Defense Business Systems

Investment Management

Guidance

Version 4.1

June 26, 2018

DBS Investment Management Guidance June 26, 2018

Department of Defense Page 2 of 54

Table of Contents

1. Introduction ......................................................................................................................... 5

2. Investment Management Process ......................................................................................... 10

3. Governance ........................................................................................................................ 27

4. Investment Review Roles and Responsibilities ....................................................................... 30

Appendix A: 10 U.S.C. § 2222 ...................................................................................................... 32

Appendix B: Key Terms ................................................................................................................. 33

Appendix C: Acronyms and Abbreviations ...................................................................................... 38

Appendix D: Integrated Business Framework tools ......................................................................... 40

Appendix E: Organizational Execution Plan Portfolio Certification Request Memorandum – Sample .... 41

Appendix F: Out-of-Cycle Portfolio Certification Request Memorandum – Sample ............................. 42

Appendix G: Mandatory Data Elements .......................................................................................... 43

Appendix H: Investment Decision Memorandum – Sample ............................................................... 51

Appendix I: References and Resources .......................................................................................... 54

Table of Figures and Tables

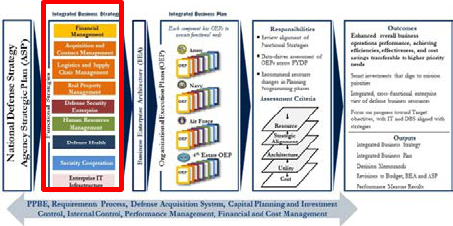

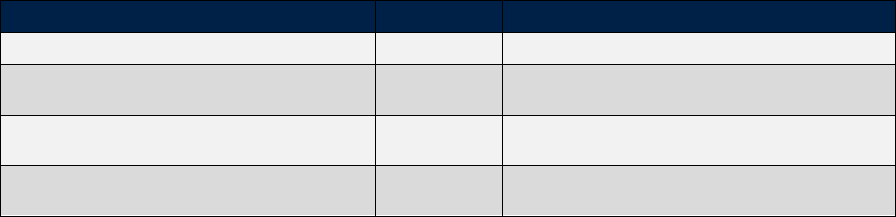

Figure 1 – Integrated Business Framework ..................................................................................... 7

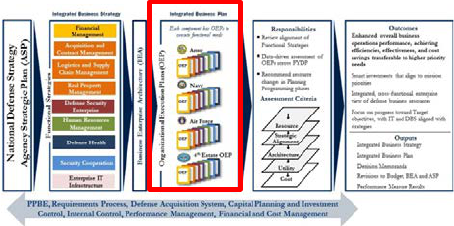

Figure 2 – Integrated Business Management Process Overview .......................................................10

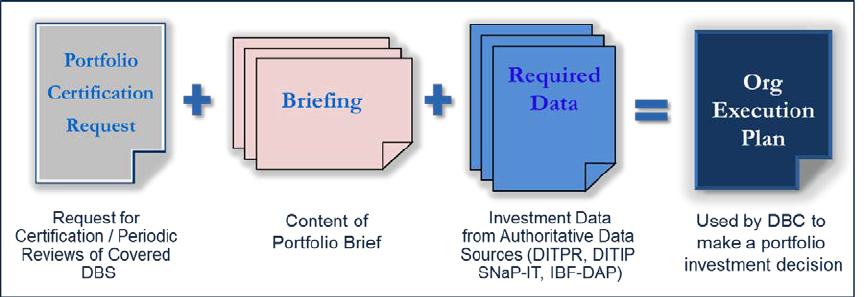

Figure 3 – Organizational Execution Plan Construct ........................................................................14

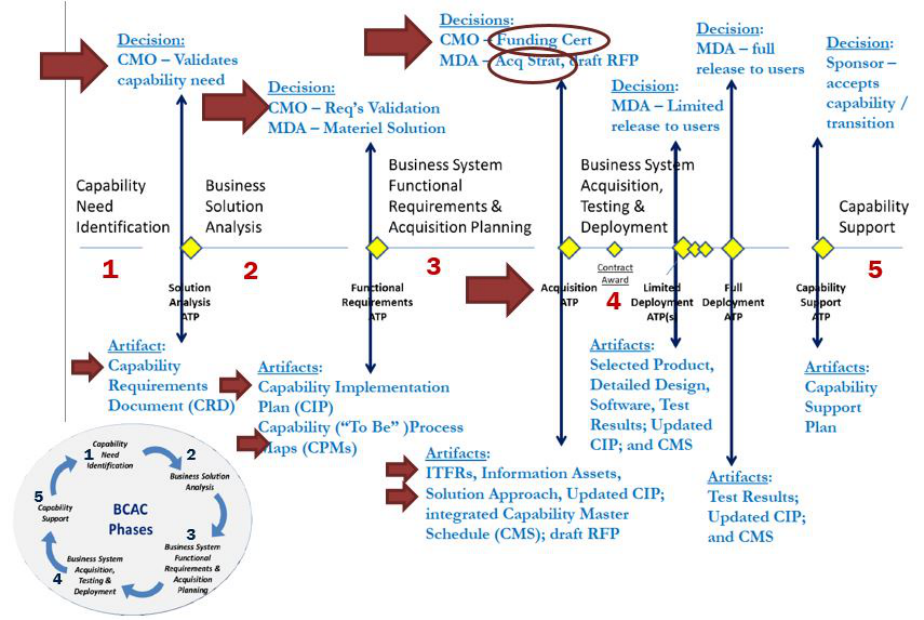

Figure 4 – Business Capability Acquisition Cycle ............................................................................18

Figure 5 – Out of Cycle Organizational Execution Plan Construct ......................................................26

Figure 6 – Integrated Business Framework tools homepage ............................................................40

Table 1 – Authoritative Data Sources .............................................................................................20

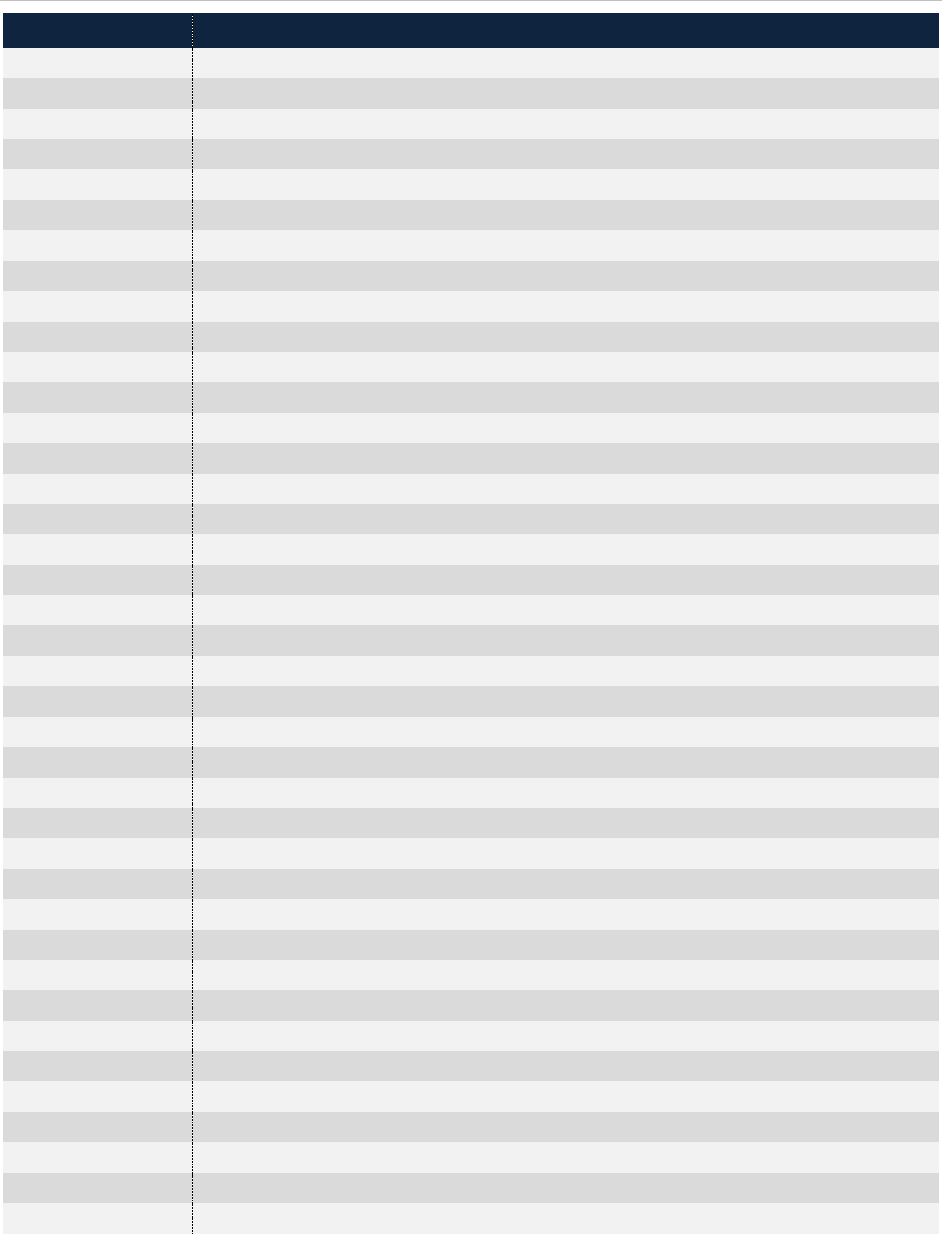

Table 2 – Investment Management Process Timeline ......................................................................24

Table 3 – Required Component Actions for OOC Requests ...............................................................25

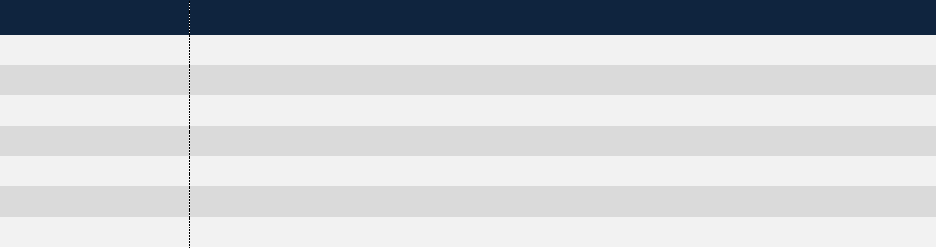

Table 4 – DBC Members ...............................................................................................................28

