Information Technology Business Case

Development

University of Wisconsin System Administration

Business Cases 1, 2, & 3

August 2015

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

Executive Summary

2

BUSINESS CASES

This document presents 3 business cases developed over the course of the 12 weeks that Huron was

engaged by UWSA.

Contents

Business Case Template 3

Organizational Context 6

Business Case Opportunities & Strategic Enablers 13

Business Case 1 17

Business Case 2 37

Business Case 3 60

Appendix 90

Business Case Template

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

Business Cases

BUSINESS CASE OVERVIEW

Huron’s business cases are structured proposals that outline the benefits and considerations of an

initiative to add informational and analytical value to decision-making.

4

Business cases are designed to:

• Quantify the impact of recommendations

• Provide analysis to support and justify the findings

• Create an impetus to take action

Strong business cases draw conclusions based on:

• Current-state assessment

• Benchmarking, gap analysis or option evaluation

• Cost benefit analysis

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

Business Cases

DATA & ASSUMPTIONS

5

Data Assumptions and Notes:

• Data available at the time of this report was either inconsistent, incomplete, or unknown. This underscores the

need for a more standardized and transparent approach to data collection and reporting.

• Projected financial impact displayed may not include full cost of implementation. For opportunities selected to

pursue, the UW should engage in more robust data collection and analysis to identify the full scope of

implementation, resource requirements, and associated costs.

• Analyses may not incorporate campus-level initiatives taking place to reduce costs in reaction to the

announced budget cuts. Additional consideration should be given to reductions that have already taken place

at the institutional level.

Organizational Context

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

Business Cases

ORGANIZATION CONTEXT

7

The work that culminates in the business cases presented in this

document was conducted during a period of immense challenge with

an uncertain budget future and therefore unclear responses to cuts.

Before we get into the detail of the business cases, we wish to

acknowledge the engagement of the IT community across the

University of Wisconsin system campuses, including the CIOs, and the

engagement of Provosts and Chief Business Officers in providing

input, data, guidance, perspective, institutional and historical context,

and encouragement.

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

Business Cases

ORGANIZATION CONTEXT

8

Providing the full context is infeasible, however, there are several critical elements of context that are

important to understand when considering the ideas and recommendations presented in this document.

Organizational Context:

• The University of Wisconsin System is facing reductions in state funding by approximately $125 million per year

• Those cuts are the largest of a series of cuts the University has received over the past decade

• The campuses that comprise the UW System operate predominately independently with several noted

exceptions including: (System-wide high-speed network, Common Systems Review Group, VoIP collaboration,

virtualization collaborations)

• Recent leadership turn-over throughout the UW System (Chancellors, Provosts, UW system leadership)

• Culture of decentralized and distributed decision making both at the system and institutional level

IT Trends:

• Rapid pace of innovation

• Changing user preferences require that IT functions be increasingly nimble and adaptive

• Increasing adoption of digitization and technology across nearly every facet of the academy

• Increased capacity and capability for 3

rd

party services (e.g., Amazon Web Services)

• Students who are “digital natives” served by faculty and staff with vastly different attitudes, capabilities, and

understanding of technology

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

Business Cases

BUSINESS CASE OPPORTUNITY IDENTIFICATION

9

Huron utilized a process by which a broad group of stakeholders provided contextual knowledge of UWS,

engaged in identifying opportunities, and provided input into language / grouping of opportunities.

• Initiated data request to all campuses

• Conducted multiple CIO working sessions

• Utilized ITMC brainstorming notes

• Distributed survey to all CIOs, CBOs, and Provosts

• Synthesized opportunities, applied prioritization

framework, and presented to Advisory Committee

• Finalized opportunities presented to Executive

Leadership Team for consideration

Idea Generation / Brainstorming

Final Opportunities for

Consideration

Advisory Committee

Engagement

Identified 52 Opportunities

Combined multiple

opportunities into three

proposed business cases

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

Business Cases

CONSIDERATIONS

10

• Culture: UW Institutions have a high degree of autonomy; this independence is ingrained in institutional cultures to varying

degrees. Feedback received from institutional stakeholders indicates that this may be very difficult to overcome for certain

opportunities identified.

• Collaboration: Institutions have begun collaborating with respect to IT initiatives, both as a result to improve service and to

reduce costs (e.g., leveraging institutions for VoIP or backup location for servers).

• Flexibility: CIOs believe that while centralization may make sense for certain initiatives / opportunities, special

consideration should be given to the need to remain flexible / sufficiently nimble to respond to institutional and market

demands in order to better serve constituents and students.

• Trust: Our discussions with stakeholders and respondents to the survey indicated that there is a lack of trust with respect to

centralization initiatives. Historically, results have been mixed and the corresponding service enhancements and costs

reductions have not been achieved.

• Timing: The timing / implementation of opportunities should be carefully considered as it will have significant impact on

change management, available funding, and service provided to constituents.

• Accountability: For any opportunity pursued, there must be clearly articulated service expectations and responsibilities

among the institutions and UWSA.

1

2

3

4

5

6

The following contextual considerations were identified through our working sessions, surveys, and

discussions with UW stakeholders.

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

11

EFFECTIVE IT DECISION MAKING STRUCTURES

Business Cases

A disciplined governance structure aligns investment decisions with institutional and system priorities.

Leadership aligned at the appropriate levels can focus IT priorities with long-term strategies and goals.

Components of Successful IT Decision Making Structures:

• Clearly delineated decision rights and ownership

• Transparency and active communication with stakeholders

• Decisions aligned with strategic direction

• Stakeholder control of cost management and investment

• Defined triage and intake process for new issues that require attention

• Process for business case analysis, review, and input based on institutional needs and appropriate justification

• Consistent, repeatable processes for executing approved initiatives that are scalable for large and small

projects

IT Decision Making Structures

Decision making structures in the case of IT are:

• Mechanisms through which clear and repeatable sets of data, inputs, analyses, priority-setting, and accountability are provided

• Supported by processes and norms that engage stakeholders and increase transparency

Decision making structures in the case of IT are not:

• IT strategy, but the processes and organization to enable strategic decisions and successful execution

• Bureaucratic structures to slow the evaluation and execution of initiatives

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

Business Cases

BUSINESS CASE OPPORTUNITIES

12

The following opportunities were selected by UWSA leadership for business case development.

Business Cases:

1. Migrate specific ERP systems currently hosted internally to third-party providers.

2. Explore alternative delivery models for IT services and administration.

3. Engage in enhanced strategic sourcing for IT hardware, etc.

Business Case Opportunities

& Strategic Enablers

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

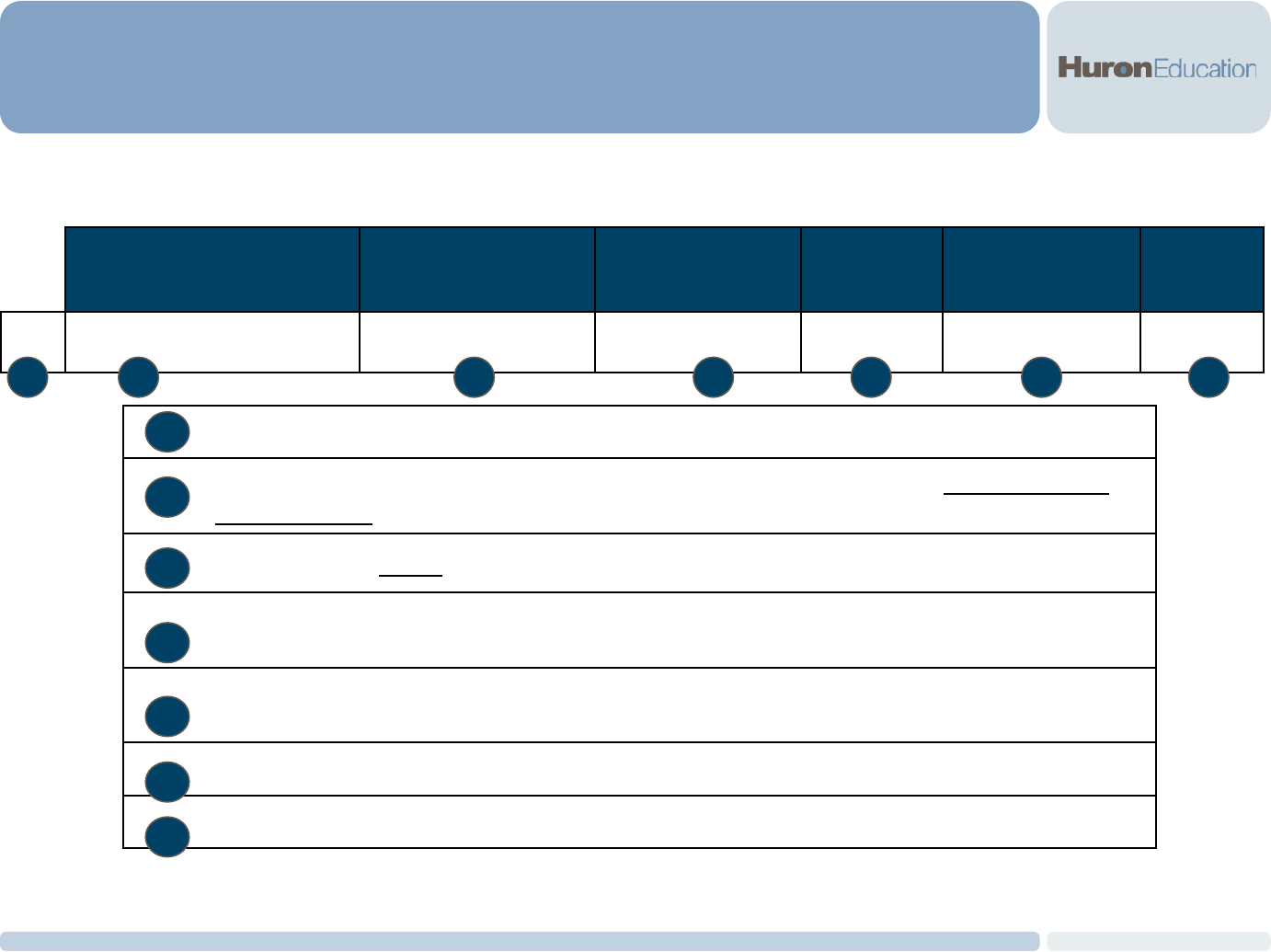

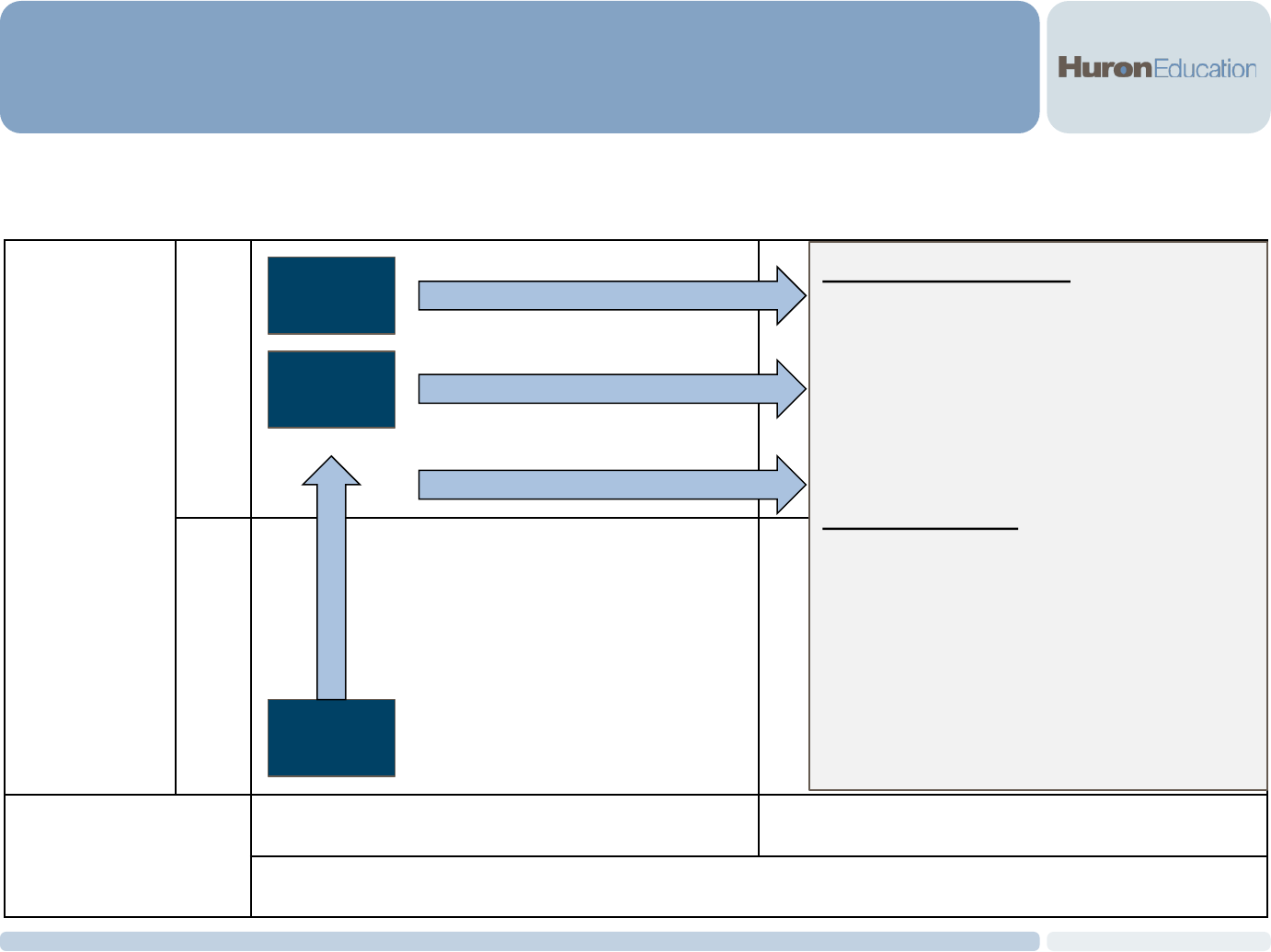

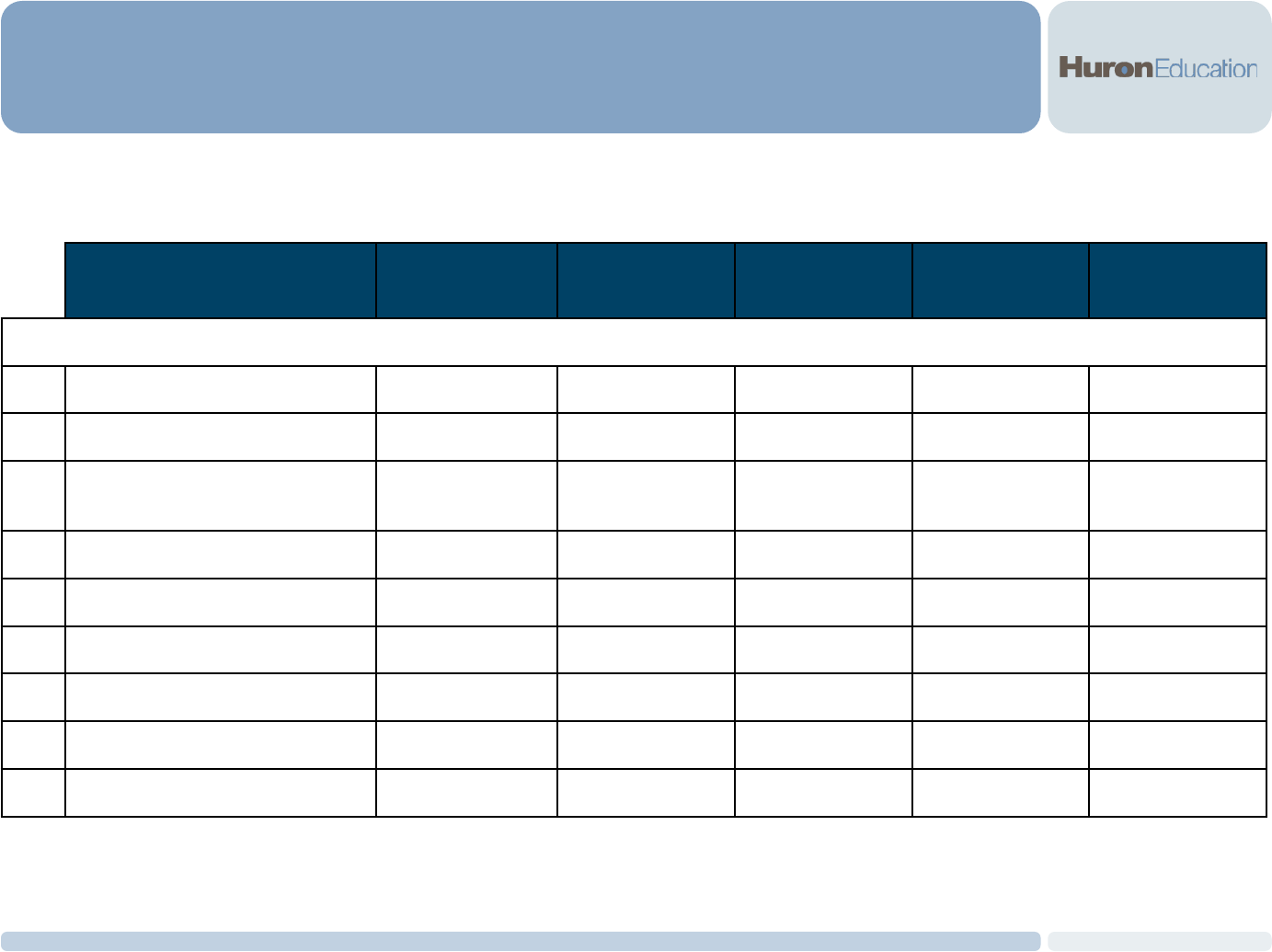

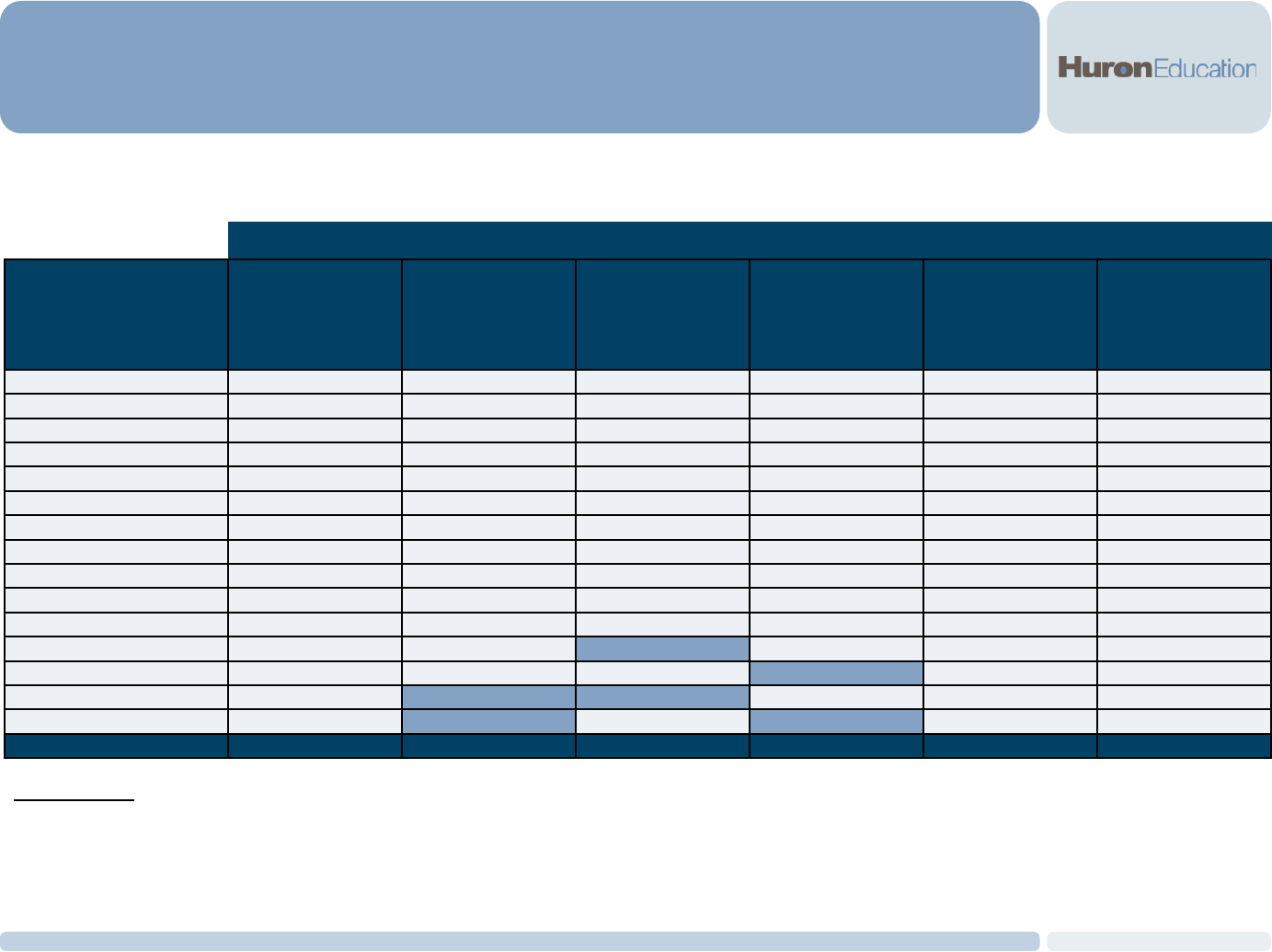

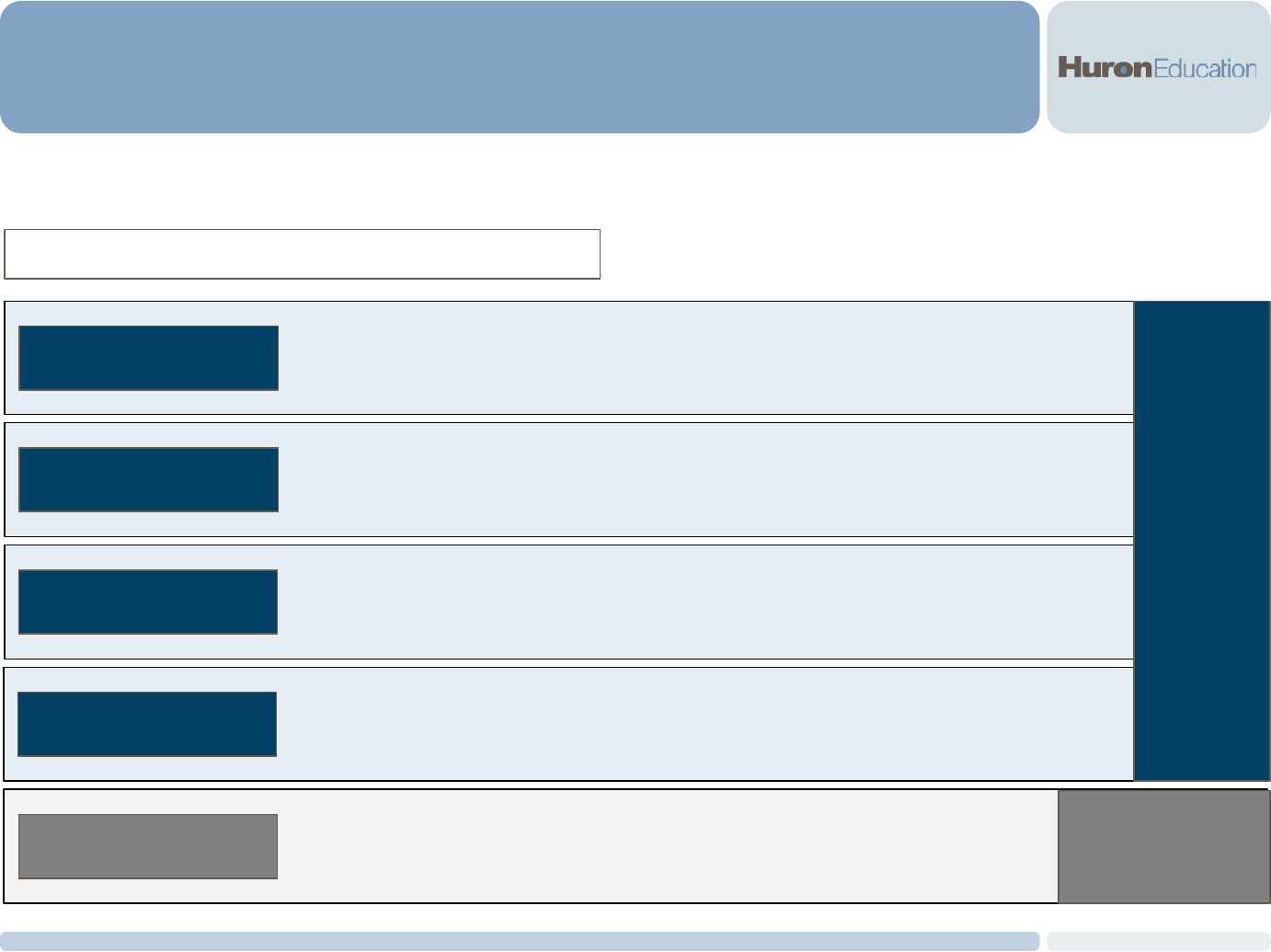

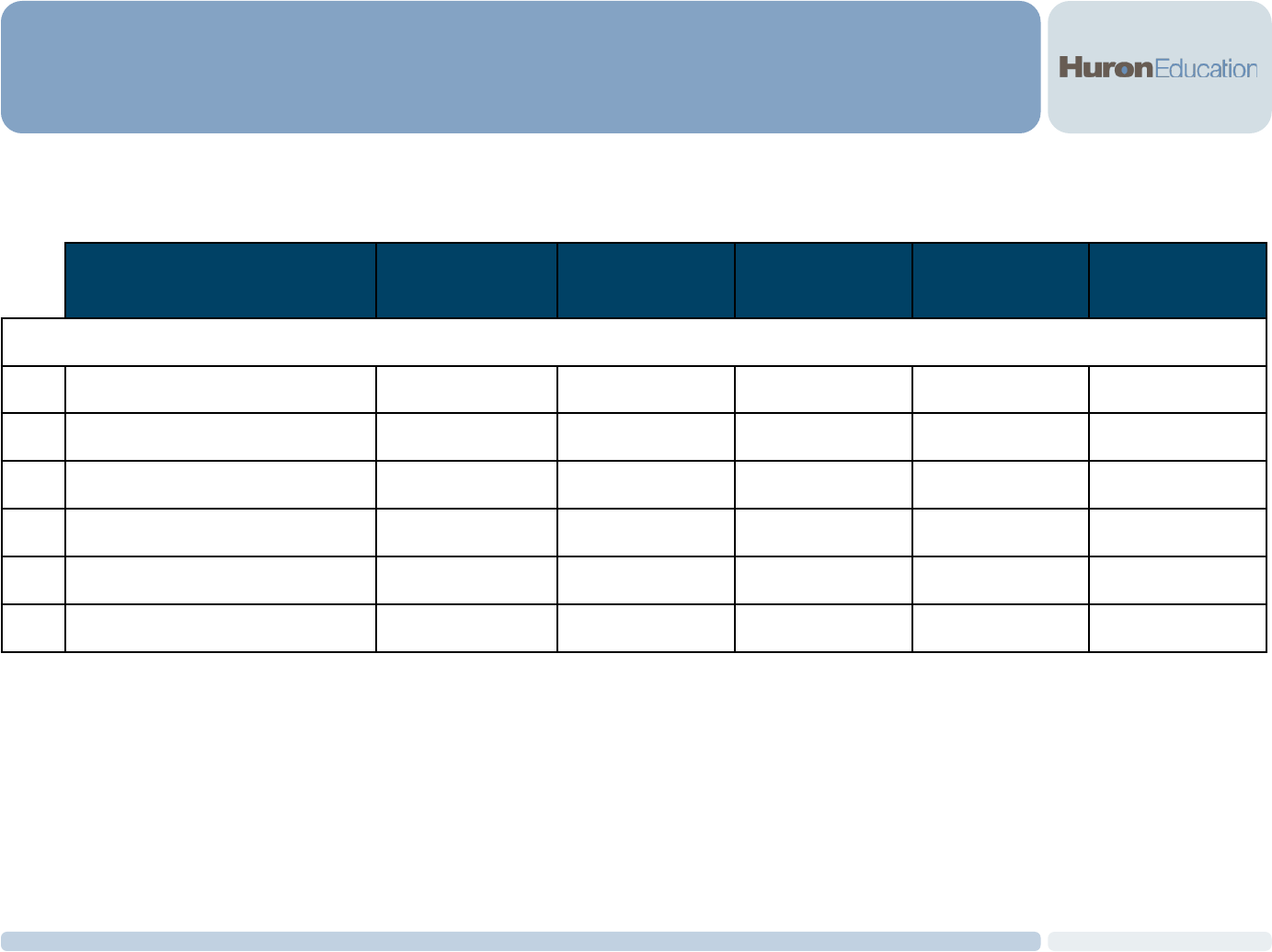

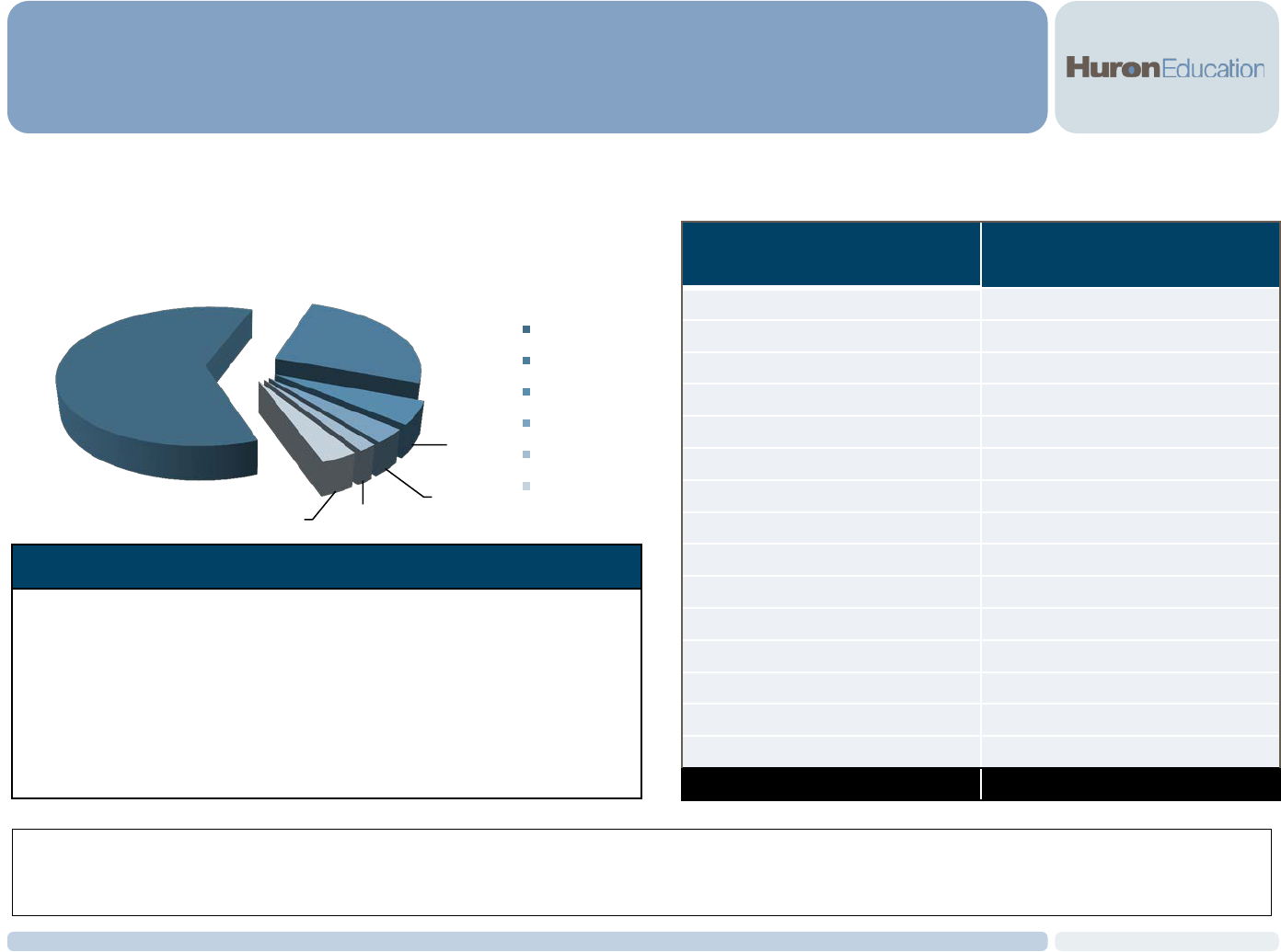

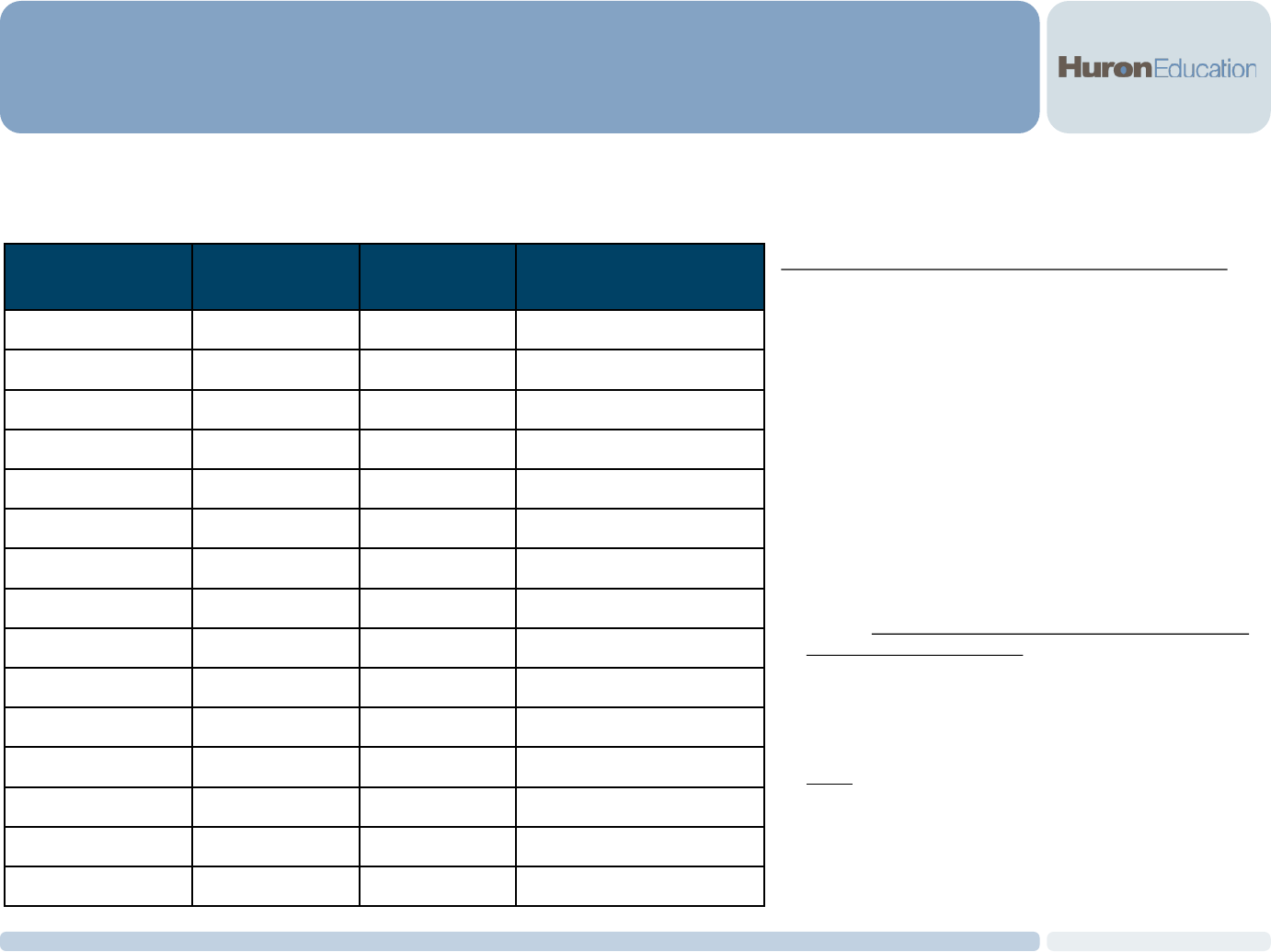

Opportunity number

Description of each opportunity worded as an action to clarify the opportunity, not to represent a

recommendation

Estimation of the annual cost savings or revenue enhancement (Net initial investment required)

1

Assessment of the risk assumed if implemented on a scale of low to high, either for the UW System

or institutional-level

Assessment of the indirect or “systemic” effects of the opportunity on other opportunities for

efficiency

Assessment of the complexity of moving forward with implementation for each opportunity

Estimate of the timeframe to realize efficiency savings (beginning from a decision to implement)

Business Cases

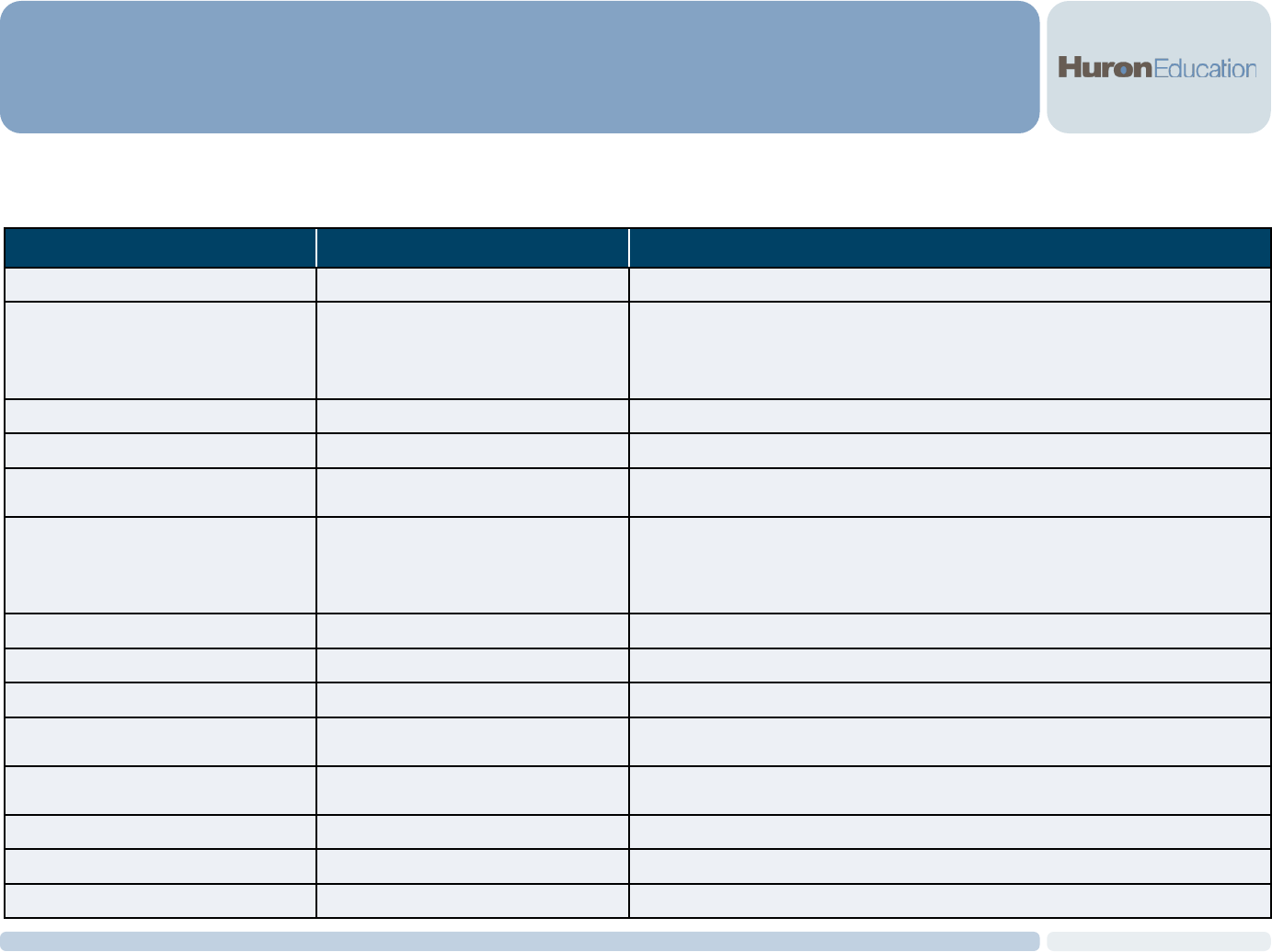

IDENTIFIED COST SAVINGS AND STRATEGIC ENABLEMENT OPPORTUNITIES

14

Each opportunity will be presented in the following “menu” format representing summary-level analyses

found within the business cases.

