a BCR > 1.0 to be

considered financially viable.

Break Even (B-E)

The fiscal year in which the initiative “breaks-even” based on discounted cash flows,

i.e., the point at which the Net Present Value (NPV) becomes positive.

Business Case

A comparative analysis that presents facts and supporting details among competing

alternatives. It should be unbiased by considering all possible alternatives and should

not be developed solely for supporting a predetermined solution.

Constraint

Constraints are factors known or discovered that are expected to limit the analysis,

possible solutions and/or expected outcomes.

Cost Savings

A reduction in costs below the projected (i.e., budgeted) level as a result of a specific

initiative. Because cost savings are a reduction in the level of budgeted costs, savings

are available to be recouped from the budget.

Cost Avoidance

A reduction in future unbudgeted costs that cannot be recouped from the budget. A

cost avoidance in current budgeted years (FYDP) may also result due to increased

productivity or other previously unrealized benefits.

Data

Characterization

Per the Cloud Security Model. Level 1 = Unclassified publicly releasable. Level 2 =

Unclassified publicly releasable with access controls, all FOIA releasable data,

information open to public even if it requires a login, low risk, non-sensitive PII. Level 3

= Controlled Unclassified Information – low confidentiality impact, moderate integrity

impact. Level 4 = Controlled Unclassified Information – Moderate confidentiality impact,

moderate integrity impact, moderate level PII. Level 5 = Moderate confidentiality impact,

Moderate integrity impact but Mission essential, critical infrastructure (military or

civilian), deployment and troop movement, ITAR data, unclassified nuclear data, Trade

Secrets Act data, sensitive PII (medical/HIPAA, personnel, legal, law enforcement,

biometric). Level 6 = Classified information up to and including SECRET – Moderate

confidentiality impact, Moderate integrity impact e.g., C2 systems, email systems.

Data Impact Level

Assessment

A determination of the potential impact (Low, Moderate, or High) to the mission that

would result from loss of confidentiality, integrity, and availability if a security breach

occurs, IAW the DoD Risk Management Framework.

Development

Modenization

Enhancement

(DME)

Development, Modernization and Enhancement refers to projects and activities leading

to new IT assets/systems, as well as projects and activities that change or modify

existing IT assets to substantively improve capability or performance, implement

legislative or regulatory requirements, or meet an agency leadership request. DME

activity may occur at any time during a program’s life cycle. As part of DME, capital

costs can include hardware, software development and acquisition costs, commercial

off-the-shelf acquisition costs, government labor costs, and contracted labor costs for

planning, development, acquisition, system integration, and direct project management

and overhead support.

DOD ENTERPRISE IT BUSINESS CASE ANALYSIS TEMPLATE

19

Direct

Direct costs include costs for hardware, software, communications, labor (sys admin,

app spt, help desk, storage admin, data admin, security, hosting), and Enterprise Svc

Mgmt/Net Ops.

DOTMLPF

The DOTMLPF acronym is defined by the CJCSI 3170.01G -Joint Capabilities

Development System (JCIDS) as: doctrine, organization, training, materiel, leadership

and education, personnel and facilities. JCIDS requires all DOTMLPF aspects (materiel

and non-materiel) be considered when developing a solution/recommendation.

G&A

General & Administrative costs include costs for internally controlled (personnel &

related costs, HW/SW requirements to support headquarters functions, Admin LAN) and

external agreements.

Goal

A description of the desired/expected end-state condition.

Indirect

Indirect costs include costs for hosting infrastructure (facility repairs/improvements,

conditioned power, full uninterrupted power supply, generated power, heat ventilation &

air conditioned services, electric/water/sewage, garbage, and physical security), Field

Security Operations, personnel & related costs.

Information System

All DoD-owned or -controlled systems that receive, process, store,

display or transmit DoD information, regardless of mission assurance category,

classification or sensitivity.

Investment funds

Funding used for non-recurring costs to upgrade, refresh, or modernize existing

systems/processes, or new developments.

Mission Impact

Assessment

A determination of the mission impact relative to the overall mission of the Department

to wage war and defend the nation. Systems/applications that may be of high

importance to the specific mission they serve, but are of low impact to the DoD mission,

allows different security profiles to be chosen for those systems

Net Present Value

(NPV)

NPV is the difference between discounted benefits and discounted costs (i.e.,

discounted savings/cost avoidances less discounted costs). An initiative must have an

NPV > 0.0 to be considered financially viable.