DBS Investment Management Guidance June 26, 2018

Department of Defense Page 3 of 54

Version History

Version

Date

Summary of Changes/Notes

1.0

June 2012

Initial release; preceded by a report to Congress how the DoD

intended to implement the FY12 National Defense Authorization Act

(NDAA) (http://dcmo.defense.gov/ >> Publications)

2.0

April 2013

• Improves alignment of Functional Strategies and Organizational

Execution Plans (OEPs)

• Directs Information Technology (IT) efficiencies with a goal of

10% reduction of Current Services (CS) across portfolios relative

to the prior year OEPs

• Provides guidance for the changes associated with the use of the

authoritative data sources in the Defense Business System (DBS)

investment review and certification process

• Seeks greater awareness of the Department’s Enterprise Resource

Planning (ERP) investments

• Increases visibility into costs of defense business operations with

focus on defense agency operating costs

• Provides guidance for Out of Cycle (OOC) certification requests

• Changes the process for reviewing OEPs submitted by all other

DoD organizational entities not included in the Military

Departments

• Improves the process for asserting Business Enterprise

Architecture (BEA) compliance using Architecture Compliance

and Requirements Traceability (ACART)

3.0

April 2014

• Synchronizes the Integrated Business Framework (described in

section 1.4) with the Planning, Programming, and Budgeting and

Execution (PPBE) process by focusing Defense Business Council

(DBC) reviews of Functional Strategies and OEP not only on

execution year fund certification requests, but also on the Future

Year Defense Program (FYDP).

• Directs identification of BEA operational activities that support

functional strategy initiatives and DBS reported in OEPs. Using

BEA Operational Activities to align Functional Strategies and

OEPs will help ensure planned DBS investments and expenditures

are aligned with DoD's business goals.

• Automates Functional Strategy and OEP content to improve the

DBC’s ability to make informed investment decisions based on

authoritative data and information.

• Improves the process for asserting compliance with the BEA.

• Incorporates review of reported progress toward Functional

Strategy performance measures.

• Defines better selection and control responsibilities within the

management of the capital investments that support business

operations.

DBS Investment Management Guidance June 26, 2018

Department of Defense Page 4 of 54

3.1

April 2014

Minor edits; Not formally released

3.2

April 2014

Minor edits; Not formally released

3.3

October

2014

Updated the OOC process and minor edits

3.4

February

2015

Eliminated Defense Business Systems Management Committee

(DBSMC) references; removed references to business systems used

within Military exchange systems funding by Nonappropriated Fund

(NAF); integrated portfolio management role of a charted Fourth

Estate Working Group

4.0

February

2017

• Clarifies Covered DBS as it applies in the guidance

• Revises thresholds for review/certification: Military Department

CMOs have approval authority for DBS investments below

$250M/FYDP; DCMO has approval authority for Fourth Estate

DBS investments $1M / FYDP and all DBS investments in excess

of $250M / FYDP

• Implements a process to meet 10 U.S.C. § 2222 requirements for

acquisition strategy, required documentation and auditability

compliance

• Implements the new 10 U.S.C. § 2222 requirement that DoD

business processes be continually reviewed and revised by

requiring components to report the results of this review as part of

their OEP annual review of systems

•

Codifies Defense Business Council as an advisory authority

4.1

April 2018

Minor edits;

• Changed DCMO to CMO throughout

• Added additional information to support business capability

acquisition cycle (BCAC), functional strategies and the BEA

• Updated definitions of core and legacy systems

• Removed the Appendix A NDAA text and added a link

• Minor updates to the purpose statement; timeline; out of cycle

table

• Updates made to include Acquisition and Strategy FS business

area as applicable

• Updated Appendix C Acronyms and Abbreviations

• Updated Appendix G Mandatory Data Elements and text for

business process reengineering (BPR) to add legacy systems

option and other editorial edits.

DBS Investment Management Guidance June 26, 2018

Department of Defense Page 5 of 54

1. Introduction

1.1. Background and Purpose

The DoD must continue to reform its business practices, improve its business operations

performance, and achieve efficiencies and effectiveness in order to achieve the Secretary of

Defense’s and Agency Strategic Plan’s (ASP) goal to reform the Department to reinvest

resources for warfighter priorities to the direct support of combat, combat support and combat

service support elements of the DoD. Achieving this goal requires reengineering business

processes; demonstrating beneficial returns on new and existing information technology (IT)

investments;

1

knowing what it costs to deliver business capabilities; and effective

implementation of the Capital Planning and Investment Control (CPIC) process for investments

in information technology (IT) that support these business processes and capabilities. This

document and the issuances listed below constitute the guidance required by title 10 U.S. Code

(10 U.S.C) § 2222 (c)(1):

• DoD Instruction 5000.75 “Business Systems Requirements and Acquisition” and

supporting acquisition policy and guidance

• DoD Directive 7045.14 “The Planning, Programming, Budgeting and Execution (PPBE)

Process” and supporting policy and guidance

• DoD Financial Management Regulation (FMR) Volume 2B, Chapter 18 “Information

Technology” and supporting IT budget policy and guidance

10 U.S.C. § 2222 provides requirements for annual review and approval for covered defense

business systems (DBSs) before they can proceed into development. If development is not

required, then the annual review and approval is needed prior to production, fielding, or

continued sustainment. 10 U.S.C. § 2222 gives greater responsibilities to Military Department

Chief Management Officers (CMOs) and defines the statutory thresholds for a covered DBS.

However, Military Departments and Fourth Estate

2

CMOs may lower thresholds used internally

as discussed later in this document.

With these laws, regulations and policies, the DoD has implemented processes to manage a well-

defined IT investment portfolio for the DoD Business Mission Area (BMA) and all DBSs. The

1

Return can be monetary or non-monetary, or a combination, with factors to include improved mission performance,

reduced business process or IT cost, improved process time, increased quality, better agility, improved security,

improved compliance, improved reporting, and/or increased user satisfaction.

2

Fourth Estate refers to Office of the Secretary of Defense (OSD), the Office of the Chairman of the Joint Chiefs of

Staff and the Joint Staff, the Combatant Commands, the Defense Agencies, the DoD Field Activities, and all other

organizational entities in the DoD that are not in the Military Departments. The CMO of the DoD is also the Fourth

Estate CMO.

DBS Investment Management Guidance June 26, 2018

Department of Defense Page 6 of 54

investment management process works in conjunction with the Planning, Programming,

Budgeting, and Execution (PPBE) process described in DoD Directive 7045.14 by focusing on

the strategy, goals and planned spending for business operations, to include DBS.

The DoD established the Defense Business Council (DBC) as the principal subsidiary

governance body to the Deputy’s Management Action Group for defense business operations.

The DBC also assumes the role of the Department's Investment Review Board (IRB) for DBS

investments. The DBC will refer to both the IRB and the DBC now codified as an advisory

authority in 10 U.S.C. § 2222.

This guidance supersedes “Guidance for Review and Certification of Defense Business Systems”

Version 4.0, dated April 16, 2017.

1.2. Summary of Changes

This guidance incorporates lessons learned from the previous investment review cycle.

Additionally, the guidance reflects the establishment of the DoD Chief Management Officer

(CMO).

3

The CMO continues as the CMO for the Fourth Estate and retains the threshold for the

review and certification of DBS investments at $1M over the FYDP.

1.3. Scope

The guidance is intended for DBS investment management process stakeholders, including

Principal Staff Assistants (PSAs), Military Department CMOs, affected combatant commanders,

directors of defense agencies, directors of DoD field activities and program managers. This

guidance applies to all DoD organizations and to the architecture, planning, budgeting and

obligation of funds, regardless of funding type for DBS investments.

The guidance does not apply to national security systems (NSS) or DBS used exclusively by and

within the defense commissary, exchange system or morale, welfare and recreation using non-

appropriated funds. An IT system which otherwise meets the definition of a DBS but has been

determined to not be managed as a DBS solely because it processes classified information or is

connected to a classified network or uses non-appropriated funds should be carefully assessed to

ensure relevancy of the DBS classification. Failure to comply with the certification requirements

of 10 U.S.C. § 2222 may result in a violation of 31 U.S.C. § 1341(a)(1)(A), otherwise known as

the Anti-deficiency Act.

For the Fourth Estate portfolios, the DoD CMO serves as the CMO. In accordance with 10

U.S.C. § 2222 and DoD Instruction 5000.75, the CMO designates the Fourth Estate minimum

threshold at $1M over the period of the current FYDP. The Military Department CMOs have

3

The term DoD CMO is used to reflect there is also a CMO of each military departments

DBS Investment Management Guidance June 26, 2018

Department of Defense Page 7 of 54

established minimum thresholds, based on their approval authorities, for any DBS investment

$250M or below over the period of the current FYDP. A Priority DBS is any DBS investment in

excess of $250M over the period of the current FYDP or as designated by the CMO as a Priority

DBS. The DoD CMO is the approval authority for all Priority DBS.