Opportunity

Annual

Financial Impact

UWS Risk

Exposure

Efficiencies

Gained

Implementation

Complexity

Timeframe

(Months)

#

High-Level Description

1 2 3 4 5 6 7

1

2

3

4

5

6

7

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

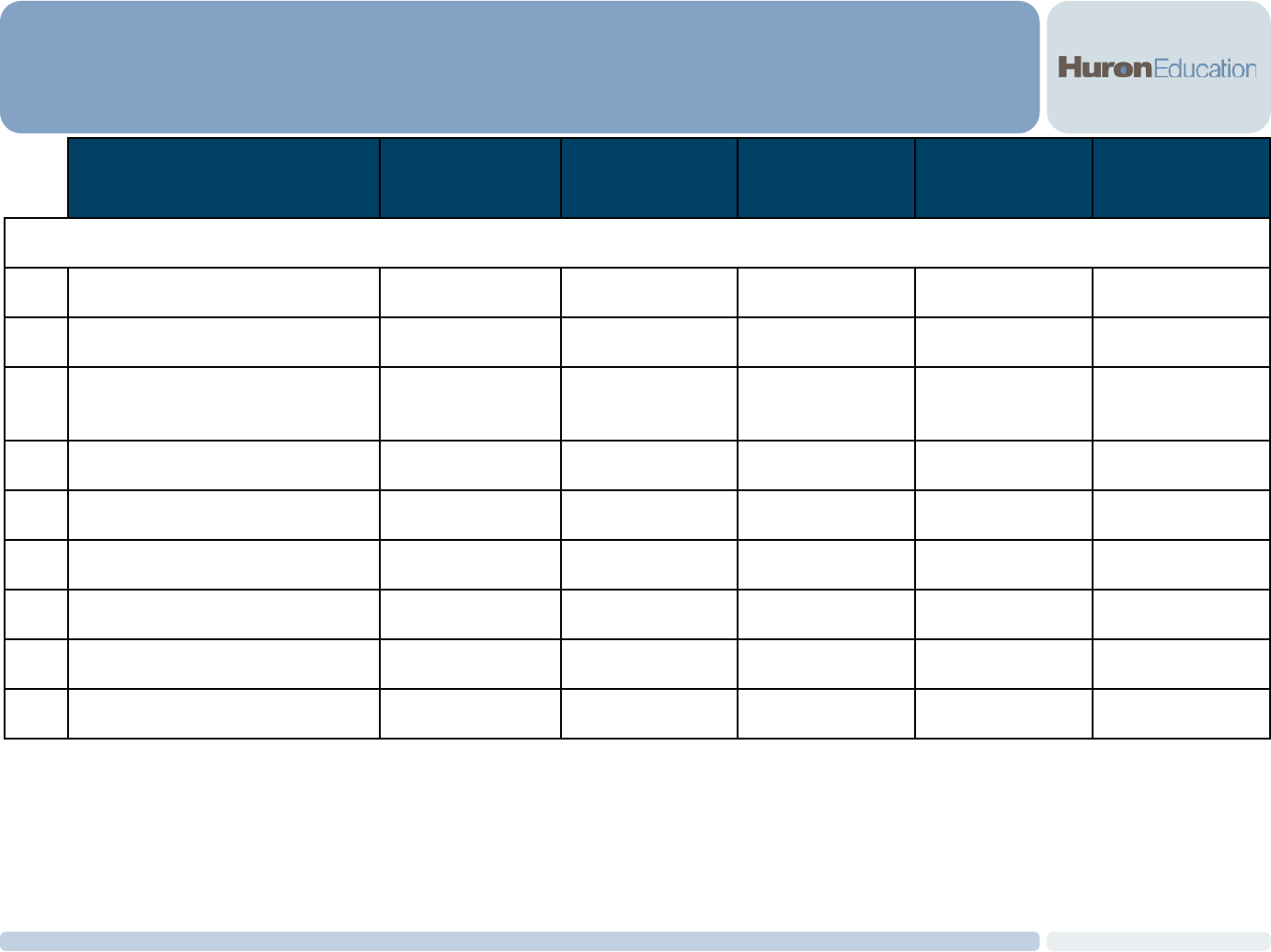

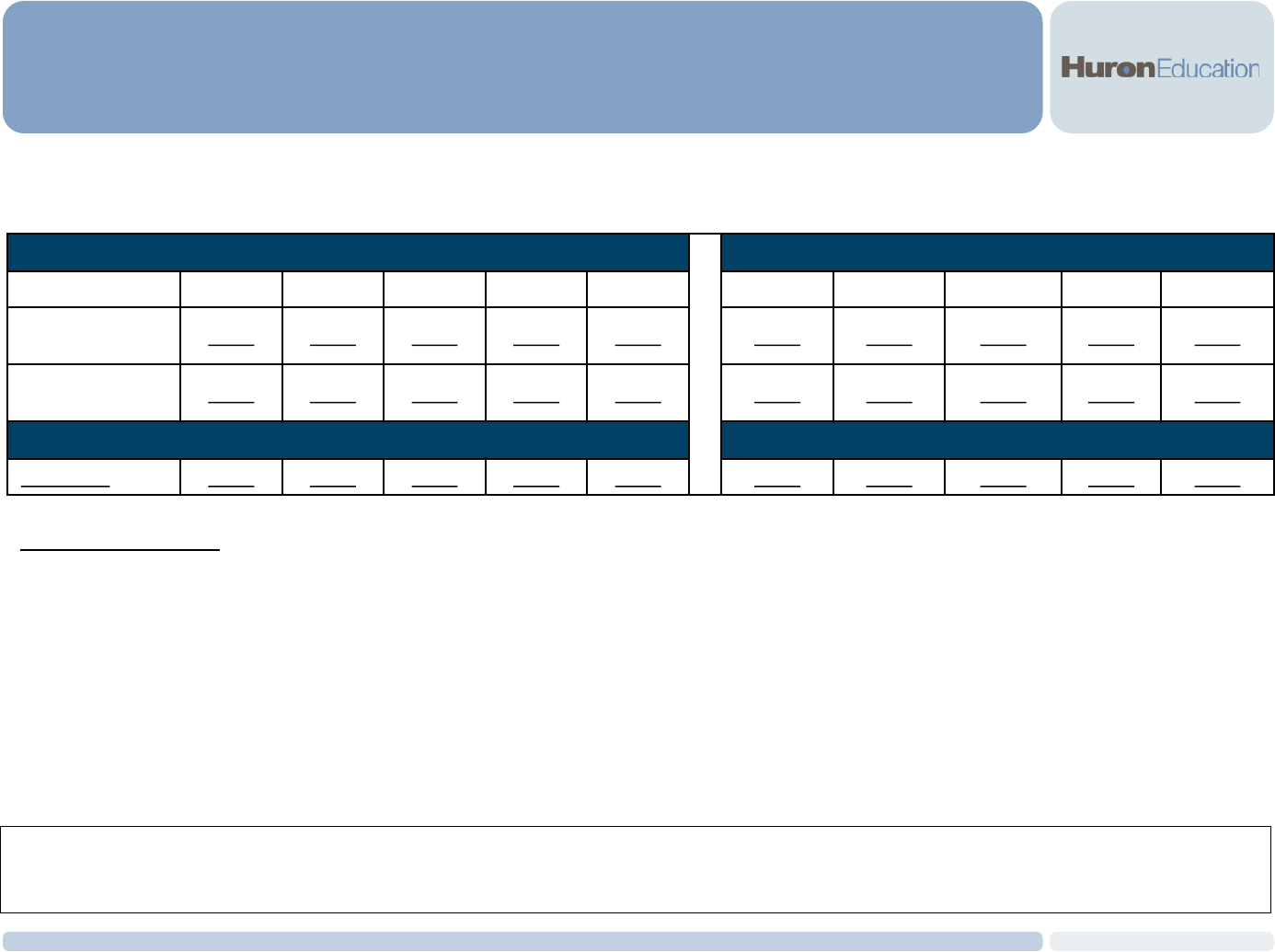

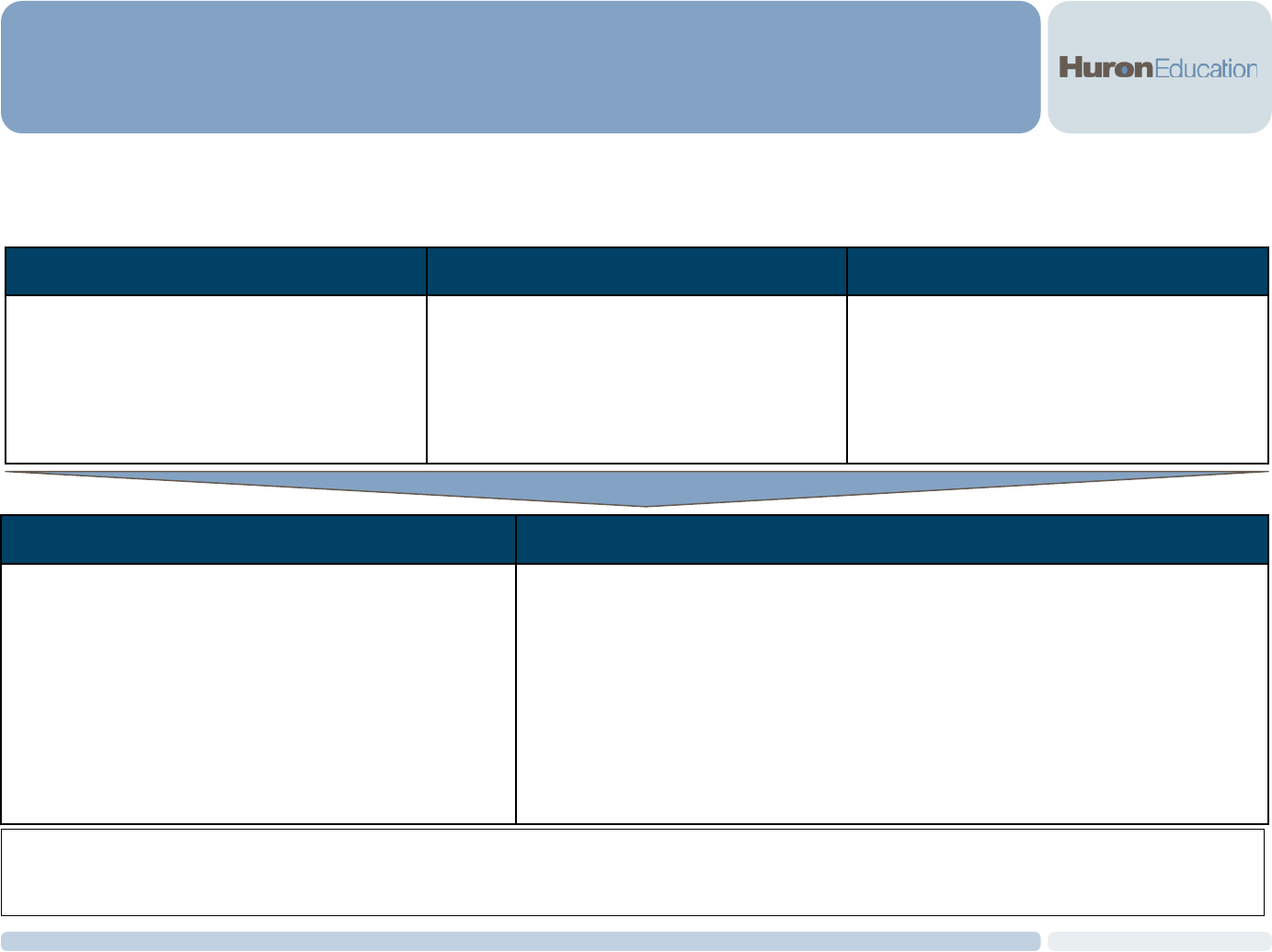

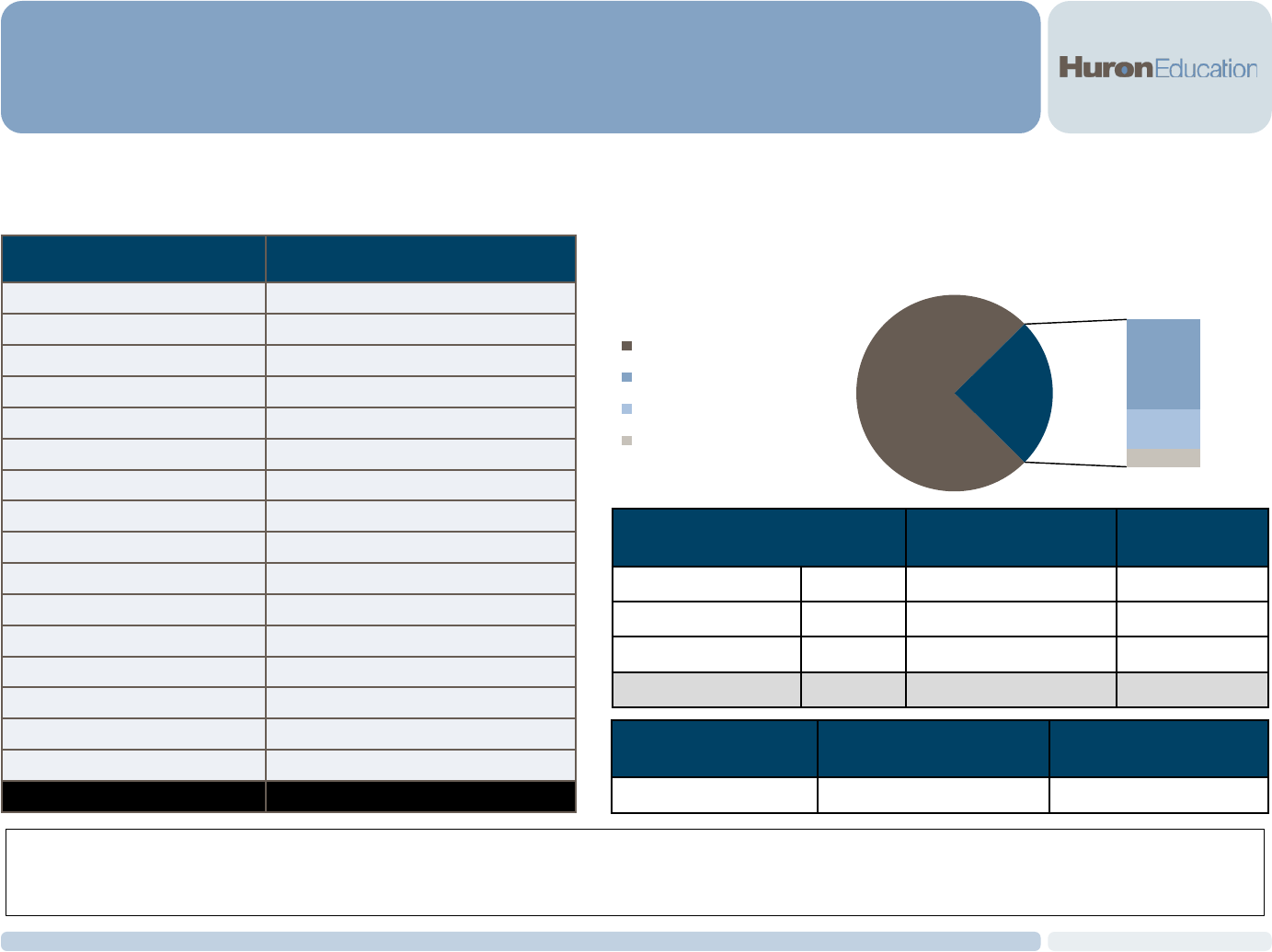

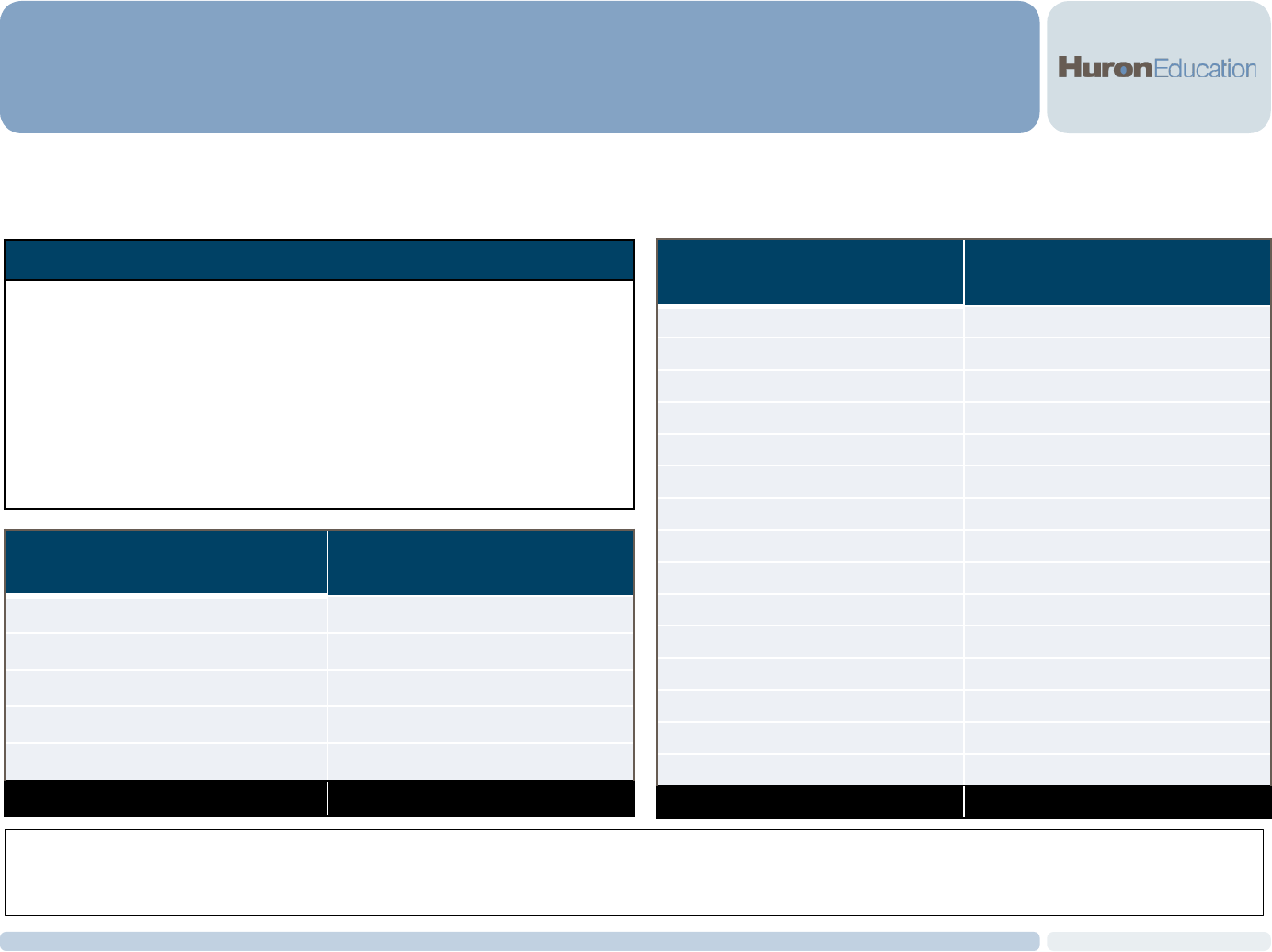

Business Cases

IDENTIFIED COST SAVINGS AND STRATEGIC ENABLEMENT OPPORTUNITIES

15

Opportunity

Annual Est.

Savings

UWS Risk

Exposure

Efficiencies

Gained

Implementation

Complexity

Implementation

Timeframe

Business Case # 1

1

Consolidate hosting of SISs

$$$$

Medium Medium Medium 12-36 Months

2

Reduce customizations within SIS and

consolidate instances

Enabling Low High High 24-36 Months

3

Explore vendor

managed infrastructure and

rationalize current infrastructure for HRS

and SFS

$$$$

Medium Medium Medium 6-18 Months

4

Reduce customizations within HRS and

SFS

Enabling Low High High 36-60 Months

5

Develop

financial model allocating the costs

of customizations to requesting campus

Enabling Low High Low 0-6 Months

6

Develop a total cost of ownership model for

future customization requests

Enabling Low High Low 3-6 Months

7

Develop a System-

wide IT decision making

process and mechanism

Enabling Low High Low 6-12 Months

8

Include cloud option as part of vendor

system selection for Budget System

Strategic Investment Low High High 12-36 Months

9

Explore transition of non-ERP systems to

cloud solutions

TBD TBD TBD TBD TBD

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

Business Cases

IDENTIFIED COST SAVINGS AND STRATEGIC ENABLEMENT OPPORTUNITIES

16

Opportunity

Annual Est.

Savings

UWS Risk

Exposure

Efficiencies

Gained

Implementation

Complexity

Implementation

Timeframe

Business Case # 2

10

Centralize IT security resources Enabling Low High Medium 6-12 Months

11

Consolidate IT Helpdesks

$$$$

Medium Medium High 12-24 Months

12

Consolidate High Performance Computing

Enabling Low Medium Medium 6-24 Months

13

Consolidate datacenter facilities

$$$$

High High High 24-48 Months

14

Identify additional areas for system-wide

collaboration

TBD

TBD TBD TBD TBD

15

Re-Organize IT Leadership

$$$$

Medium High High 24-48 Months

Business Case # 3

16

Create System-wide

standardized bundles

for laptops, desktops, and peripherals

$$$$

Low Medium Medium 6-12 Months

17

Enforce policies for preferred purchases

(Madison foregone savings displayed)

$$$$

Low Low Low 0-6 Months

18

Develop a collaborative, System-wide

procurement function to take advantage of

scale

Enabling Low High High 12-24 Months

Business Case #1:

Evaluate Alternative Hosting Models

for Primary Systems

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

Business Case # 1

OBJECTIVES

Our objective in this business case was to evaluate the feasibility of migrating primary information systems

to alternative hosting models or cloud based environments.

18

Though the focus of this business case was on the UW’s primary systems (SIS, HRS, SFS, Budget), Huron believes that

additional services should be considered for cloud computing.

Objectives: Huron was asked to evaluate the feasibility and / or impact of transitioning UW’s ERP systems to

alternative hosting models or cloud-based solutions. The following were incorporated into the analysis:

• Identify available options for hosting (e.g., centrally, cloud-based)

• Identify primary solutions available (e.g., Oracle, Workday)

• Evaluate the relative level of cloud maturity (e.g., infrastructure, SaaS / Cloud)

• Evaluate each system’s readiness to transition to cloud-based solutions (e.g., level of customizations)

Future-State Considerations:

• Systems are inter-connected and the development of a holistic approach to future-state system integration and

process re-design is recommended

• The impact of bolt-on and other applications should be considered as part of future-state requirements

determination

• Cloud-based solutions continue to mature; the UW should develop a comprehensive roadmap to system

upgrades and an overall cloud adoption strategy

• Upgrade to Cloud / SaaS solution may require multiple steps – cannot “flip a switch”

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

Business Case # 1

CONTEXT AND BACKGROUND

The rapid evolution of technology is fundamentally changing the way companies and higher education

institutions consider, consume, and manage IT.

19

Context:

• As technology continues to become more pervasive across all facets of university activities, the demand to do

more with less becomes stronger

• UW institutions are having issues recruiting, hiring, and retaining technical IT staff (e.g., DBAs)

• Responses to the problem this poses include changing what institutional IT does, what system-level IT does,

and what is procured from third-parties

o Vendor solutions continue to mature

o Scale economies may drive down cost

o Vendor pricing models impact the beneficiaries from increased efficiencies

• Timing and approach to any transition will be critical factors in determining success and realization of efficiencies

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

Business Case # 1

WHAT IS CLOUD COMPUTING

Cloud computing is the delivery of IT resources and applications through the use of the internet rather than

through the utilization of a local server or personal computer.

20

Characteristic Comments Benefits

Scale

Immediate provisioning and de-provisioning of

compute resources

Increases ability to manage and plan for IT resources

Speed

Often offers improved infrastructure and speed

over traditional, on premise environments

Servers or new environments can be deployed in minutes /

hours vs. days / weeks

Cost

Utilize a pay-as-you-use pricing model

Reduced capital expenditures and increased ability to

manage budgets

Resiliency

Geographically dispersed infrastructure Improved ability to mitigate risks

Who is Using Cloud Computing?