Operating &

Sustainment (O&S)

Operations & Sustainment Costs refers to the expenses required to operate and sustain

an IT asset that is operating in a production environment. O&S costs include costs

associated with operations, maintenance activities, and maintenance projects needed to

sustain the IT asset at the current capability and performance levels. It includes Federal

and contracted labor costs, corrective hardware and software maintenance, voice and

data communications maintenance and service, replacement of broken or obsolete IT

equipment, overhead costs, and costs for the disposal of an asset. Also commonly

referred to as steady state, current services and operations & maintenance..

Operating &

Support (O&S)

All costs to sustain the system/project after it has been released to production (i.e., after

deployment or upon achievement of Full Operational Capability (FOC).

Return on

Investment

A performance measure used to evaluate the efficiency of an investment or to compare

the efficiency of a number of different investments. To calculate ROI, the benefit (return)

of an investment is divided by the cost of the investment.

Sensitivity Analysis

A technique used to determine how different values of an independent variable will

impact a dependent variable under a given set of assumptions. It is particularly

important to test sensitivity if it is likely the actual outcome will differ from assumptions.

Sunk Costs

Money already spent and permanently lost (past opportunity costs). Generally

considered irrelevant to future decision-making.

Target

Expected/planned progress in quantifiable terms towards a specific end-state.

Total Cost of

Ownership

Life cycle cost of a system, including all development, acquisition, and operations and

support costs.

DOD ENTERPRISE IT BUSINESS CASE ANALYSIS TEMPLATE

20

APPENDIX B: Cost Element Structure

<< This appendix provides example cost element structures that can be tailored for each unique

situation.>>

<<As Is 2d Level Cost Element Structure. As Is is synonymous with Alternative 1/baseline/status quo.

>>

CES # Cost Element Name Definition

As Is

Life cycle cost estimate for As Is systems relevant to the To Be Investment under consideration..

1 As Is Investment

Cost estimate for non-recurring efforts of currently funded initiatives relevant to the To Be Investment under consideration.

1.1

Program Management

Cost estimate for Program Management activities for any currently funded efforts relevant to the To Be Investment under

consideration. Program Management is defined as business and administrative planning, business process re-engineering,

change management, organizing, directing, coordinating, and controlling actions designated to accomplish overall program

objectives which are not associated with specific hardware elements and are not included in systems engineering. Includes

fully burdened Military, Civilian, and Contractor personnel costs, travel costs, and other relevant costs.

1.2

Concept Exploration

Cost estimate for all costs for concept explorations of currently funded initiatives relevant to the To Be Investment under

consideration. Includes costs for study, analysis, design development, and test involved in investigating alternative methods of

delivering prototype(s) or end item(s).

1.3

System Development

Cost estimate for all non-recurring costs for currently funded initiatives for development of system relevant to the To Be

Investment under consideration. Includes fully burdened costs of military, civilian, and contractor personnel. Includes

development hardware and software, Sys T&E, and IV&V.

1.4

System Procurement

Cost estimate for procurement of operational systems developed through currently funded initiatives relevant to the To Be

Investment under consideration. Includes hardware and software for prime mission product and COOP elements.

1.5

Data Center Investment

Cost estimate for investment, or lease in lieu of investment, required by any outsource support provider as required for the

system to attain and maintain FOC. Includes Capital Investment and Leasing.

1.6

Sys Initiation,

Implementation, Fielding

Cost estimate for activities required to train first users of the operational system developed through currently funded initiatives

relevant to the To Be Investment under consideration. Includes initial training, system integration/site test acceptance, and

engineering changes.

1.7

Upgrade/Pre-Planned

Product Improvement

Cost estimate for element currently funded planned enhancements to As Is systems relevant to the To Be Investment under

consideration.

2 As Is O&S

Cost estimate for all activities to operate and sustain As Is systems that will remain fully operational throughout the timeframe of

the analysis. Includes the cost to manage and maintain prime mission product hardware and software. Includes fully burdened

military, civilian, and contractor personnel and travel costs associated with system manaagement. Includes tech/life cycle

refresh and maintenance of wide area network, local area network, security architecture and data centers. Includes software

operations and support, assurance, and licenses of application, COTS, database, NETOPS, GOTS, and Data Center software.