For the purposes of this guidance, the term ‘covered DBS’ includes those DBS investments

greater than the minimum thresholds stated above as well as the statutory thresholds defined in

10 U.S.C. § 2222.

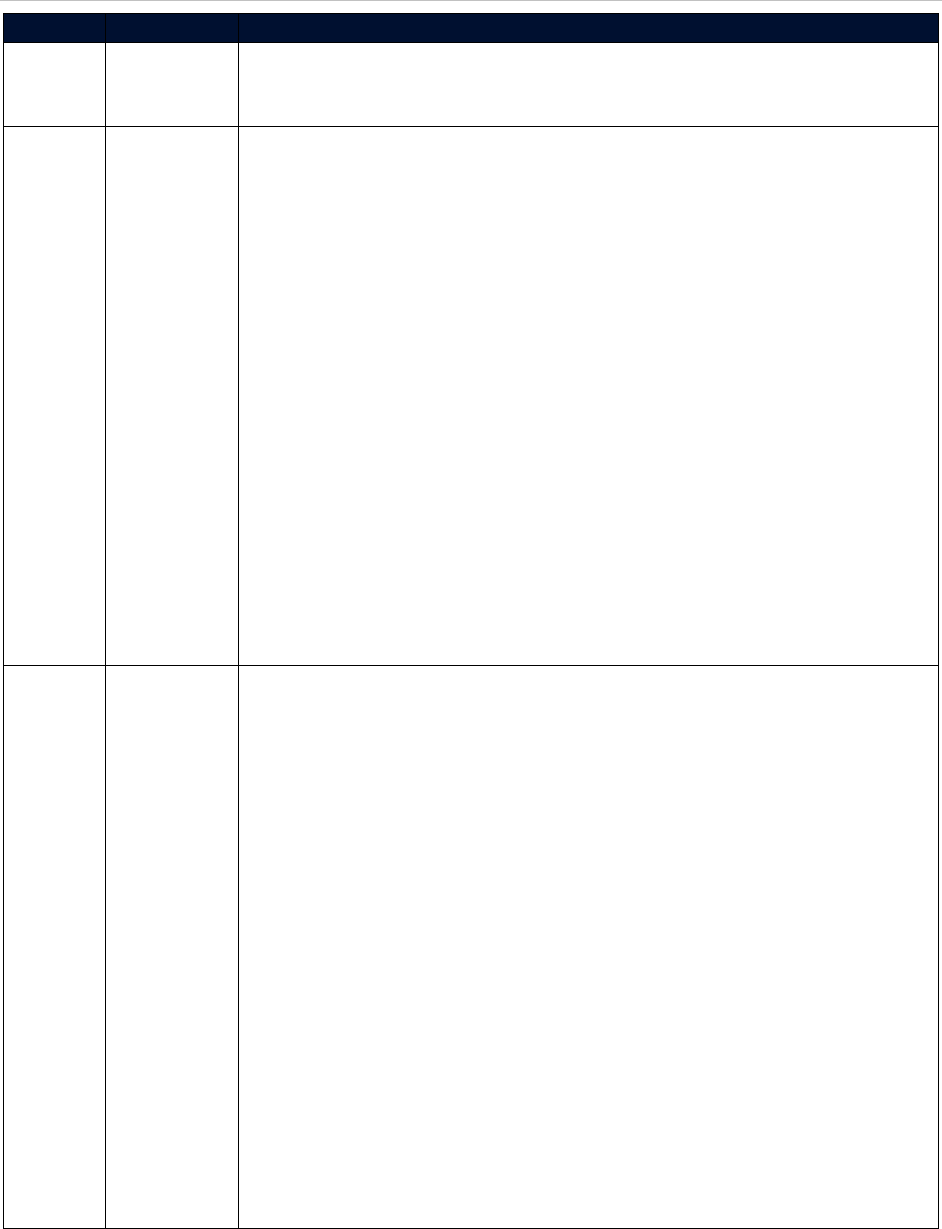

1.4. Integrated Business Framework Overview

The Integrated Business Framework (IBF)

4

provides the overarching structure used to help

understand how the Department governs and manages business operations to include business IT

investments. The IBF drives the creation of aligned business strategies, investment plans,

component execution plans, and the measurement of outcomes. The framework facilitates a

cross-functional, enterprise-wide view for the governance and review of DBS and certification of

covered DBS over the period of the current FYDP. One of the elements of the ASP, as

illustrated in Figure 1, is the enterprise plan for improving DoD's business operations.

Figure 1 - Integrated Business Framework

Guided by the ASP, the PSAs, as the business line owners, develop and periodically refine the

Functional Strategies. The Functional Strategies are an important element within the investment

management process because they establish strategic direction for PPBE activities. Reflecting

4

The IBF originated with the DoD implementation of section 901 of the FY2012 NDAA.

DBS Investment Management Guidance June 26, 2018

Department of Defense Page 8 of 54

the planning associated with business operations and the IT portfolios that support them, the

Functional Strategies articulate business outcomes, priorities, measures, and standards. An

Organization Execution Plan (OEP) is developed by each organization and specify the

organization’s annual certification request. The OEP articulates an organization’s approach to

align with the Functional Strategies and produce business results. The objective is to enable end-

to-end integration, improve business operations, and leverage the appropriate technology to

deliver agile, effective, and efficient business solutions that support and enable the Warfighter.

Within the IBF, the Functional Strategies and OEPs inform the Business Enterprise Architecture

(BEA) and support an integrated business strategy for the DoD. The IBF will continue to mature

as the DoD achieves outcomes.

Given the IBF focus on efficient and effective performance management, the IBF integrates with

the DoD’s PPBE annual resource allocation process, the Defense Acquisition System and the

management internal control program.

5

The IBF also utilizes resource management principles

though cost management and financial accounting to support decision-making and to

demonstrate DoD accountability externally. The DoD Performance Management Framework, as

outlined in the ASP and Office of Management and Budget Circular A-11, institutes a

disciplined approach to providing leadership with a linkage between performance and resourcing

management through strategy, planning, monitoring, reporting and managing progress.

Performance and resourcing management are integral components in the IBF that helps to

enhance the overall business operations performance, achieving efficiencies and cost savings.

The IBF also incorporates the CPIC process required by the Clinger-Cohen Act of 1996 for

selecting, managing, and evaluating the results of DoD’s investments in DBS. The IBF is

broader and addresses the Department’s business operations, business processes, and business

strategy, and CPIC is incorporated within the IBF to focus on IT investments. It also encourages

the use of performance and results based management business process reengineering prior to

investing in IT. Organizations develop and review their portfolios based on investments for

business functions and activities in both Core (part of the target environment) and Legacy

(scheduled for termination within 36 months) systems and services. Portfolios are evaluated for

alignment with applicable Functional Strategies and assessed from multiple perspectives such as

strategic alignment, performance, risk, affordability, business value, return on investment (ROI),

cost, duplication of capabilities, architecture alignment and compliance, interoperability,

efficiency, and effectiveness. The DBC and components establish selection and control criteria

for the management of the portfolio to achieve the outcomes and performance required. Review

criterion ensures that IT projects and systems support the organization’s ongoing and future

5

The PPBE process, defined in DoDD 7045.14, is the annual resource allocations and requirements process that

provides validated and prioritized capability requirements. The Defense Acquisition System, defined in DoDD 5000.01

and DoDI 5000.75, is a process that provides effective, affordable, and timely systems to users. Internal control

program, defined in DoDI 5010.40, helps an entity run its operations efficiently and effectively, report reliable

information about its operations and comply with applicable laws and regulations.

DBS Investment Management Guidance June 26, 2018

Department of Defense Page 9 of 54

business needs. The DBC evaluates portfolios to ensure compatibility with the ASP and

Functional Strategies and provides budget and certification adjustment recommendations where

necessary.

The approval of certification requests declares that a DBS meets 10 U.S.C. § 2222 requirements

to obligate funds. The DBC may also submit issues into the PPBE process where required.

Portfolios should demonstrate progress in portfolio performance to optimize portfolio cost and

ensure investments contribute to a lower total cost of business operations and / or deliver

required capabilities to the Warfighter.

This guidance implements the new 10 U.S.C. § 2222 requirement that DoD business processes

be continually reviewed and revised. The BEA acts as a blueprint to guide the development of

integrated business processes within the DoD. Organizations are to regularly review their

business processes and those of the DoD enterprise as appropriate and revise or make

recommendations to revise them. Revision of these processes occurs through business process

reengineering and continuous process improvement.

DBS Investment Management Guidance June 26, 2018

Department of Defense Page 10 of 54

2. Investment Management Process

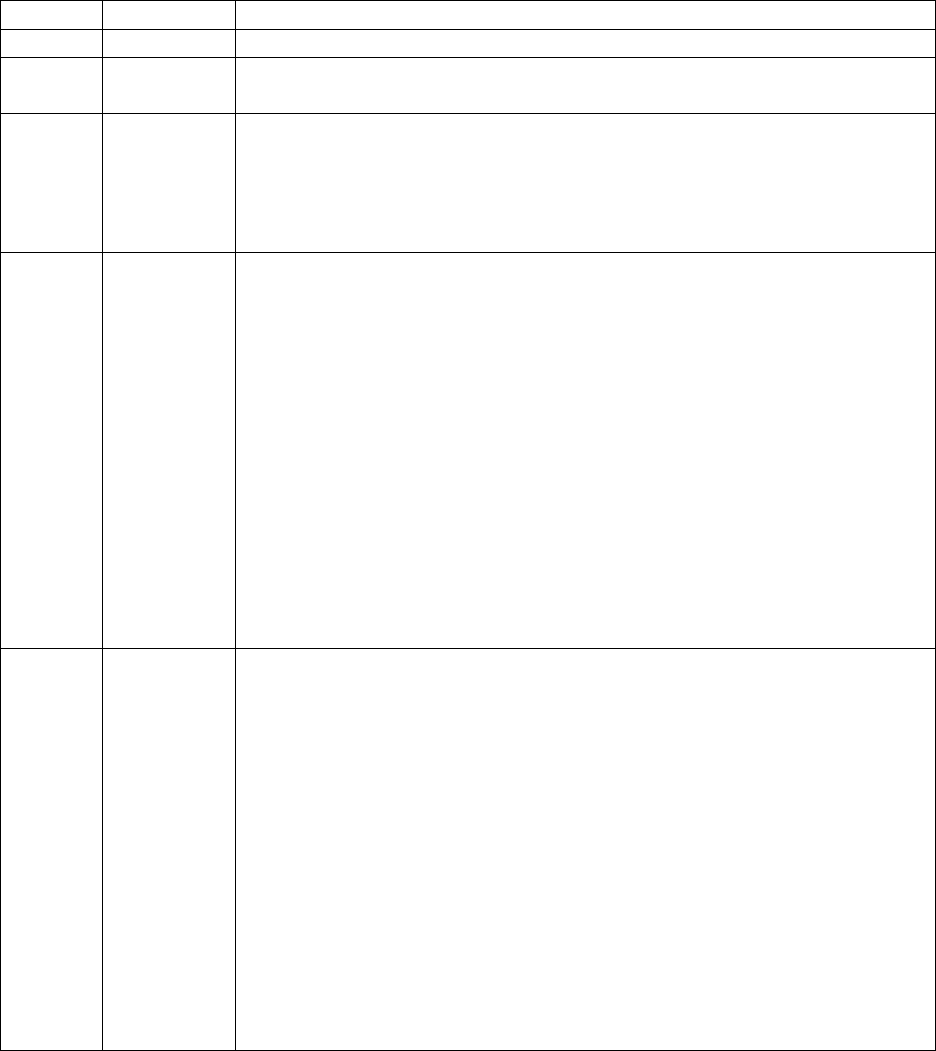

The annual investment management process includes ASP and Functional Strategies as inputs

used by the appropriate DoD PSAs as illustrated in Figure 2. Organizations then use these

business strategies and priorities to develop and refine their portfolios. The integrated business

strategy will serve as additional guidance to the Pre-Certification Authorities (PCAs)

6

for their

budgets in the DoD business mission area. The Functional Strategies may include evaluation

criteria that the PSA will use to evaluate budget and certification requests proposed by the PCA.