• Companies: Netflix does not own or operate their own datacenters outsourced to Amazon

• Higher Education: Consortiums such as Unizin or Internet2 collaborations able to leverage scale

• Personal Users: All iPhone users have access to Apple’s iCloud storage personal cloud

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

Business Case # 1

WHAT IS CLOUD COMPUTING

21

Essential Characteristics*

1. On Demand: Consumer can provision computing capabilities as needed, such as server time and network storage, without requiring human

interaction with each service’s provider

2. Broad Network Access: Capabilities are available over the network and accessed through standard mechanisms that promote heterogeneous

thin/thick client platforms (e.g., mobile phones)

3. Resource Pooling: Provider’s computing resources are pooled to serve multiple consumers using a multi-tenant model, with different physical and

virtual resources dynamically assigned and re-assigned according to consumer demand

4. Rapid Elasticity: Capabilities can be rapidly and elastically provisioned, in some cases automatically, to quickly scale out and rapidly released to

quickly scale in

5. Measured Service: Cloud systems automatically control and optimize resource use by leveraging a metering capability at some level of abstraction

appropriate to the type of service (e.g., storage, processing, bandwidth, and active user accounts)

*Source: EDUCAUSE

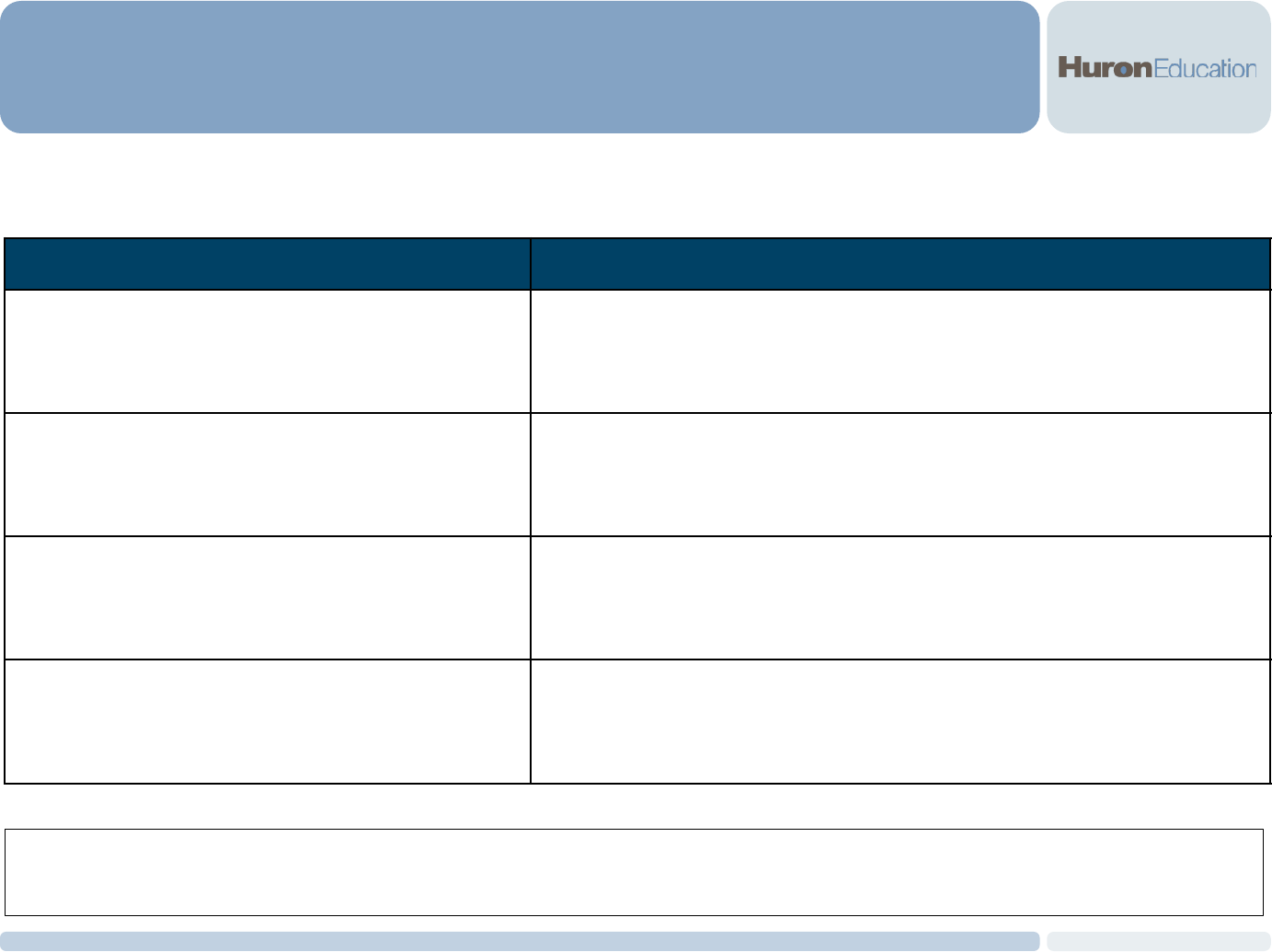

Characteristics Localized Private Cloud

Virtual Private

Cloud

Public Cloud

Location

On Premise Off Premise Off Premise Off Premise

Hardware Owner

Institution Vendor Vendor Vendor

Payment Model

Capital + Support Provision + Usage Monthly / Usage Pay-per-use

Scalability

Low-Medium Medium High Very High

App. Migration Effort

None Low Low Dependent on App.

Break / Fix Approach

Repair H/W Repair VM or H/W Repair VM Recreate VM

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

Business Case # 1

WHAT IS CLOUD COMPUTING

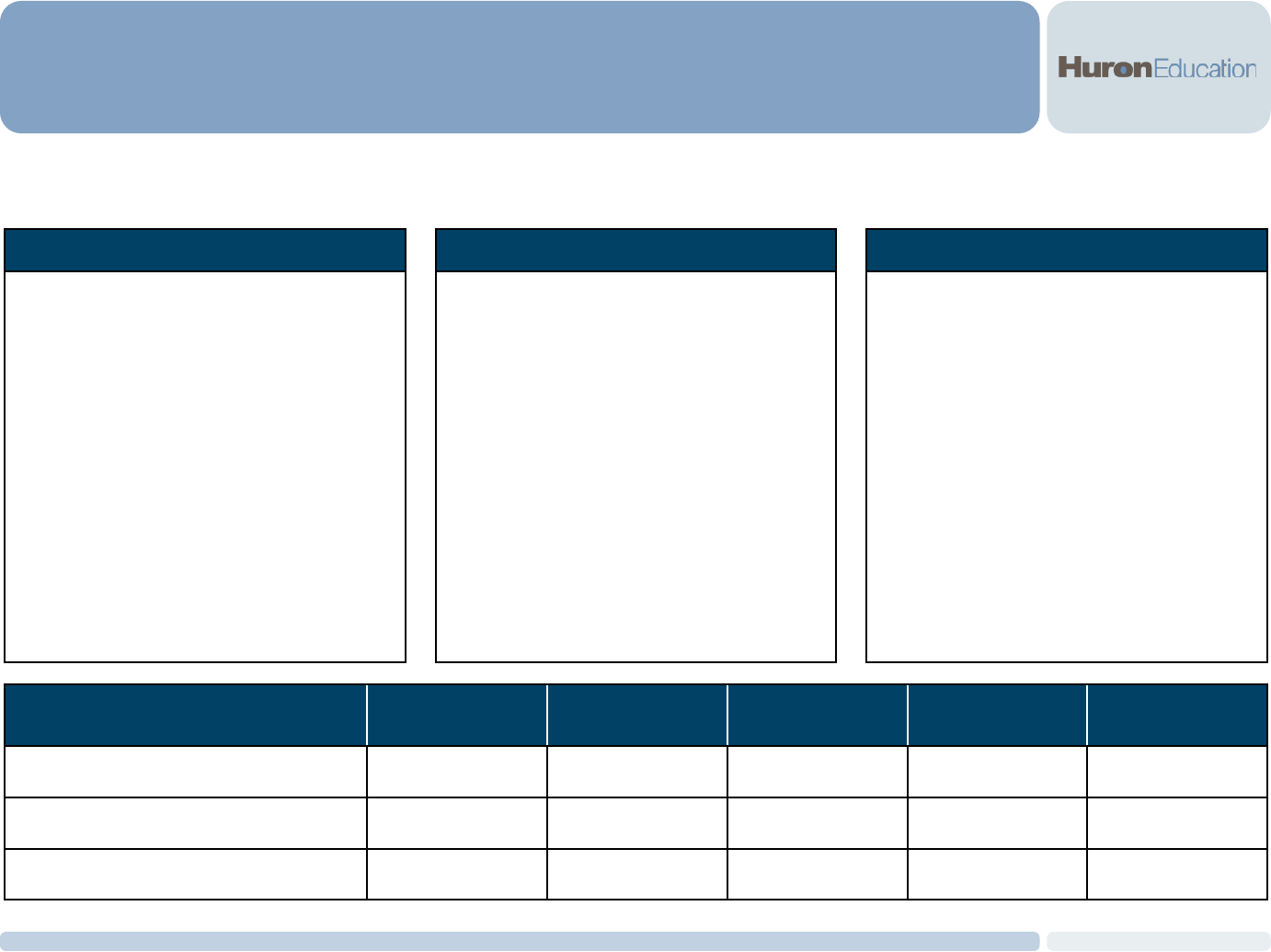

In addition to the localized (on premise) hosting model, “X as a service” options are changing the way

corporations and higher education institutions manage, provision, and invest in IT resources.

22

Infrastructure as a Service

(IaaS)

Platform as a Service

(PaaS)

Software as a Service

(SaaS)

Overview

Virtualized computing

infrastructure (pooling of

resources)

Web and mobile application

development using pre-

configured components

Delivers on-demand

applications that are hosted

and managed by vendor

Benefits

• Vendor manages

infrastructure

• Highly scalable

• Reduced capital expenditures

• Service provider

maintains programming

languages, application

servers, and databases

• Reduced upgrade times

• Pay-as-you-use pricing

model

• Encourages

standardization

Considerations

• Reduced control of local IT

resources

• Requires careful analysis of

actual resources required

• Increased vendor lock-in

• Integration and support

to existing applications

• Customizations can

quickly increase costs to

support and upgrade

complexity

• High vendor lock-in

Example Companies

Providing Service

• Amazon, Microsoft, Google,

Rackspace, IBM, HP

• Amazon, Oracle,

Microsoft, Engine Yard

• Salesforce, Microsoft,

Google

Level of Standardization

Level of Local Control

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

Business Case # 1

WHAT IS CLOUD COMPUTING

Within higher education and more broadly, organizations seek increased efficiency through a transition to a

hybrid service delivery environment comprised of a network of internal and external service providers.

23

Public

Computing

Consortiums

System Level

Campus

Level

Ex: Infrastructure, Hosted Services

Ex: Unizin, Internet2

Ex: Collaborative Disaster Recovery

Scale

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

Business Case # 1

LEADING HIGHER EDUCATION ERP VENDORS

24

Increasingly, vendors and companies are investing in cloud-based solutions as a transition from

“traditional” ERPs.

Comments:

• Industry investment in “cloud” based ERP systems is strong and appears to be the signaled direction of

technology migration

• PwC predicts that by 2016, investments by companies in SaaS solutions will double to $78 billion, vs.

investments in traditional ERP systems, declining by over 30% to less than $15 billion*

• Gartner predicts that by 2018, at least 30% of service-centric companies will move the majority of their

ERP applications to the cloud**

• Gartner predicts that by 2017, 70% of hybrid ERPs (combination of cloud and “traditional” solutions) will fail

to improve cost-benefit outcomes unless cloud applications provide differentiated functionality – cloud

applications do not provide value without careful consideration of process, etc.

• Companies like Oracle and Workday are rapidly investing in, and developing, integrated cloud solutions

Source:

*Forbes: Five Catalysts Accelerating Cloud ERP Growth in 2015

**Gartner

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

Business Case # 1

HIGHER EDUCATION CLOUD CONSORTIUMS– UNIZIN AND INTERNET 2

Large, Higher Education led consortiums are changing the way cloud-based services are developed and

made available to institutions, research centers, and other governmental / industry partners.

25

• Founded in 2014

• Consortium founded and led by higher education

institutions with a focus on developing a new approach to

digital learning

• Sought an alternative option for learning management

systems with a focus on collaboration rather than

institution-specific initiatives

• Cloud-scale service operator and integrator supporting

Digital Education offerings to partners including Content,

Software Platforms, and Analytics

• Designed to better support faculty and enable student

success

• Focus to provide “common gauge rail approach” for

infrastructure – encourages faculty collaboration

• Founded in 1997

• Non-profit computer networking consortium

• Institutions / partners can provision network and other

services

• Connects over 60,000 U.S. educational, research,

government, and community anchor institutions

• Develops and deploys network technologies such as

large-scale performance measurement and management

tools, secure identity and access management tools, and

the ability to schedule high-bandwidth, high-performance

circuits

• Creates a faster alternative to the internet and fostered

creativity, research, and development not previously

possible

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

Business Case # 1

SELECT EXAMPLES OF ERP CLOUD COMPUTING IN HIGHER EDUCATION

26

Increasingly, institutions are pursuing cloud-based options to reduce expenditures, re-allocate resources

towards strategic initiatives, and enhance services provided to constituents.

Select Examples of Managed Services (Primary Systems)

Institution Service Pursued Stated Institutional Reasoning

Cornell University

Cloud HCM and Payroll

• Elimination of difficult and time-consuming upgrades

• Wanted to streamline administrative operations

Brown University

Cloud Expenses, Financials, HCM,

Payroll, and Time Tracking

• Ability to re-allocate resources to mission critical

endeavors

• Cost of ownership and business model concept –

institution does not want to be designing business

processes

Boise State

University

Oracle ERP Planning Cloud

• Ability to achieve savings from process improvements

• Reduced infrastructure costs, ability to re-purpose staff,

and eliminate costly upgrades

Case Western

Reserve

Opted for vendor managed application

and production support rather than

invest in new infrastructure

• Infrastructure reliability & speed – increased service

provided while avoiding investment in capital expenditures

• Reduced Risk – improved disaster recovery, data security,

ability to recruit and retain staff

In addition to cloud ERPs, some institutions have developed a more holistic approach to the cloud. The University of

Notre Dame instituted a “cloud first” program with the goal of moving 80% of IT services to the cloud by 2017.

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

Business Case # 1

BENEFITS / CONSIDERATIONS OF CLOUD COMPUTING

27

Benefits Considerations

• Cloud-based computing is emerging as a more mature

market than it was several years ago

• Reduces costs (transition from CapEx and OpEx)

• Increases focus on core business and strategic vision –

frees up internal resources

• 24/7 service and support

• Pay-per-user / pay-as-you-use model vs. building and

maintaining infrastructure

• Accelerates innovation

• Potential reduction in deployment / upgrade time due to

increased standardization

• Not dependent on location Increased mobilization

• Changes the role of institutional IT staff – focus transitions

to service management and other institutional priorities

• Transition to cloud-computing cannot take place overnight –

requires appropriate due diligence and appropriate vendor

management mechanisms

• Inhibits customizations and increases standardization

(customizations may result in increased costs)

• Requires clearly articulated Service Level Agreements that

define expectations and services provided to constituents

• Requires that the vendor remains compliant with state and

federal rules and regulations – certain cloud models (e.g.,

SaaS) may require additional costs to support new

regulations

• Increases focus on data security – management of data

security changes from on premise model to vendor

managed, potentially requiring changes in current policies /

technical standards

• Increased cost / and ramp-up time (e.g., hiring and training

staff) of transition away from cloud computing – can become

heavily vendor dependent

While cloud computing can offer significant benefits with respect to service, standardization, and cost, the

movement to a cloud environment will require significant due diligence prior to migration.

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

Business Case # 1

HOSTING OPTIONS FOR CURRENT SYSTEMS

28

There are several hosting options available for each system. At present, the largest short-to-intermediate

term opportunity that exists is centralized hosting of Student Information Systems (SISs).

Hosting Model

Centralized Local

Highly Customized “Vanilla”

Level of Customization

SFS

HRS

SIS

Reduce Customizations

Reduce Customizations

Reduce Customizations

Centralize SIS Hosting

Future-State Options: Huron

anticipates that, for the foreseeable

future, the University’s enterprise IT

environment could be a hybrid of

multiple hosting / delivery modalities.

Hosting Options:

1. Hosted centrally

2. Identify vendor managed

infrastructure and application

support

3. Identify cloud / SaaS solution

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

Business Case # 1

SIS RECOMMENDATION OVERVIEW

29

Although precise costs

1

for operating current SISs are unknown, a high-level quantification indicates UW

institutions can realize significant savings by consolidating from campus-based to central hosting of SISs.

* Current state of discussions with CIOs

** Initial survey responses from institutions

***All estimates are based on discussions conducted between UW institution CIOs and UWSA CIO. Data provided by UWSA CIO.

Table Assumptions:

• Current-state salary and fringe estimated to be $95,000 for all FTE salary calculations

• Current-state localized FTE ranges identified through survey and subsequent discussions among CIOs (range 20-35 FTE)

• Future-state hosting assumes centralized staff increased by 4 FTE to manage centralized hardware, etc.

• Multi-year approach assumes financing of Oracle equipment – Future-state consolidation figures provided by Oracle

• UW CIOs suggest potential hardware savings will vary as same hardware supports multiple campus-level service

Note: (1) See Appendix for cost estimates using available data

Huron estimates that, System-wide, the UW could achieve significant annual savings by consolidating the hosting of SISs

to a single location with additional savings opportunities through reducing customizations.

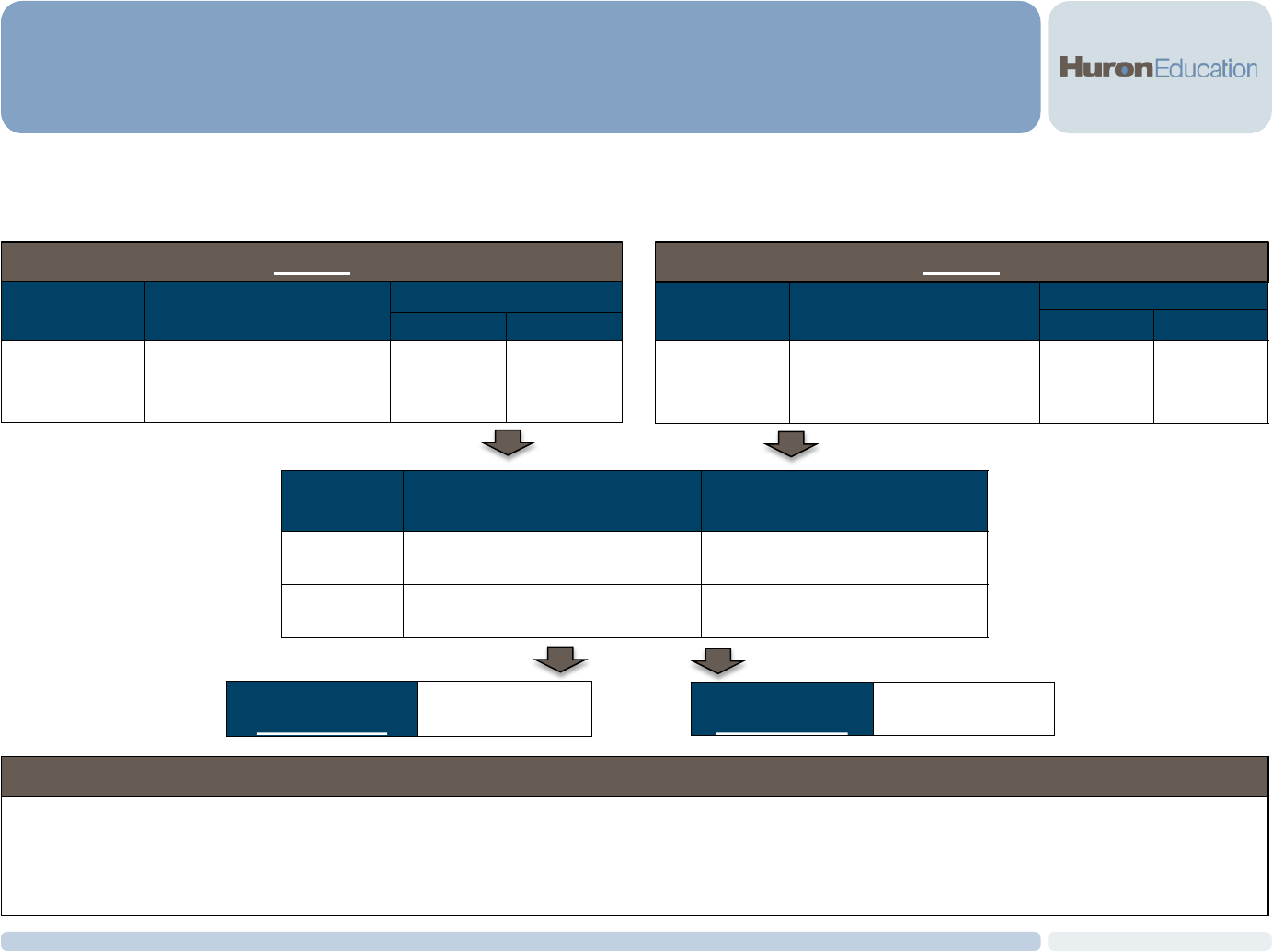

Est. Current State Operating Costs ($000s) Est. Current State Operating Costs ($000s)

Year 1 Year 2 Year 3 Year 4 Year 5 Year 1 Year 2 Year 3 Year 4 Year 5

Current State Low

(20 Inst. FTE)**

$4,500 $4,500 $4,500 $4,500 $4,500 $4,500 $4,500 $4,500 $4,500 $4,500

Current State High

(35 Inst. FTE)***

$6,000 $6,000 $6,000 $6,000 $6,000 $6,000 $6,000 $6,000 $6,000 $6,000

Oracle Consolidation Recommendation – Accelerated ($000s) Oracle Consolidation Recommendation – Multi-Year ($000s)

Annual Cost $5,200 $2,100 $2,100 $2,100 $2,100 $3,500 $3,200 $3,200 $2,400 $2,100

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

Business Case # 1

STANDARDIZATION OF INSTITUTIONAL BUSINESS PROCESSES

30

In addition to consolidating hosting of all SISs to a centralized model, the UWS should engage in a

comprehensive business process review to identify and remove lower-value-add customizations.

Drivers of Disparate SIS Processes

• Institutional move to PeopleSoft was incremental –

development of business processes not coordinated

• Processes developed around available functionality.

As functionality improved, business processes may

have remained – unclear level of utilized system

functionality

• Disparate use of bolt-on technologies and applications

results in increased institutional customizations and

localized support required

Move Towards Standardization

• Requires directive from System and Institutional

leadership to engage in business process and coding

structure evaluation and re-design

• Recognize and develop common approach to

addressing differences in campus processes

• Develop a systematic approach and strategy for

future-state SIS implementation that identifies

commonalities among institutions

Achievable Outcomes from Standardized Processes & Data Coding

• Allows institutions to re-allocate IT resources to more strategic objectives rather than supporting institution-specific customizations

– may also provide institutions and the system to consolidate systems / applications

• Enables the development of real-time or predictive analytics vs. point-in-time review

• Reduces complexity and enables deployment of shared services for back-office / administrative processing without impact to

constituents

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

Business Case # 1

VENDOR MATURITY AND UWS READINESS

31

At this point in time, large-scale cloud-based SIS solutions are several years from mainstream adoption.