Includes Unit/Site Operations, including labor associated with systems administration, storage administration, database

administration, service desk, application support, utilities, facilities, longhaul and intrabase communications, recurring training.

Includes security costs such as base/site security/ field security operations, and certification and accreditaiton. Includes

application hosting costs for services such as DISA enterprise services, DISA MilCloud, Commerical Cloud, and Private Cloud.

2.1

System Management

Cost estimate for activities such as business and administrative planning, business process re-engineering, change

management, organizing, directing, coordinating, and controlling As Is systems relevant to the To Be Investment under

consideration. Does not include objectives associated with specific hardware/software elements or systems engineering.

2.2

Annual Operations

Investment / Life Cycle

Refresh

Cost estimate for all replacement components, replenishment spares, supplies and consumables required over the life cycle of

As Is systems relevant to the To Be Investment under consideration. Includes WAN, LAN, Security Architectures, and Data

Center systems. Includes prime mission product and COOP elements.

2.3

Hardware Maintenance

Cost estimate for all labor and material required to restore As Is system hardware to specified performance standards and

prevent system malfunctions. Includes WAN, LAN, Security Architectures, and Data Center systems. Includes prime mission

product and COOP elements.

2.4

Software O&S

Cost estimate for all labor and material required to restore As Is system software to specified performance standards and

prevent system malfunctions. Includes WAN, LAN, Security Architectures, and Data Center systems.

2.5

Unit/Site Operations

Cost estimate for all day to day operations of the As Is system. Includes technical personnel performing system management

functions. Includes systems administration, storage administration, database administration, service desk, and application

support. Includes utility and facility costs. Includes long haul and intrabase communications. Includes recurring training costs.

2.6

Security

Cost estimate for all labor and material involved in reducing risk of physical and logical damage to the As Is system from outside

actors. Includes base/site security, field security operations, and certification and accreditation.

2.7

Application Hosting

Cost estimate for services performed by data centers that host applications in the As Is state.

enterprise hosting, DISA MilCloud, Commercial Cloud, and Private Cloud hosting.

Includes services such as DISA

DOD ENTERPRISE IT BUSINESS CASE ANALYSIS TEMPLATE

21

<<Alt n 2-Level Cost Element Structure. To Be is synonymous with Alt n. It may be necessary to tailor a

cost element structure for each Alternative to the status quo>>

CES #

Cost Element Name Definition

Alt n

Life cycle cost estimate for the To Be state. Includes an Investment phase to implement a new system, a new To Be state

operations and support cost, and phase out costs for As Is systems that will be replaced, retired, or divested as a result of the

To Be Investment.

1

Alt n Investment

Cost estimate for non-recurring efforts relevant to the To Be Investment.

1.1

Program Management

Cost estimate for Program Management activities for any currently funded efforts required to implement the To Be Investment.

Program Management is defined as business and administrative planning, organizing, directing, coordination, controlling, and

approval actions designated to accomplish overall program objectives which are not associated with specific hardware elements

and are not included in systems engineering. Includes fully burdened Military, Civilian, and Contractor personnel costs, travel

costs, and other relevant costs.

1.2

Concept Exploration

Cost estimate for all costs of concept explorations for the To Be Investment. Includes costs for study, analysis, design

development, and test involved in investigating alternative methods of delivering prototype(s) or end item(s).

1.3

System Development

Cost estimate for all non-recurring costs for the To Be Investment. Includes fully burdened costs of military, civilian, and

contractor personnel. Includes development hardware and software, Sys T&E, and IV&V.

1.4

System Procurement

Cost estimate for procurement of operational systems developed through the To Be Investment.

for prime mission product and COOP elements.

Includes hardware and software

1.5

Data Center Investment

Cost estimate for investment, or lease in lieu of investment, required by any outsource support provider as required for the To

Be system to attain and maintain FOC. Includes Capital Investment and Leasing.

1.6

Sys Initiation,

Implementation, Fielding

Cost estimate for activities required to train first users of the To Be operational system.

integration/site test acceptance, and engineering changes.