The PSA may also identify DBS that should be considered by the PCA for retirement based on

misalignment to DoD business goals, costs, duplication or other factors.

Figure 2 – Integrated Business Management Process Overview

6

The term PCA no longer exists in 10 U.S.C. § 2222 however the term is being retained to address the compliance

determinations that will continue to be made by the component level leadership before approval by the appropriate

approval officials, the DCMO and the Military Department CMOs. For example, the component PCA will continue to

make system and business system portfolio BEA compliance determinations in advance of the appropriate approval

official determinations based on PCA determinations. Component PCAs will continue to be designated senior

executives, flag officers, or general officers.

DBS Investment Management Guidance June 26, 2018

Department of Defense Page 11 of 54

OEPs will be representative of the organization’s covered DBS budget and certification request

and must demonstrate the organization’s efforts to align DBSs with outcomes and Functional

Strategies to drive value in the DoD’s business IT investment portfolio.

As the plan matures, OEPs will represent more than the DBS investment IT resources to become

the organization’s integrated business plan to achieve the outcomes and goals articulated in both

the ASP and Functional Strategies. OEPs must also identify the component’s business goals.

The DBC can review each OEP and make recommendations to the Chair regarding certification.

Additionally, the DBC may issue decision documents where appropriate, to the Director, Cost

Analysis, and Program Evaluation (DCAPE) and the Under Secretary of Defense (Comptroller)

(USD(C)), for proposed DBS investment budgeted funds which are not aligned to Functional

Strategies.

2.1. Functional Strategies

Integral to the IBF, Functional Strategies

represent a crucial component of the strategic

planning process for the BMA. Functional

Strategies articulate each functional area’s

strategic vision, business outcomes, and

measurable targets over the next three to five

years. Functional Strategies should be aligned

to the ASP and the Department’s Reform

initiatives in order to ensure integration,

alignment, and interoperability across the DoD. They will be used to provide guidance and

prioritize activities as they propose how to deliver the DoD’s business priorities and assemble

DBSs into portfolios, known as OEPs. Functional Strategies inform the re-selection of DBS

investments via certification in the portfolio prior to the fiscal year of execution and provide

direction used to inform IT investment decisions now and in the future.

Functional Strategy Business Areas

Functional Strategies are developed by the appropriate PSA for business areas and captured

within the Integrated Business Framework – Data Alignment Portal (IBF-DAP), an on-line tool,

provided by the Office of the Chief Management Officer (OCMO). The IBF-DAP enables

informed DBS decisions based on data (see Appendix D). An “other” business area is included

to address DBSs that do not map to one of the existing areas or are not specifically listed in 10

U.S.C. § 2222 (j)(1). The business area “other” does not have a Functional Strategy but PSAs

may develop one as the business alignment process continues to evolve. These categories may

result in additional content within the BEA to address these functions, activities, or capabilities.

Current functional strategy business areas are listed below:

• Acquisition and Contract Management (Under Secretary of Defense for Acquisition and

Sustainment (A&S))

DBS Investment Management Guidance June 26, 2018

Department of Defense Page 12 of 54

• Logistics and Supply Chain Management Readiness (Under Secretary of Defense for

A&S)

• Defense Health (Under Secretary of Defense for Personnel and Readiness)

• Defense Security Enterprise (Under Secretary of Defense for Intelligence)

• Real Property Management (Under Secretary of Defense for A&S)

• Enterprise IT Infrastructure (DoD Chief Information Officer (CIO))

7

• Financial Management (Under Secretary of Defense (Comptroller))

• Human Resources Management (Under Secretary of Defense for Personnel and

Readiness)

• Training and Readiness (Under Secretary of Defense for Personnel and Readiness)

• Security Cooperation (Under Secretary of Defense for Policy)

• Other

8

All DBS from all functional areas within the BMA must adhere to the business outcomes,

standards, measures, and planned initiatives specified in the applicable functional strategies.

Multiple Functional Strategies can affect any single business system.

Functional Strategy Elements

The IBF-DAP will capture the required sections for each Functional Strategy element listed

below (see Appendix D). The DBC may review a Functional Strategy briefing generated from

data captured in the IBF-DAP.

• Functional Overview: This section of the Functional Strategy defines the mission and

vision.

7

Guidance in the Enterprise IT Infrastructure Functional Strategy applies to all DoD business IT systems. The strategy

for Enterprise IT Infrastructure provides the DoD CIO’s requirements for all DBS to ensure systems can operate in the

Joint Information Environment (JIE). Due to the crosscutting nature, the Enterprise IT Infrastructure is not a business

system portfolio and should not be selected in DITPR as the functional area for any DBS system.

8

The Other category includes functions and systems that do not fit into another function and typically includes case /

correspondence / task / records management, project or program management, library management, administrative

management, business intelligence, inspector general, or other staff functions.

DBS Investment Management Guidance June 26, 2018

Department of Defense Page 13 of 54

• Functional Strategy Business Outcomes: Each Functional Strategy business outcome

should demonstrate a clear linkage to ASP goals and Functional Strategy initiatives. The

Functional Strategy business outcomes should address all applicable ASP line items.

This section of the Functional Strategy defines business outcomes that are critical to

achieving DoD business goals. The business outcomes must include measurable targets,

risks, and challenges. OEPs submitted by organizations should align to the business

objectives and must measure their progress toward achieving the business goals.

• Functional Strategy Initiatives: This section of the Functional Strategy defines

initiatives deemed critical to the achievement of one or more business outcomes. The

Functional Strategy initiatives must demonstrate measureable targets, risk and challenges

(e.g. interdependencies), and assess progress toward accomplishment of business

outcomes. An initiative should state whether compliance with a standard or the use of an

enterprise system is required. The OEPs submitted by organizations should subsequently

align to these strategic initiatives and support metric progress. Each Functional Strategy

should also demonstrate a clear linkage in IBF DAP between the Functional Strategy

initiatives to the Operational Activities and applicable Laws, Regulations and Policies in

the BEA.

• Business Outcome and Prior Year Initiative Progress: This section documents

progress toward business outcomes identified in prior Functional Strategy’s performance

results in addition to percentage completeness relative to the target.

2.2. Organizational Execution Plan

The primary focus of the OEP is the annual

identification and prioritization of DBS

investments over the period of the current

FYDP as aligned with the strategic direction

from applicable Functional Strategies. OEPs

represent the ongoing results of an

organization’s CPIC effort for the analysis,

selection, control, and evaluation of its

portfolio of DBS used to support business

operations focusing on the year of execution. The results of an organization’s plan for managing

its portfolio of business IT investments in alignment with the Functional Strategies and ASP are

also represented. As a result of the CPIC control and evaluation phases, the OEP highlights

changes from the previous plan to help demonstrate aspects of component compliance with 10

U.S.C. § 2222.

The OEP certification review is performed annually on the approaching fiscal year of execution.

The year of execution budget amounts will form the basis of the certification request submissions

for the portfolio. Review of the OEP consists of the entire DBS portfolio as well as past and

future year budgets.

DBS Investment Management Guidance June 26, 2018

Department of Defense Page 14 of 54

OEPs include data from authoritative sources that help support investment management

decisions. All DBS investments across the period of the current FYDP are included in the OEP

by virtue of being in the DoD Information Technology Portfolio Repository (DITPR), DoD IT

Investment Portal (DITIP), and Select and Native Programming Data Input Systems for IT

(SNaP-IT) and are therefore available for DBC review. However, the OEP certification review

mainly focuses on the covered DBS investments.

Information for each DBS as identified in Appendix G must be documented within the DoD’s

authoritative data sources prior to the initiation of DBC reviews on a date that will be established

by the DBC chair. Covered DBSs will be at risk of not receiving certification and omitted as a

resource requirement within the future year budget if these Mandatory Data Elements are not

complete.

Organizationally, there is one OEP for the Fourth Estate made up of individual component OEP

chapters, and there is one OEP for each of the Military Departments made up of chapters. The

organization develops and submits the OEP or OEP chapter to the DBC by issuing a Portfolio

Certification Request (PCR). The PCR template is provided in Appendix E. In addition to the

PCR, the OEP includes an agency portfolio briefing developed using the Integrated Business

Framework – Data Alignment Portal (IBF-DAP) and validated system data from the other

authoritative data sources. Figure 3 illustrates the construct of an OEP.

Figure 3 – Organizational Execution Plan Construct

DBS Investment Management Guidance June 26, 2018

Department of Defense Page 15 of 54

Portfolio Certification Request

The PCR is the document developed by the PCA that asserts compliance with goals and

initiatives articulated within functional strategies and the requirements of 10 U.S.C. § 2222. The

PCR contains an update to the status of outstanding Investment Decision Memorandum (IDM)

conditions. See Appendix E for a PCR template.