The UWS should utilize this timeframe to develop an approach to process and data standardization.

Vendor Maturity:

• Gartner predicted (2014) that SIS SaaS models are at least 5-10 years from widespread adoption

• Primary cloud-based vendors, Oracle Campus Solutions and Workday Student, are at least 2-3 years away from being fully

functional, cloud-based student lifecycle solutions – both currently building, testing, and rolling out modules

Examples of Standardization Effort Representatives

Examples of Data Coding Differences (Student Records):

• Basic student demographic information (e.g., gender,

ethnicity)

• Academic identifiers – taking courses at multiple institutions,

course completion / withdraw

• Coding of students (e.g., resident, distance education)

Examples of Institutional Process Differentiators:

• Academic calendars

• Registration timelines

• Posting of grades

• Student billing cycles

• Application of student aid packages (e.g., merit aid)

• Tracking student advising sessions

• How / where data are stored

System-wide standardization will require a sizeable effort from

UW staff across multiple units, including representatives from

each of the following areas:

• Faculty Representation

• Financial Aid

• Registrar

• Bursar

• Institutional Research

• Academic Advising

• Technical Staff

• Professional School and Distance Learning Programs –

tend to be more complex

• Standardization may require significant changes to current

campus business processes and operating culture

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

Business Case # 1

HRS & SFS OVERVIEW

32

The current HRS and SFS systems are at similar points with respect to centralization and support. Over the

next several years, both will be considered for upgrades.

System Current State Opportunity Reasoning

SFS

• Centrally hosted and supported at DoIT

and funded through CSRG

• Current version: 9.1

• Approximately 290 unique modifications

• Recently reduced number of instances

and back-up schedule to reduce costs

• Explore vendor managed

infrastructure (IaaS)

• Explore upgrade to PeopleSoft

9.2 and alternative infrastructure

hosting

• Refine and standardize business

processes and then explore

upgrade to cloud solution

• Upgrade decision will

likely be made in the next

few years

• IaaS model has potential

for reduced short-to-mid-

term costs while

processes are

standardized in

preparation for cloud

solution

• Upgrade to 9.2 or cloud

solution presents different

cost scenarios, timelines,

and impact to UW

business processes

HRS

• Centrally hosted and supported at DoIT

and funded through CSRG

• Current version 9.0

• System customizations are in part due

to state legislation and lack of

systematic IT governance

• Unique customization examples include

multiple TAMS, time clock, JEMS,

duplicated personnel systems (UPS)

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

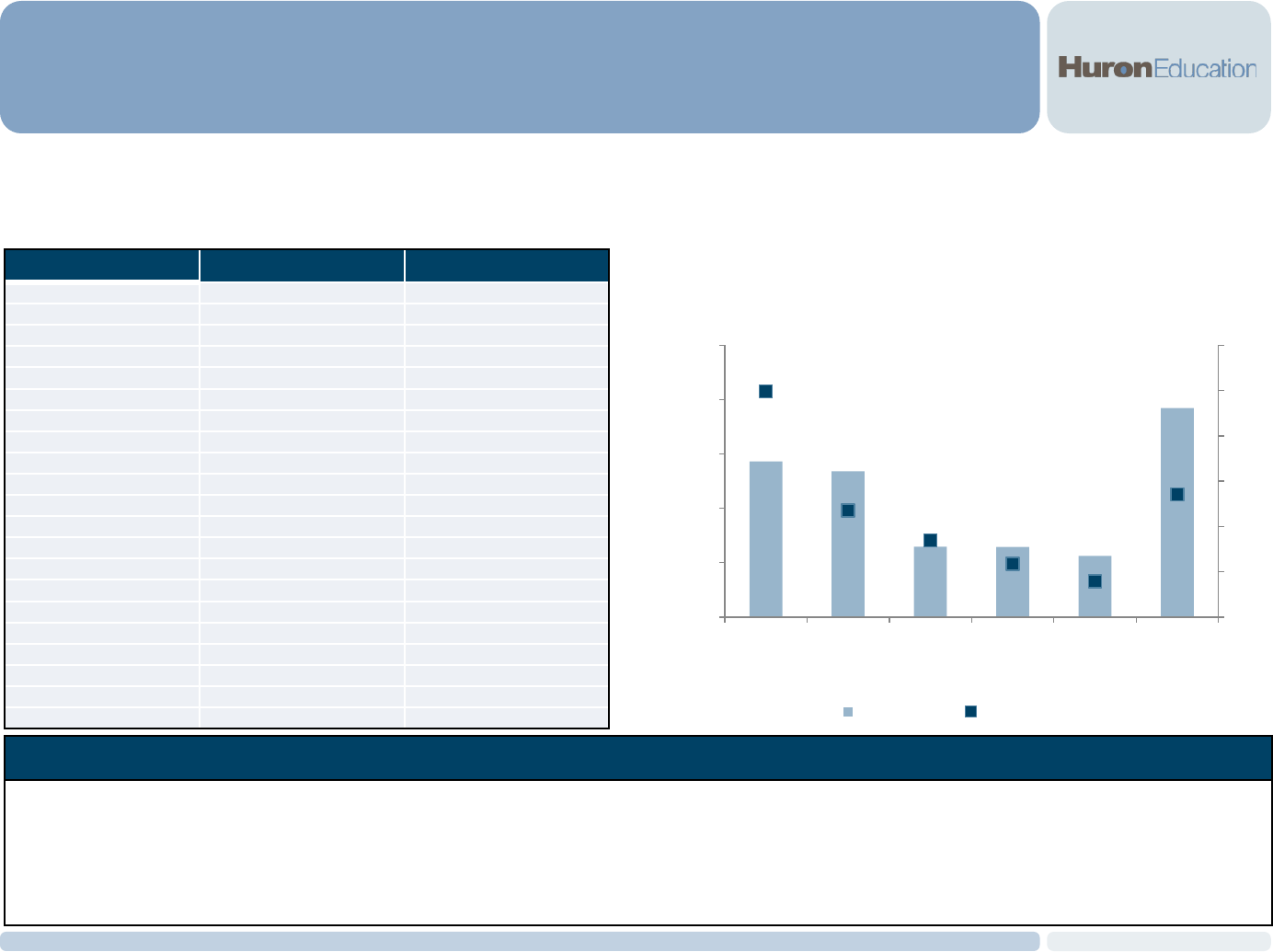

Business Case # 1

HRS & SFS OVERVIEW (CONT’D)

33

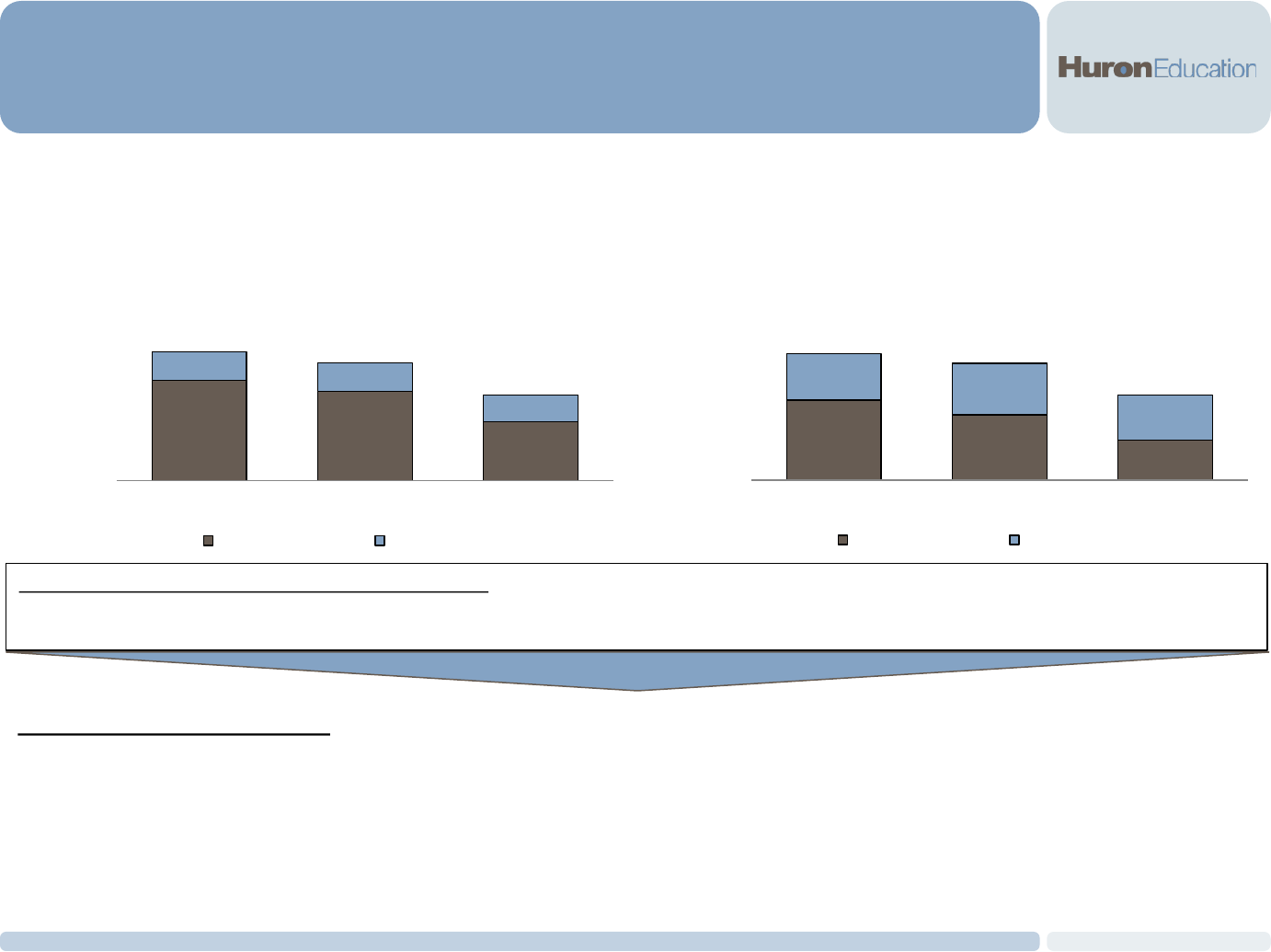

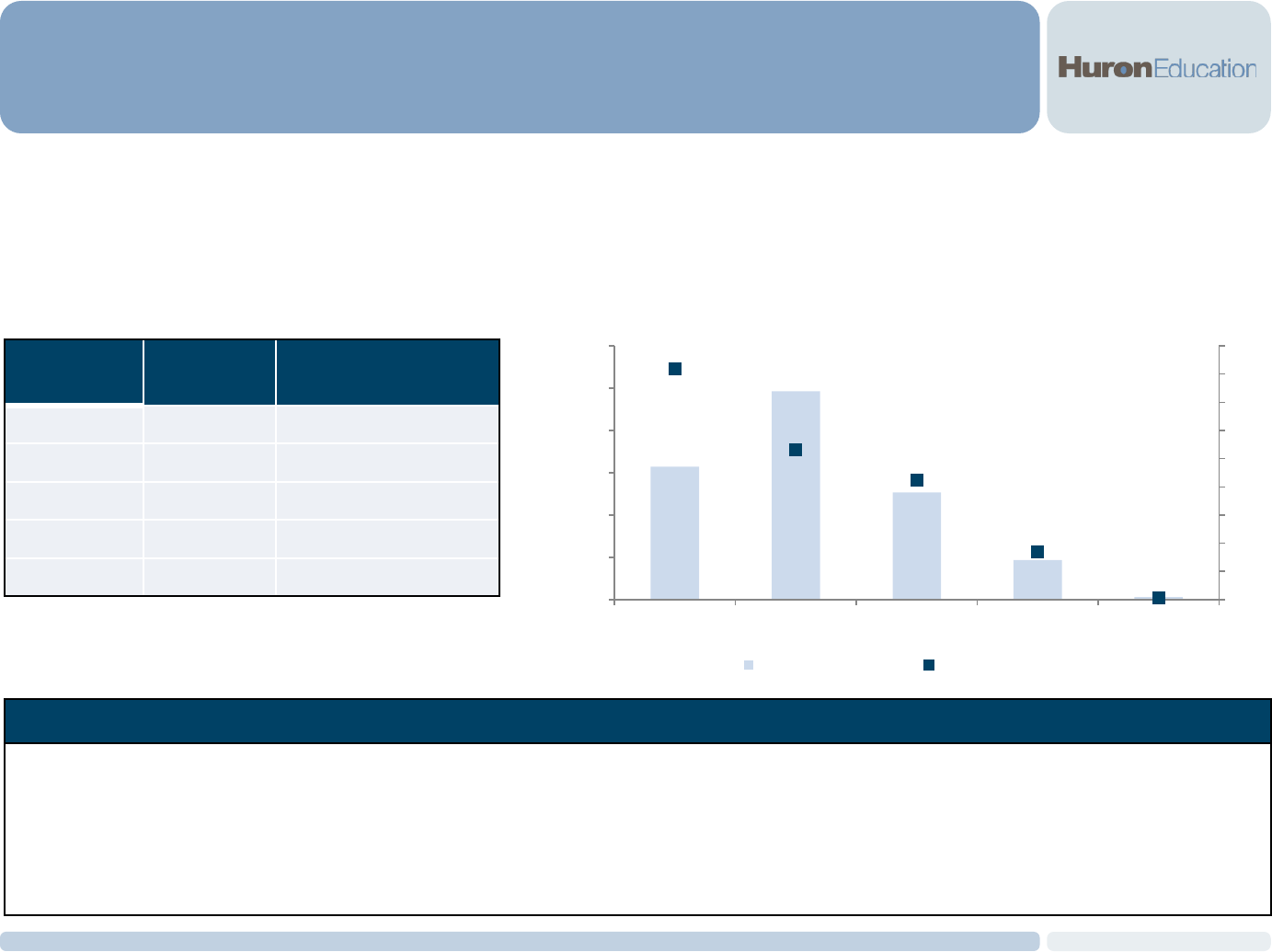

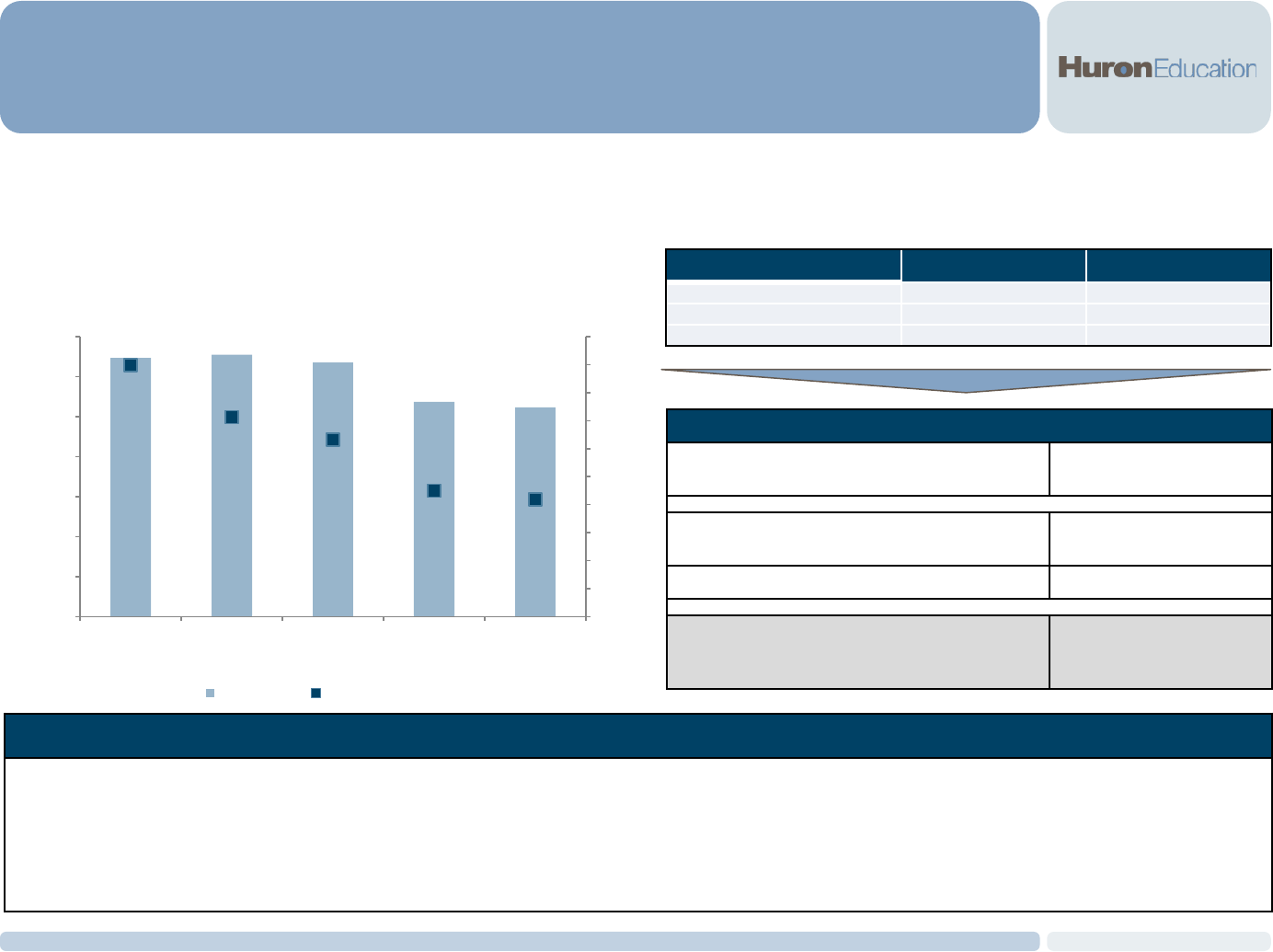

According to the Gartner Benchmarking Report completed for the UWS, infrastructure costs exceeded

those of identified peer institutions. The opportunity exists to evaluate annual infrastructure costs for each

system.

$-

$1,000,000

$2,000,000

$3,000,000

UWS System Peer Avg. Peer 25th

2014 Gartner Benchmarking Report

HRS Spend on Infrastructure

Compute - Midrange Storage

$-

$200,000

$400,000

$600,000

$800,000

$1,000,000

UWS System Peer Avg. Peer 25th

2014 Gartner Benchmarking Report

SFS Spend on Infrastructure

Compute - Midrange Storage

Gartner HRS and SFS Benchmarking Analysis:

• Range of annual potential savings for HRS and SFS infrastructure between $200k - $800k and between $60k - $262k to Peer

Avg. and Peer 25

th

(respectively)

Hosting Model Considerations:

• Review current state infrastructure support to identify where reductions can occur (e.g., number of instances, back-up

schedules, number of active projects)

• Engage with vendor to evaluate alternative hosting infrastructure costs to support instances requires increased focus on

vendor management and full analysis of operating infrastructure requirements

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

Business Case # 1

HRS & SFS OVERVIEW (CONT’D)

34

The UWS should address the underlying drivers of customizations, and overall costs prior to moving to

cloud-based solutions.

Reasoning: Inefficiencies exist that cannot be solved simply by implementing a cloud-based solution. Cloud-based

solutions provide the opportunity to standardize business processes that meet future-state business models.

• Lack of a formalized mechanism through which System-wide IT decisions can be made and the current model of

distributing the costs of customizations into the CSRG charges (across the board) means that requestors of

customizations or configurations may not fully understand implications / costs with requested customizations and

there is no group formally charged to review and approve/ deny requests

• Inefficient processes or one-off customizations are costly and cannot be solved by moving to a cloud-based

system

• Identification of future-state processes / users requirements (e.g., Establish minimum threshold to be

granted administrator access in HRS) can result in reduced costs under a pay-per-user structure

• Utilize a common approach to talent acquisition management systems

• Review of current policies will identify what is / is not operationally required – differentiate between

legislative requirements and UWS policy

• Reduce number of bolt-on / support applications system-wide

Short-term savings may be achieved through a vendor-hosted infrastructure, the UW should accelerate its strategy of

removing customizations to further reduce costs and to prepare for a potential transition to the cloud.

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

Business Case # 1

BUDGET SYSTEM CONSIDERATIONS

35

As Oracle and other companies are investing in the cloud and following a cloud-first mentality, the

University may consider a cloud-based option as part of its consideration for a new budget system.