Includes initial training, system

1.7

Upgrade/Pre-Planned

Product Improvement

Cost estimate for pre-planned enhancements to the To Be system.

2

Alt n O&S

Cost estimate for all activities to operate and sustain the To Be system that will remain fully operational throughout the timeframe

of the analysis. Includes the cost to manage and maintain prime mission product hardware and software. Includes fully

burdened military, civilian, and contractor personnel and travel costs associated with system manaagement. Includes tech/life

cycle refresh and maintenance of wide area network, local area network, security architecture and data centers. Includes

software operations and support, assurance, and licenses of application, COTS, database, NETOPS, GOTS, and Data Center

software. Includes Unit/Site Operations, including labor associated with systems administration, storage administration,

database administration, service desk, application support, utilities, facilities, longhaul and intrabase communications, recurring

training. Includes security costs such as base/site security/ field security operations, and certification and accreditaiton.

Includes application hosting costs for services such as DISA enterprise services, DISA MilCloud, Commerical Cloud, and

Private Cloud.

2.1

System Management

Cost estimate for activities such as business and administrative planning, organizing, directing, coordinating, and controlling the

To Be system that does not include objectives associated with specific hardware/software elements or systems engineering.

2.2

Annual Operations

Investment/LCR

Cost estimate for all replacement components, replenishment spares, supplies and consumables required over the life cycle of

the To Be system. Includes WAN, LAN, Security Architectures, and Data Center systems. Includes prime mission product and

COOP elements.

2.3

Hardware Maintenance

Cost estimate for all labor and material required to restore To Be system hardware to specified performance standards and

prevent system malfunctions. Includes WAN, LAN, Security Architectures, and Data Center systems. Includes prime mission

product and COOP elements.

2.4

Software O&S

Cost estimate for all labor and material required to restore To Be system software to specified performance standards and

prevent system malfunctions. Includes WAN, LAN, Security Architectures, and Data Center systems.

2.5

Unit/Site Operations

Cost estimate for all day to day operations of the To Be system. Includes technical personnel performing system management

functions. Includes systems administration, storage administration, database administration, service desk, and application

support. Includes utility and facility costs. Includes long haul and intrabase communications. Includes recurring training costs.

2.6

Security

Cost estimate for all labor and material involved in reducing risk of physical and logical damage to the To Be system from

outside actors. Includes base/site security, field security operations, and certification and accreditation.

2.7

Application Hosting

Cost estimate for services performed by data centers that host applications in the To Be state.

enterprise hosting, DISA MilCloud, Commercial Cloud, and Private Cloud hosting.

Includes services such as DISA

<<Alt n C

ost Element Structure continued on next page>>

DOD ENTERPRISE IT BUSINESS CASE ANALYSIS TEMPLATE

22

<<Al

t n Cost Element Structure continued>

Cost estimate for all activities to operate and sustain As Is system that will be replaced, retired, and/or divested as a result of the

To Be Investment. Includes the cost to manage and maintain prime mission product hardware and software. Includes fully

burdened military, civilian, and contractor personnel and travel costs associated with system manaagement. Includes tech/life

cycle refresh and maintenance of wide area network, local area network, security architecture and data centers. Includes

software operations and support, assurance, and licenses of application, COTS, database, NETOPS, GOTS, and Data Center

software. Includes Unit/Site Operations, including labor associated with systems administration, storage administration,

database administration, service desk, application support, utilities, facilities, longhaul and intrabase communications, recurring

training. Includes security costs such as base/site security/ field security operations, and certification and accreditaiton.

Includes application hosting costs for services such as DISA enterprise services, DISA MilCloud, Commerical Cloud, and

Private Cloud.

3 Alt n Phase Out O&S

Cost estimate for activities such as business and administrative planning, organizing, directing, coordinating, and controlling the

As Is system that will be replaced, retired, and/or divested as a result of the To Be Investment. that does not include objectives

associated with specific hardware/software elements or systems engineering.

3.1 System Management

Cost estimate for all replacement components, replenishment spares, supplies and consumables required over the life cycle of

the As Is system that will be replaced, retired, and/or divested as a result of the To Be Investment. Includes WAN, LAN,

Security Architectures, and Data Center systems. Includes prime mission product and COOP elements.