When preparing a PCR, the PCA must review the portfolio and determine if each IT investment

is a DBS based on the definition provided in 10 U.S.C. § 2222 (i)(1). If the answer to any of the

questions below is “yes” then the IT investment likely meets the intent and therefore falls under

the authority of 10 U.S.C. § 2222.

• Does the IT investment support a business operation, function, or activity that meets the

definition of a DBS?

• Does the IT investment used to support a business operation, function, or activity meet

the definition of an information system, as defined in title 44 U.S.C. § 3502?

• Does the IT investment rely on other DBSs for interoperability?

• Does the IT investment rely on a level of adherence to the BEA to effectively guide,

constrain and permit interoperable DBSs solutions or support the governance framework

for DBSs?

• Does the IT investment involve inherently managerial functions or provide business

functions or capabilities such as strategic planning, case / correspondence / records

management, project or program management or other staff functions performed at a

management headquarters level?

As referenced in Section 1.3, certification requests for covered DBSs are not limited to systems

that reside on the Non-Classified Internet Protocol Router Network (NIPRNet). If the DBS

performs a business function, such as acquisition, financial management, logistics, strategic

planning and budgeting, installations and environment and human resource management then it

may be a candidate for certification.

Once the PCA determines the portfolio of investments that are DBSs, the PCA must determine

how the proposed DBS (see Appendix A):

DBS Investment Management Guidance June 26, 2018

Department of Defense Page 16 of 54

1) Comply with the Functional Strategies and are (or will be) in compliance with the BEA

9

2) Have undertaken appropriate Business Process Reengineering (BPR) efforts to ensure

that:

a) The business process supported by the DBSs are as streamlined (or are being

streamlined) and efficient as practicable as well as to match best commercial

practices, to the maximum extent practicable, so as to minimize customization of

commercial business systems and

b) The need to tailor commercial-off-the-shelf (COTS) systems to meet unique

requirements or incorporate unique interfaces has been eliminated or reduced to the

maximum extent practical;

3) Have valid, achievable requirements and a viable plan for implementing those

requirements (including, as appropriate, market research, business process reengineering

and prototyping activities);

4) Have an acquisition strategy designed to eliminate or reduce the need to tailor

commercial off-the-shelf systems to meet unique requirements, incorporate unique

requirements or incorporate unique interfaces to the maximum extent practicable; and

5) Comply with the DoD’s auditability requirements.

PCAs also classify DBS as “Core” or “Legacy” by their establishment of lifecycle end dates in

DITPR. A core DBS is an enduring system with a sunset date greater than 36 months.

10

A

Legacy DBS is a system with a sunset date within 36 months. FYDP budget data must

appropriately reflect this determination. For Core DBSs, the organization must ensure that the

DBS is compliant with all applicable BEA regulations, policy, data standards, and business rules

and that appropriate BPR efforts have been undertaken. DBSs currently in sustainment with no

future modernizations planned are not required to create a requirements plan document or an

acquisition strategy that meets the new requirement. Components will identify these DBSs for

DBC or Military Department CMO review.

9

Portfolio BEA compliance determinations required by 10 U.S.C. § 2222 (g)(1)(b) will be made by the PCA, the Military

Departments CMO and the DBC as appropriate. PCAs should note in their PCR memo whether portfolio

determinations were conducted. As DoD policy, at the portfolio level, the “business system portfolio will be in

compliance with the BEA developed pursuant to subsection (e) or will be in compliance as a result of modifications

planned.” If there is one or more noncompliant system in a portfolio, the portfolio will always be planned compliant.

10

Core and legacy dates are generally calculated based on the start of the particular fiscal year of analysis, however any

base date could be used.

DBS Investment Management Guidance June 26, 2018

Department of Defense Page 17 of 54

The CMO has specified that organizations must perform BEA assessments in IBF-DAP and must

assert compliance in DITIP to ensure BEA assessments are consistent and rigorous. Enterprise-

wide use of the functionality within IBF-DAP has the additional benefit of creating an

authoritative data source of BEA compliance assessment information. The DBC leverages BEA

compliance assessment information as part of the certification process. Legacy DBSs are not

required to assess or assert compliance with applicable BEA requirements but they are required

to perform mappings in IBF-DAP to applicable BEA Operational Activities, Business

Capabilities, Processes, System Functions, and End-to-End (E2E) Processes. DITIP will

document covered DBS assertions for compliance with requirements plan documents, acquisition

strategy, and auditability assertions.

The PCA is responsible for determining whether appropriate BPR

11

has been accomplished or is

planned prior to submitting request for investment certification. All DBS must be aligned to

appropriate business processes within the BEA. DITIP will document BPR covered DBS

assertions and the PCR will include an overall statement of compliance.

When a DBS investment contains resources provided from multiple organizations, the PCA for

the executive agent / primary investment owner of the DBS investments is responsible for

coordinating with the resource providers to ensure the investment reports all known resources in

SNaP-IT and the PCR addresses the entire amount expected for obligation. In order to avoid

duplication, there is also a responsibility upon the PCA within the contributing organizations to

ensure resource contributions to DBS investments within other organizations’ portfolios are

correctly documented in SNaP-IT. The executive agent / investment owner must make the

certification requests for systems with shared funding in SNaP-IT. This direction is similar to

the budget request responsibilities defined in DoD Financial Management Regulation Volume

2B, Chapter 18.

Once the PCA has determined the DBSs are compliant or planned compliant, the PCA must

determine if each DBS investment is covered based on the definition provided in 10 U.S.C. §

2222 (i)(1), as well as any lower thresholds established by the CMO.

The PCA is responsible for submitting certification requests for each covered DBS in DITIP.

The amount and appropriation type of funds associated with each system certification request

should be in agreement with the amount and type in the DoD IT budget exhibit data in SNaP-IT.

Deviations must be justified with an explanation entered in the DITIP. Certification is by year of

obligation. In cases where the appropriation allows obligation over more than one program year,

the program year field will identify the year. However, any deviations between DoD IT budget

exhibit data for a specific program year and corresponding certification request amount require

explanation. DITIP will document the certification requests and associated explanations.

Appendix G provides the compliance options available for each 10 U.S.C. § 2222 (g) item. Final

11

Title 10 § 2222 (a) and (b)

DBS Investment Management Guidance June 26, 2018

Department of Defense Page 18 of 54

certification amounts and associated actions, conditions, or comments will also be documented in

DITIP.

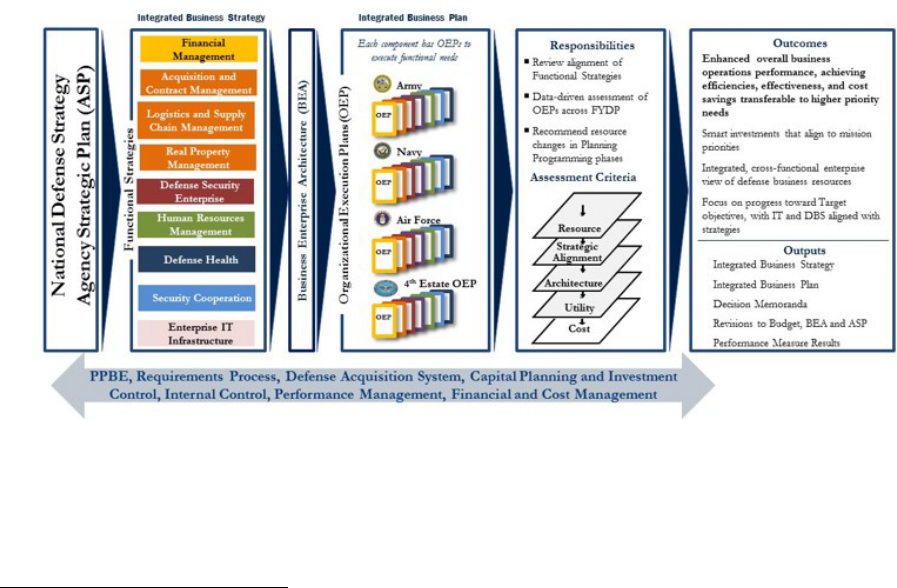

All requests for review and certification of covered DBS that include funding for Development /

Modernization (Dev / Mod) must have approved documentation as identified in DoD Instruction

5000.75. Figure 4 illustrates the business capability acquisition cycle (BCAC) process for

business system requirements and acquisition, its phases, and the CMO decisions. For the

Acquisition authority to proceed (ATP), per 10 U.S.C. § 2222 (h), the relevant CMO § 2222

certification and approvals must be made before the milestone decision authority (MDA)

authorizes acquisition of the business system and approves continued execution of the updated

implementation plan.

Certification under § 2222 for Dev / Mod funding typically would review the following

Acquisition ATP documentation to ensure § 2222 (g) requirements (BPR; BEA compliance;

valid, achievable requirements and a viable plan for implementing those requirements;

acquisition strategy; auditability requirements) are met: the implementation plan, definition of IT

functional requirements, and overall solution approach, as well as previous phase ATP

documentation, to include the capability requirements document and capability “to-be” process

maps. Certification under § 2222 for current services (CS) funding would assess confirmation

that the covered defense business system program continues to satisfy the requirements.

Figure 4 - Business Capability Acquisition Cycle

DBS Investment Management Guidance June 26, 2018

Department of Defense Page 19 of 54

Definitions for Dev / Mod and Current Services are defined in the DoD FMR 7000.14-R,

Volume 2B, Chapter 18.

Organizational Execution Plan Briefing Content

The OEP provides critical information to support decision-making for future year programming,

budgeting, and annual certification of covered DBS. The OEP includes an agency portfolio

briefing developed using the Integrated Business Framework – Data Alignment Portal (IBF-

DAP). Instructions that conform to the OEP specifications in this section are also included in

IBF-DAP. At a minimum, IBF-DAP input for the briefing will address the following:

• Portfolio Business Summary: Introduce the portfolio from a business operations

perspective. Summarize the major business process(es), functions, activities, and

outcomes supported by the DBS with relevant annual high-level financial information as

to the costs of the business operations, if known. Also, provide and explain the key cost

drivers of the business operations. Cost drivers are factors of a particular activity or the

unit of an activity that causes the change of an activity cost.