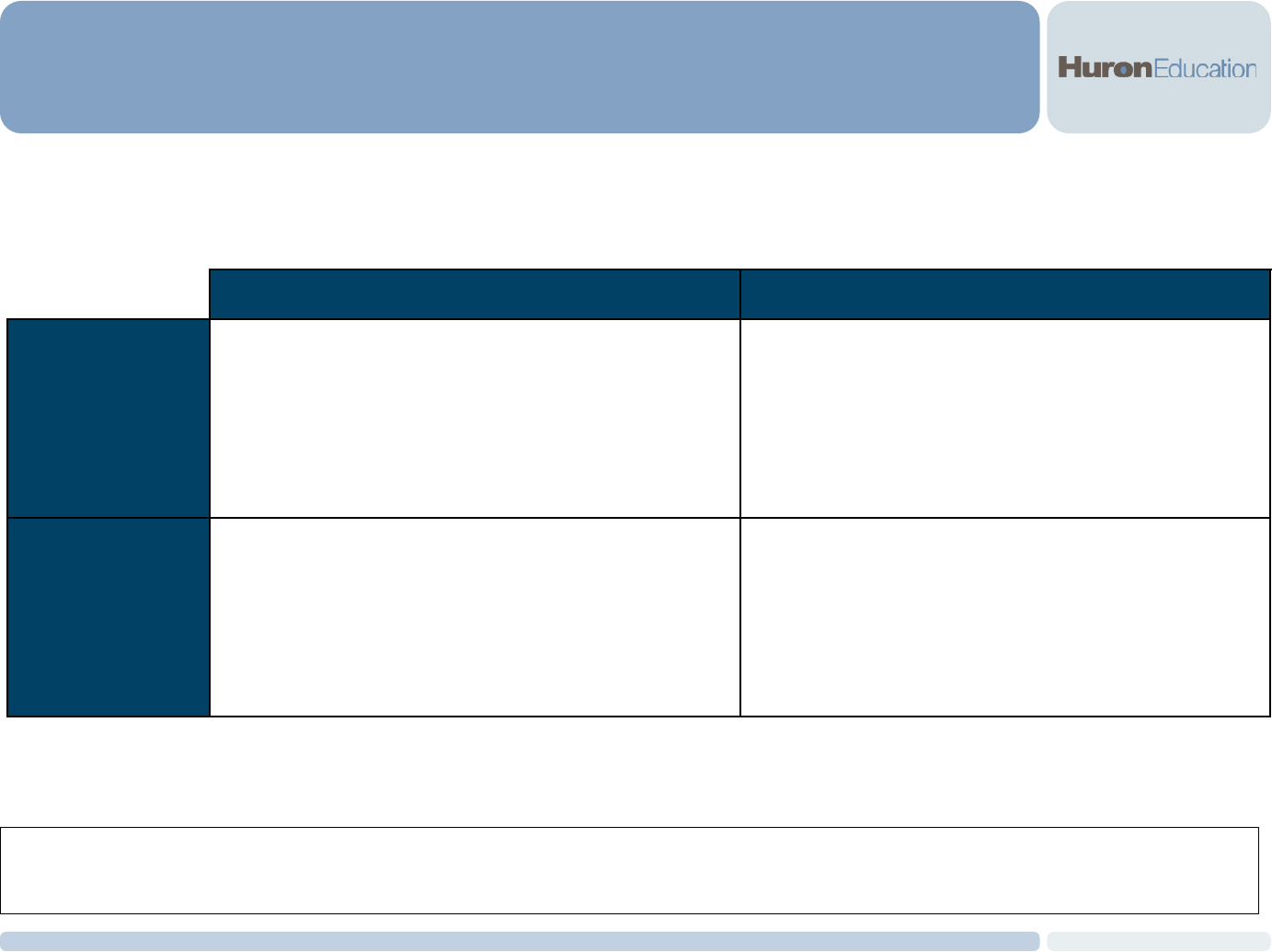

On-Premise Hosted Model Cloud Based Model

Benefits

• Increased control over customizations and

configuration of system

• Greater control over system including data,

upgrade timing and cycles

• Fewer local IT resources needed to operate and

maintain system

• Quicker installations and upgrades

• Earlier access to system enhancements

• May be lower cost (depending on licensing

structure and number of users)

Considerations

• Large, complex universities / systems may

require unique hardware to maintain system

performance

• May require specialized technical staff (who are

hard to recruit and retain) to maintain and

operate system

• Some functionality not yet available on cloud

instances

• Upgrades happen on vendor’s schedule

• Data/system integration for custom / local

systems may be more difficult

Depending on the vendor selected, the University should consider cloud based options for a new budget system.

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

Business Case # 1

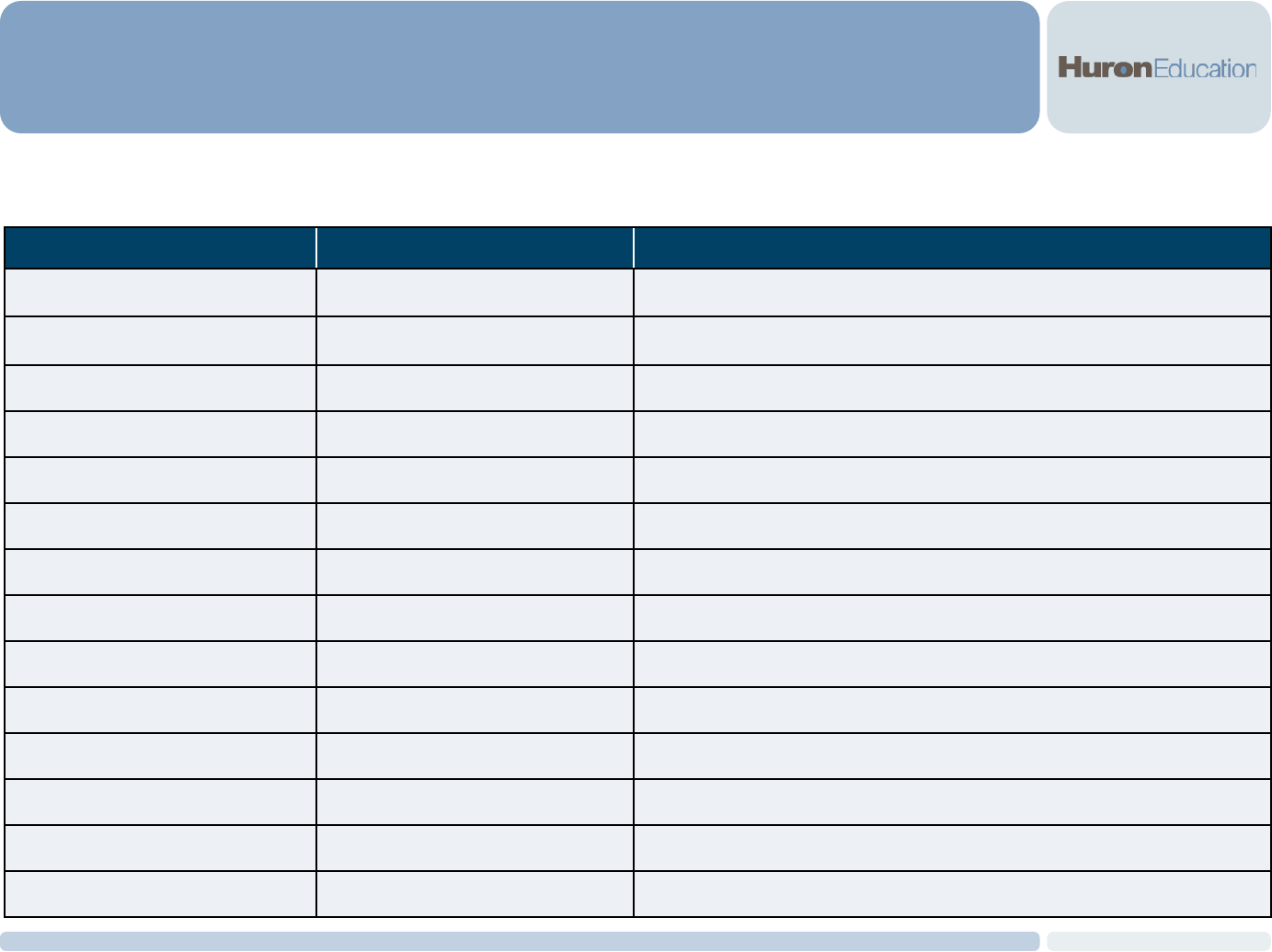

RECOMMENDATIONS

36

The UWS should take several steps over the next 36-48 months to achieve immediate cost reductions and

position the System to successfully transition to cloud based solutions as they mature.

Opportunity

Annual Est.

Savings

UWS Risk

Exposure

Efficiencies

Gained

Implementation

Complexity

Implementation

Timeframe

Business Case # 1

1

Consolidate hosting of SISs

$$$$

Medium Medium Medium 12-36 Months

2

Reduce customizations within SIS and

consolidate instances

Enabling Low High High 24-36 Months

3

Explore vendor

managed infrastructure and

rationalize current infrastructure for HRS

and SFS

$$$$

Medium Medium Medium 6-18 Months

4

Reduce customizations within HRS and

SFS

Enabling Low High High 36-60 Months

5

Develop

financial model allocating the costs

of customizations to requesting campus

Enabling Low High Low 0-6 Months

6

Develop a total cost of ownership model for

future customization requests

Enabling Low High Low 3-6 Months

7

Develop a System-

wide IT decision making

process and mechanism

Enabling Low High Low 6-12 Months

8

Include cloud option as part of vendor

system selection for Budget System

Strategic Investment Low High High 12-36 Months

9

Explore transition of non-ERP systems to

cloud solutions

TBD TBD TBD TBD TBD

Business Case #2:

Evaluate Alternative IT Administrative and Service

Delivery Models

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

38

CURRENT STATE IT ADMINISTRATION & SERVICE DELIVERY

Business Case #2

Each UW has built and supports localized information technology structures designed to meet the needs of

their institution, resulting in system-wide duplication and disparate operating models.

Overview:

• Aligned with the decentralized nature of the UWS, each campus has its own IT organization(s) providing a range

of similar services (e.g., Network and Infrastructure, Client Services, Enterprise Systems, Academic

Technologies) to similar constituencies (e.g., faculty, students, staff) supporting similar functions (e.g., teaching,

research, administration)

• Campus specific organization of IT activities varies greatly from campus to campus, reflective of the differences

in campus structure, culture, and operational norms

• Campus IT organizations and CIOs have engaged in a range of collaborative ventures (e.g., Disaster Recovery,

back-up support), though participation in these ventures is voluntary and they lack an overarching approach to

governance

Huron utilized the following guiding principles regarding the consolidation of IT services; cost reduction, mission

enablement, standardization, and service enhancement to constituents.

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

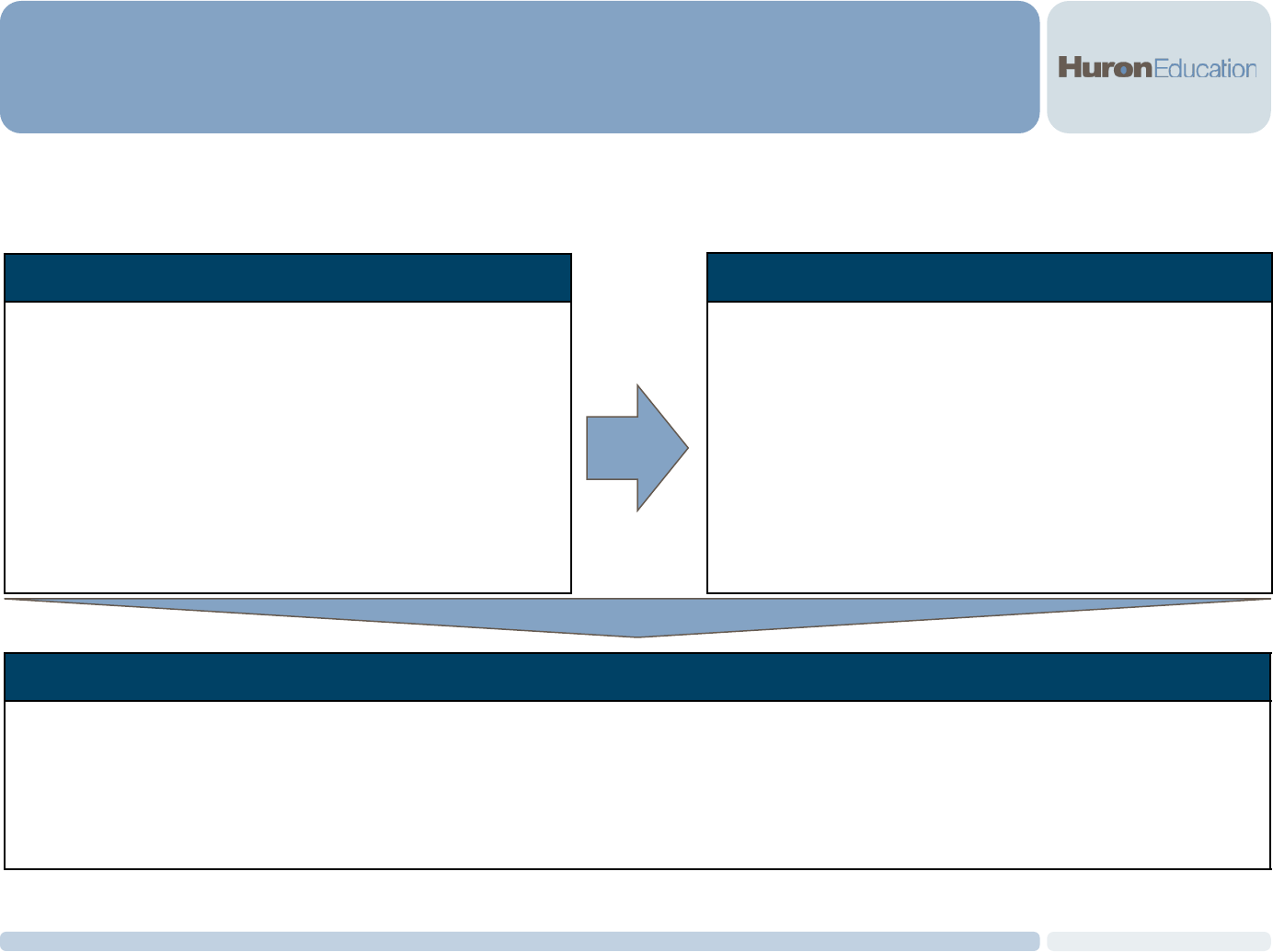

39

CURRENT STATE IT ADMINISTRATION & SERVICE DELIVERY

Business Case #2

The opportunity exists to systematically re-envision the way IT is administered and services are delivered.

In order to fully explore the concept of collaboration, we have structured and focused our thinking in two areas:

function-specific opportunities that are achievable within the current operating context and holistic opportunities that

would require a reimagining of the way IT services are delivered across the University of Wisconsin.

Function Specific Assessment:

Hypothesis: The UWS could lower cost, improve service, or a combination of the two by creating a cross-campus

capacity to support specific functions, including:

Holistic Approach:

Hypothesis: The UWS could add substantial capability and expertise without a significant increase in expenditure or

significant reduction to the administrative costs of Information Technology by organizing the provision of IT at a

“System” level.

• Training

• IT Security

• Helpdesk and IT Support

• IT Purchasing

• Research Computing

• Network Support /

Investments

• Datacenters

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

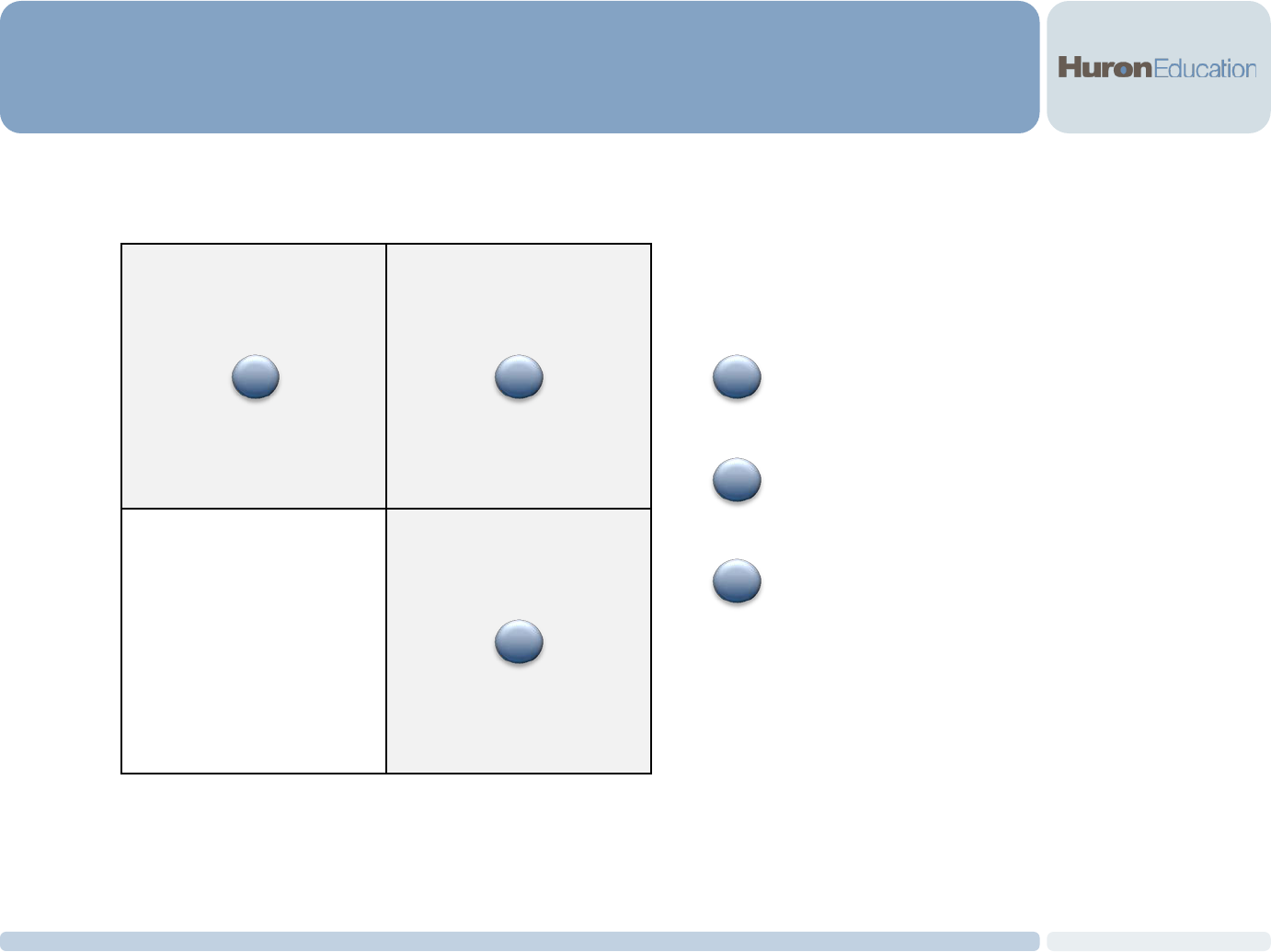

40

TYPES OF IT MODELS

Business Case #2

While there are nuances to operating models, there are two primary types that the UWS should consider -

consolidation of service-specific operations or a more holistic approach to IT.

Service

Higher

3 1

Same

2

Same Lower

Cost

3

1

2

1

3

2

IT Security

Help-desk

Data Center Consolidation, HPC

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

41

EXAMPLE 1: IT SECURITY

The opportunity exists to create a centralized team of UW IT security staff focused on developing,

implementing, and ensuring system-wide standards and technical controls are met.

Business Case # 2

Current State:

• 13 known UW contacts (headcount) related to IT security, some split time with other local responsibilities

• Not all campuses have financial resources or ability to attract / retain dedicated IT security staff

• System-wide UW Baseline for IT security has been developed over the previous two years, though it is

unclear if some or all campuses have met those standards at this time

• Disparate approach to IT standards, coupled with shared / common systems present potential systematic

vulnerabilities for individual campuses

Impetus for Change: Institutions are increasingly exposed to security threats:

• Auburn University publically exposed over 360,000 SSNs while replacing a broken server

• Penn State’s Engineering School exposed staff, student, and public/ private research partner information over a

period of two years because of a breach in the school’s computers

• Additional institutions recently impacted by security threats: Johns Hopkins, Carnegie Mellon, UC Berkeley, MIT,

University of Maryland, North Dakota University, Butler University, and Indiana University (among others)

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

42

EXAMPLE 1: IT SECURITY (CONT’D)

Transitioning to a IT Security team that is, perhaps geographically dispersed but with central reporting,

while complex, can provide the UWS with a standardized approach to IT security.

Business Case # 2

Challenges with transition:

• Lack of standardized IT functions system-wide result in disparate current state operations and standards

• Lack of an existing formalized governance mechanism to empower centralized security efforts (e.g., policy

development and enforcement)

• Centralized security team would require financial and staff resources from institutions:

o Institutional FTE resources to assist in centralization efforts, new policy development, and

implementation efforts (e.g., identification of localized current state)

o Funding to support centralized team and potential changes in current practices to meet system-wide

standards (e.g., changes in system configurations)

o Training of current staff on newly developed policies

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

43

EXAMPLE 1: IT SECURITY (CONT’D)

The deployment of a centralized team should be considered as an enabler of a comprehensive and

systematic approach to developing and enforcing standards and risk mitigation strategies.

Business Case # 2

Impact of Consolidation:

• Standard approach to system-wide IT security

management and risk mitigation

• Standard technical auditing and accountability

standardized audit procedures, timing, review, etc.

• Consistent approach leads to reduced institutional

and systematic vulnerabilities

• Alignment of IT procurement and lifecycle

management with end-point risk

• Consistent data security and retention policies

Similar Example – UWSA Internal Audit

• UWSA recently centralized system auditors as a way to

provide increased consistency and a more formalized

approach to process review

• Chief Auditor reports directly to President Cross and the

Board of Regents – delegated authority to develop a

systematic, unbiased, approach to review

Benefits of Centralized IT Security Model

• Consistent, systematic approach and standards to IT

security

• Authority to assess, implement, and refine standards in an

expedited fashion

• Proactive and coordinated approach to meeting newly

established standards

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

Business Case # 2

EXAMPLE 2: HELPDESK (HD) OVERVIEW

44

Currently, each institution maintains centralized helpdesks for IT support. Madison and Milwaukee list

distributed IT support via locally managed helpdesk (e.g., college level).

*Data Assumptions:

• Does not include distributed Helpdesk staff – number of distributed helpdesks not fully known. Madison and Milwaukee list distributed help desks for certain colleges / schools

• Institutional FTE defined as FTE Faculty, FTE Staff, or FTE Student

• Aggregate ticket information uses most recent complete year as provided by CIOs or publically available information on websites.

• Central HD Ticket information not available for Eau Claire, Oshkosh, or Colleges / Extension – an estimation was made by multiplying the average known (Ticket/Inst. FTE) by the number of institutional FTE

Helpdesk Overview (System-wide)

• 20 known centrally managed helpdesks – Madison and Milwaukee list distributed IT support (e.g., respective Colleges)

• Approximately 339,000 total centralized HD tickets received ranging from basic inquiries through more resource intensive

application support

• Disparate data tracking utilized system-wide resulting in inconsistent data availability – no consistent metric tracking

• Multiple instances and types of ticket management systems and virtual self-service knowledge management documents.

Institutions do collaborate with respect to knowledge bases (e.g., UW Milwaukee utilizes UW Madison’s knowledge base)

• Institutional operating hours vary - most adjust hours for fall/spring/summer terms

• Institutions are utilizing student workers to encourage career development, retention, etc.