Annual Operations

Investment/LCR

3.2

Cost estimate for all labor and material required to restore the As Is system that will be replaced, retired, and/or divested as a

result of the To Be Investment hardware to specified performance standards and prevent system malfunctions. Includes WAN,

LAN, Security Architectures, and Data Center systems. Includes prime mission product and COOP elements.

3.3 Hardware Maintenance

Cost estimate for all labor and material required to restore As Is system that will be replaced, retired, and/or divested as a result

of the To Be Investment software to specified performance standards and prevent system malfunctions. Includes WAN, LAN,

Security Architectures, and Data Center systems.

3.4 Software O&S

Cost estimate for all day to day operations of the As Is system that will be replaced, retired, and/or divested as a result of the To

Be Investment.. Includes technical personnel performing system management functions. Includes systems administration,

storage administration, database administration, service desk, and application support. Includes utility and facility costs.

Includes long haul and intrabase communications. Includes recurring training costs.

3.5 Unit/Site Operations

Cost estimate for all labor and material involved in reducing risk of physical and logical damage to the As Is systems that will be

replaced, retired, and/or divested as a result of the To Be Investment from outside actors. Includes base/site security, field

security operations, and certification and accreditation.

3.6 Security

Cost estimate for services performed by data centers that host applications in the As Is systems that will be replaced, retired,

and/or divested as a result of the To Be Investment. Includes services such as DISA enterprise hosting, DISA MilCloud,

Commercial Cloud, and Private Cloud hosting.

3.7 Application Hosting

DOD ENTERPRISE IT BUSINESS CASE ANALYSIS TEMPLATE

23

APPENDIX C: REQUIREMENTS

<<This appendix provides additional detail regarding requirements, including those resulting from the

DOTMLPF analysis, lean six sigma and business process reengineering efforts, and change

management planning. Additional detail is expected to be added to this appendix over the duration of the

project as more information is known and requirements can be more clearly defined.>>

<<Clearly state the analyses performed, information sources and benchmarks used, etc. For example:

A DOTMLPF

1

, process reengineering and other analyses were performed to identify the materiel and

non-materiel requirements for this [project, acquisition, investment]. Information collected from [name

of Stakeholder/ User Group forum] comprised of [identify areas of expertise and/or organizations that

participated] that met from [dates] was used to determine functional requirements. Information from

lean six sigma projects conducted by [state who and when] was used to identify current process root

cause issues. Operations at [give example] were used as benchmarks to determine labor and other

non-materiel requirements. Materiel and technical requirements were gathered from [sources].

General requirements are summarized below.>>

Statutory, Regulatory and other Compliance Requirements

<<Identify any statutory, regulatory, compliance requirements and/or organizational strategic goals and

objectives this project/initiative must satisfy. Include as a reference all known statutory and regulatory

requirements, specific to the IT functional area, known at the time of publishing. Include Enterprise

Architecture and Information Assurance requirements as applicable.>>

Functional Requirements

<<Summarize functional requirements. Focus particularly on requirements necessary to achieve desired

outcomes and measureable performance objectives. >>

Materiel, Technical and Interface/Data Exchange Requirements

<<Summarize general materiel requirements (e.g., equipment, hardware, software, apparatus, and

supplies of the project), related technical requirements and interface/data exchange requirements to the

level of detail needed to do a valid comparison of alternatives. A summary table may be appropriate. All

material requirements associated with Direct, Indirect and G&A costs need to be included. Material

requirements associated with Direct costs include hardware, software, and communications. Material

requirements associated with Indirect costs include Hosting infrastructure (facility repairs/improvements,

conditioned power, full uninterrupted power supply, generated power, heat ventilation & air conditioned

services, electric/water/sewage/garbage, physical security). Material requirements associated with G&A

costs include hardware and software requirements to support headquarters functions and External

Agreements. >>

1

CJCSI 3170.01G Joint Capabilities Integration and Development System of 7 Mar 2011 requires, military planners to perform an analysis of needs

associated with doctrine, organizational changes, training, materiel requirements, leadership and education, personnel and/or facilities – referred to as

a DOTMLPF analysis -- before authorizing a new course of action. The DOTMLPF analysis results are reflected in this business case in various