• Strategic Alignment: Identify the portfolio goals in order to highlight how

improvements in business operations and cost savings will be made and how they are

essential to achieving the integrated business strategy. Show how the Component’s OEP

aligns with the initiatives of the appropriate Functional Strategy(ies) and document how

investments align to the functional strategy initiatives, by using Unique Investment

Identifiers. Goals will include portfolio priorities, objectives, or outcomes. Also, include

cost and time estimates to implement a functional strategy initiative.

• Performance Measures: Document business outcome measures and targets related to

the strategy and associated DBSs – especially with regard to progress against the

Functional Strategy targets. DITPR and other sources, such as acquisition information

repositories, will provide lifecycle data for milestone information.

• Portfolio Accomplishments: Report on the control and evaluate phases of CPIC and the

results of business process reengineering. Identify major business results / outcomes

bound by a link to measurable benefits that were realized within the fiscal years

preceding the OEP and not previously reported. Emphasize results that lower the actual

cost of business operations and reduce redundancy in IT. This should be a higher-level

summary report.

• PCA Review Results: Provide a summary of results of the PCA review required by 10

U.S.C. § 2222 (g) for covered DBS and 10 U.S.C. § 2222 (a) for review of business

processes. Results will include any DBSs with a change in transition plan state and the

reason for the change, any changes in termination dates of legacy DBSs, any revision of

milestones and performance measures in the previous fiscal year, progress against BEA

or BPR plans; and any significant changes in plans such as funding amounts or

certification requests not recommended by PCA. The results should also include the

DBS Investment Management Guidance June 26, 2018

Department of Defense Page 20 of 54

PCA criteria used for selecting investments for certification and investment alignment to

functional strategy initiatives and criteria for reviewing business processes.

• Roadmap to the target environment: Show how systems align to the desired end state

(including sunset dates or timeframes and interoperability with other systems as

appropriate). Include any systems that have been sunset. Prior year outcomes should be

included to highlight systems planned to sunset in the prior OEP submission and the

eliminations that actually occurred. The roadmap presented must be consistent with the

data entered into DITPR and the FYDP budget data. The roadmap should also address

system changes related to a business strategy initiative, such as a plan for transitioning to

a mandatory enterprise system.

• Portfolio Risks and Challenges: Describe risks or challenges that inhibit the

Component’s ability to reach its desired end state. If applicable, address risks and

challenges associated with becoming fully BEA compliant. These risks or challenges

could include BEA and BPR compliance matters such as use of mandatory standards or

enterprise systems stated in Functional Strategies or a lack of needed standards or

enterprise systems. Risks applicable to the entire DoD such as sequestration should not

be included. Many system and service investments that deliver services across multiple

business areas may align to more than one Functional Strategy and more than one

initiative. Systems must be identified with the functional area that aligns closest to the

system’s primary business area to enable an efficient and effective review. Regardless of

the identification, DBS within a functional area will normally align to initiatives within

multiple Functional Strategies and thus may require resources to address the initiatives

within the different functional areas.

Organizational Execution Plan Required Data

Component system owners are required to provide a standard set of minimum data elements in

the authoritative data sources identified in Table 1 no later than the date prescribed by the DBC

chair for the investment review. This requirement ensures that DITPR, SNaP-IT, IBF-DAP, and

DITIP have accurate and complete information for the data elements identified in Appendix G.

This authoritative data facilitates in-depth analysis that informs the DBC review and

certification. Data analytics will be performed at the functional level for each organization and

functional area as well as across organization and functional area. DBSs that do not have the

data required in Appendix G will be at risk of not receiving certification.

Authoritative Source

Type

Information Contained

DoD IT Portfolio Repository (DITPR)

Database

Defense Business System Attributes

Select and Native Programming Data

Input Systems for IT (SNaP-IT)

Database Budget Data

Integrated Business Framework Data

Alignment Portal (IBF-DAP)

Portal OEP alignment for Strategy and BEA

DoD IT Investment Portal (DITIP) Portal

Merged Source for DBS Certification

Requests

Table 1 Authoritative Data Sources

DBS Investment Management Guidance June 26, 2018

Department of Defense Page 21 of 54

Organizational Execution Plan Submission Requirements

OEP data must be made available in DITPR, IBF-DAP, SNaP-IT, and DITIP. The PCR OEP

memorandum will be uploaded to the OEP module in IBF-DAP and the OEP brief will be

generated. OEP submissions are to be submitted no later than the date established by the DBC

chair. Defense Agencies and Field Activities should submit one OEP for all business areas in

coordination with the appropriate PSA.

2.3. Organizational Execution Plan Evaluation Process

OEPs will be evaluated for alignment with applicable Functional Strategies and assessed from

multiple perspectives such as progress toward the target environment, alignment to lines of

business and architecture, business value / ROI, cost, interoperability, efficiency, risk, and

effectiveness. OEPs will undergo a CMO review to create investment awareness and assist the

DBC in understanding the organization’s capabilities in a given functional area. The review

helps determine whether OEPs meet the requirements of Functional Strategies and identify any

gaps between the OEP and the Functional Strategies. Reviews will encompass both a functional

and organizational perspective.

The Fourth Estate Working Group will review the combined Fourth Estate OEP and provide

recommendations prior to review by the DBC. Military Departments will brief results of their

review and approvals to the Fourth Estate Working Group and DBC.

DBS Investment Management Guidance June 26, 2018

Department of Defense Page 22 of 54

General Review Criteria

As illustrated in the IBF, the DBC will use the

following criteria to evaluate OEPs for

certification:

Compliance: The DBC will assess the

determination made by the PCA to ensure that

the portfolio and each applicable DBS are

compliant with 10 U.S.C. § 2222.

Strategic Alignment: The DBC, assisted by the PSA, will assess the viability of the

organization’s business plan, as reflected in proposed investments, to result in specific

improvements in business operations and cost savings and the degree of alignment to strategic

goals and missions and the organization’s lines of business. In addition, the DBC will assess the

degree to which investments are being managed in accordance with the budget guidance

reflected in Functional Strategies, CPIC process and DoD’s Better Buying Power guidance, and

key focus areas / priorities and how they align to investment requests.

Utility: The DBC will assess the portfolio’s ability to deliver required capabilities and provide

performance results, efficiency and effectiveness for a given function as reflected in the

alignment to Operational Activities within the BEA and the progress toward the target for

measures identified in Functional Strategies or OEPs.

Architectural Alignment: The DBC will assess portfolio inter / intra dependencies, architecture

alignment, interoperability, duplication of capabilities, and redundancies, for both processes and

systems. This includes assessing the ability for systems and processes to routinely produce

verifiable, timely, accurate, and reliable business and financial information for management

purposes; and integrating budget, accounting, and program information and systems.

Cost: The DBC will assess cost and proposed resources in the context of the improvements in

business operations and cost savings using criteria established by the PCA and the DBC. Criteria

will include performance against established measures for the estimated ROI. Assessment will

also be determined from a CPIC evaluate phase perspective for current business costs and IT

lifecycle current services costs. The total DBS investment cost includes hardware and software

procurement, licensing and operation costs, design, development and deployment costs, full-time

equivalent military and civilian costs, and help desk and program support activity. Cost will be

reflected using budget data, data derived from the OEP submission, and additional information.

ROI is an important factor in the assessment of reasonable cost. Future investments in DBS can

significantly improve the performance of business operations while reducing costs if they are

supported by a well-defined business case with clear performance measures, a positive ROI, and

a reasonable payback period.

DBS Investment Management Guidance June 26, 2018

Department of Defense Page 23 of 54

The DBC will assess how future covered DBS address the following key ROI tenets:

• Optimization of business process and consideration of how the IT can support and enable

a reengineered process

• IT solutions should use a modular, incremental approach that ensures technology can be

rapidly and effectively implemented with clear performance measures and outcomes

• A positive ROI that can be quantified and demonstrated. However, a ROI may not be

fully quantifiable for certain types of investments, such as those mandated by law,

because they may not produce easily quantifiable cost or resource reductions. In those

cases, the goal should be to deliver the compliant capability as efficiently as possible.

The DBC Chair will provide supplemental guidance as additional review criteria on yearly basis.

Certification

The DBC will recommend whether or not to certify funds on covered DBS for an amount that

will be obligated only within that fiscal year. Future year budget amounts that represent the

capital investment plan for the future of the portfolio will be considered as part of the review. For

example, an FY18 OEP submission’s certification amounts are for obligation of funds during

FY18. Certification decisions will be captured in an IDM (sample found in Appendix H) and

DITIP stipulating that an OEP’s investment is either:

• Certified or certified with conditions – All or part of the covered DBS certification

request is approved but may be conditioned so as to restrict the use of funds or direct

mandatory changes to the portfolio of business systems. Before obligating funds,

organizations must inform the OCMO when a condition is cleared, at which point the

OCMO will confirm or deny the change and close the condition. The IDM may also

direct actions that must be completed.

• Not Certified / Declined to certify –All or part of the covered DBS certification request is

not approved due to misalignment with strategic direction, mission needs or other

deficiencies identified. Covered DBS that are not certified must be resubmitted for

reconsideration after addressing deficiencies.

Budget Adjustment

In addition to certification, the DBC chair may make recommendations for programming and

budget adjustments to DCAPE and USD (C) via the PPBE process. OEPs must explain

consistency of the business plan outlined in the resources within the future budget relative to

guidance and initiatives provided by DoD CMO and PSAs. The DBC and CMOs assesses the

adequacy of the plans and may identify issues for further analysis by Program Budget Review

issue teams. Major defense business budget issues may be referred to an issue team established

by DCAPE for further review within the PPBE process.

DBS Investment Management Guidance June 26, 2018

Department of Defense Page 24 of 54

Enterprise Architecture Plans

OEPs and other authoritative data sources are used to develop baseline architecture, target

architecture, and sequencing plan required by 44 U.S.C. § 3601.