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

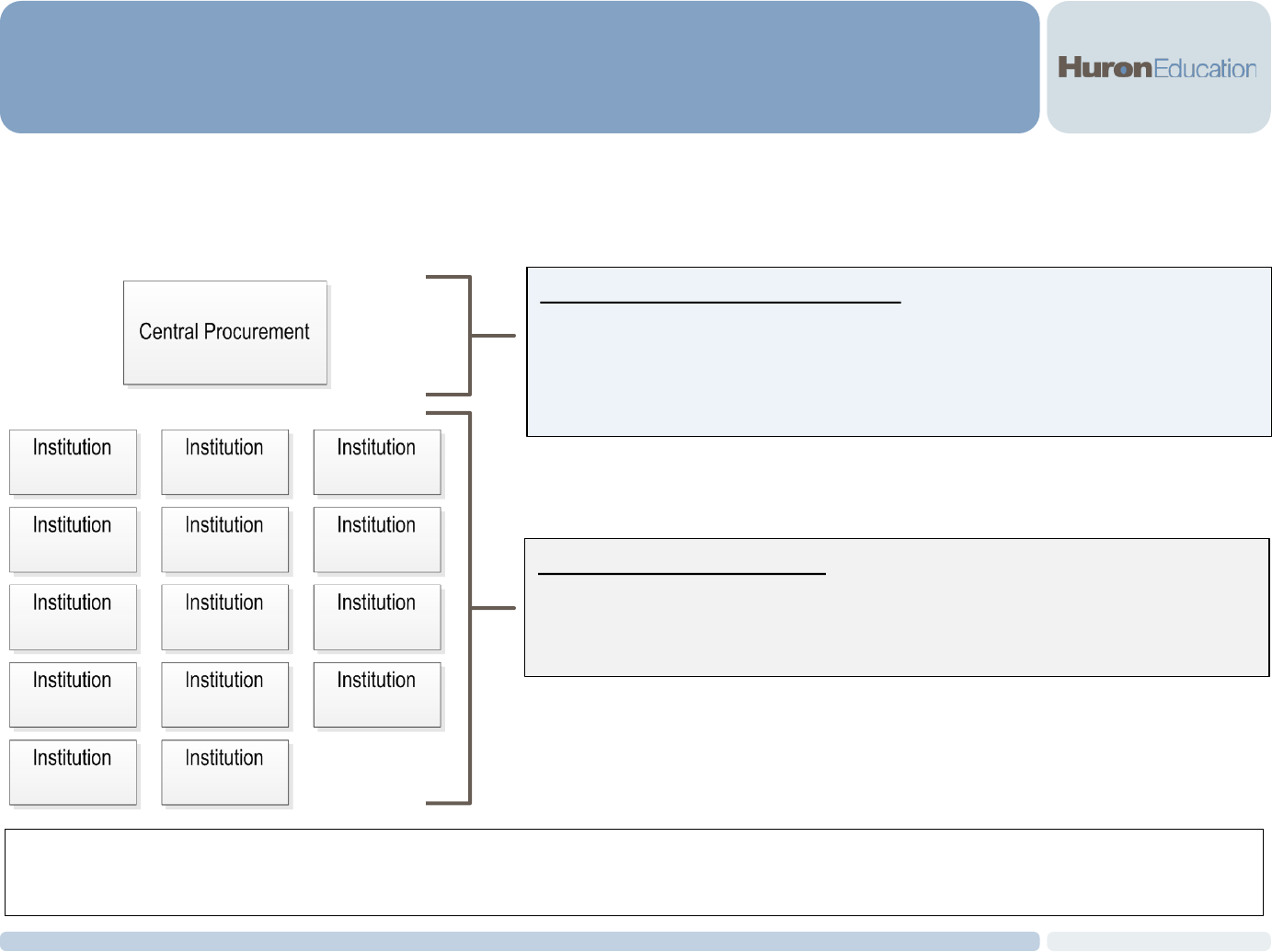

45

EXAMPLE 2: CONCEPTUAL FUTURE STATE HD MODEL

A hub-and-spoke model for helpdesk delivery will require additional analysis, planning, and potential

investment to ensure a seamless transition and uninterrupted service provided to staff and students.

Business Case # 2

Central Helpdesk:

• Highly trained “generalist” and tier-2 staff respond to all incoming tickets, or route calls appropriately to

institutional level (e.g., desktop / classroom support)

• Utilizes a routing resolution priority whereby the most serious issues are prioritized using a single ticketing system

Distributed Support:

• “On-the-ground” staff and students assist with physical desktop support, laptop re-imaging, classroom set-up, etc.

• Promotes the increased use of student workers which can lower operating costs while contributing to student

success and retention (e.g., financial, career building)

• Distance learning faculty and students likely not significantly impacted by change in operations

Change Components

• Disparate knowledge management / virtual self-service systems will need to be consolidated

• Requires the development of unified processes and standardized escalation procedures

• Requires development of system-wide Service Level Agreement

• Constituent change management efforts to new processes

• Development of a formalized training program for all student workers

• Future-state FTE distribution – some institutions may require additional on-site staff to meet institutional policies (e.g., Stout

with student laptop program)

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

46

EXAMPLE 2: FUTURE-STATE HELPDESK BENEFITS AND CONSIDERATIONS

Centralizing helpdesk activities provides for increased standardization of service provided, the ability to

monitor metrics and demonstrate accountability to stakeholders, and support a growing "bring your own

device" trend.

Business Case # 2

Benefits Considerations

• Consistent ticket tracking and reportable system-wide

metrics

• Consistent, systematic approach to constituent support

(e.g., response times, escalation procedures, follow-up,

etc.)

• Enables the standardization of technologies supported

• Increased use of students can further reduce overall costs

while maintaining consistent levels of service – ability to

scale up / down during academic and summer terms

• Requires change management efforts to coach

stakeholders on new process

• Requires highly trained centralized staff versed in multiple

applications and devices

• May require standardization of applications, hardware, etc.

supported

• UWS can choose to outsource “after-hours” ticketing

management to third-party vendor – requires additional

analysis

Ex: Helpdesk / Desktop Support Consolidation Comments

Institutional Example: University of Minnesota

• Evaluated current Helpdesk and desktop support staffing

(collegiate and non-collegiate) – operated 72 separate

helpdesks

• Identified an annual range of savings / staff re-allocation of

$7.3 - $9.1 million

• Transition to consolidated future-state is still in progress –

achieved annual savings of approximately $2.3 million

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

47

EXAMPLE 3: CENTRALIZED HIGH PERFORMANCE COMPUTING (HPC)

The opportunity exists to develop a policy that centralizes research computing and enables all institutional

faculty, researchers, and students to provision computing resources upon request.

Business Case # 2

Examples of Shared HPC Computing Comments

Multi-Institutional Example: POD IU

• High performance computing cluster available for on-demand use by any

domestic or foreign researchers associated with institutions of higher

education, federally funded R&D center, or other federal / state entities

• Collaborative effort among Indiana University, UVA, UC Berkeley, and U.

Michigan and Penguin Computing

• Utilizes a “pay-as-you-go” pricing model with same configurations as

existing government supercomputers cost effective solution to access

compute resources

Examples of HPC Across UW Considerations for Centralization System-wide Mission Enablement

• UW Madison

• UW Milwaukee

• UW La Crosse

• UW Eau Claire

• Some institutions use XSEDE

• Implementation should coincide with

UW Institutions grant funded HPC

cycles

• Leverage existing dedicated

infrastructure

• Provide access to cutting-edge

computing resources to all UW

faculty, researchers, and students

• Utilize a pay-as-you-use cost

recovery model

Huron recommends further analysis regarding realizing scale of existing shared system research / high performance

computing investments and the development of an implementation timeline that incorporates technology refresh cycles.

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

48

EXAMPLE 4: CONSOLIDATE SYSTEM-WIDE DATACENTERS / SERVER FACILITIES

Currently, each institution maintains their own respective datacenter(s). The opportunity exists to explore

the consolidation of system-wide data-centers and server facilities, resulting in achieved economies of

scale.

Business Case # 2

*Data received was either not explicit in naming number of datacenters or was inconclusive based on wording. Some institutions did not provide data resulting in estimation of a minimum of one datacenter / institution.

Anticipated Approach / Data Issues Known Information

• Assess current inventory of datacenter / server facility

equipment, policies, procedures, usage statistics, operating

costs, space, etc.

• Review level of virtualization and identify estimated near-

term savings by increased virtualization

• Identify estimated savings by co-location / consolidated

facilities and potential cost avoidance

Available data was either inconsistent or not provided at all.

Huron was not provided with UW Whitewater survey.

• Estimated number of “centrally” managed datacenters is 22*

• Limited current server, data center/ facility inventory, etc. –

some institutions provided detailed server information others

did not participate

• Generally, institutions indicated they have or plan to engage

in server virtualization (Centrally)

• Distributed / departmental level datacenters / server

facilities is unknown, though UW Madison estimates their

number to be approximately 96

• UW Madison initially estimated a 5-year savings of ~$6.8

million, primarily by co-locating data centers / server

facilities

• UW Stout’s strategic plan highlights institutional datacenter

consolidation as a priority

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

49

EXAMPLE 4: CONSOLIDATE SYSTEM-WIDE DATACENTERS (CONT’D)

The consolidation of UW datacenters would be a complex initiative spanning several years of planning,

rationalization, and migration efforts.

Business Case # 2

*Data received was either not explicit in naming number of datacenters or was inconclusive based on wording. Some institutions did not provide data resulting in estimation of a minimum of one datacenter / institution.

Representative Example: New York State & SUNY

• In 2013, Governor Cuomo announced the consolidation of 50 New York State Datacenters and server rooms spanning 140,000

square feet into one location at SUNY College of Nanoscale Science and Engineering

• Currently engaged in increased server virtualization, physical co-location, and a systematic review of current applications to

reduce amount of storage and compute resources required

• Consolidated datacenter is a 50,000 square foot tier 3 facility promising 99.982% availability

• Estimated $1 billion in savings over 20 years (~$50 million per year)

• Effort is part of an overall consolidation effort by the state of New York to realize IT savings estimated to be $100 million / year

Consolidation Complexities & Components:

• Comprehensive inventory of current infrastructure

• Comprehensive understanding of Tier 1, 2, and 3 applications

• Identification of future-state infrastructure needs

• Identification of future-state datacenter locations

• Identification of project funding and future-state budget model for operation

• System-wide disaster recovery plan

• Development of a institutional data and application migration plan migrate institutions gradually

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

50

EXAMPLE 4: CONSOLIDATING SYSTEM-WIDE DATACENTERS (CONT’D)

Huron recommends that further analyses be conducted to identify the full extent of the opportunity,

including a systematic data collection and evaluation process to understand the true current state.

Business Case # 2

UW Madison anticipates saving ~$7M over 5 years through the consolidation of its data centers and server facilities;

based on the scale and scope of computing across the System, Huron anticipates that number to increase for a

coordinated UW-wide effort.

Benefits of Data Center Consolidation Data Required for Comprehensive Analysis

• Reduced Costs: Reduced network and application

infrastructure results in lower hardware costs, energy

consumption, space requirements, and avoidance in capital

expenditures.

• Increased Control for IT: Simplified architecture and the

ability to deploy management strategies and protocols

designed to maximize bandwidth utilization and performance

• Reduced Scope of Security: Reduced number of sites leads

to a standardized approach to physical center management.

Similarly, reduced centers leads to more consistent disaster

recovery planning, implementation, and execution of solutions.

• Improved Compliance: Promotes process and system

automation (reducing staff involvement) and aligns procedures

and functions with policies, regulations, standards, and

service metrics. Additionally, it encourages comprehensive

auditing and demonstration of operational compliance.

• System-wide inventory of:

o Centralized and de-centralized datacenter and

server facilities, PUE analysis, level of server

virtualization / utilization, and total current state

operating costs

o Plans to reduce level of hosted applications (e.g.,

SIS centralization reduces localized infrastructure)

o Planned or anticipated capital expenditures for

servers, equipment, and facilities

o Future state compute and storage requirements

o Development of a system-wide master plan to

realize facilities savings over the next 10 years

Consolidation efforts can be achieved by two primary

methods; 1) consolidate current infrastructure into 3

regionalized datacenters (e.g., Geographically), or 2)

outsource to a vendor managed provider (e.g., AWS, IBM)

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

51

HOLISTIC APPROACH: REORGANIZE INFORMATION TECHNOLOGY DELIVERY

The UW has the opportunity to significantly increase service and/or reduce costs by reorganizing the

provisioning and administration of IT at a “System” level.

Business Case # 2

Considerations:

• Current model of a campus-centric service model creates significant redundancy in activities and services

across the System

• Alternative models seeking to organize IT services at a different level (e.g., regional, campus profile) are without

precedent at the University of Wisconsin and run counter to the prevailing organizational cultures

• Alternative models present significant opportunities to increase service and / or reduce costs; these benefits

should be considered in the context of the changes to institutional control, challenges with culture, and

institutional strategies

Decision: Huron does not believe this to be a binary (yes/no) decision. Ultimately, careful consideration

should be given to the following decision components:

• Mix (and location) of leadership / management – how will governing group be selected?

•

Services provisioned – what will this group be responsible for?

• Financial impact – how will budgets / investment priorities be established?

• Changes in risk profile - how does re-organization impact institutional / system risk?

• Changes to control – how will re-organized decision-making be managed and enforced?

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

52

REORGANIZE INFORMATION TECHNOLOGY DELIVERY

Although differences exist in scope, diversity, and scale of institutional-specific IT, institutional based CIOs

have significant commonality in organization and service provision.

Business Case # 2

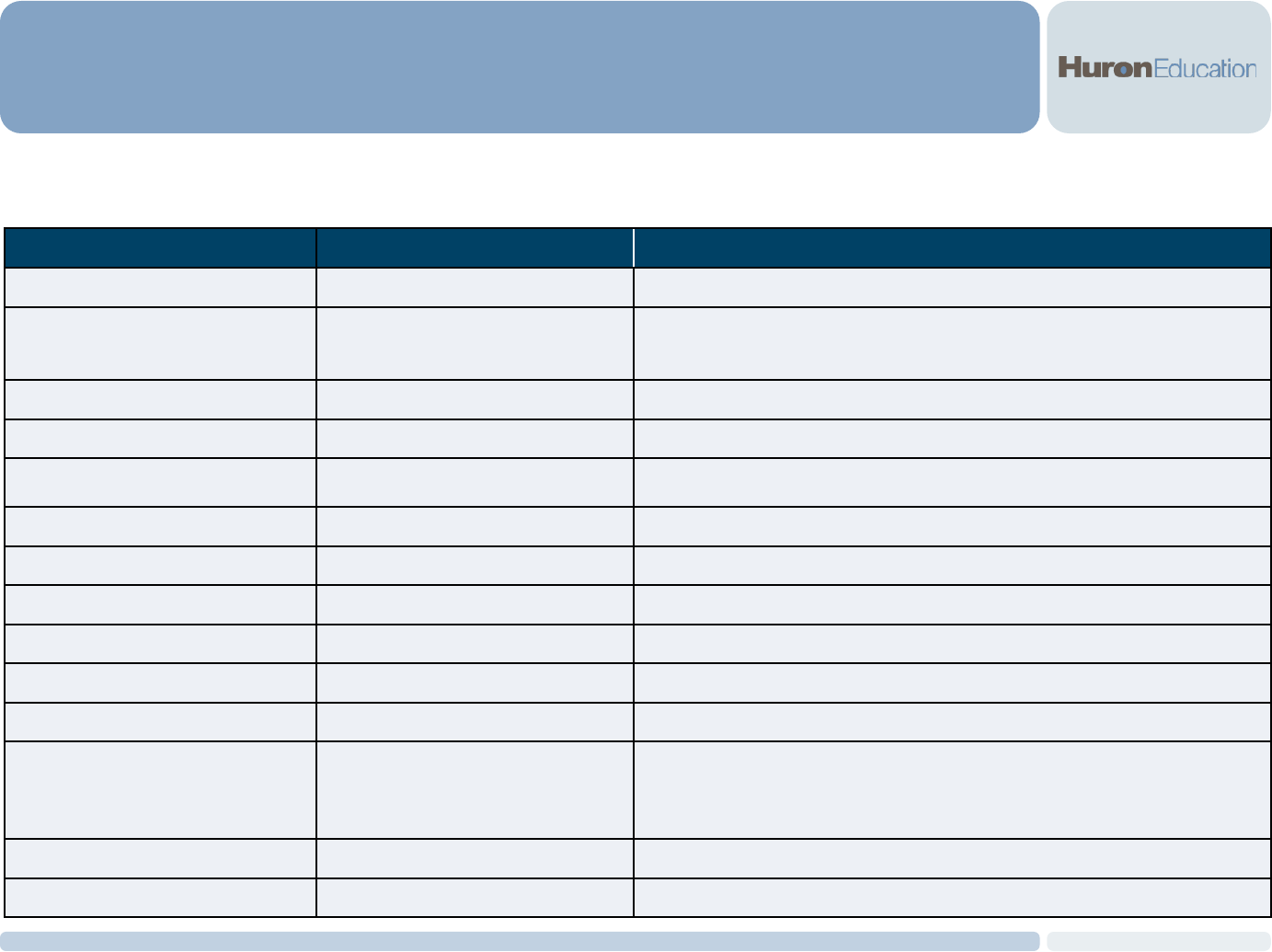

Estimated FTEs / IT Unit

Institution Client Services

Network &

Infrastructure

Services

Enterprise

Software &

Application

Services

Instructional

Technology

Services

Administration/

Finance/ Other

Est. Total FTEs

Eau Claire

13.8 13.0 15.9 10.9 1.0 54.6

Extension / Colleges

4.0 18.7 1.0 6.0 11.0 40.7

Green Bay

7.0 4.0 9.6 12.0 4.0 36.6

La Crosse

13.0 10.0 5.0 8.0 2.0 38.0

Milwaukee

25.0 39.0 16.8 8.0 7.0 95.8

Madison

67.5 204.2 90.7 75.6 25.8 463.8

Oshkosh

12.0 7.0 9.0 13.5 3.0 44.5

Parkside

4.0 3.0 5.0 5.0 8.0 25.0

Platteville

12.0 12.0 12.0 7.0 2.0 45.0

River Falls

4.0 13.0 10.0 2.0 2.0 31.0

Stout

9.0 9.0 7.5 10.0 4.0 39.5

Stevens Point

24.8 10.0 2.0 10.0 46.8

Superior

5.0 6.0 6.0 0.8 17.8

Whitewater

2.0 4.0 33.0 39.0

UWSA

1.0 13.0 3.0 17.0

Total

204.1 348.9 201.5 164.0 116.6 1,035.1

Assumptions:

• Categorized staff based on available organizational charts, public website information, or position descriptions within HR provided file. Description of

categorization can be found in the appendix

• Positions not clearly marked or aligned to a single category placed in Administration/ Finance/ Other category

• Source: HR Personnel file received from UWSA, does not include distributed IT staff

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

53

REORGANIZE INFORMATION TECHNOLOGY DELIVERY

In order to successfully transition to a System-wide model for the provision and leadership of IT services,

the UWS would have to develop enhanced capabilities to support a new model.

Business Case # 2

Required Core Capabilities:

1. A mechanism through which the System could make decisions regarding IT priorities, budgets, service models,

and service levels – currently, decision-making is institutionally focused

• Campus leadership collectively should consider what technology is truly unique to campus strategic

priorities and rationalize IT Services accordingly

2. Improved data environment, enhanced reporting, and performance measurement – currently, data are not

readily available or fully understood resulting in the inability to inform decision-making

3. Articulation of the value added to faculty, institutional leadership, and the System of new IT-related roles both

on-campus and at the system level

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

54

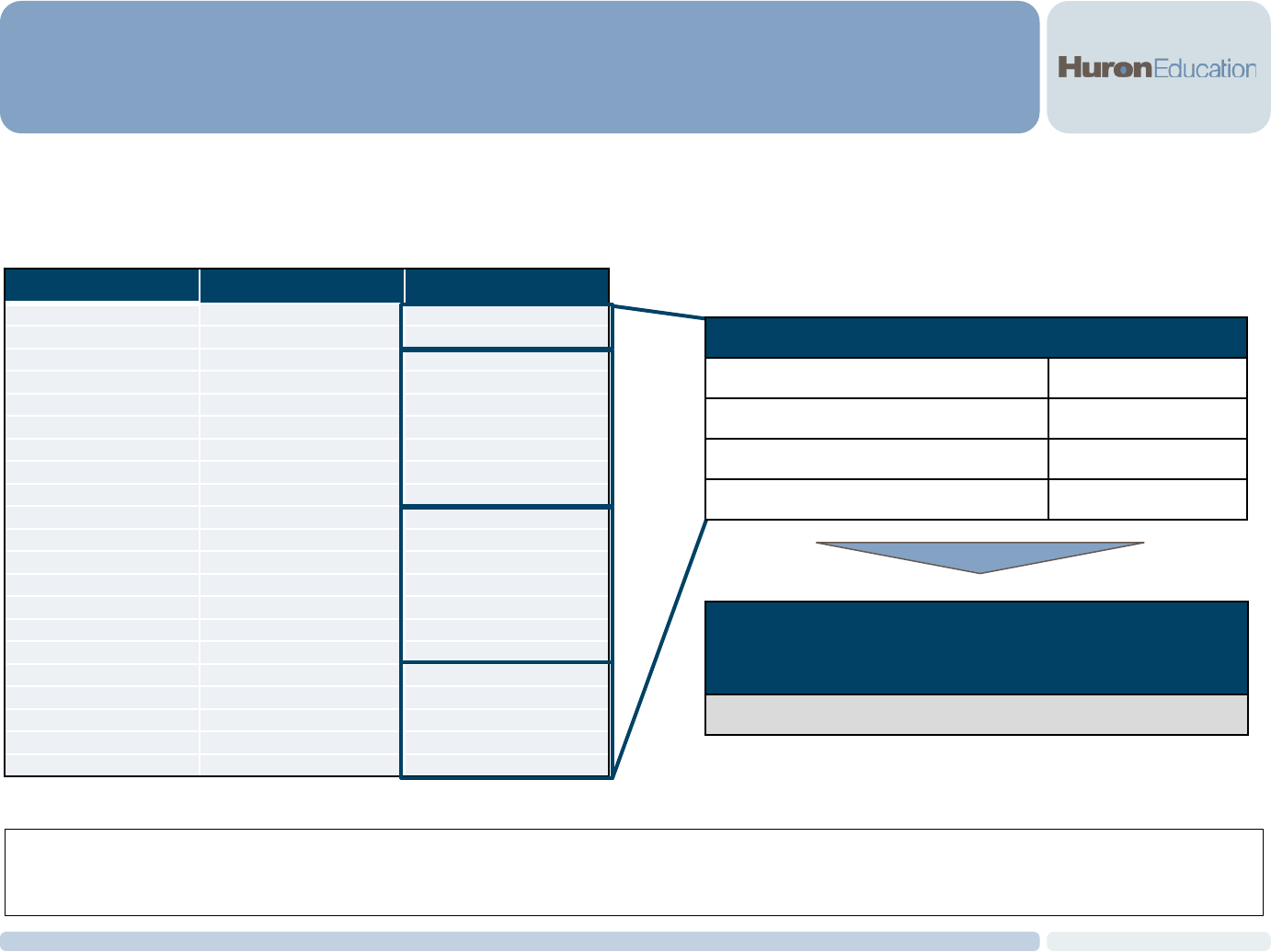

DECISION MAKING

The University of Wisconsin has few System-wide mechanisms through which opportunities can be

evaluated and decisions made as a “system.”