2.4. General Investment Management Process Timeline

Table 2 depicts the sequence of events for Functional Strategy and OEP reviews. The DBC chair

will publish a schedule identifying specific dates for Functional Strategy input, PCA requests,

OEP reviews, etc. Functional area owners will initiate the process by submitting updated

Functional Strategies for DBC review with a focus upon strategic direction for the future budget

years. Upon completion of the Functional Strategy reviews, DoD Components will then develop

OEPs and submit them with a PCR by a date determined by the DBC chair. System data for

each DBS must be in DITPR, SNaP-IT, IBF-DAP, and DITIP. Certification approval for OEPs

will be documented in an IDM and budget adjustments, if any will be proposed to DCAPE and

Comptroller via the PPBE process.

Activity

Proponent

Date

Investment management guidance update issued

OCMO

February-March

Functional strategies available

PSAs, OCMO

February-March

SNaP-IT updated All organizations

Part of budget cycle

annually

Authoritative data sources updated

All organizations

June

OEPs submitted

All organizations

July

OEP analyses

CMOs, PSAs

February - August

DBC and CMO reviews

DBC and CMOs

July -August

IDM memorandums issued

DBC and CMOs

August - September

Program review (subsequent fiscal year’s budget)

DBC and CMOs

August- November

Budget Review

DBC and CMOs

December - January

Table 2 Investment Management Process Timeline

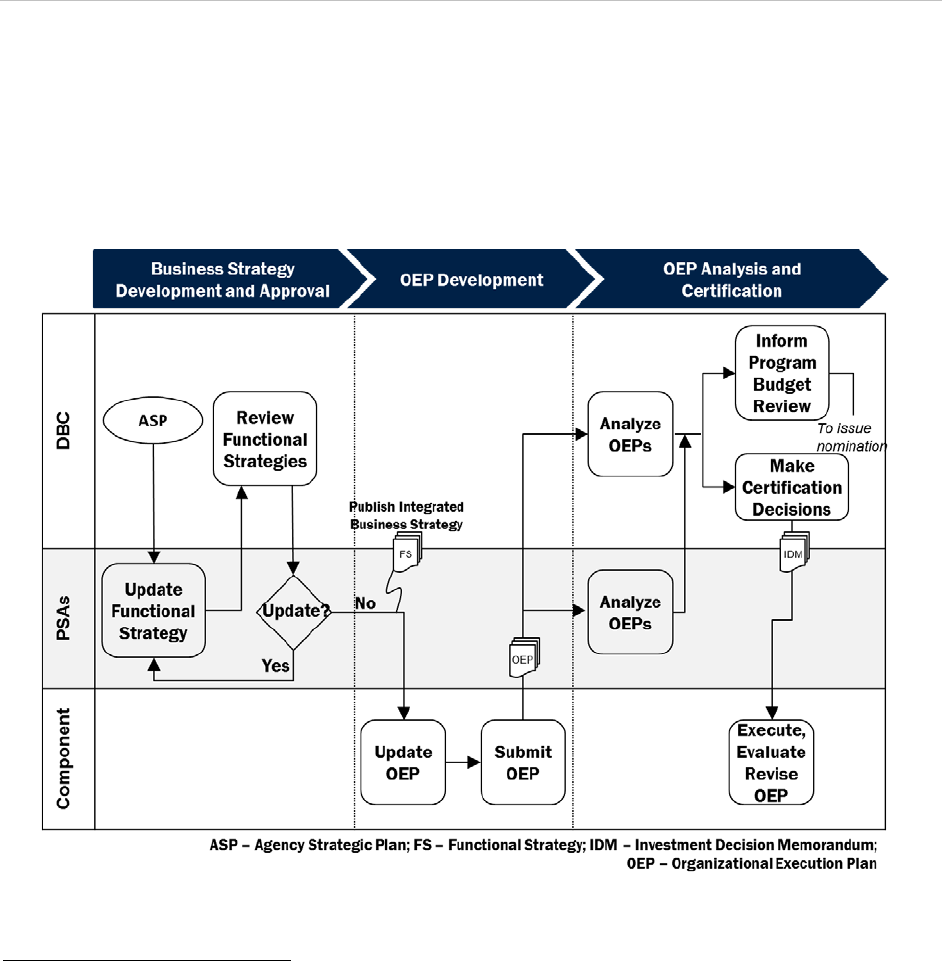

2.5. Out of Cycle Guidance

DoD organizations may require changes to previously approved OEPs; an Out of Cycle (OOC)

request is the vehicle for submission of these changes. Table 3 provides a summary required

component actions / business rules for OOC requests and activities.

An OOC request for review and certification of a covered DBS is required when a covered DBS

or associated funding has changed since previously reviewed, certified and approved during the

annual review cycle or when a covered DBS was not previously reviewed, certified or approved

during the same annual cycle. Dev / Mod OOC requests require approved documentation as

indicated by the DoDI 5000.75. If approved documentation is not available then it should be

submitted with the Dev / Mod OOC as a combined request for review and approval.

DBS Investment Management Guidance June 26, 2018

Department of Defense Page 25 of 54

Component Action

Required

Certification Owner Conditions for CMO / CMO of DoD Review

1. Submit OOC

for Review and

Certification

Request

Military Departments

(using DITIP)

Any increase in a system below $250M over the

period of the current FYDP and over the

established Military Departments threshold will

be reviewed for decision by Military Department

CMO in DITIP

Any increase in a system in excess of $250M over

the period of the current FYDP will be reviewed

for decision by CMO and the DCMO in DITIP

Fourth Estate

(using DITIP)

Any increase in a system will be reviewed for

decision by the DoD CMO in DITIP

2. Submit for

Notification

Only***

All (using DITPR) Removal of covered DBS from active Portfolio*

All (using DITIP) Any decrease in funding

Requests and Notifications are initiated using DITIPR, and DITIP. Application data updates to

DITIP, DITPR and IBF-DAP data are still required in all cases.

* A DBS may be removed from an active Portfolio either by archiving (e.g. retiring/erroneous entry)

or designating as a non DBS.

** As a business rule, an OOC request made in DITIP cannot mix positive and negative numbers.

All OOC requests with decreases should be processed first as a separate OOC request, followed by

increase(s) request.

***A signed PCR is not required for notification only submissions. Briefly explain the reason in the

DITIP comments field.

Table 3 – Required Component Actions for OOC Requests

DBS Investment Management Guidance June 26, 2018

Department of Defense Page 26 of 54

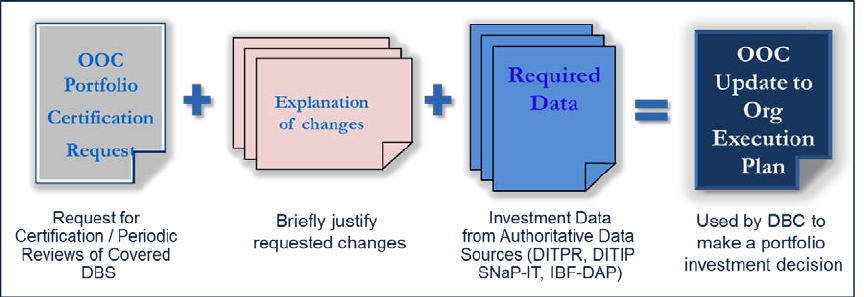

OOC review and certification requests, as depicted in Figure 5, must contain:

• A signed PCR with either the appropriate PCA or CMO approval determinations

discussed in Section 2.2 of this guidance will be uploaded to DITIP with the request.

Additionally, an OOC PCR should identify proposed changes to the OEP using the PCR

Memorandum Template in Appendix F as a guide

• Appropriate data entry for the OOC request in DITIP, DITPR IBF-DAP (when changes

warrant) and SNaP-IT as the schedule permits.

The Fourth Estate Working Group will review Fourth Estate and priority DBS OOC requests on

a bi-weekly basis beginning in October. Submission of all Fourth Estate and priority DBS OOC

requests must be submitted no later than 15 August of the given year for certification. All other

Military Department OOC requests must be submitted and processed by the end of the FY.

Figure 5 Out of Cycle Organizational Execution Plan Construct

DBS Investment Management Guidance June 26, 2018

Department of Defense Page 27 of 54

3. Governance

The DBC provides unified direction and leadership through decision making to guide DoD’s

functional areas and organizations, drives alignment of activities with DoD’s strategic goals and

objectives to optimize DoD business operations, and promotes cost visibility. See Appendix A

and DBC Charter

12

for full description of responsibilities. The DBC leads governance efforts to

manage the IBF to include the DBC and future releases of BEA content. In particular, the DBC

concentrates on efforts to build a cost culture in DoD and to improve the focus on ROI. The key

governance bodies essential to the DBC process are comprised of the Military Department

CMOs, PCAs, PSAs, and the DBC itself.

3.1. Governance Bodies

Defense Business Council (DBC)

The DoD CMO and DoD CIO co-chair the DBC and review the Functional Strategies and DBS

based upon the review of portfolios. See DBC membership is listed in Table 4.

DBC Member Title

Co-Chairs

DoD CMO, DoD CIO

Principal

Members

Under Secretary of Defense for Acquisition, Technology and Logistics

Under Secretary of Defense for Policy

Under Secretary of Defense (Comptroller)/Chief Financial Officer

Under Secretary of Defense for Personnel and Readiness

Under Secretary of Defense for Intelligence

Director, Cost Assessment and Program Evaluation

Joint Staff

Chief, National Guard Bureau

Department of the Army, Chief Management Officer

Department of the Army, Chief Information Officer

Department of the Army, Acquisition Executive

12

http://dcmo.defense.gov/Governance/Defense-Business-Council/ linked in dates of charter

DBS Investment Management Guidance June 26, 2018

Department of Defense Page 28 of 54

DBC Member Title

Department of the Navy, Chief Management Officer

Department of the Navy, Chief Information Officer

Department of the Navy, Acquisition Executive

Department of the Air Force, Chief Management Officer

Department of the Air Force, Chief Information Officer

Department of the Air Force, Acquisition Executive

Advisor to Chair Office of the General Counsel

Table 4 - DBC Members

In the absence of the DoD CMO, the Assistant CMO will perform the functions of the co-chair.

OCMO will serve as Executive Secretary.

Chief Management Officer (CMO)

The CMO is responsible for review of the portfolio prior to the DBC. Military Department

CMOs review their portfolio for decision investments that are under $250M over the period of

the current FYDP. As the CMO for the Fourth Estate, the DoD CMO reviews the Fourth Estate

portfolios for decision. The CMOs provide results of their review and approval in a presentation

to the DBC which substantially eliminate redundant DBC reviews during the OOC certification

process.

Pre-Certification Authority (PCA)

The PCA is responsible for review of portfolios at the organizational level and for the statutory

assertions required such as BPR and BEA compliance. PCAs will make a recommendation to

the DBC in the PCR submitted to the DBC for review of the portfolios. This responsibility may

not be further delegated without notification to the DoD CMO and may not be delegated lower

than a General Officer or Senior Executive Service level equivalent.

3.2. DBC Governance Process Roles

The DBC plays a central governance role in the certification process of DBS investments. The

DBC process will follow these steps. A timeline for these steps are defined in the Investment

Management Process Timeline (Table 2)

• PSAs develop Functional Strategies: As discussed in 2.1, PSAs draft Functional

Strategies based on DBC guidance to prioritize activities of DoD organizations to support

DoD business priorities and system investments. The Functional Strategies articulate

each area’s strategic vision, goals, and targeted outcomes over the next three to five

years.

DBS Investment Management Guidance June 26, 2018

Department of Defense Page 29 of 54

• Working Groups conduct analysis (if necessary): The DBC Chair may establish

working groups, as required, to provide concentrated subject matter expertise and in-

depth analyses on complex, time-limited tasks to assist the DBC in executing its DBC

responsibilities. Led by a representative from a PSA or CMO with primary support from

OCMO and secondary / subject matter experts, working groups will assess specific

business issues such as those raised during the review of Functional Strategies and make

recommendations to the DBC based on quantitative analyses. To focus these efforts,

OCMO will draft working group project charters to identify primary objective, scope,

timeline, and team lead.

• DBC reviews Functional Strategies: When strategic priorities change and require

update, the PSAs will present their Functional Strategies to the DBC. PSA designees,

relevant domain experts, will participate in DBC discussions and make recommendations

on the draft Functional Strategies for DBC decision. Upon approval, the DBC will direct

DoD organizations to draft OEPs that identify and prioritize investments aligned with

these Functional Strategies.

• PCAs draft OEPs: As described in section 2.2, DoD organizations will draft OEPs to

align their DBS investments within their respective budgets. PCAs are responsible for

review of OEPs at the organizational level.

• CMOs review portfolio: CMOs perform portfolio reviews for the portfolio within their

respective organization and will review investments under $250M over the FYDP.

OCMO performs the portfolio review for the Fourth Estate exclusive of the Military

Departments.

• Pre-decisional review: PCAs will review their portfolios and make a recommendation

to the DBC in the PCR submitted to the DBC with the OEPs via the responsible CMO.

PSAs will review their portfolios and make a recommendation to the DBC. A workgroup

consisting of the chartered Fourth Estate Working Group and the Military Departments

provides a pre-decisional review and recommendation to the DBC based upon the OEP

and results performed by the responsible CMO. The workgroup will vet all

documentation and analysis prior to presentation to the DBC.

• DBC review portfolio: The responsible CMO representative will present the results of

their review to DBC.

• DoD CMO or Military Department CMO decision: Certify covered DBS decisions as

determined, and using relevant results of the DBC review.

DBS Investment Management Guidance June 26, 2018

Department of Defense Page 30 of 54

4. Roles and Responsibilities

4.1. Defense Business Council

DoD CMO and DoD CIO co-chair the DBC. See Appendix A and DBC Charter

13

for full

description of responsibilities

Defense Business Council Members

The DBC will review the Functional Strategies and portfolios presented by the respective PSAs

and CMOs, along with the analysis from chartered teams when required. The DBC is the focal

point for the investment review process using the IBF. PSAs are encouraged to establish and

document, in Functional Strategies, select and control criteria for CMOs to employ in evaluation

of their portfolios. Additionally, DBC members are responsible for making recommendations on

organizational DBS investment budgets if required and for providing certification

recommendations for covered DBS to the DBC Chair. These recommendations will focus on

details surrounding the planning, design, acquisition, development, deployment, operation,

maintenance, modernization and project cost benefits, and risks of all covered DBSs within the

portfolio. When the review process is complete, the DBC will make recommendations

concerning the certification of investments and any actions or conditions that may be required.

4.2. Chief Management Officer / Pre-Certification Authority

The PCA is the senior accountable official that is responsible for ensuring compliance with

investment review policies prescribed by the organization and this guidance. The approval

authority and PCA responsibilities are assigned to the CMO for each Military Department. For

the Fourth Estate, the CMO and approval authority is assigned to the DoD CMO. For the Fourth

Estate, the PCA is the organization head unless otherwise designated by the DoD CMO. See

Section 3 of this guidance for PCA delegation. The OEPs submitted to the DBC for the Fourth

Estate exclusive of the Military Departments must be via the Fourth Estate Working Group

chartered by the DBC.

PCAs will submit and present requests to the DBC with complete, current, and accurate

documentation within prescribed deadlines. Certification and periodic review requests must

comply with laws, regulations, and policy, such as the Clinger Cohen Act, BEA, BPR and

applicable documentation per the DoDI 5000.75. Validation of Fourth Estate pre-certification

will be documented via a PCR in the form of a PCA-issued memorandum (example found in

Appendix E), which will outline the portfolio’s composition, capabilities, and alignment to

13

http://dcmo.defense.gov/Governance/Defense-Business-Council/ linked in dates of charters

DBS Investment Management Guidance June 26, 2018

Department of Defense Page 31 of 54

applicable Business Strategies. Military Department pre-certification and approval must be

completed in DITIP.

The PCA is responsible for creation and use of select and control criteria used to manage

business processes and capital investments and for ensuring the incorporation of the CPIC

control and evaluation phase outcomes such as eliminating underperforming or low value

investments. The portfolio must reduce redundancy and be aligned to the strategic direction for

outcomes and initiatives within the Functional Strategies and the goals of the organization.

DBS Investment Management Guidance June 26, 2018

Department of Defense Page 33 of 54

Appendix B

Appendix B: Key Terms

Term

Definition

Fourth Estate

Refers to the other Defense organizations exclusive of the Military

Departments

Agency Strategic

Plan

The ASP is the DoD’s highest-level plan for improving DoD business

operations. It lays out the DoD’s priority business goals, objectives,

measures, and initiatives. The ASP informs and is informed by, processes

and activities that support the execution of the DoD’s business strategy.

The DOD CMO oversees the execution of this strategy.

Alignment

Linkage to higher-level goals and strategies. Also, consonance and

integration across related activities.

Authoritative

Data Sources

A recognized or official data production source with a designated mission

statement or source / product to publish reliable and accurate data for

subsequent use by customers. An authoritative data source may be the

functional combination of multiple, separate data sources (see Table 1 for

DITPR, SNaP-IT, IBF-DAP, and DITIP).

Baseline

An “as is” reading of all measures constitutes a baseline (included in the

Functional Strategy). Targets are set against that baseline. Periodic

measures are captured and compared to the baseline to assess

performance, financial benefits, and non-financial benefits or look at

results of changes. A baseline can also refer to an architecture “as is.”

Business

Enterprise

Architecture

In accordance with 10 U.S.C. § 2222(c), the BEA is the enterprise

architecture developed and maintained as a blueprint to guide the

development of integrated business processes within the DoD. It must be

sufficiently defined to effectively guide implementation of interoperable

defense business system solutions and consistent with the policies and

procedures established by the Director of the Office of Management and

Budget. The BEA is the DoD’s blueprint for improving DoD business

operations and the reference model for DBC certification.

Business Process

Reengineering

Business Process Reengineering (BPR) is a logical methodology for

assessing process weaknesses, identifying gaps, and implementing

opportunities to streamline and improve the processes to create a solid

foundation for success in changes to the full spectrum of operations. BPR

seeks to ensure that the business processes to be supported by a Defense

Business System is as streamlined and efficient as possible. All DBSs

must be mapped to appropriate business processes during BPR.

Capital Planning

and Investment

Control

CPIC is an IT portfolio-driven management process for ongoing

identification, selection, control, and evaluation of investments. This

process attempts to link budget activities and agency strategic priorities

with achieving specific IT program modernization outcomes.

Core

An enduring system with a sunset date greater than 36 months from the

start of the fiscal year. For consistency, core status in DITPR is

DBS Investment Management Guidance June 26, 2018

Department of Defense Page 34 of 54

Appendix B

Term

Definition

calculated the same for both covered and non-covered as more than 36

months.

14

Covered and

Priority Defense

Business System

Program

Covered DBS means a DBS that is expected to have a total amount of

budget authority, over the period of the current future-years defense

program submitted to Congress under section 221 of title 10, in excess of

$50,000,000 (10 U.S.C. § 2222 (j)(2)).

Priority Defense Business System Program means a DBS that is expected

to have a total amount of budget authority over the period of the current

future-years defense program submitted to Congress under section 221 of

this title in excess of $250,000,000; or designated by the DOD CMO as a

priority DBS, based on specific program analyses of factors including

complexity, scope and technical risk and after notification to Congress of

such designation (10 U.S.C. § 2222 (j)(2)).

For the purposes of this guidance, the term ‘covered DBS’ includes those

DBSs greater than the minimum thresholds defined in 10 U.S.C. § 2222

stated above as well as the thresholds established by the CMOs.

Fundamentally, all DBSs greater than the internal thresholds will be part

of the review and certification process described in this guidance.

Defense Business

Council

The senior governance forum for the effective management of the DoD

Business Mission Area, to include performing the roles and

responsibilities of 10 U.S.C. § 2222 (f), providing portfolio analysis and

process integration, and implement the Secretary’s Management Agenda,

for vetting issues related to management, improvement of defense

business operations.

Defense Business

System

An information system that is operated by, for or on behalf of the DoD,