Business Case # 2

Common Systems Review Group (CSRG), comprised of IT, academic, and administrative leadership, is one of the

few examples of System-wide IT decision making (though the reality is that only approximately 4% of the CSRG

budget is uncommitted per year and there are far more projects requesting funding than there is funding available).

To be successful, any new model will need to expand the remit of a group like CSRG.

Required Capabilities & Authority:

• Develop shared solutions

• Evaluate opportunities to transition campus based activities to “scale”

• Decide on service levels and functionality of shared systems

• Ensure IT services are aligned with budgets and campus requirements.

Changes to IT funding may include:

• Pay overhead costs for central IT out of a central fund and charge institutions on a direct or marginal basis

• Provide select IT services without a charge to institutions

The University of Wisconsin should empower the CSRG (or a variant) to expand it’s remit to include the development of a

capacity to make broader cross-campus IT decisions and to provide oversight of any System-wide services.

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

55

SYSTEM-WIDE CAPABILITIES

The current campus-centric model means that the data that comprise IT investment are distributed

throughout the organization, limiting the ability for effective system-wide decision making.

Business Case # 2

Establish

authority of

CSRG (or

similar group)

Identify

reporting

needs

Document

required data

elements

Establish

common data

definitions

Develop data

collection tool

Collect data

(iterative)

Illustrative – for discussion purposes only

IT Data is not readily available or fully known through-out the

system. Creating a standard process for data collection and

reporting will increase transparency and provide for more

informed decision making

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

56

RE-ENVISIONING THE ROLES OF CAMPUS-BASED IT SERVICES

If we consciously ignored the traditional boundaries of institutions and pushed our thinking beyond the

current state, we believe the UW could serve campus-based IT needs through a regional CIO model.

Business Case # 2

Changing Role of the CIO:

• Shift from “technology – oriented” focus to “business – oriented” strategic partner

• Highly adaptable to rapidly changing IT landscape

• Focused on global security

• Driver of process innovation and improvement

• Shift from asset managers to service managers (e.g., cloud computing)

To successfully transition the role of the UW CIOs and allow them to focus on more strategic and value-add initiatives, IT

services will need to be administered and provisioned differently than they currently are.

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

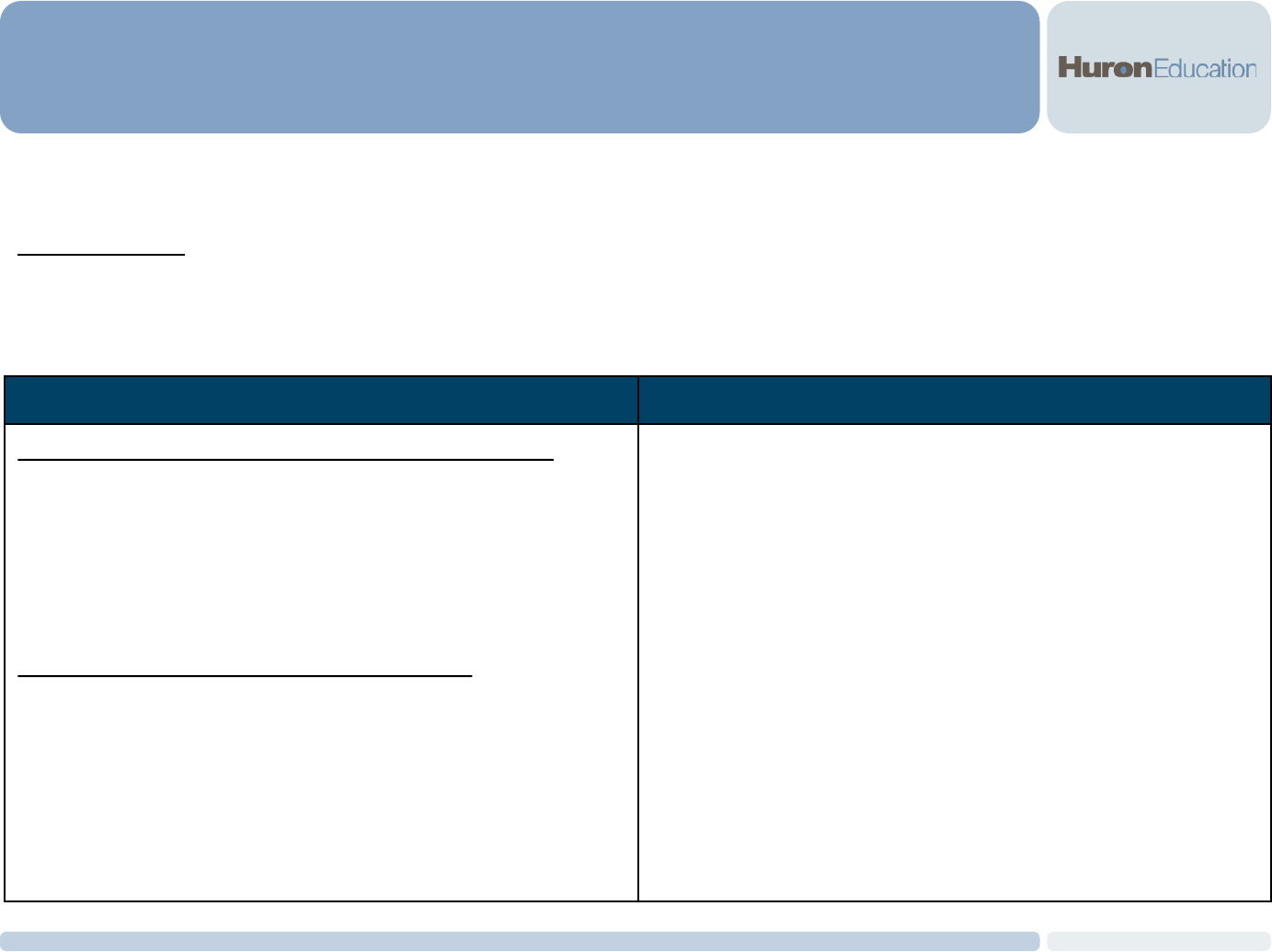

57

RE-ENVISIONING THE ROLE OF CAMPUS-BASED IT SERVICES

If campuses were able to procure more IT services from UW System, the time and attention of CIOs could

shift from operational to strategic. Creating individual specializations would extend the services offered.

Business Case # 2

Illustrative – for discussion purposes only

IT Operations

Responsible for

• Operating (service level and P&L responsive) enterprise-scale applications and services

• Network architecture and maintenance

• Managing vendor relationships

Implementation

Responsible for

• Scaling new technology

• Overseeing management of all IT “projects”

Risk

Responsible for

• Establishing system-wide risk management infrastructure

• Advising institutions where resources don’t exist

• Working with institution-specific resources (where available)

Digital Officer(s)

Responsible for

• Becoming “trusted strategic” and digital leaders on-campus IT

• Supporting institution-specific teaching and learning technology

• Supporting institution-specific strategic planning

Data

Responsible for

• Establishing and maintaining system-wide data governance

• Managing core data inventory

• Working with institution-specific resources (where available)

System-wide Responsibility

Campus-based

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

58

POTENTIAL FUTURE-STATE SYSTEM-WIDE IT ADMINISTRATION MODEL (CONT’D)

Business Case # 2

Leadership Component Proposed Role / Governance

System-wide IT Governance Group

• Governed by “board of directors” comprised of institutional and system

leadership (CBOs, IT, Academic, Chancellor)

• Provide strategic and directive oversight over IT related policies and initiatives

• Provide budgetary oversight for systematic IT initiatives

• Focus on transforming UWS IT to best support business / student management

needs

• Engage with other (external) institutions to identify collaborative opportunities

Leadership Components (Alternative CIO Model)

• Re-allocate Institutional IT Leadership – strategic and IT decision-making made

at system-level

• Reduced disparate IT administration services provided – move towards pooled

resources focused on systematic standardization (e.g., Data Center, analytics)

Structure Requirements:

• Systematic support for new approach (UWSA, Chancellors) – draft governing group bylaws and reporting structure

•

Negotiated and enforced SLAs with institutions – board and institutions must be held accountable to each other

• Formalized cost-recovery / funding model

• Decision-making authority for major IT initiatives – reduced campus autonomy for IT decision-making

• Early input into business decisions – IT must be integrated in business decisions and associated analyses

• Accountable to constituencies – elected board, communication channels, feedback loop, etc.

The defined roles of the System-wide IT Governance Group are critical to its success. To achieve a more

strategic approach to IT, Institution- and System-leadership should empower it with decision-making authority.

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

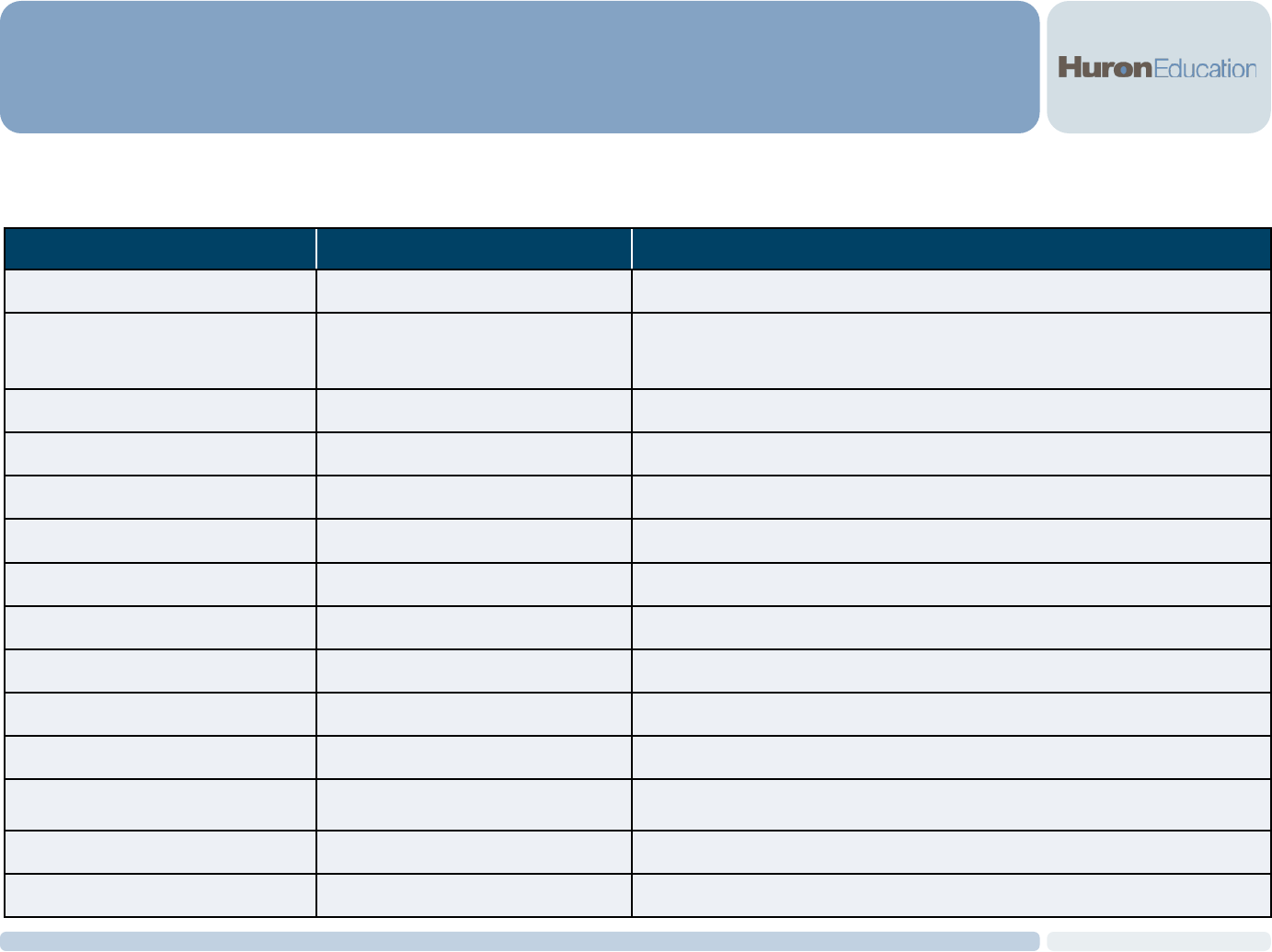

59

RECAP

The UWS should take several steps over the next few years to reorganize the way IT systems and services

are organized and provisioned to realize both medium- and long-term cost reductions.

Business Case # 2

Opportunity

Annual Est.

Savings

UWS Risk

Exposure

Efficiencies

Gained

Implementation

Complexity

Implementation

Timeframe

Business Case # 2

10

Centralize IT security resources Enabling Low High Medium 6-12 Months

11

Consolidate IT Helpdesks

$$$$

Medium Medium High 12-24 Months

12

Consolidate High Performance Computing

Enabling Low Medium Medium 6-24 Months

13

Consolidate datacenter facilities

$$$$

High High High 24-48 Months

14

Identify additional areas for system-wide

collaboration

TBD

TBD TBD TBD TBD

15

Re-Organize IT Leadership

$$$$

Medium High High 24-48 Months

Business Case #3:

Engage in Enhanced Strategic Sourcing for

IT Hardware

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

Business Case # 3

CONTEXT AND BACKGROUND

Our objective in this business case was to evaluate specific IT categories where increased strategic

sourcing and demand management could provide substantial savings to UW Institutions.

61

Objectives: Huron was asked to evaluate IT spend across the UW-System to determine where substantial cost

savings can be achieved.

• Evaluate System-wide spend on IT-related products

• Evaluate vendor-specific IT spend to determine savings opportunities (Dell, HP, Apple)

• Evaluate the processes and structures by which IT purchases are made

Future-State Considerations:

• Actual cost-savings are dependent on the willingness of individual UW Institutions to collaborate on purchasing

decisions, negotiations, and policy creation and compliance.

• Per UW Madison purchasing staff, collaboration efforts by the UW have historically been focused on the

purchase of software products due to a history of mandatory IT hardware contracts at DOA

© 2015 Huron Consulting Group. All Rights Reserved. Proprietary & Confidential.

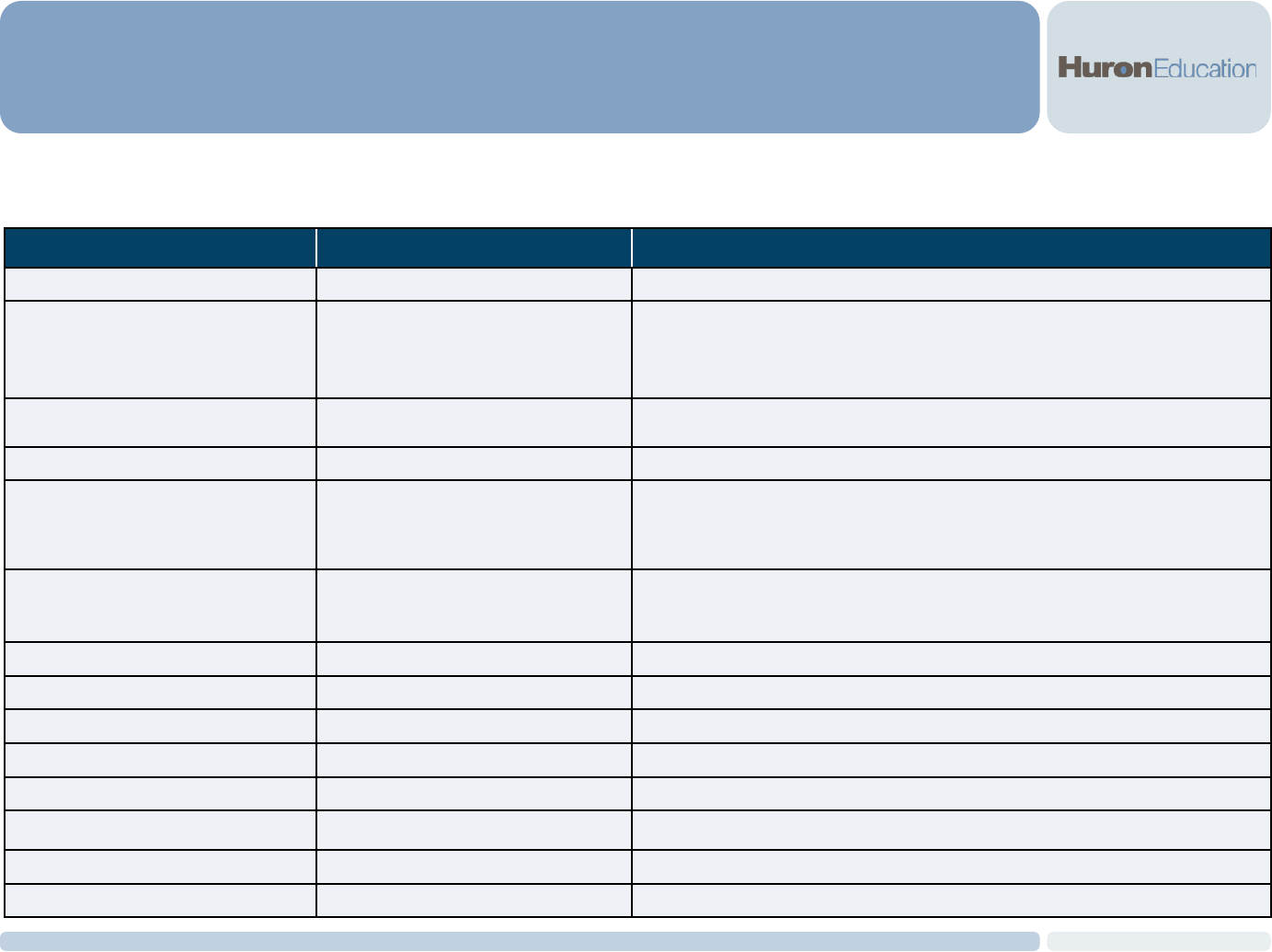

62

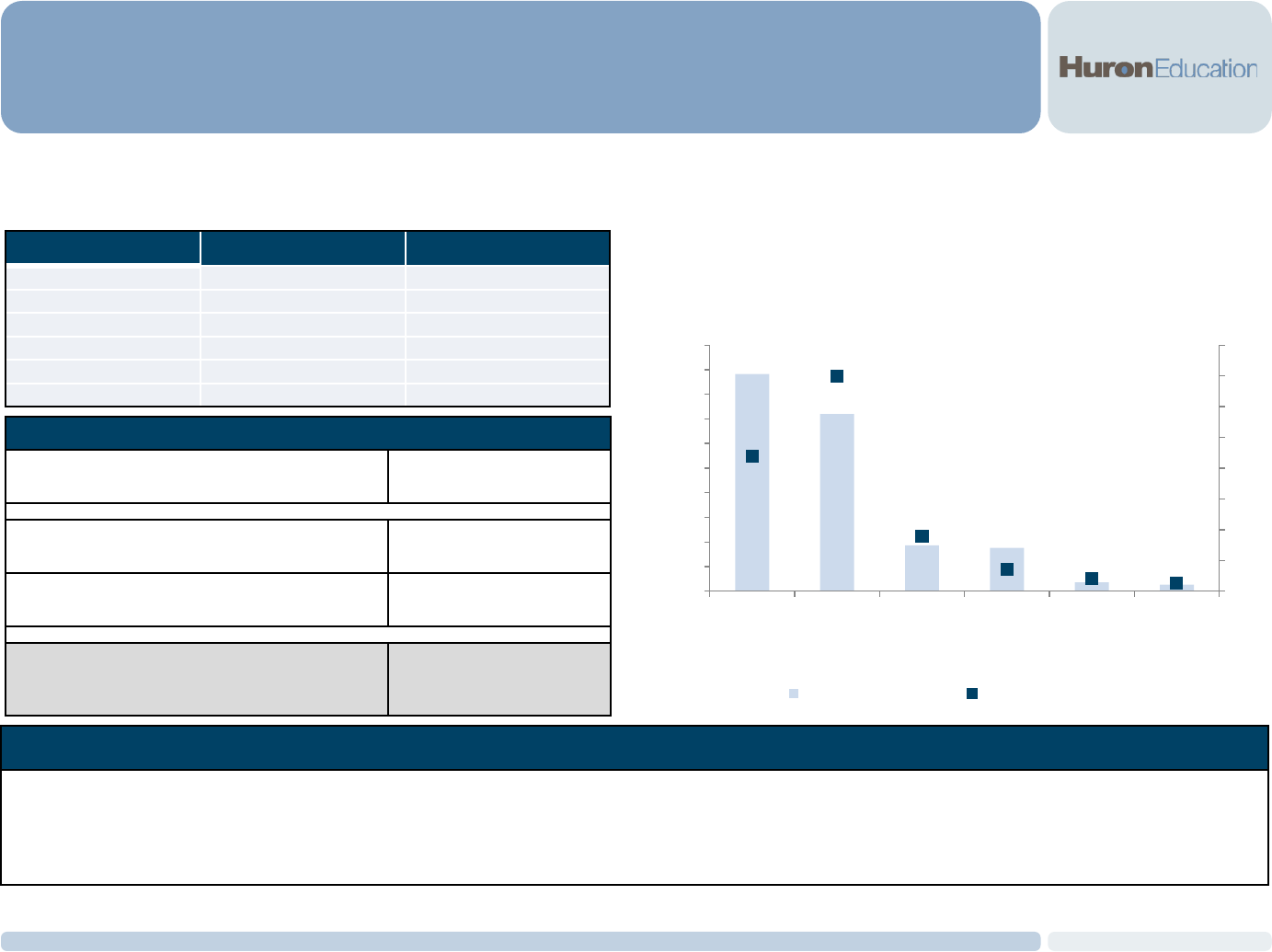

RECOMMENDATION OVERVIEW

Opportunity Annual Est. Savings

UWS Risk

Exposure

Efficiencies Gained